budgeted income statement

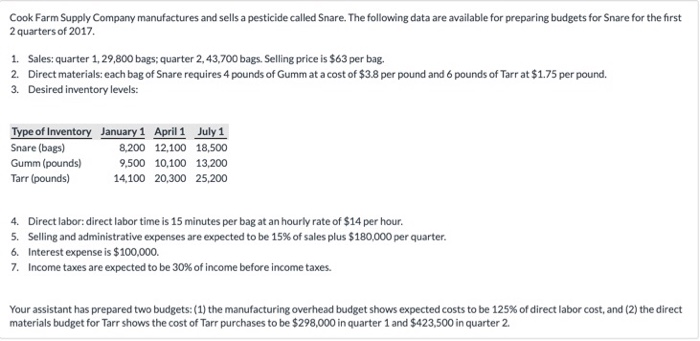

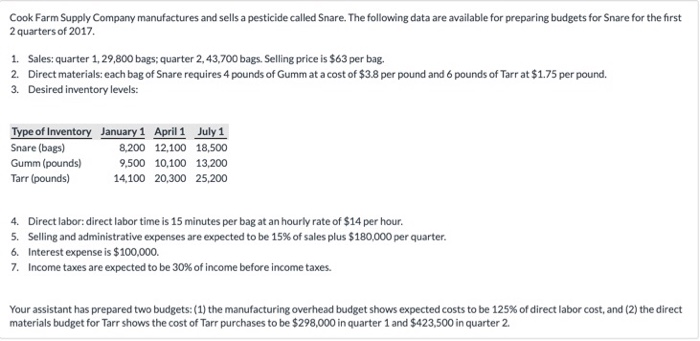

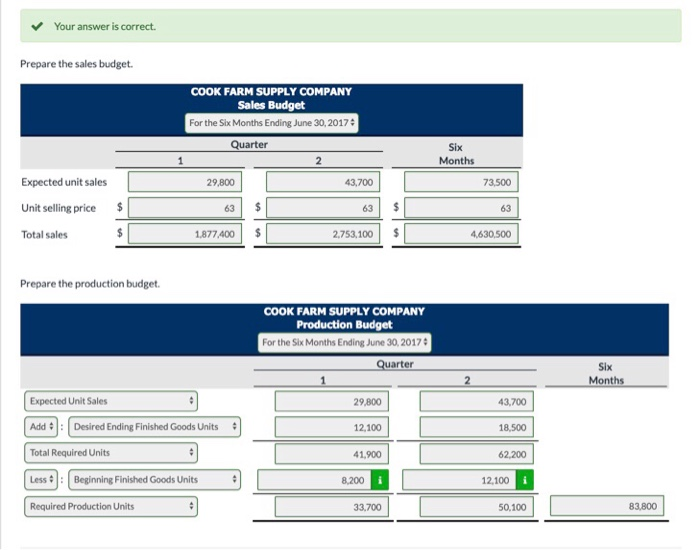

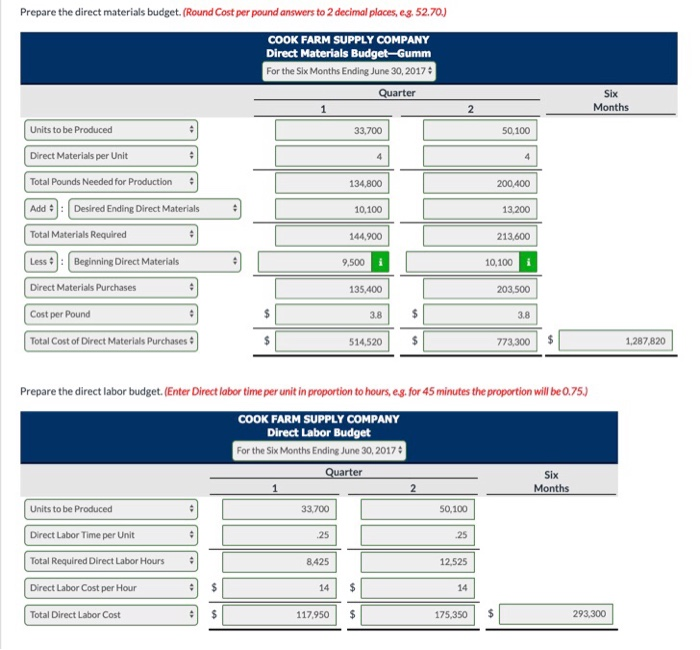

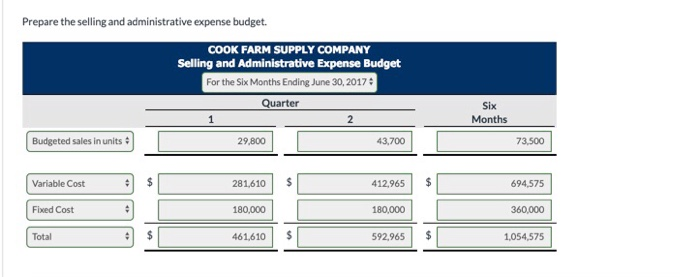

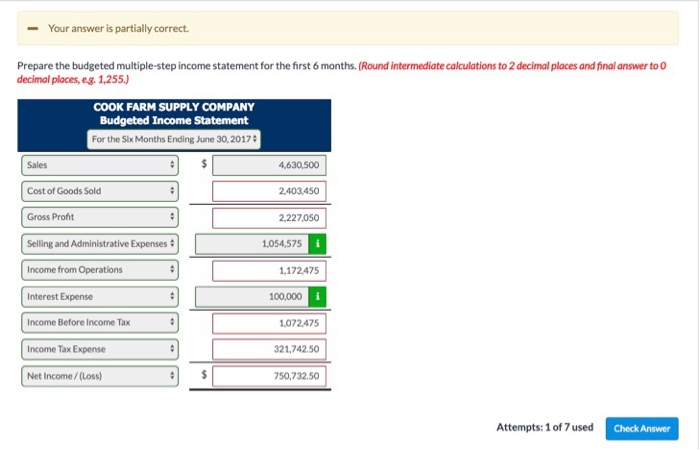

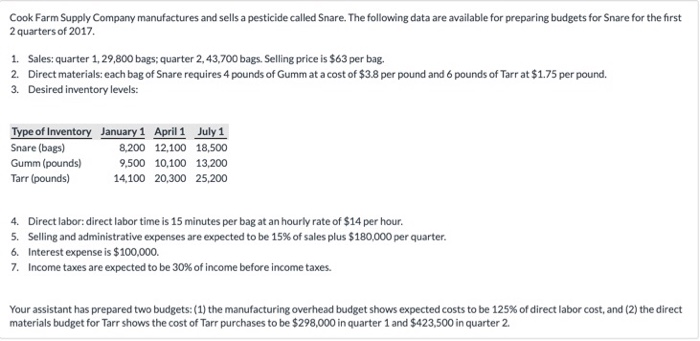

Cook Farm Supply Company manufactures and sells a pesticide called Snare. The following data are available for preparing budgets for Snare for the first 2 quarters of 2017. Sales: quarter 1, 29,800 bags; quarter 2,43,700 bags. Selling price is $63 per bag. Direct materials: each bag of Snare requires 4 pounds of Gumm at a cost of $3.8 per pound and 6 pounds of Tarr at $1.75 per pound. Desired inventory levels: 1. 2. 3. Type of Inventory Snare (bags) Gumm (pounds) Tarr (pounds) January 1 April 1 8,200 12,100 18,500 9,500 10,100 13,200 14100 20,300 25,200 July 1 4. 5. 6. 7, Direct labor: direct labor time is 15 minutes per bag at an hourly rate of $14 per hour. Selling and administrative expenses are expected to be 15% of sales plus $180,000 per quarter. Interest expense is $100,000. Income taxes are expected to be 30% of income before income taxes. Your assistant has prepared two budgets: (1) the manufacturing overhead budget shows expected costs to be 125% of direct labor cost, and (2) the direct materials budget for Tarr shows the cost of Tarr purchases to be $298,000 in quarter 1 and $423,500 in quarter 2. Your answer is correct Prepare the sales budget COOK FARM SUPPLY COMPANY Sales Budget For the Six Months Ending June 30,20174 Six Expected unit sales Unit selling price Total sales 29,800 63 1,877,400 43,700 63 2.753,100 73,500 63 4,630,500 Prepare the production budget. COOK FARM SUPPLY COMPANY Production Budget For the Six Months Ending June 30, 20174 Six Month Expected Unit Sales Add # 1 : 1 Desired Ending Finished Goods Units Total Required Units Less Beginning Finished Goods Units Required Production Units 29,800 