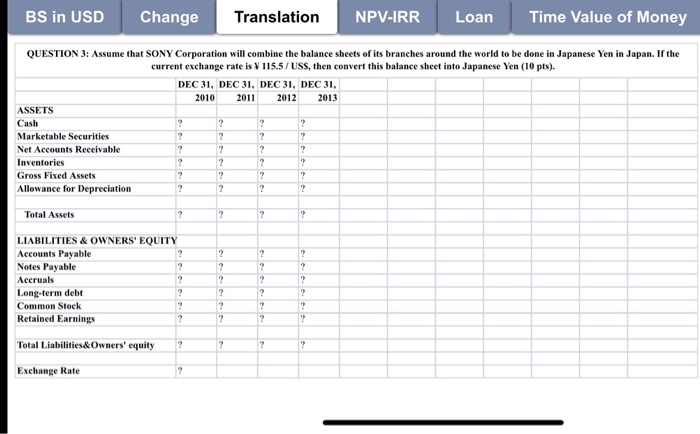

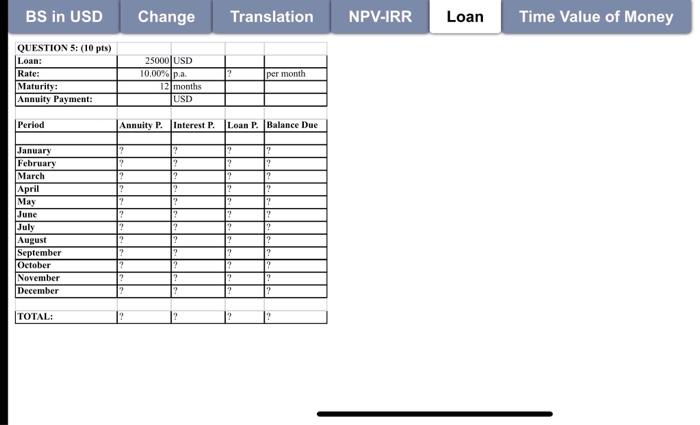

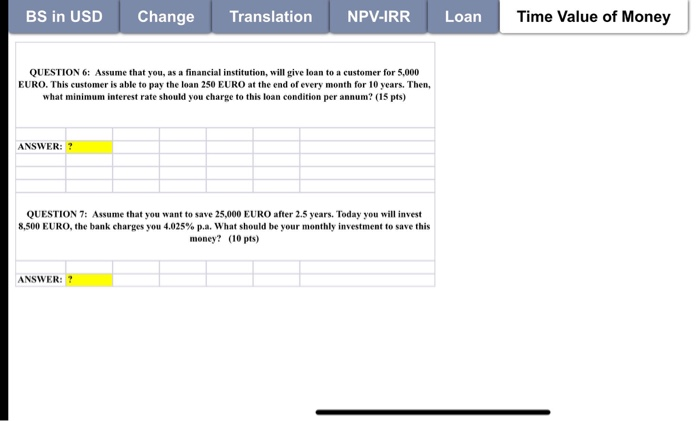

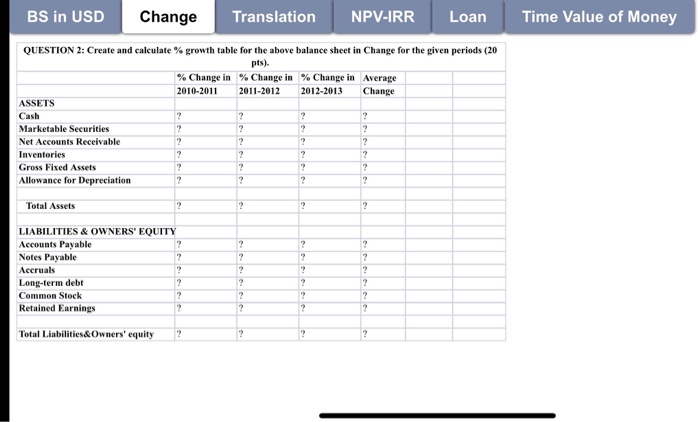

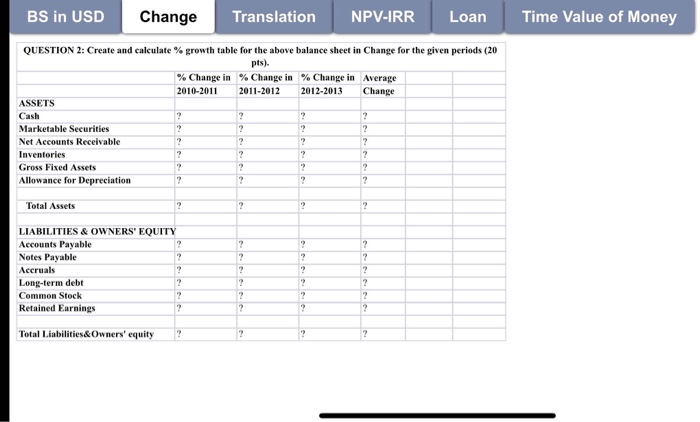

BS in USD Change Translation NPV-IRR Loan Time Value of Money QUESTION 3: Assume that SONY Corporation will combine the balance sheets of its branches around the world to be done in Japanese Yen in Japan. If the current exchange rate is Y 115.5/USS, then convert this balance sheet into Japanese Yen (10 pts). DEC 31, DEC 31, DEC 31, DEC 31, 2010 2011 2012 2013 ASSETS Cash ? ? Marketable Securities ? ? Net Accounts Receivable ? ? ? Inventories ? ? Gross Fixed Assets ? 2 Allowance for Depreciation ? 2 - 2 2 2 2 ? 2 2 2 Total Assets ? ? 2 ? 2 2 ? ? LIABILITIES & OWNERS' EQUITY Accounts Payable ? Notes Payable ? Accruals ? Long-term debt ? Common Stock ? Retained Earnings ? ? ? 2 ? ? ? 2 2 ? ? ? 2 ? 2 Total Liabilities&Owners' equity ? ? 2 ? Exchange Rate BS in USD Change Translation NPV-IRR Loan Time Value of Money QUESTION 5: (10 pts) Loan: Rate: Maturity: Annuity Payment: per month 25000 USD 10.00% pa 12 months USD Period Annuity P. Interest P. Loan P. Balance Due ? 2 ? ? 1? 2 12 12 12 ? ? January February March April May June July August September October November December 2 2 2 2 TOTAL: ? BS in USD Change Translation NPV-IRR Loan Time Value of Money QUESTION 6: Assume that you, as a financial institution, will give loan to a customer for 5,000 EURO. This customer is able to pay the loan 250 EURO at the end of every month for 10 years. Then, what minimum interest rate should you charge to this loan condition per annum? (15 pts) ANSWER: ? QUESTION 7: Assume that you want to save 25,000 EURO after 2.5 years. Today you will invest 8,500 EURO, the bank charges you 4.025% p.a. What should be your monthly investment to save this money? (10 pts) ANSWER: ? BS in USD Change Translation NPV-IRR Loan Time Value of Money QUESTION 2: Create and calculate% growth table for the above balance sheet in Change for the given periods (20 pts). % Change in % Change in % Change in Average 2010-2011 2011-2012 2012-2013 Change ASSETS Cash ? ? ? Marketable Securities ? ? ? ? Net Accounts Receivable 2 ? Inventories ? 