Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Buck bought his first home three years ago where he borrowed $ 2 5 , 0 0 0 from his Registered Retirement Savings Plan (

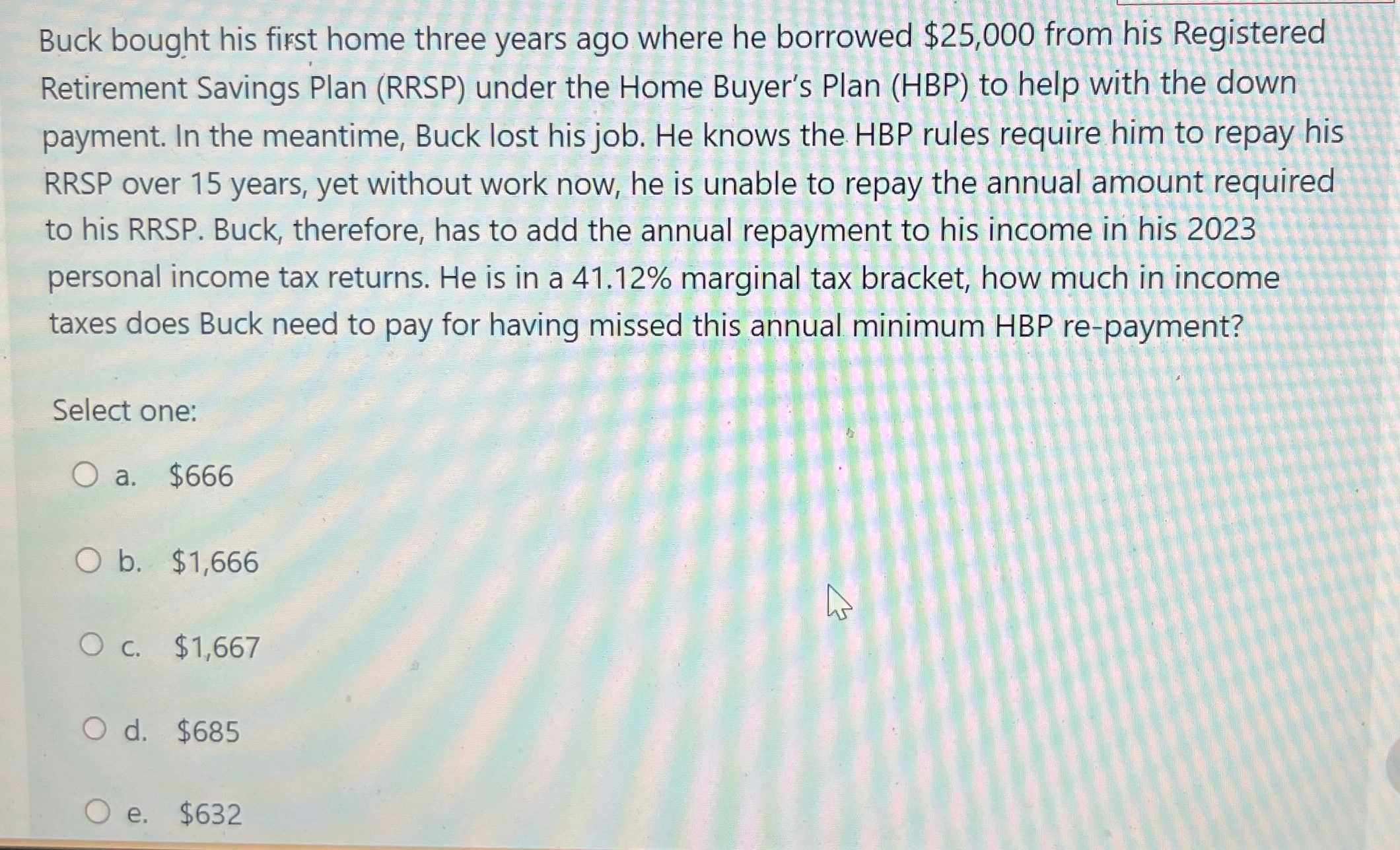

Buck bought his first home three years ago where he borrowed $ from his Registered Retirement Savings Plan RRSP under the Home Buyer's Plan HBP to help with the down payment. In the meantime, Buck lost his job. He knows the HBP rules require him to repay his RRSP over years, yet without work now, he is unable to repay the annual amount required to his RRSP Buck, therefore, has to add the annual repayment to his income in his personal income tax returns. He is in a marginal tax bracket, how much in income taxes does Buck need to pay for having missed this annual minimum HBP repayment?

Select one:

a $

b $

c $

d $

e $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started