12,100 41,900 43,700 18,500 62,200 12,100 33,700 50,100 83.800 Prepare the direct materials budget. (Round Cost per pound answers to 2 decimal places, eg. 52.70,) COOK FARM SUPPLY COMPANY Direct Materials Budget-Gumm For the Six Months Ending June 30, 2017 Six Units to be Produced 33,700 50,100 Direct Materials per Unit Total Pounds Needed for Production Add Desired Ending Direct Materials Total Materials Required Less Beginning Direct Materials 200,400 10,100 13,200 44,900 213,600 9,500 10,100 Direct Materials Purchases 135,.400 Cost per Pound 3.8 3.8 Total Cost of Direct Materials Purchases 514,520 773,300 1,287,820 Prepare the direct labor budget. (Enter Direct labor time per unit in proportion to hours, eg.for 45 minutes the proportion will be0.75) COOK FARM SUPPLY COMPANY Direct Labor Budget For the Six Months Ending June 30, 2017 er Six 33,700 25 8,425 Units to be Produced 0,100 Direct Labor Time per Unit Total Required Direct Labor Hours Direct Labor Cost per Hour 12,525 14 14 Total Direct Labor Cost 117950$ 175,350 293,300 Prepare the selling and administrative expense budget. COOK FARM SUPPLY COMPANY Selling and Administrative Expense Budget For the Six Months Ending June 30, 2017 Quarter Six Months Budgeted sales in units 29,800 43,700 73,500 281610$ 180,000 461,610 $ 412965 694,575 360,000 1,054,575 Variable Cost Fixed Cost 180,000 Total 592,965 $ -Your answer is partially correct. Prepare the budgeted multiple-step income statement for the first 6 months. (Round intermediate calculations to 2 decimal places and final answer to o decimal places, eg. 1,255.) COOK FARM SUPPLY COMPANY Budgeted Income Statement For the Six Months Ending June 30,2017 Sales 4,630,500 2403,450 2,22705 Cost of Goods Sold Gross Profit Selling and Administrative Expenses Income from Operations Interest Expense 1,054,575 1,172,475 100,000 Income Before Income Tax 1072,475 321,742.50 750,732.50 Income Tax Expense Net Income/(Loss) Attempts: 1 of 7 used Check