Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bud received 2 0 0 shares of Georgia Corporation stock from his uncle as a gift on July 2 0 , 2 0 2 2

Bud received shares of Georgia Corporation stock from his uncle as a gift on July when the stock had a $ fair market value FMV His uncle paid $ for the stock on April The taxable gift was

$ because his uncle made another gift to Bud for $ in January and used the annual exclusion. The uncle paid a giff tax of $ Without considering the transactions below, Bud's AGI is $ in No other

transactions involving capital assets occur during the year.

Read the requirement.

a He sells the stock on October for $

b He sells the stock on October for $

c He sells the stock on December for $

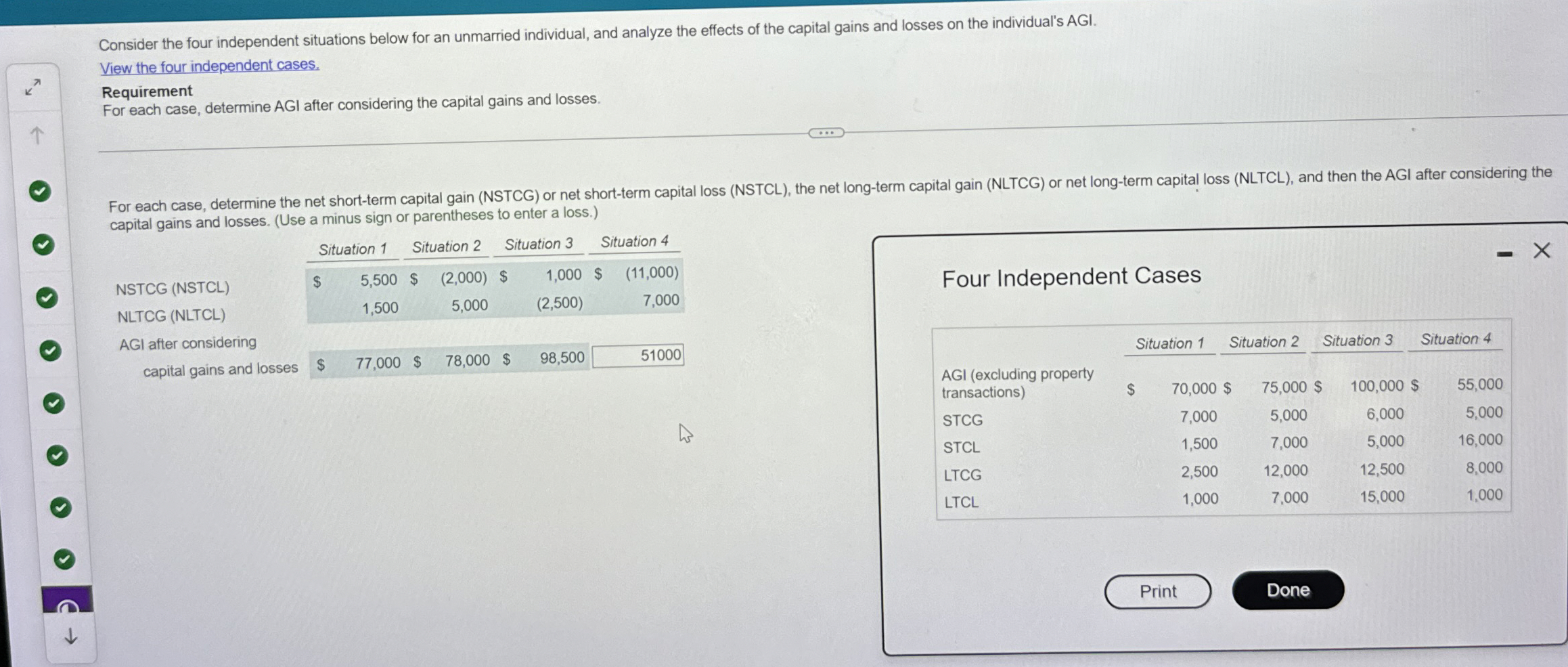

Consider the four independent situations below for an unmarried individual, and analyze the effects of the capital gains and losses on the individual's AGI.

View the four independent cases.

Requirement

For each case, determine AGI after considering the capital gains and losses.

capital gains and losses. Use a minus sign or parentheses to enter a loss.

NSTCG NSTCL

NLTCG NLTCL

AGI after considering

capital gains and losses

Situation

Situation

Situation

Situation

$ $ $

Four Independent Cases

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started