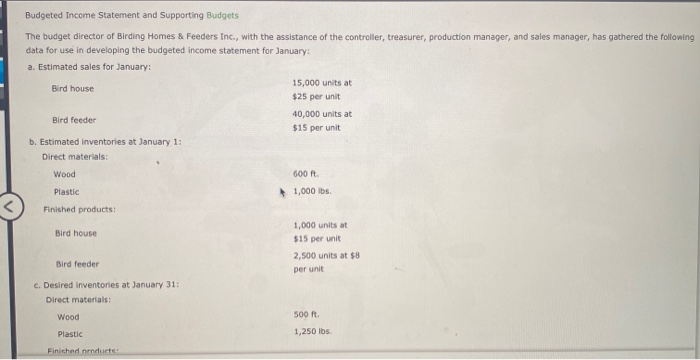

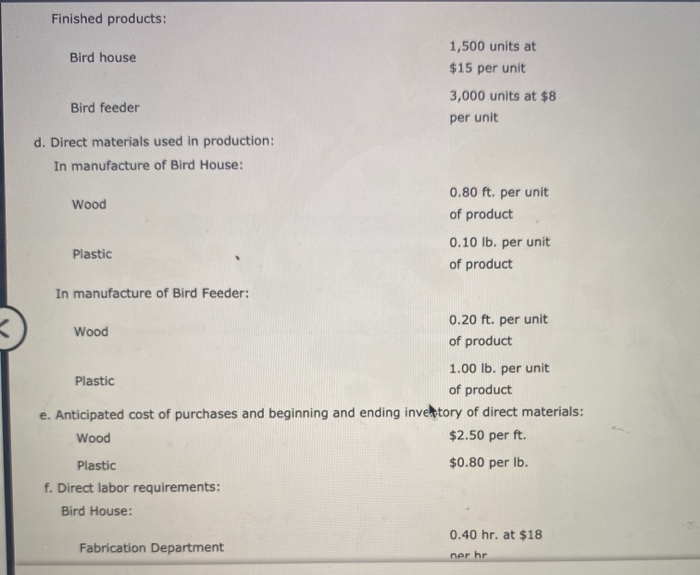

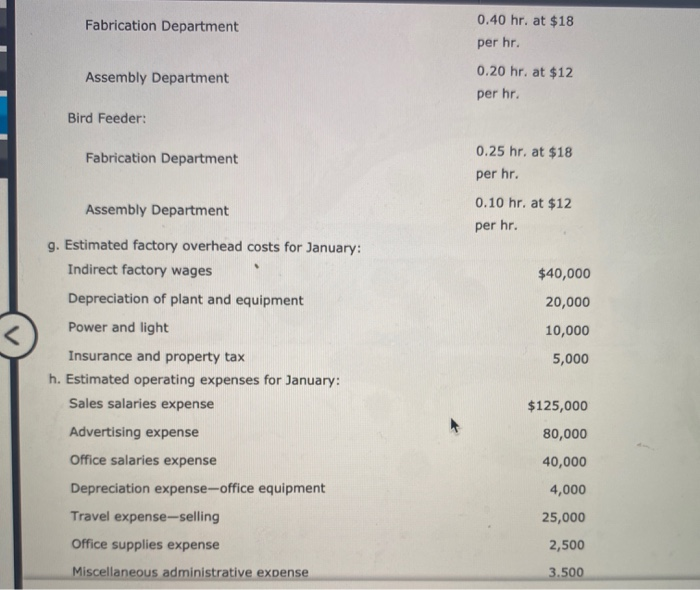

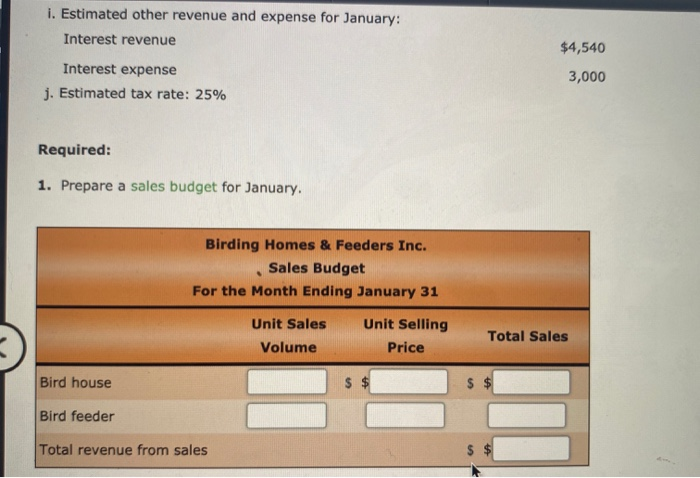

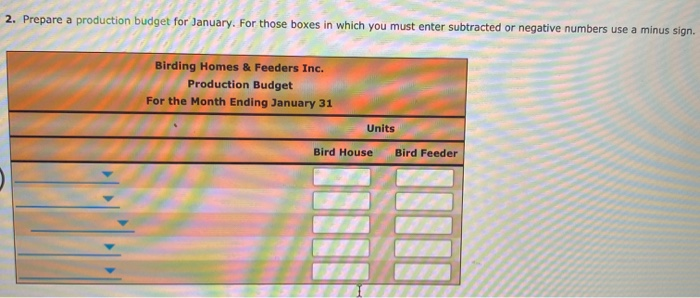

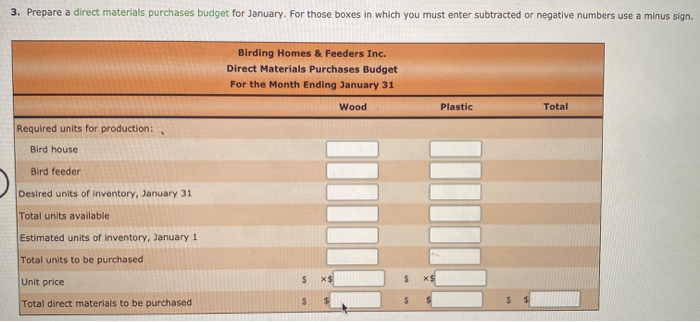

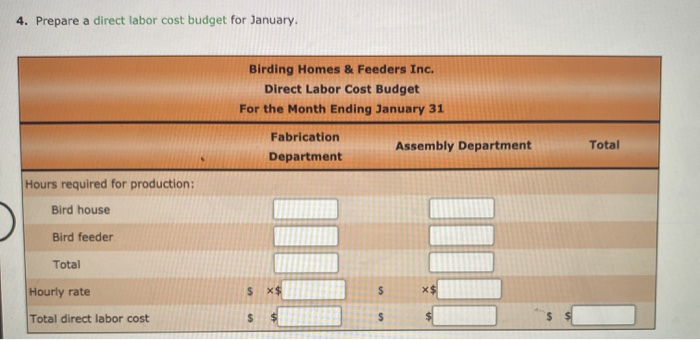

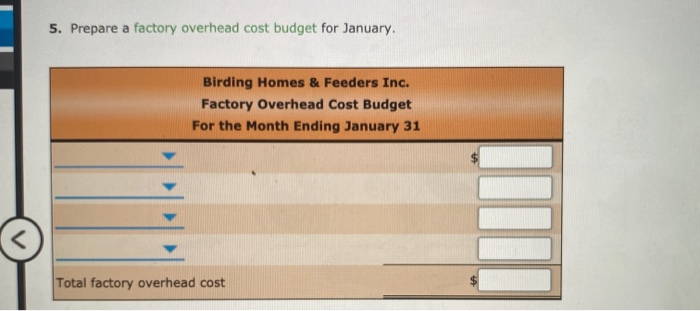

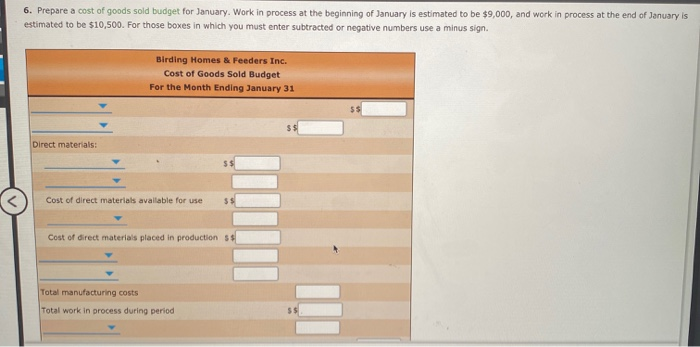

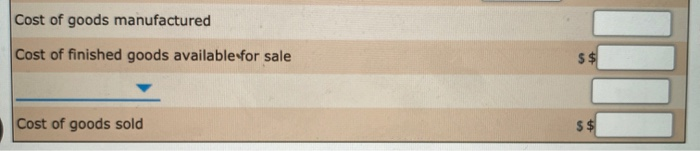

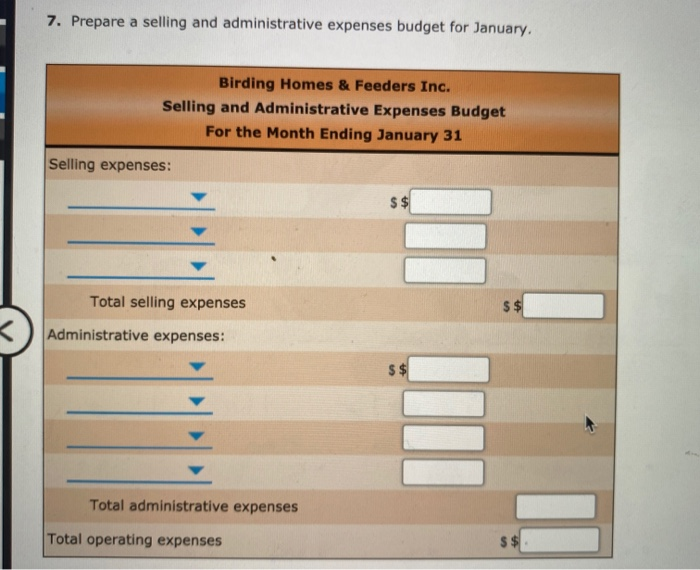

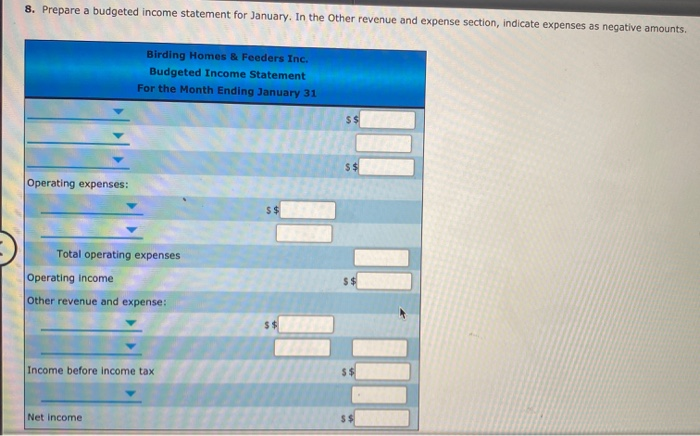

Budgeted Income Statement and Supporting Budgets The budget director of Birding Homes & Feeders Inc., with the assistance of the controller, treasurer, production manager, and sales manager, has gathered the following data for use in developing the budgeted income statement for January: a. Estimated sales for January: Bird house 15,000 units at $25 per unit 40,000 units at Bird feeder $15 per unit b. Estimated Inventories at January 1: Direct materials: Wood 600 ft Plastic 1,000 lbs Finished products 1,000 units at Bird house $15 per unit 2,500 units at $8 Bird Feeder per unit c. Desired inventories at January 31: Direct materials: Wood 500 Ft Plastic 1,250 lbs Finished nonducte Finished products: Bird house 1,500 units at $15 per unit 3,000 units at $8 per unit Bird feeder d. Direct materials used in production: