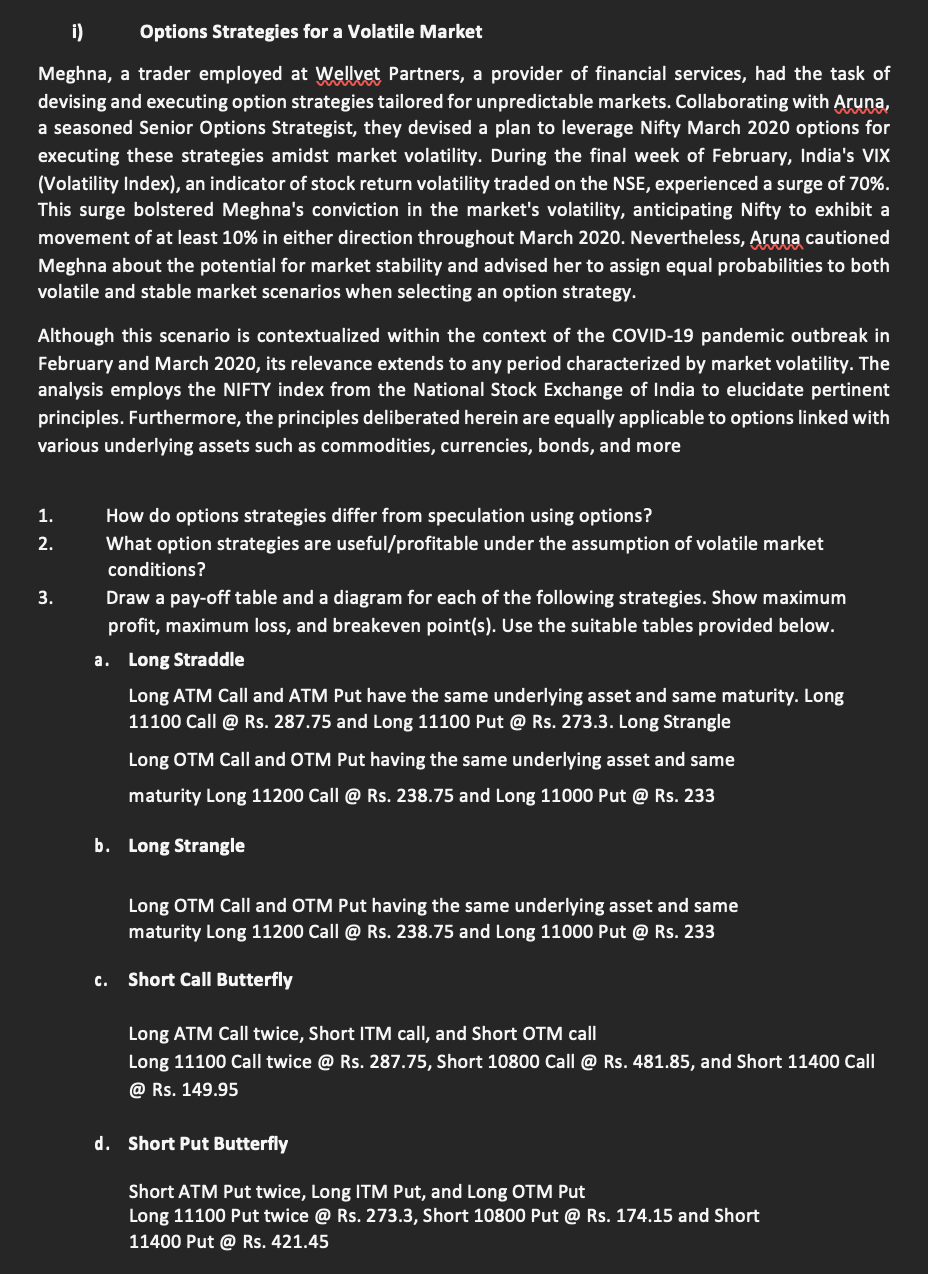

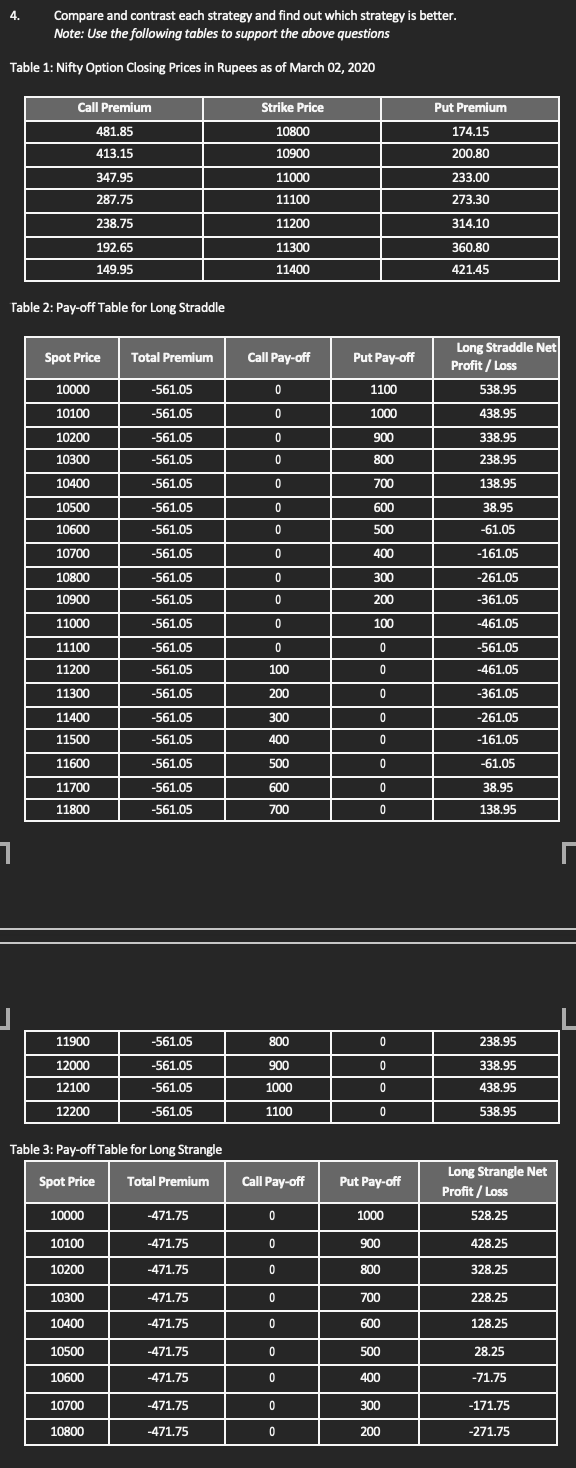

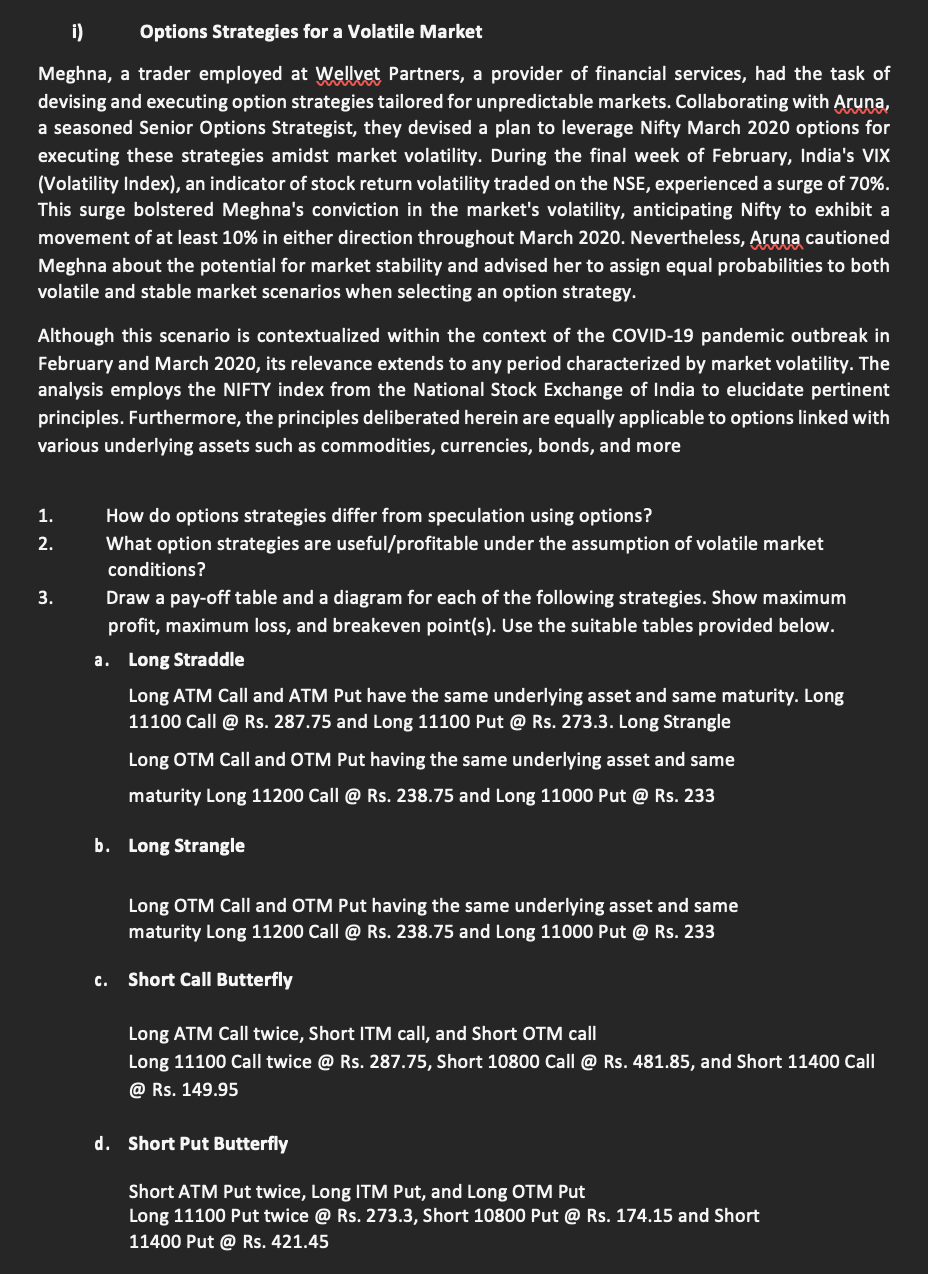

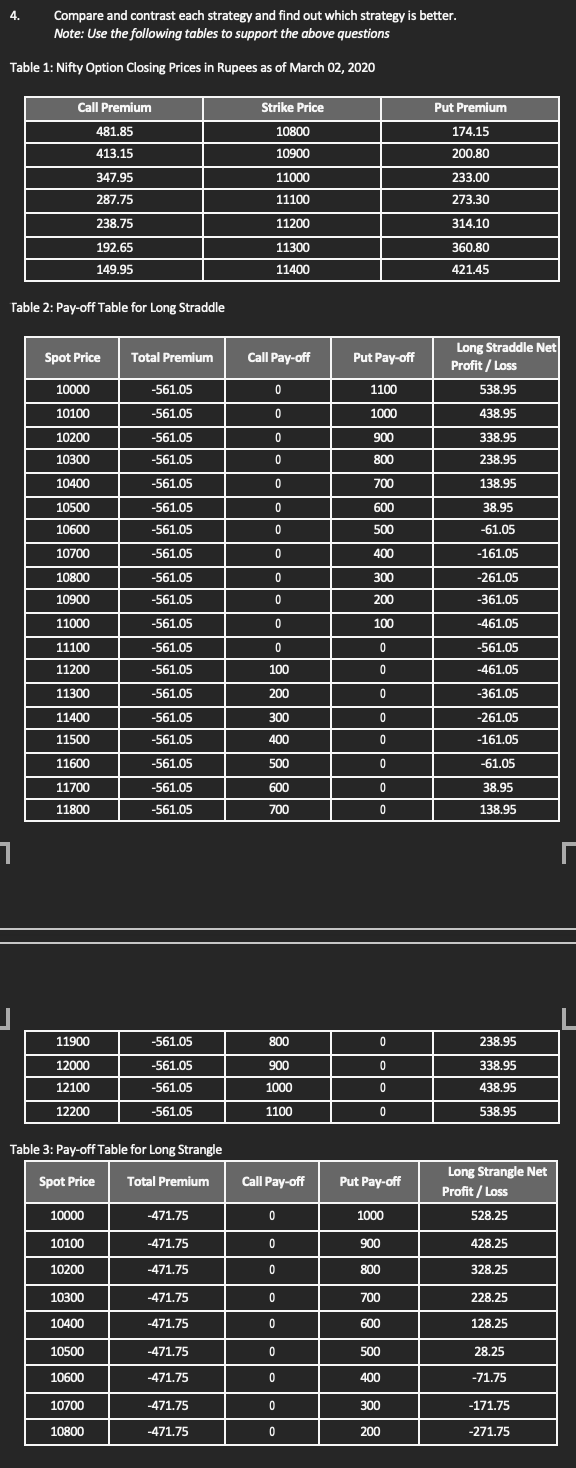

i) Options Strategies for a Volatile Market Meghna, a trader employed at Wellyet Partners, a provider of financial services, had the task of devising and executing option strategies tailored for unpredictable markets. Collaborating with Aruna, a seasoned Senior Options Strategist, they devised a plan to leverage Nifty March 2020 options for executing these strategies amidst market volatility. During the final week of February, India's VIX (Volatility Index), an indicator of stock return volatility traded on the NSE, experienced a surge of 70%. This surge bolstered Meghna's conviction in the market's volatility, anticipating Nifty to exhibit a movement of at least 10% in either direction throughout March 2020. Nevertheless, Aruna cautioned Meghna about the potential for market stability and advised her to assign equal probabilities to both volatile and stable market scenarios when selecting an option strategy. Although this scenario is contextualized within the context of the COVID-19 pandemic outbreak in February and March 2020, its relevance extends to any period characterized by market volatility. The analysis employs the NIFTY