Question

B/S QUESTIONS PLZ HELP Last July (2020), over a thousand advertisers in the U.S., including Coca-Cola, Nike and Starbucks, stopped their advertising on Facebook in

B/S QUESTIONS PLZ HELP

Last July (2020), over a thousand advertisers in the U.S., including Coca-Cola, Nike and Starbucks, stopped their advertising on Facebook in support of the #StopHateForProfit campaign that advocated for the boycotting of ads on Facebook. This New York Times articles sums this wellhttps://www.nytimes.com/2020/08/01/business/media/facebook-boycott.html.

Critics of Facebook stated the company was not doing enough to stop hate speech on its social media platforms. It was rumoured that Mark Zuckerberg told his Facebook employees he would not change company policies because of a threat to a small percent of company revenue due to the boycott. Yet, as this June 2021 article states, "Under fire, the company has almost entirely reversed course on its free speech haven by clamping down on hate, increasing penalties for users who repeatedly share misinformation, and linking readers of any post related to COVID-19 to information from government sources."

Steven Hahn-Griffiths, VP of RepTrak stated in his blog "What could really hurt Facebook is the long-term effect of its perceived reputation and the association with being viewed as a publisher of 'hate speech' and other inappropriate content."A July 2020 study by RepTrak indicated that consumers are more willing to buy from brands or firms with a strong positive reputation. Some marketing experts stated that"Facebook is unlikely to suffer significant damage from the growing ad boycott over its initial reluctance to prohibit hate speech in its advertisements."

Debate:

Facebook has an ethical and social responsibility to monitor and censor any form of hate speech on its platforms. The company was correct to reverse its policy on free speech.

Facebook's reputation, brand equity and user loyalty are too strong to be impacted by the hate speech controversy.

Financial Analytics Toolkit: Financial Statement Forecasting 1)...

Financial Analytics Toolkit: Financial Statement Forecasting

1) What is the scope of and the role of consultants in financial management consulting?

For the next questions, assume that your financial analytics and management consulting firm, FAMCF Inc. ("FAMCF") was invited to deliver a sales pitch to Morgan Industries' CFO on November 14, 2019 and to discuss your consulting firm's services and capabilities.

2) How would you prepare for your meeting considering that you were told that two other consulting firms were being considered? On the entry phase and the C-C relationship" when preparing your answers.

3) Based on the mandatory readings, what did you learn about consulting proposals, contracting and negotiating engagement in the entry phase of the consulting process?

For the next questions, assume that your consulting firm (FAMCF) ended up being hired by Morgan Industries on November 29, 2019. After an initial meeting with Morgan Industries' CFO on December 2, 2019, it was decided that you would focus on analyzing the recent financial performance at Morgan Industries (using common size/vertical analysis and select financial ratios) and develop a financial forecast for the year 2020.

4) Perform the following calculations at Morgan Industries in 2017, 2018, and 2019): a) annual revenue growth, common size/vertical analysis of income statement (yearly revenues as base amount), b) common size/vertical analysis of balance sheet (total assets or liabilities as base amount), and c) gross profit ratio, quick ratio (acid test ratio), and assets/equity ratio. Based on your calculations, analyze the recent financial performance at Morgan Industries (2017-2019) and prepare summary of your analysis which you would be presenting to Morgan Industries' CFO. What could be done to increase Morgan Industries' financial performance in 2020?

5) Following the presentation of your financial analysis, Morgan Industries' CFO asked you to help prepare financial forecast (income statement and balance sheet) for the year 2020. You and the CFO agreed to make the following assumptions regarding the income statement and balance sheet forecast for the purpose of the 2020 financial forecast:

Base-case growth rate in revenues of 5% (year 2020 vs 2019)

COGS of 67% (vs revenues)

SG&A of 31% (vs revenues)

Interest expense of 5.2% of debt outstanding (bonds and bank loans) at the end of the year (2020)

A target cash balance is 2.9% of revenues

13 days receivables (i.e., accounts receivables / revenues * 365)

Inventory turnover of 12 times (inventory to COGS ratio)

$0M / no planned additional CAPEX and $50M in depreciation

35 days payables assumed (i.e., accounts payables / COGS * 365)

Other accrued expenses of 2.1% of revenues

No plans in changing the amount of bonds outstanding

10 million shares outstanding and no changes planned for 2020 as far as share issue or share repurchase

No plans to change the level of dividends (i.e., same level as 2019)

The financial forecast is to be balanced by plugging the bank loan amount (if required)