2 Gross Fixed Assets ? ? ? Allowance for Depreciation ? 2 ? ? 2 Total Assets 2 ? ? 2 ? ? ? ? LIABILITI & OWNERS' EQUITY Accounts Payable ? Notes Payable ? Accruals ? Long-term debt ? Common Stock ? Retained Earnings ? ? ? ? 2 2 ? 2 2 2 ? ? ? ? ? Total Liabilities&Owners' equity ? ? ? ? BS in USD Change Translation NPV-IRR Loan Time Value of Money QUESTION 2: Create and calculate % growth table for the above balance sheet in Change for the given periods (20 pts). % Change in % Change in % Change in Average 2010-2011 2011-2012 2012-2013 Change ASSETS Cash ? ? ? Marketable Securities ? ? ? 2 Net Accounts Receivable 2 ? ? Inventories ? 2 Gross Fixed Assets ? ? ? Allowance for Depreciation ? 2 ? ? 2 Total Assets ? ? ? 2 ? ? ? ? LIABILIT OWNERS' EQUITY Accounts Payable ? Notes Payable ? Accruals Long-term debt ? Common Stock ? Retained Earnings ? 2 ? ? ? ? 2 ? 2 2 2 ? ? ? ? ? Total Liabilities&Owners' equity ? ? ? ? BS in USD Change Translation NPV-IRR Loan Time Value of Money QUESTION 3: Assume that SONY Corporation will combine the balance sheets of its branches around the world to be done in Japanese Yen in Japan. If the current exchange rate is Y 115.5/USS, then convert this balance sheet into Japanese Yen (10 pts). DEC 31, DEC 31, DEC 31, DEC 31, 2010 2011 2012 2013 ASSETS Cash ? ? Marketable Securities ? ? Net Accounts Receivable ? ? ? Inventories ? ? Gross Fixed Assets ? 2 Allowance for Depreciation ? 2 - 2 2 2 2 ? 2 2 2 Total Assets ? ? 2 ? 2 2 ? ? LIABILITIES & OWNERS' EQUITY Accounts Payable ? Notes Payable ? Accruals ? Long-term debt ? Common Stock ? Retained Earnings ? ? ? 2 ? ? ? 2 2 ? ? ? 2 ? 2 Total Liabilities&Owners' equity ? ? 2 ? Exchange Rate BS in USD Change Translation NPV-IRR Loan Time Value of Money QUESTION 5: (10 pts) Loan: Rate: Maturity: Annuity Payment: per month 25000 USD 10.00% pa 12 months USD Period Annuity P. Interest P. Loan P. Balance Due ? 