index from the National Stock Exchange of India to elucidate pertinent principles. Furthermore, the principles deliberated herein are equally applicable to options linked with various underlying assets such as commodities, currencies, bonds, and more 1. How do options strategies differ from speculation using options? 2. What option strategies are useful/profitable under the assumption of volatile market conditions? 3. Draw a pay-off table and a diagram for each of the following strategies. Show maximum profit, maximum loss, and breakeven point(s). Use the suitable tables provided below. a. Long Straddle Long ATM Call and ATM Put have the same underlying asset and same maturity. Long 11100 Call @ Rs. 287.75 and Long 11100 Put @ Rs. 273.3. Long Strangle Long OTM Call and OTM Put having the same underlying asset and same maturity Long 11200 Call @ Rs. 238.75 and Long 11000 Put @ Rs. 233 b. Long Strangle Long OTM Call and OTM Put having the same underlying asset and same maturity Long 11200 Call @ Rs. 238.75 and Long 11000 Put @ Rs. 233 c. Short Call Butterfly Long ATM Call twice, Short ITM call, and Short OTM call Long 11100 Call twice @ Rs. 287.75, Short 10800 Call @ Rs. 481.85, and Short 11400 Call @ Rs. 149.95 d. Short Put Butterfly Short ATM Put twice, Long ITM Put, and Long OTM Put Long 11100 