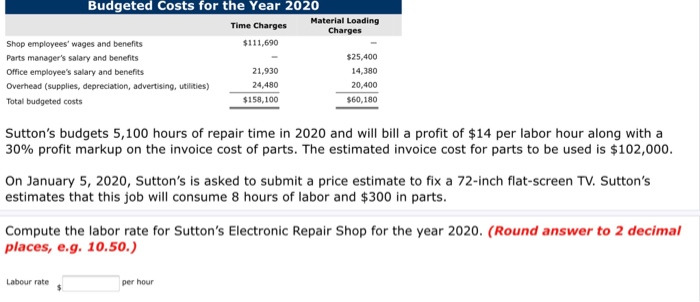

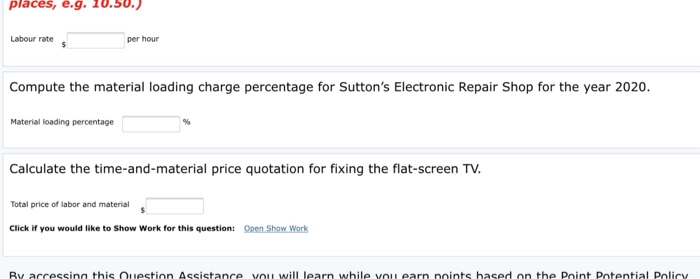

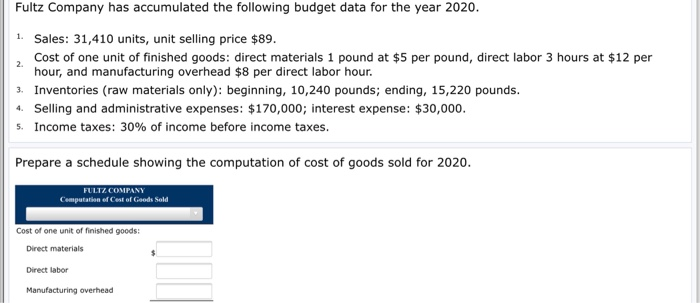

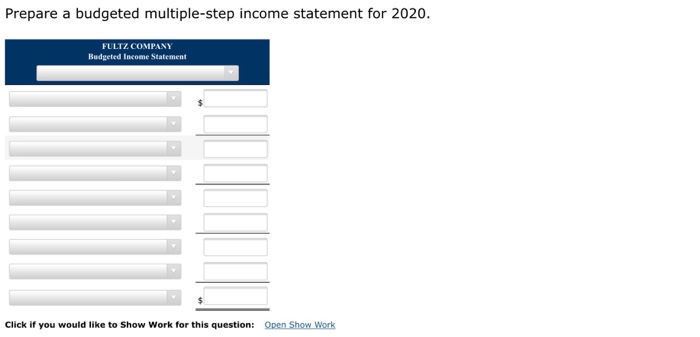

Budgeted Costs for the Year 2020 Material Loading Time Charges Charges Shop employees' wages and benefits $111,690 Parts manager's salary and benefits $25,400 Office employee's salary and benefits 21,930 14,380 Overhead (supplies, depreciation, advertising, utilities) 24,480 20,400 Total budgeted costs $158,100 $60,180 Sutton's budgets 5,100 hours of repair time in 2020 and will bill a profit of $14 per labor hour along with a 30% profit markup on the invoice cost of parts. The estimated invoice cost for parts to be used is $102,000. On January 5, 2020, Sutton's is asked to submit a price estimate to fix a 72-inch flat-screen TV. Sutton's estimates that this job will consume 8 hours of labor and $300 in parts. Compute the labor rate for Sutton's Electronic Repair Shop for the year 2020. (Round answer to 2 decimal places, e.g. 10.50.) Labour rates per hour places, e.g. 10.50.) Labour rates per hour Compute the material loading charge percentage for Sutton's Electronic Repair Shop for the year 2020. Material loading percentage Calculate the time-and-material price quotation for fixing the flat-screen TV. Total price of labor and material Click if you would like to Show Work for this question: Open Show Work By accessing this Question Assistance you will learn while you earn noints based on the Point Potential Policy Fultz Company has accumulated the following budget data for the year 2020. 1. Sales: 31,410 units, unit selling price $89. Cost of one unit of finished goods: direct materials 1 pound at $5 per pound, direct labor 3 hours at $12 per hour, and manufacturing overhead $8 per direct labor hour. 3. Inventories (raw materials only): beginning, 10,240 pounds; ending, 15,220 pounds. 4. Selling and administrative expenses: $170,000; interest expense: $30,000. 5. Income taxes: 30% of income before income taxes. Prepare a schedule showing the computation of cost of goods sold for 2020. FULTZ COMPANY Computation of Cast of Goods Sold Cost of one unit of finished goods: Direct materials Direct labor Manufacturing overhead Prepare a budgeted multiple-step income statement for 2020. FULTZ COMPANY Budgeted Income Statement Click if you would like to Show Work for this question: Open Show Work