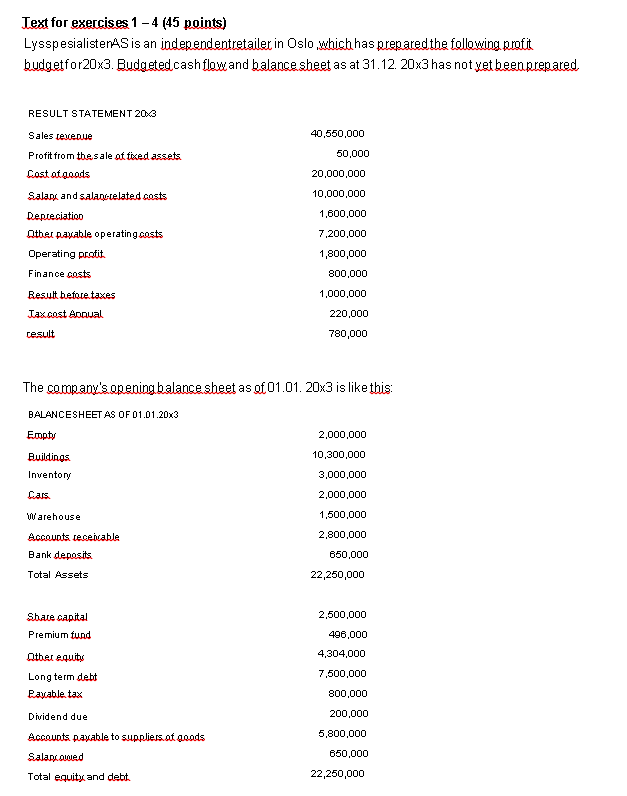

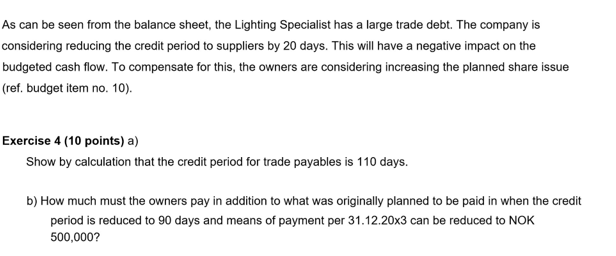

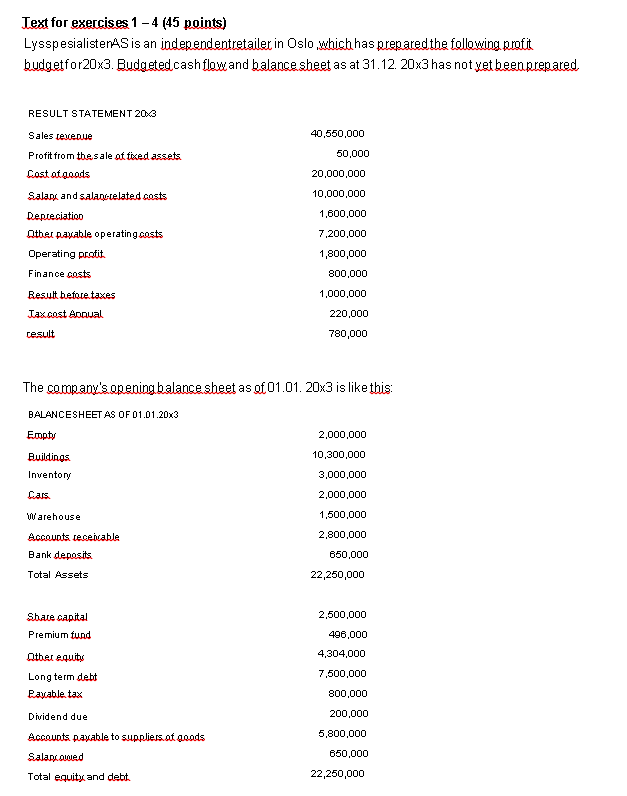

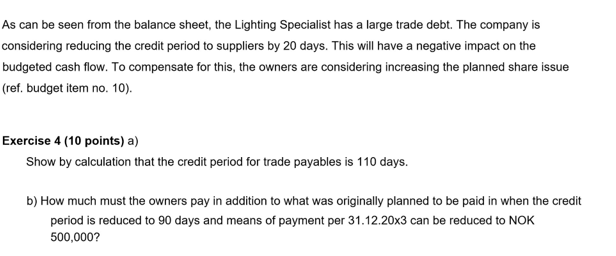

Budget momentsfor 203 : 1. Disregard VAT. in this task. 2. Assume that qoods sales and poods purchases are distibuted equally over the ieare. Translated by Google 3. All merchandise sales are on credit with a budgeted credit period of 30 days. Assume that the year has 360 days. 4. It is budgeted for a reduction of the inventory by NOK 300,000 in the budget year. 5. Investments in new inventory of NOK 2,600,000 are budgeted for 203. It is also budgeted for the sale of a van, which has a book value of NOK 400,000 . The depreciation of NOK 1,600,000 is divided by NOK 200,000 on cars, NOK 1,000,000 on fixtures and NOK 400,000 on the building. 6. The business does not have an overdraft facility. All deposits and withdrawals are made through the company's bank deposit account. 7. The debt to suppliers is expected to increase by NOK 200,000 during the budget year. Payments to other suppliers take place in the same month as the cost is incurred. 8. At the end of 203, NOK 500,000 in wages owed has been budgeted. 9. The tax cost for 203 is fully payable tax. 10. It is budgeted that the owners inject NOK 1,800,000 in new equity. The amount is distributed with NOK 1,300,000 on share capital and NOK 500,000 on the premium fund. No allocated dividend from the budgeted result for 203 is budgeted. 11. Old debt must be repaid with NOK 200,000 in 203. New loans of NOK 1,000,000 are budgeted for. Text for exercises 14 (45 points) LysspesialisterAS is an jadependentretailer in Oslo which has prepared the following arofit budgetf or20 3. Budgetedcash flow and balance sheet as at 31.12 . 203 has not yet been prenared. The comnany's opening balance sheet as of 01.01. 203 is like this: As can be seen from the balance sheet, the Lighting Specialist has a large trade debt. The company is considering reducing the credit period to suppliers by 20 days. This will have a negative impact on the budgeted cash flow. To compensate for this, the owners are considering increasing the planned share issue (ref. budget item no. 10). Exercise 4 (10 points) a) Show by calculation that the credit period for trade payables is 110 days. b) How much must the owners pay in addition to what was originally planned to be paid in when the credit period is reduced to 90 days and means of payment per 31.12.203 can be reduced to NOK 500,000