Answered step by step

Verified Expert Solution

Question

1 Approved Answer

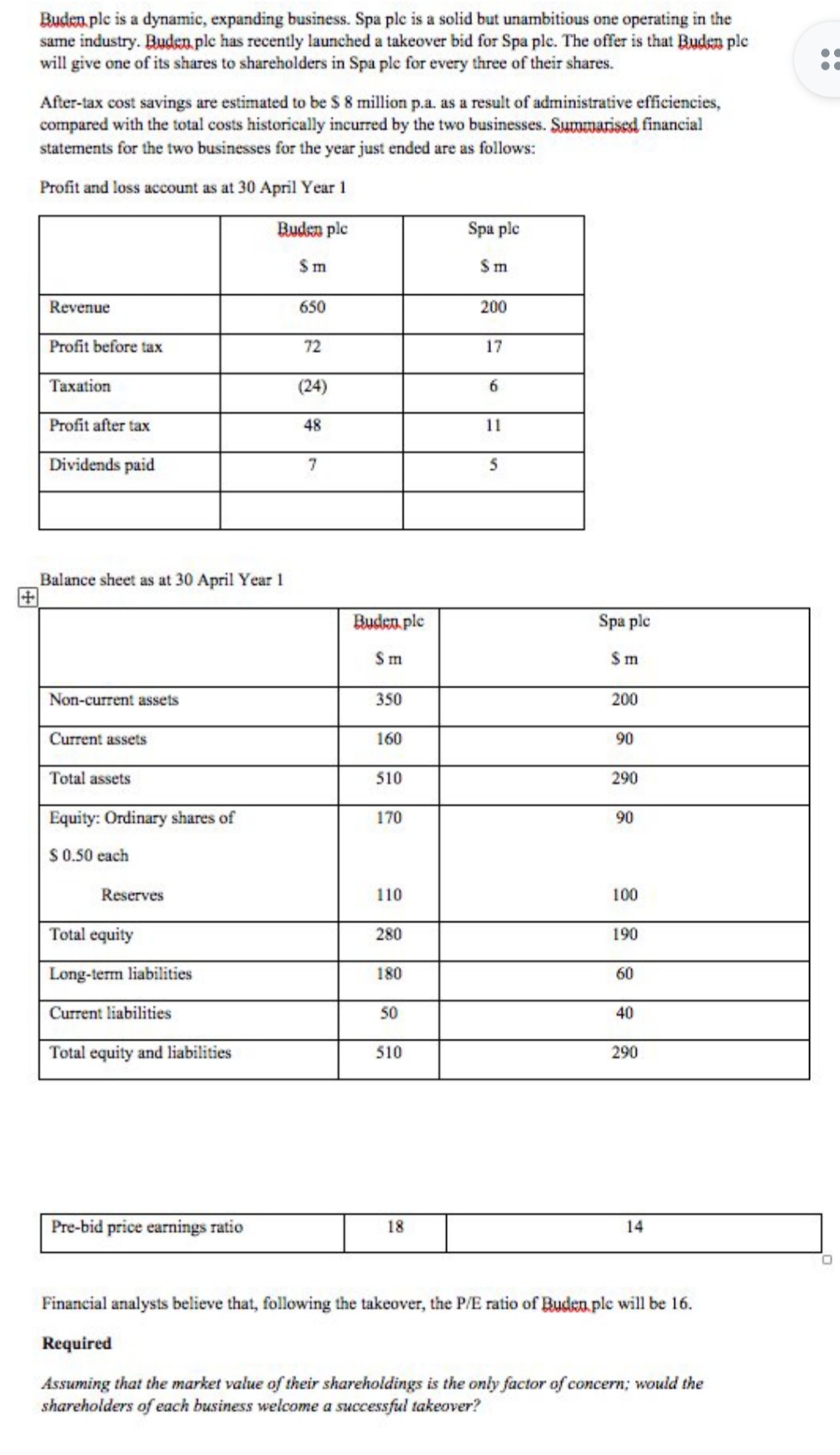

Buden plc is a dynamic, expanding business. Spa ple is a solid but unambitious one operating in the same industry. Buden ple has recently launched

Buden plc is a dynamic, expanding business. Spa ple is a solid but unambitious one operating in the

same industry. Buden ple has recently launched a takeover bid for Spa ple. The offer is that Buden ple

will give one of its shares to shareholders in Spa ple for every three of their shares.

Aftertax cost savings are estimated to be $ million pa as a result of administrative efficiencies,

compared with the total costs historically incurred by the two businesses. Surwararised financial

statements for the two businesses for the year just ended are as follows:

Profit and loss account as at April Year

Balance sheet as at April Year

Financial analysts believe that, following the takeover, the ratio of Buden ple will be

Required

Assuming that the market value of their shareholdings is the only factor of concern; would the

shareholders of each business welcome a successful takeover?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started