Put twice @ Rs. 273.3, Short 10800 Put @ Rs. 174.15 and Short 11400 Put @ Rs. 421.45 i) Options Strategies for a Volatile Market Meghna, a trader employed at Wellyet Partners, a provider of financial services, had the task of devising and executing option strategies tailored for unpredictable markets. Collaborating with Aruna, a seasoned Senior Options Strategist, they devised a plan to leverage Nifty March 2020 options for executing these strategies amidst market volatility. During the final week of February, India's VIX (Volatility Index), an indicator of stock return volatility traded on the NSE, experienced a surge of 70%. This surge bolstered Meghna's conviction in the market's volatility, anticipating Nifty to exhibit a movement of at least 10% in either direction throughout March 2020. Nevertheless, Aruna cautioned Meghna about the potential for market stability and advised her to assign equal probabilities to both volatile and stable market scenarios when selecting an option strategy. Although this scenario is contextualized within the context of the COVID-19 pandemic outbreak in February and March 2020, its relevance extends to any period characterized by market volatility. The analysis employs the NIFTY index from the National Stock Exchange of India to elucidate pertinent principles. Furthermore, the principles deliberated herein are equally applicable to options linked with various underlying assets such as commodities, currencies, bonds, and more 1. How do options strategies differ from speculation using options? 2. What option strategies are useful/profitable under the assumption of volatile market conditions? 3. Draw a pay-off table and a diagram for each of the following strategies. Show maximum profit, maximum loss, and breakeven point(s). Use the suitable tables provided below. a. Long Straddle Long ATM Call and ATM Put have the same underlying asset and same maturity. Long 11100 Call @ Rs. 287.75 and Long 11100 Put @ Rs. 273.3. Long Strangle Long OTM Call and OTM Put having the same underlying asset and same maturity Long 11200 Call @ Rs. 238.75 and Long 11000 Put @ Rs. 233 b. Long Strangle Long OTM Call and OTM Put having the same underlying asset and same maturity Long 11200 Call @ Rs. 238.75 and Long 11000 Put @ Rs. 233 c. Short Call Butterfly Long ATM Call twice, Short ITM call, and Short OTM call Long 11100 Call twice @ Rs. 287.75, Short 10800 Call @ Rs. 481.85, and Short 11400 Call @ Rs. 149.95 d. Short Put Butterfly Short ATM Put twice, Long ITM Put, and Long OTM Put Long 11100 Put twice @ Rs. 273.3, Short 10800 Put @ Rs. 174.15 and Short 11400 Put @ Rs. 421.45