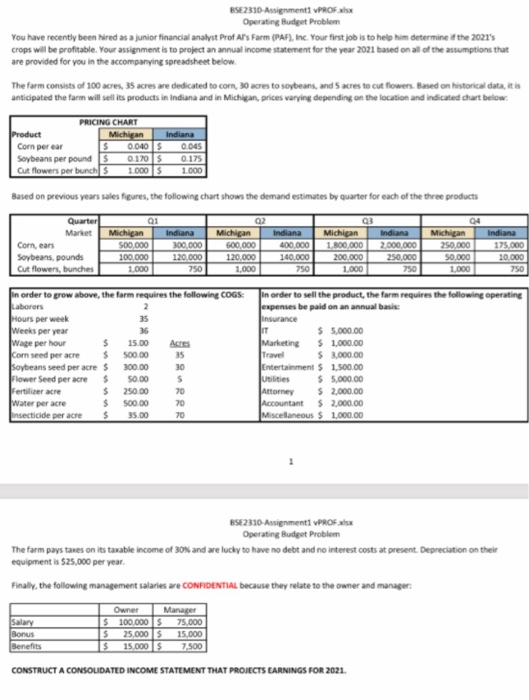

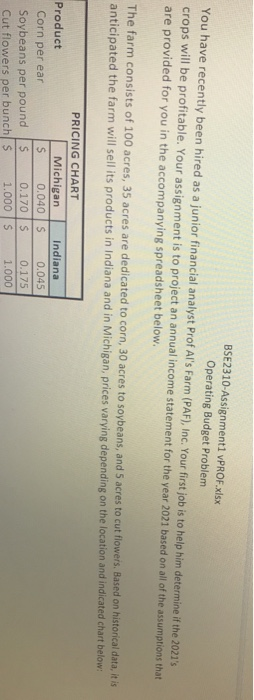

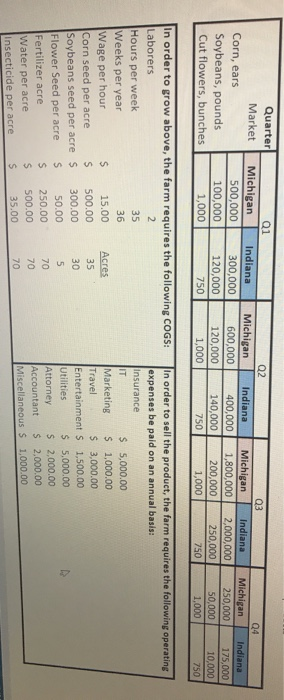

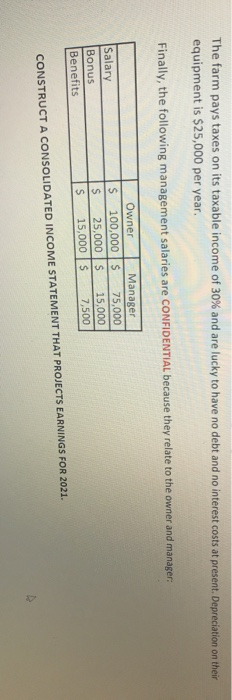

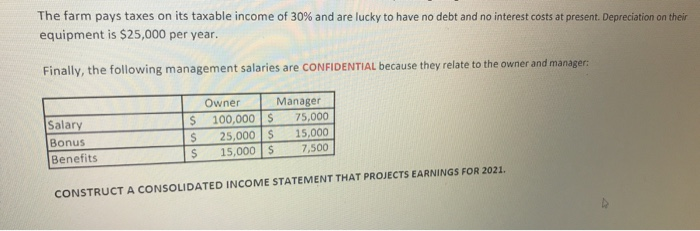

BSE2310 Assignment PROFxx Operating Budget Problem You have recently been hired as a junior financial analyst Prof Ars Farm (PAF), Inc. Your first job is to help him determine if the 2021's crops will be profitable. Your assignment is to project an annual income statement for the year 2021 based on all of the assumptions that are provided for you in the accompanying spreadsheet below. The farm consists of 100 acres, 35 acres are dedicated to corn, 30 acres to soybeans, and 5 acres to cut flowers. Based on historical data, it is anticipated the farm will sell its products in Indiana and in Michigan, prices varying depending on the location and indicated chart below. PRICING CHART Product Michigan Indiana Corn perear $ 0.0405 0.045 Soybeans per pound S 0.1705 0.175 Cut flowers per bunch 5 1.000 1.000 Based on previous years sales figures, the following chart shows the demand estimates by quarter for each of the three products Quarter Q1 Market Michigan Corn, cars 500,000 Soybeans, pounds 100.000 Cut flowers, bunches 1.000 Indiana 300,000 120,000 750 Michigan 600.000 120.000 1.000 Indiana 400,000 140,000 750 Michigan 1.800.000 200.000 1.000 Indiana 2.000.000 250.000 750 04 Michigan 250.000 50.000 1.000 Indiana 175,000 10,000 750 in order to grow above, the farm requires the following COGS: Laborers Hours per week 35 Weeks per year 36 Wage per hour $ 15.00 Acres Com seed per acre $ 500.00 35 Soybeans seed per acres 300.00 30 Flower Seed per acre $ 50.00 5 Fertilizer acre $ 250.00 70 Water per acre $ 500.00 70 Insecticide per acres 35.00 70 in order to sell the product, the farm requires the following operating expenses be paid on an annual basis insurance IT $ 5.000.00 Marketing $ 1.000.00 Travel $3,000.00 Entertainment $ 1.500.00 Utilities $ 5.000.00 Attorney $ 2,000.00 Accountant $ 2.000.00 Miscellaneous $ 1,000.00 BSE2310 Assignment PROF.xlsx Operating Budget Problem The farm pays taxes on its taxable income of 30% and are lucky to have no debt and no interest costs at present. Depreciation on their equipment is $25,000 per year. Finally, the following management salaries are CONFIDENTIAL because they relate to the owner and manager: Salary Bonus Benefits Owner Manager $ 100,00075,000 $ 25.000 $ 15.000 15.000 7.500 CONSTRUCT A CONSOLIDATED INCOME STATEMENT THAT PROJECTS EARNINGS FOR 2021. BSE2310-Assignment1 VPROF.xlsx Operating Budget Problem You have recently been hired as a junior financial analyst Prof Al's Farm (PAF), Inc. Your first job is to help him determine if the 2021's crops will be profitable. Your assignment is to project an annual income statement for the year 2021 based on all of the assumptions that are provided for you in the accompanying spreadsheet below. The farm consists of 100 acres, 35 acres are dedicated to corn, 30 acres to soybeans, and 5 acres to cut flowers. Based on historical data, it is anticipated the farm will sell its products in Indiana and in Michigan, prices varying depending on the location and indicated chart below: PRICING CHART Product Michigan Corn per ear S 0.040 S Soybeans per pound $ 0.170S Cut flowers per bunch S 1.000 $ Indiana 0.045 0.175 1.000 