Answered step by step

Verified Expert Solution

Question

1 Approved Answer

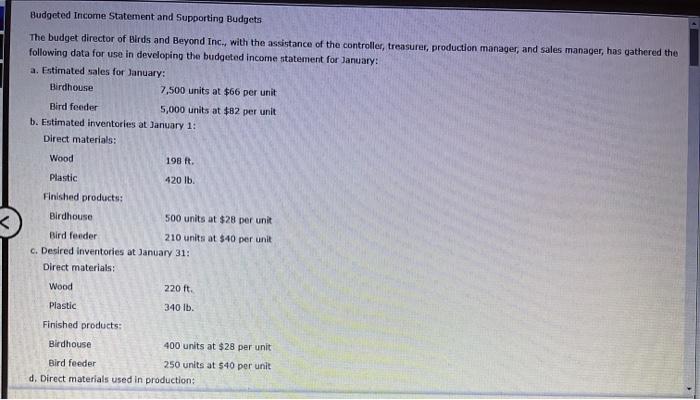

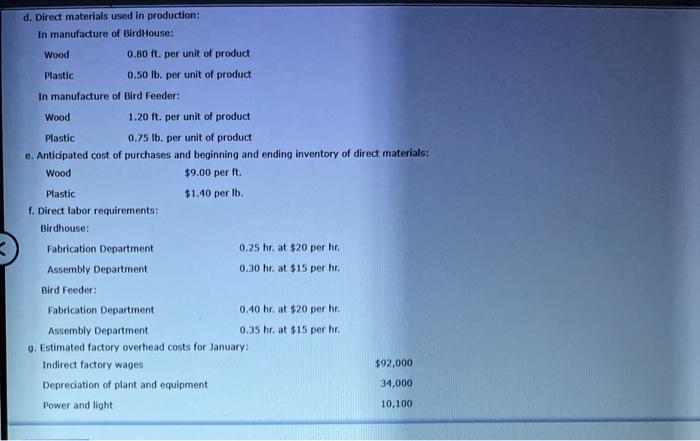

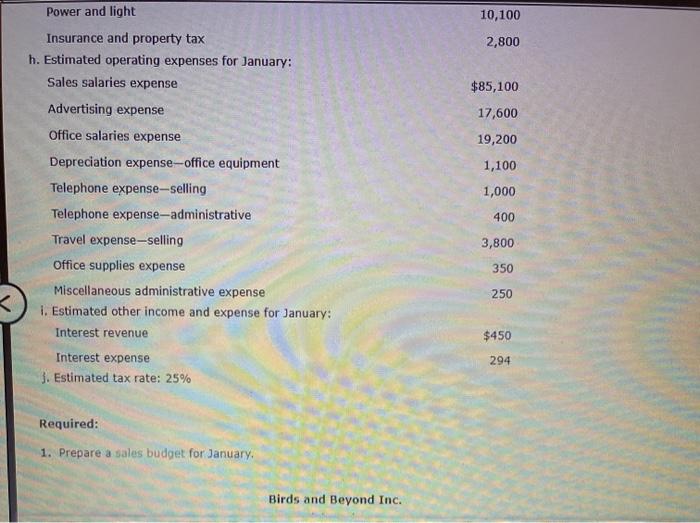

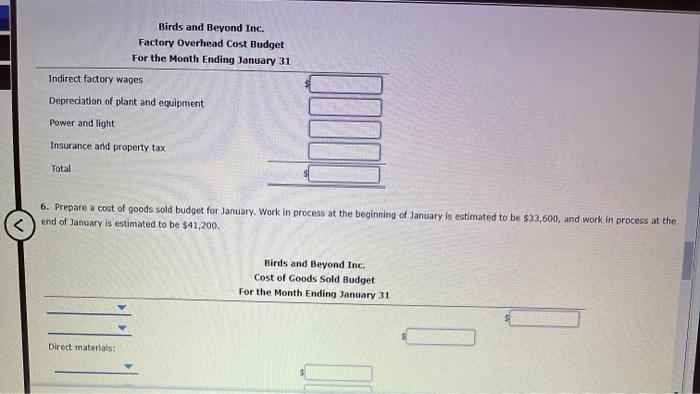

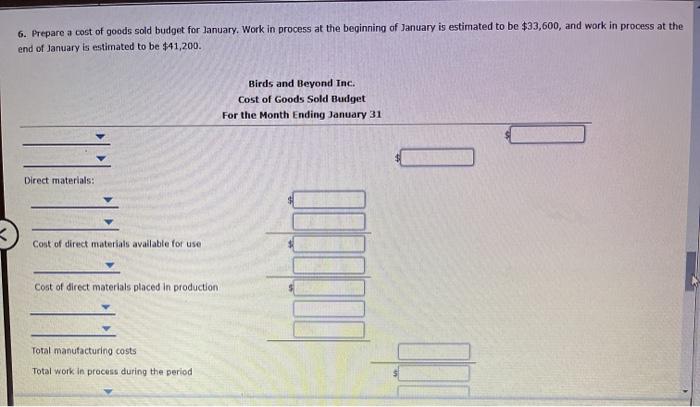

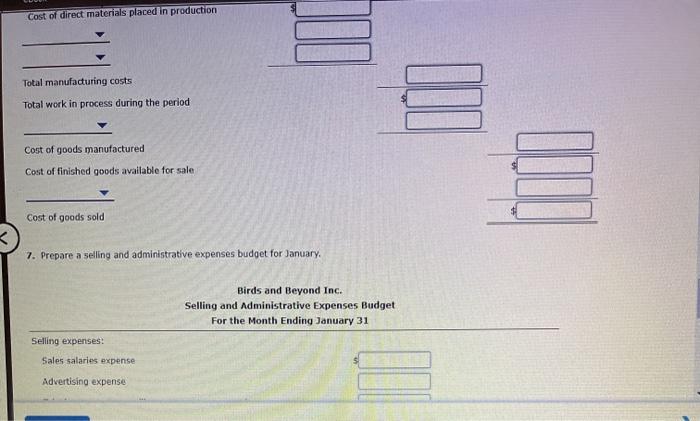

