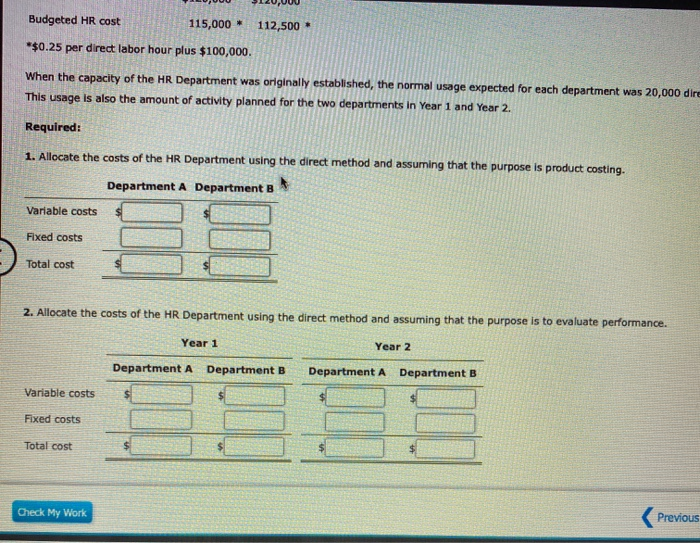

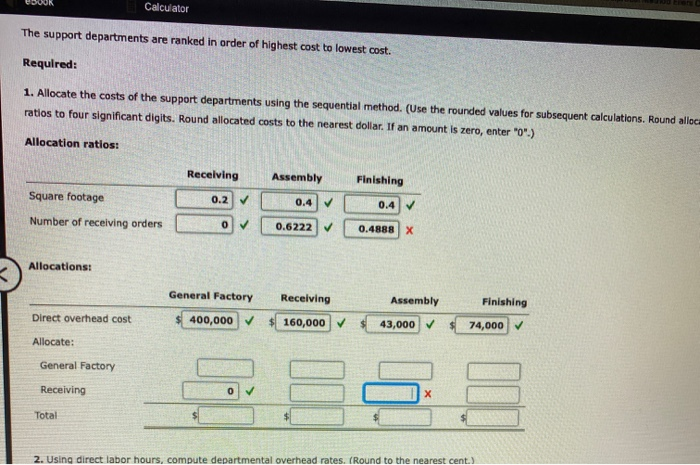

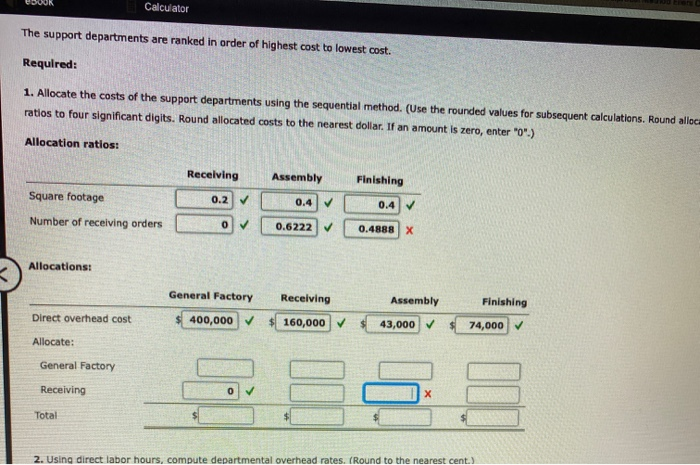

Budgeted HR Cost 115,000 * 112,500 *$0.25 per direct labor hour plus $100,000. When the capacity of the HR Department was originally established, the normal usage expected for each department was 20,000 din This usage is also the amount of activity planned for the two departments in Year 1 and Year 2. Required: 1. Allocate the costs of the HR Department using the direct method and assuming that the purpose is product costing. Department A Department B Variable costs Fixed costs Total cost $ 2. Allocate the costs of the HR Department using the direct method and assuming that the purpose is to evaluate performance. Year 1 Year 2 Department A Department B Department A Department B Variable costs Fixed costs BE Total cost Check My Work Previou DUUR Calculator The support departments are ranked in order of highest cost to lowest cost. Required: 1. Allocate the costs of the support departments using the sequential method. (Use the rounded values for subsequent calculations. Round alloc ratios to four significant digits. Round allocated costs to the nearest dollar. If an amount is zero, enter "O'.) Allocation ratios: Receiving 0.2 Square footage Number of receiving orders Assembly 0.4 0.6222 Finishing 0.4 0.4888 Allocations: General Factory Receiving Finishing Direct overhead cost $400,000 $160,000 Assembly 43,000 $ 74,000 Allocate: General Factory Receiving 0 Total 2. Using direct labor hours, compute departmental overhead rates. (Round to the nearest cent.) Budgeted HR Cost 115,000 * 112,500 *$0.25 per direct labor hour plus $100,000. When the capacity of the HR Department was originally established, the normal usage expected for each department was 20,000 din This usage is also the amount of activity planned for the two departments in Year 1 and Year 2. Required: 1. Allocate the costs of the HR Department using the direct method and assuming that the purpose is product costing. Department A Department B Variable costs Fixed costs Total cost $ 2. Allocate the costs of the HR Department using the direct method and assuming that the purpose is to evaluate performance. Year 1 Year 2 Department A Department B Department A Department B Variable costs Fixed costs BE Total cost Check My Work Previou DUUR Calculator The support departments are ranked in order of highest cost to lowest cost. Required: 1. Allocate the costs of the support departments using the sequential method. (Use the rounded values for subsequent calculations. Round alloc ratios to four significant digits. Round allocated costs to the nearest dollar. If an amount is zero, enter "O'.) Allocation ratios: Receiving 0.2 Square footage Number of receiving orders Assembly 0.4 0.6222 Finishing 0.4 0.4888 Allocations: General Factory Receiving Finishing Direct overhead cost $400,000 $160,000 Assembly 43,000 $ 74,000 Allocate: General Factory Receiving 0 Total 2. Using direct labor hours, compute departmental overhead rates. (Round to the nearest cent.)