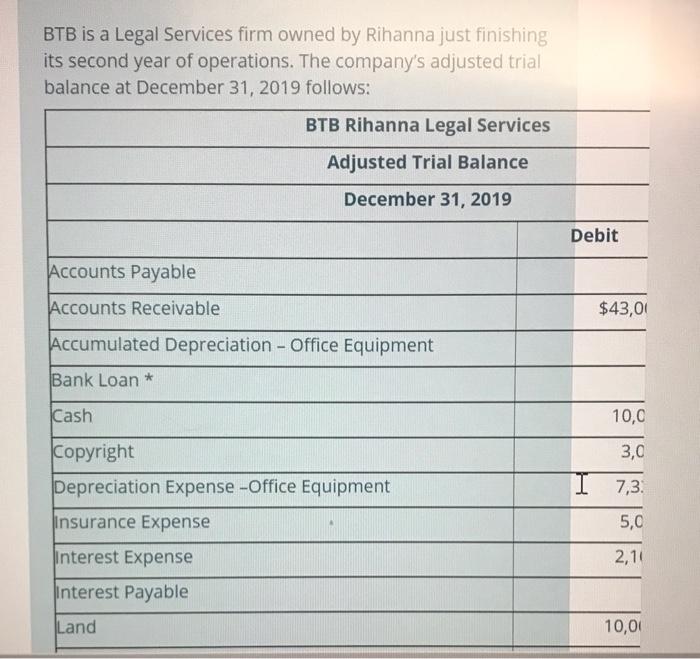

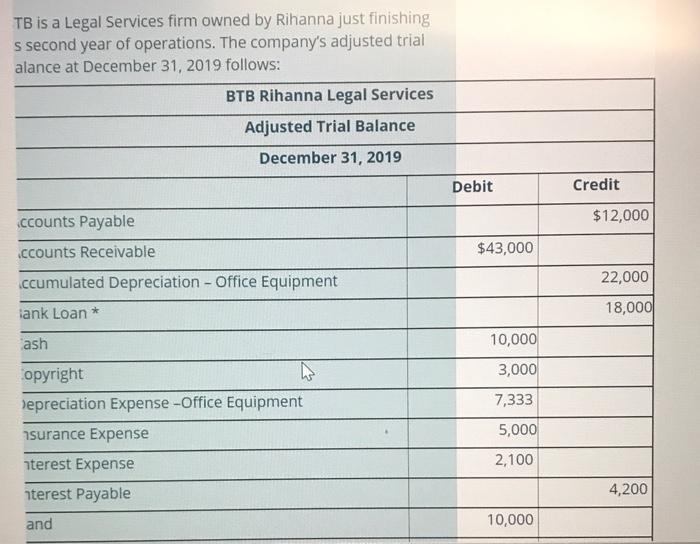

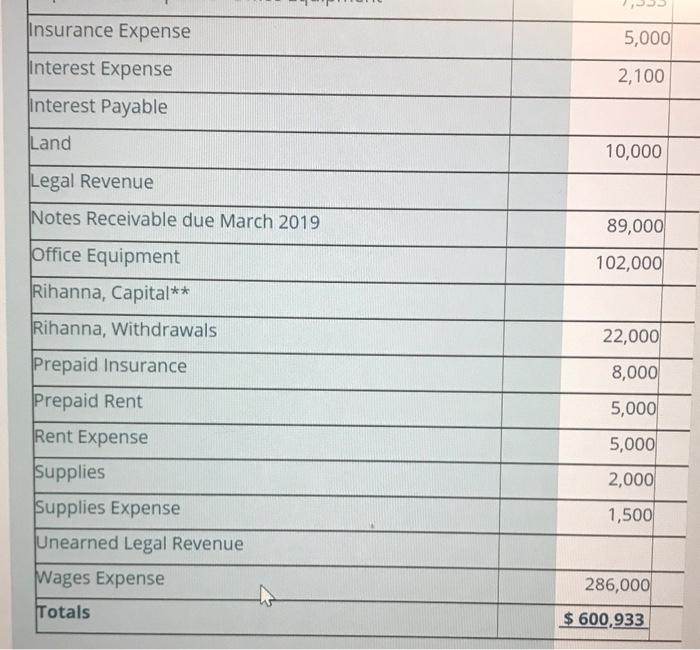

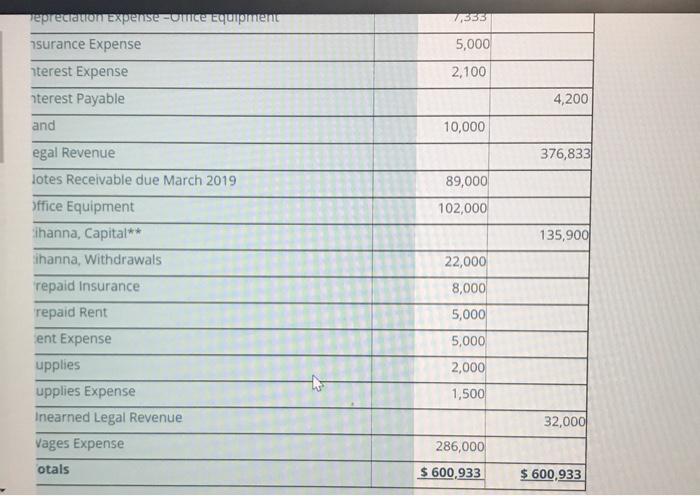

BTB is a Legal Services firm owned by Rihanna just finishing its second year of operations. The company's adjusted trial balance at December 31, 2019 follows: BTB Rihanna Legal Services Adjusted Trial Balance December 31, 2019 Debit Accounts Payable Accounts Receivable $43,00 Accumulated Depreciation - Office Equipment Bank Loan * Cash 10,0 Copyright 3,0 Depreciation Expense-Office Equipment I 7,3 5,0 Insurance Expense Interest Expense 2,140 Interest Payable Land 10,00 TB is a Legal Services firm owned by Rihanna just finishing s second year of operations. The company's adjusted trial alance at December 31, 2019 follows: BTB Rihanna Legal Services Adjusted Trial Balance December 31, 2019 Debit Credit ccounts Payable $12,000 .ccounts Receivable $43,000 iccumulated Depreciation - Office Equipment 22,000 iank Loan * 18,000 ash 10,000 opyright N 3,000 Depreciation Expense-Office Equipment 7,333 asurance Expense 5,000 nterest Expense 2,100 nterest Payable 4,200 and 10,000 Insurance Expense 5,000 2,100 Interest Expense Interest Payable