Quarter Market Corn, ears Soybeans, pounds Cut flowers, bunches 01 Michigan 500,000 100,000 1,000 Indiana 300,000 120,000 750 Q2 Michigan 600,000 120,000 1,000 Indiana 400,000 140,000 750 03 Michigan 1,800,000 200,000 1,000 Indiana 2,000,000 250,000 750 04 Michigan 250,000 50,000 1,000 Indiana 175,000 10,000 750 In order to grow above, the farm requires the following COGS: Laborers 2 Hours per week 35 Weeks per year 36 Wage per hour 15.00 Acres Corn seed per acre 500.00 35 Soybeans seed per acre $ 300.00 30 Flower Seed per acre 50.00 5 Fertilizer acre 250.00 70 Water per acre 500.00 70 35.00 70 Insecticide per acre Innnnnnn In order to sell the product, the farm requires the following operating expenses be paid on an annual basis Insurance IT $5,000.00 Marketing $ 1,000.00 Travel $ 3,000.00 Entertainment S 1,500.00 Utilities $ 5.000.00 Attorney $ 2,000.00 Accountant $ 2.000.00 Miscellaneous S 1,000.00 The farm pays taxes on its taxable income of 30% and are lucky to have no debt and no interest costs at present. Depreciation on their equipment is $25,000 per year. Finally, the following management salaries are CONFIDENTIAL because they relate to the owner and manager: S Salary Bonus Benefits Owner Manager 100,000 $ 75,000 25,000 15.000 15,000 S 7,500 S s CONSTRUCT A CONSOLIDATED INCOME STATEMENT THAT PROJECTS EARNINGS FOR 2021. The farm pays taxes on its taxable income of 30% and are lucky to have no debt and no interest costs at present. Depreciation on their equipment is $25,000 per year. Finally, the following management salaries are CONFIDENTIAL because they relate to the owner and manager: Salary Bonus Benefits $ $ S Owner Manager 100,000 $ 75,000 25,000 $ 15,000 15,000 7,500 CONSTRUCT A CONSOLIDATED INCOME STATEMENT THAT PROJECTS EARNINGS FOR 2021. BSE2310 Assignment PROFxx Operating Budget Problem You have recently been hired as a junior financial analyst Prof Ars Farm (PAF), Inc. Your first job is to help him determine if the 2021's crops will be profitable. Your assignment is to project an annual income statement for the year 2021 based on all of the assumptions that are provided for you in the accompanying spreadsheet below. The farm consists of 100 acres, 35 acres are dedicated to corn, 30 acres to soybeans, and 5 acres to cut flowers. Based on historical data, it is anticipated the farm will sell its products in Indiana and in Michigan, prices varying depending on the location and indicated chart below. PRICING CHART Product Michigan Indiana Corn perear $ 0.0405 0.045 Soybeans per pound S 0.1705 0.175 Cut flowers per bunch 5 1.000 1.000 Based on previous years sales figures, the following chart shows the demand estimates by quarter for each of the three products Quarter Q1 Market Michigan Corn, cars 500,000 Soybeans, pounds 100.000 Cut flowers, bunches 1.000 Indiana 300,000 120,000 750 Michigan 600.000 120.000 1.000 Indiana 400,000 140,000 750 Michigan 1.800.000 200.000 1.000 Indiana 2.000.000 250.000 750 04 Michigan 250.000 50.000 1.000 Indiana 175,000 10,000 750 in order to grow above, the farm requires the following COGS: Laborers Hours per week 35 Weeks per year 36 Wage per hour $ 15.00 Acres Com seed per acre $ 500.00 35 Soybeans seed per acres 300.00 30 Flower Seed per acre $ 50.00 5 Fertilizer acre $ 250.00 70 Water per acre $ 500.00 70 Insecticide per acres 35.00 70 in order to