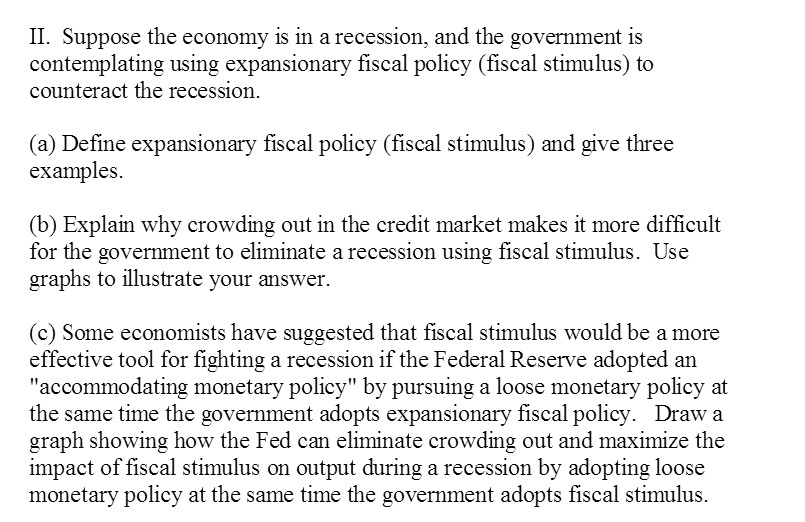

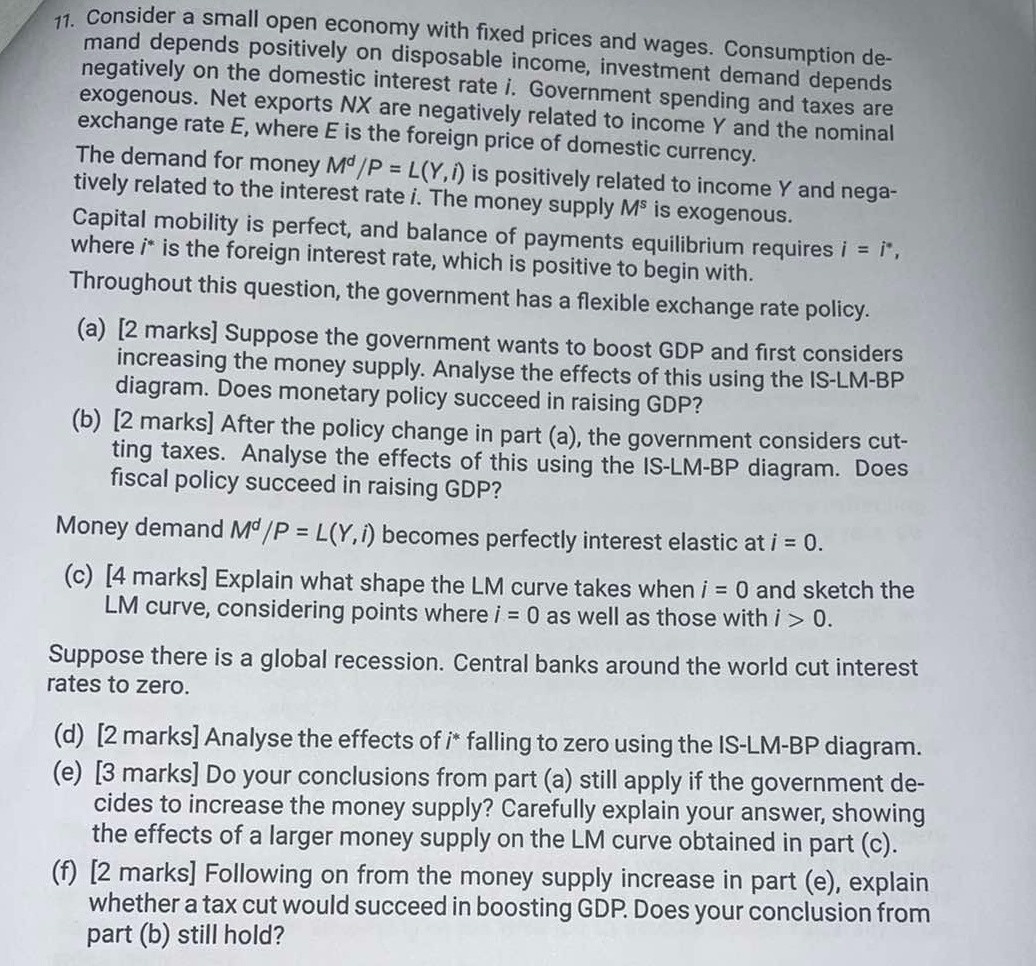

0. Suppose there is a global recession. Central banks around the world cut interest rates to zero. (d) [2 marks] Analyse the effects of i* falling to zero using the IS-LM-BP diagram. (e) [3 marks] Do your conclusions from part (a) still apply if the government de- cides to increase the money supply? Carefully explain your answer, showing the effects of a larger money supply on the LM curve obtained in part (c). (f) [2 marks] Following on from the money supply increase in part (e), explain whether a tax cut would succeed in boosting GDP. Does your conclusion from part (b) still hold?17. Consider a small open economy with fixed prices and wages. Consumption de- mand depends positively on disposable income, investment demand depends negatively on the domestic interest rate i. Government spending and taxes are exogenous. Net exports NX are negatively related to income Y and the nominal exchange rate E, where E is the foreign price of domestic currency. The demand for money Md/P = L(Y, i) is positively related to income Y and nega- tively related to the interest rate i. The money supply MS is exogenous. Capital mobility is perfect, and balance of payments equilibrium requires i = i, where i' is the foreign interest rate, which is positive to begin with. Throughout this question, the government has a flexible exchange rate policy. (a) [2 marks] Suppose the government wants to boost GDP and first considers increasing the money supply. Analyse the effects of this using the IS-LM-BP diagram. Does monetary policy succeed in raising GDP? (b) [2 marks] After the policy change in part (a), the government considers cut- ting taxes. Analyse the effects of this using the IS-LM-BP diagram. Does fiscal policy succeed in raising GDP? Money demand Md/P = L(Y, i) becomes perfectly interest elastic at i = 0. (c) [4 marks] Explain what shape the LM curve takes when i = 0 and sketch the LM curve, considering points where i = 0 as well as those with i > 0. Suppose there is a global recession. Central banks around the world cut interest rates to zero. (d) [2 marks] Analyse the effects of i* falling to zero using the IS-LM-BP diagram. (e) [3 marks] Do your conclusions from part (a) still apply if the government de- cides to increase the money supply? Carefully explain your answer, showing the effects of a larger money supply on the LM curve obtained in part (c). (f) [2 marks] Following on from the money supply increase in part (e), explain whether a tax cut would succeed in boosting GDP. Does your conclusion from part (b) still hold

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started