Land 10,000 Legal Revenue Notes Receivable due March 2019 89,000 Office Equipment 102,000 Rihanna, Capital** Rihanna, Withdrawals Prepaid Insurance 22,000 8,000 Prepaid Rent 5,000 Rent Expense 5,000 2,000 1,500 Supplies Supplies Expense Unearned Legal Revenue Wages Expense 286,000 Totals $ 600,933 Teprecieron expense unice Equipment 7355 nsurance Expense 5,000 nterest Expense 2,100 nterest Payable 4,200 and 10,000 egal Revenue 376,833 lotes Receivable due March 2019 89,000 102,000 Office Equipment ihanna, Capital** 135,900 ihanna, Withdrawals repaid Insurance 22,000 8,000 5,000 repaid Rent Sent Expense 5,000 upplies 2,000 1,500 upplies Expense Inearned Legal Revenue 32,000 Vages Expense 286,000 otals $ 600,933 $ 600,933 *Bank loan requires a payment of $10,000 principle on January 1, 2020. ** Rihanna invested $10,000 in Smart Rihanna on July 2, 2019. Required: Based on the adjusted trial balance above prepare: 1. An income statement (9 marks) 2. Statement of changes in equity (5 marks) 3. A classified balance sheet (22 marks). Space is provided on the following pages. However, if you prefer to attach ONE excel sheet file for all statement feel free to do so and put your name in that excel sheet