In manufacture of Bird House: Wood 0.80 ft. per unit of product Plastic 0.10 lb. per unit of product In manufacture of Bird Feeder: 0.20 ft. per unit Wood of product 1.00 lb. per unit Plastic of product e. Anticipated cost of purchases and beginning and ending inventory of direct materials: Wood $2.50 per ft. Plastic $0.80 per lb. f. Direct labor requirements: Bird House: 0.40 hr. at $18 Fabrication Department ner hr Fabrication Department 0.40 hr. at $18 per hr. Assembly Department 0.20 hr. at $12 per hr. Bird Feeder: Fabrication Department 0.25 hr. at $18 per hr. Assembly Department 0.10 hr. at $12 per hr. $40,000 20,000 10,000 5,000 g. Estimated factory overhead costs for January: Indirect factory wages Depreciation of plant and equipment Power and light Insurance and property tax h. Estimated operating expenses for January: Sales salaries expense Advertising expense Office salaries expense Depreciation expense-office equipment Travel expense-selling Office supplies expense Miscellaneous administrative expense $125,000 80,000 40,000 4,000 25,000 2,500 3.500 i. Estimated other revenue and expense for January: Interest revenue $4,540 Interest expense j. Estimated tax rate: 25% 3,000 Required: 1. Prepare a sales budget for January. Birding Homes & Feeders Inc. Sales Budget For the Month Ending