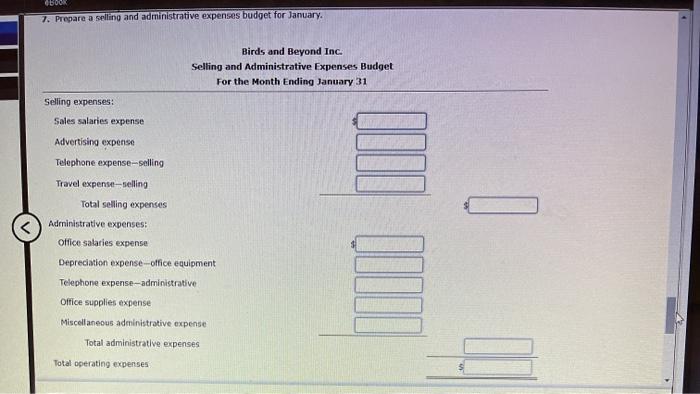

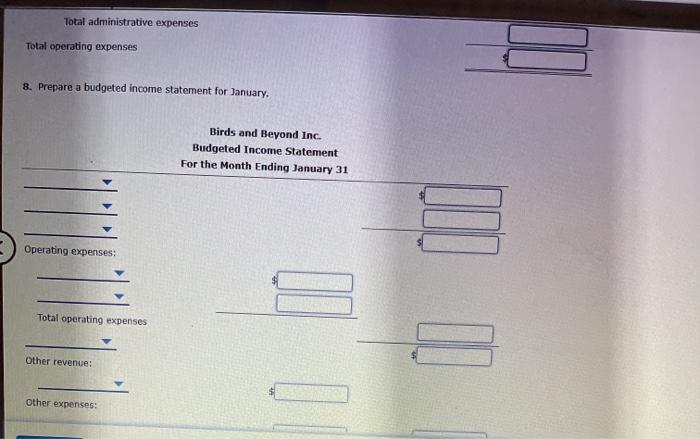

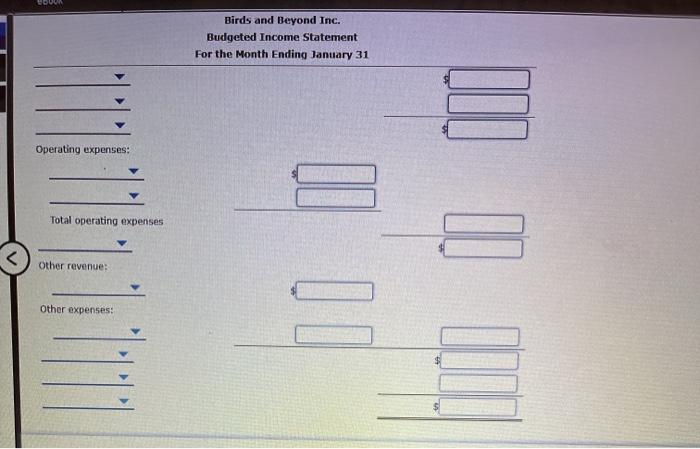

Budgeted Income Statement and Supporting Budgets The budget director of Birds and Beyond Inc., with the assistance of the controller, treasurer, production manager, and sales

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started