Answered step by step

Verified Expert Solution

Question

1 Approved Answer

BTH - STANDS FOR TREASURY BONDS Please help me! An investor decided to choose between the following 2 strategies: a. Protective put: simultaneous purchase of

BTH - STANDS FOR TREASURY BONDS

Please help me!

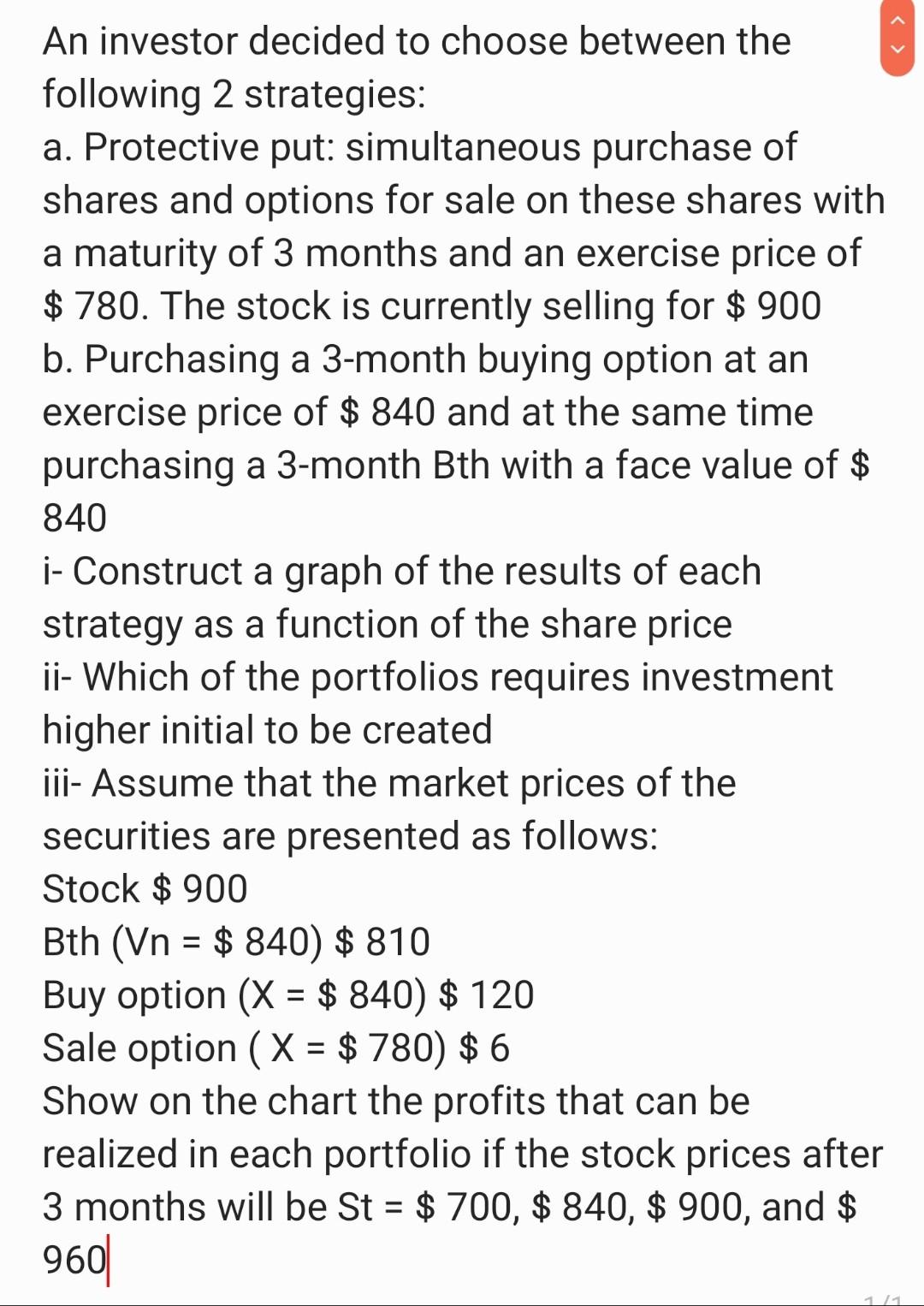

An investor decided to choose between the following 2 strategies: a. Protective put: simultaneous purchase of shares and options for sale on these shares with a maturity of 3 months and an exercise price of $ 780. The stock is currently selling for $ 900 b. Purchasing a 3-month buying option at an exercise price of $ 840 and at the same time purchasing a 3-month Bth with a face value of $ 840 i- Construct a graph of the results of each strategy as a function of the share price ji- Which of the portfolios requires investment higher initial to be created iii- Assume that the market prices of the securities are presented as follows: Stock $ 900 Bth (Vn = $ 840) $ 810 Buy option (X = $ 840) $ 120 Sale option ( X = $ 780) $ 6 Show on the chart the profits that can be realized in each portfolio if the stock prices after 3 months will be St = $ 700, $ 840, $ 900, and $ 960 1-1 An investor decided to choose between the following 2 strategies: a. Protective put: simultaneous purchase of shares and options for sale on these shares with a maturity of 3 months and an exercise price of $ 780. The stock is currently selling for $ 900 b. Purchasing a 3-month buying option at an exercise price of $ 840 and at the same time purchasing a 3-month Bth with a face value of $ 840 i- Construct a graph of the results of each strategy as a function of the share price ji- Which of the portfolios requires investment higher initial to be created iii- Assume that the market prices of the securities are presented as follows: Stock $ 900 Bth (Vn = $ 840) $ 810 Buy option (X = $ 840) $ 120 Sale option ( X = $ 780) $ 6 Show on the chart the profits that can be realized in each portfolio if the stock prices after 3 months will be St = $ 700, $ 840, $ 900, and $ 960 1-1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started