January 31 Unit Sales Volume Unit Selling Price Total Sales Bird house $ $ Bird feeder Total revenue from sales 2. Prepare a production budget for January. For those boxes in which you must enter subtracted or negative numbers use a minus sign. Birding Homes & Feeders Inc. Production Budget For the Month Ending January 31 Units Bird House Bird Feeder 3. Prepare a direct materials purchases budget for January. For those boxes in which you must enter subtracted or negative numbers use a minus sign. Birding Homes & Feeders Inc. Direct Materials Purchases Budget For the Month Ending January 31 Wood Plastic Total Required units for production: Bird house Bird feeder Desired units of inventory, January 31 Total units available Estimated units of inventory, January 1 Total units to be purchased Unit price S x$ S X$ Total direct materials to be purchased $ $ $ $ $ $ 4. Prepare a direct labor cost budget for January. Birding Homes & Feeders Inc. Direct Labor Cost Budget For the Month Ending January 31 Fabrication Department Assembly Department Total Hours required for production: Bird house Bird feeder Total Hourly rate $X$ $ X$ Total direct labor cost $ 5. Prepare a factory overhead cost budget for January. Birding Homes & Feeders Inc. Factory Overhead Cost Budget For the Month Ending January 31 Total factory overhead cost 6. Prepare a cost of goods sold budget for January. Work in process at the beginning of January is estimated to be $9,000, and work in process at the end of January is estimated to be $10,500. For those boxes in which you must enter subtracted or negative numbers use a minus sign. Birding Homes & Feeders Inc. Cost of Goods Sold Budget For the Month Ending January 31 Direct materials: Cost of direct materials available for use $$ Cost of direct materiais placed in production & Total manufacturing costs Total work in process during period Cost of goods manufactured Cost of finished goods available for sale $$ Cost of goods sold $$ 7. Prepare a selling and administrative expenses budget for January. Birding Homes & Feeders Inc. Selling and Administrative Expenses Budget For the Month Ending January 31 Selling expenses: $ $ Total selling expenses $ $ Administrative expenses: CA III Total administrative expenses Total operating expenses $$ 8. Prepare a budgeted income statement for January. In the other revenue and expense section, indicate expenses as negative amounts. Birding Homes & Feeders Inc. Budgeted Income Statement For the Month Ending January 31 $ $ $$ Operating expenses: Total operating expenses $$ Operating income Other revenue and expense: $$ Income before income tax $$ Net Income S$