sell the product, the farm requires the following operating expenses be paid on an annual basis insurance IT $ 5.000.00 Marketing $ 1.000.00 Travel $3,000.00 Entertainment $ 1.500.00 Utilities $ 5.000.00 Attorney $ 2,000.00 Accountant $ 2.000.00 Miscellaneous $ 1,000.00 BSE2310 Assignment PROF.xlsx Operating Budget Problem The farm pays taxes on its taxable income of 30% and are lucky to have no debt and no interest costs at present. Depreciation on their equipment is $25,000 per year. Finally, the following management salaries are CONFIDENTIAL because they relate to the owner and manager: Salary Bonus Benefits Owner Manager $ 100,00075,000 $ 25.000 $ 15.000 15.000 7.500 CONSTRUCT A CONSOLIDATED INCOME STATEMENT THAT PROJECTS EARNINGS FOR 2021. BSE2310-Assignment1 VPROF.xlsx Operating Budget Problem You have recently been hired as a junior financial analyst Prof Al's Farm (PAF), Inc. Your first job is to help him determine if the 2021's crops will be profitable. Your assignment is to project an annual income statement for the year 2021 based on all of the assumptions that are provided for you in the accompanying spreadsheet below. The farm consists of 100 acres, 35 acres are dedicated to corn, 30 acres to soybeans, and 5 acres to cut flowers. Based on historical data, it is anticipated the farm will sell its products in Indiana and in Michigan, prices varying depending on the location and indicated chart below: PRICING CHART Product Michigan Corn per ear S 0.040 S Soybeans per pound $ 0.170S Cut flowers per bunch S 1.000 $ Indiana 0.045 0.175 1.000 Quarter Market Corn, ears Soybeans, pounds Cut flowers, bunches 01 Michigan 500,000 100,000 1,000 Indiana 300,000 120,000 750 Q2 Michigan 600,000 120,000 1,000 Indiana 400,000 140,000 750 03 Michigan 1,800,000 200,000 1,000 Indiana 2,000,000 250,000 750 04 Michigan 250,000 50,000 1,000 Indiana 175,000 10,000 750 In order to grow above, the farm requires the following COGS: Laborers 2 Hours per week 35 Weeks per year 36 Wage per hour 15.00 Acres Corn seed per acre 500.00 35 Soybeans seed per acre $ 300.00 30 Flower Seed per acre 50.00 5 Fertilizer acre 250.00 70 Water per acre 500.00 70 35.00 70 Insecticide per acre Innnnnnn In order to sell the product, the farm requires the following operating expenses be paid on an annual basis Insurance IT $5,000.00 Marketing $ 1,000.00 Travel $ 3,000.00 Entertainment S 1,500.00 Utilities $ 5.000.00 Attorney $ 2,000.00 Accountant $ 2.000.00 Miscellaneous S 1,000.00 The farm pays taxes on its taxable income of 30% and are lucky to have no debt and no interest costs at present. Depreciation on their equipment is $25,000 per year. Finally, the following management salaries are CONFIDENTIAL because they relate to the owner and manager: S Salary Bonus Benefits Owner Manager 100,000 $ 75,000 25,000 15.000 15,000 S 7,500 S s CONSTRUCT A CONSOLIDATED INCOME STATEMENT THAT PROJECTS EARNINGS FOR 2021. The farm pays taxes on its taxable income of 30% and are lucky to have no debt and no interest costs at present. Depreciation on their equipment is $25,000 per year. Finally, the following management salaries are CONFIDENTIAL because they relate to the owner and manager: Salary Bonus Benefits $ $ S Owner Manager 100,000 $ 75,000 25,000 $ 15,000 15,000 7,500 CONSTRUCT A CONSOLIDATED INCOME STATEMENT THAT PROJECTS EARNINGS FOR 2021