2 ? ? 1? 2 12 12 12 ? ? January February March April May June July August September October November December 2 2 2 2 TOTAL: ? BS in USD Change Translation NPV-IRR Loan Time Value of Money QUESTION 6: Assume that you, as a financial institution, will give loan to a customer for 5,000 EURO. This customer is able to pay the loan 250 EURO at the end of every month for 10 years. Then, what minimum interest rate should you charge to this loan condition per annum? (15 pts) ANSWER: ? QUESTION 7: Assume that you want to save 25,000 EURO after 2.5 years. Today you will invest 8,500 EURO, the bank charges you 4.025% p.a. What should be your monthly investment to save this money? (10 pts) ANSWER: ? BS in USD Change Translation NPV-IRR Loan Time Value of Money QUESTION 2: Create and calculate% growth table for the above balance sheet in Change for the given periods (20 pts). % Change in % Change in % Change in Average 2010-2011 2011-2012 2012-2013 Change ASSETS Cash ? ? ? Marketable Securities ? ? ? ? Net Accounts Receivable 2 ? Inventories ? 2 Gross Fixed Assets ? ? ? Allowance for Depreciation ? 2 ? ? 2 Total Assets 2 ? ? 2 ? ? ? ? LIABILITI & OWNERS' EQUITY Accounts Payable ? Notes Payable ? Accruals ? Long-term debt ? Common Stock ? Retained Earnings ? ? ? ? 2 2 ? 2 2 2 ? ? ? ? ? Total Liabilities&Owners' equity ? ? ? ? BS in USD Change Translation NPV-IRR Loan Time Value of Money QUESTION 2: Create and calculate % growth table for the above balance sheet in Change for the given periods (20 pts). % Change in % Change in % Change in Average 2010-2011 2011-2012 2012-2013 Change ASSETS Cash ? ? ? Marketable Securities ? ? ? 2 Net Accounts Receivable 2 ? ? Inventories ? 2 Gross Fixed Assets ? ? ? Allowance for Depreciation ? 2 ? ? 2 Total Assets ? ? ? 2 ? ? ? ? LIABILIT OWNERS' EQUITY Accounts Payable ? Notes Payable ? Accruals Long-term debt ? Common Stock ? Retained Earnings ? 2 ? ? ? ? 2 ? 2 2 2 ? ? ? ? ? Total Liabilities&Owners' equity