Question

Bubbly Business Caf is trying to decide should they open a second location, hire more people, or upgrade machines. Depending on increases in tuition or

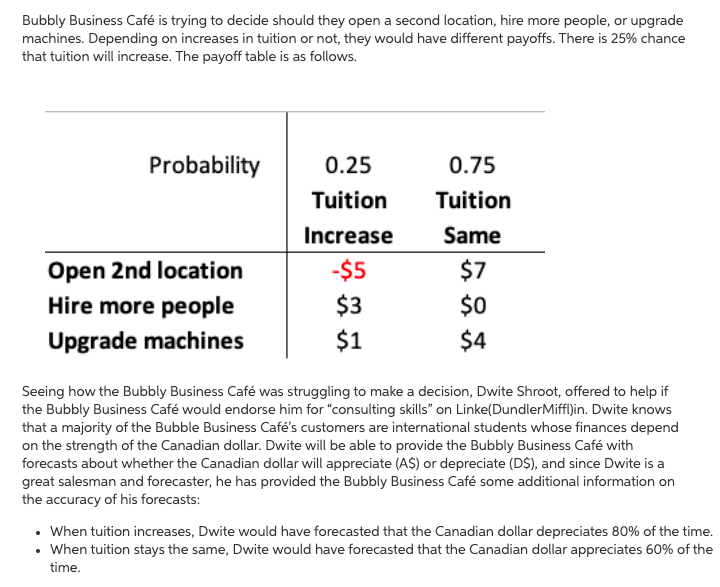

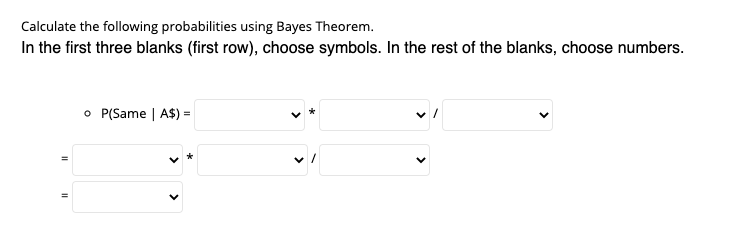

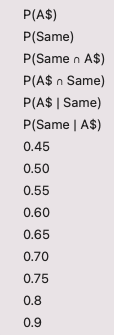

Bubbly Business Caf is trying to decide should they open a second location, hire more people, or upgrade machines. Depending on increases in tuition or not, they would have different payoffs. There is 25% chance that tuition will increase. The payoff table is as follows. Probability 0.25 0.75 Tuition Tuition Increase Same Open 2nd location Hire more people Upgrade machines -$5 $3 $1 $7 $0 $4 Seeing how the Bubbly Business Caf was struggling to make a decision, Dwite Shroot, offered to help if the Bubbly Business Caf would endorse him for "consulting skills" on Linke(DundlerMiffl)in. Dwite knows that a majority of the Bubble Business Caf's customers are international students whose finances depend on the strength of the Canadian dollar. Dwite will be able to provide the Bubbly Business Caf with forecasts about whether the Canadian dollar will appreciate (A$) or depreciate (D$), and since Dwite is a great salesman and forecaster, he has provided the Bubbly Business Caf some additional information on the accuracy of his forecasts: . When tuition increases, Dwite would have forecasted that the Canadian dollar depreciates 80% of the time. When tuition stays the same, Dwite would have forecasted that the Canadian dollar appreciates 60% of the time. Calculate the following probabilities using Bayes Theorem. In the first three blanks (first row), choose symbols. In the rest of the blanks, choose numbers. o P(Same A$) = * > P(A$) P(Same) P(Samen A$) P(A$ n Same) P(A$ | Same) P(Same | A$) 0.45 0.50 0.55 0.60 0.65 0.70 0.75 0.8 0.9

Bubbly Business Caf is trying to decide should they open a second location, hire more people, or upgrade machines. Depending on increases in tuition or not, they would have different payoffs. There is 25% chance that tuition will increase. The payoff table is as follows. Probability 0.25 0.75 Tuition Tuition Increase Same Open 2nd location Hire more people Upgrade machines -$5 $3 $1 $7 $0 $4 Seeing how the Bubbly Business Caf was struggling to make a decision, Dwite Shroot, offered to help if the Bubbly Business Caf would endorse him for "consulting skills" on Linke(DundlerMiffl)in. Dwite knows that a majority of the Bubble Business Caf's customers are international students whose finances depend on the strength of the Canadian dollar. Dwite will be able to provide the Bubbly Business Caf with forecasts about whether the Canadian dollar will appreciate (A$) or depreciate (D$), and since Dwite is a great salesman and forecaster, he has provided the Bubbly Business Caf some additional information on the accuracy of his forecasts: . When tuition increases, Dwite would have forecasted that the Canadian dollar depreciates 80% of the time. When tuition stays the same, Dwite would have forecasted that the Canadian dollar appreciates 60% of the time. Calculate the following probabilities using Bayes Theorem. In the first three blanks (first row), choose symbols. In the rest of the blanks, choose numbers. o P(Same A$) = * > P(A$) P(Same) P(Samen A$) P(A$ n Same) P(A$ | Same) P(Same | A$) 0.45 0.50 0.55 0.60 0.65 0.70 0.75 0.8 0.9

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started