Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Budgeted income statement The Williams Company Budgeting Example The Williams Company manufactures PVC piping in long pipes which a finish manufecturer purchases and cuts to

Budgeted income statement

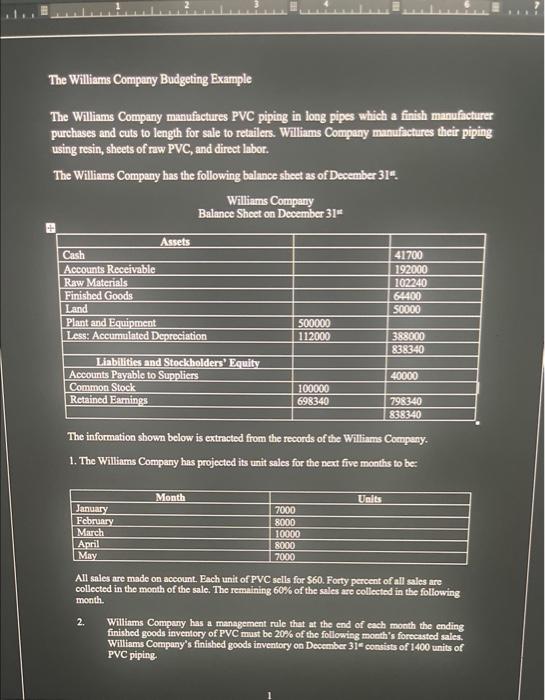

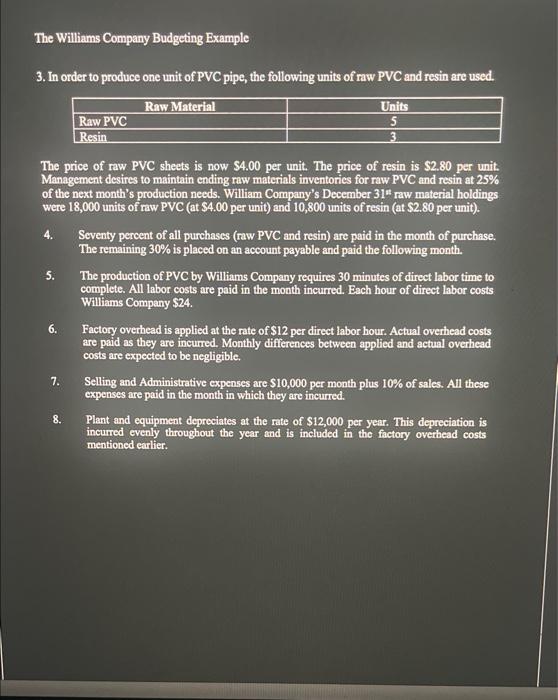

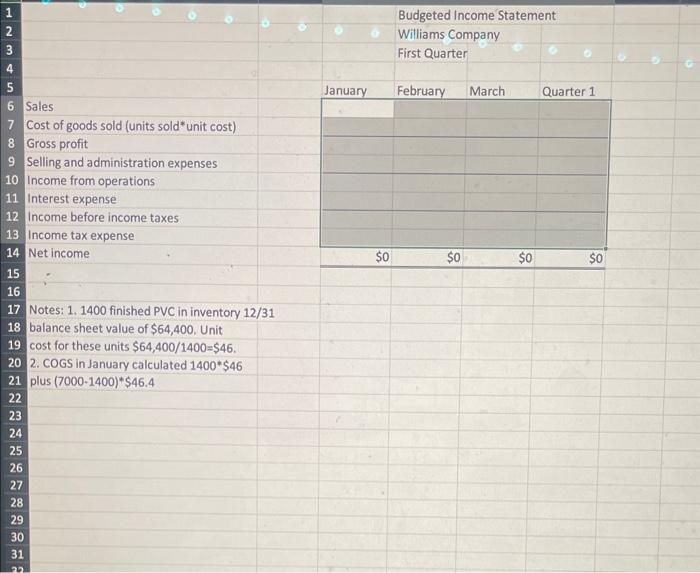

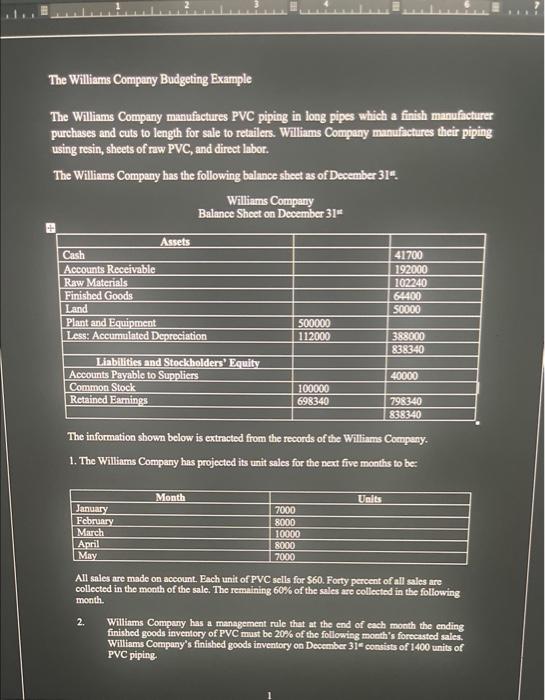

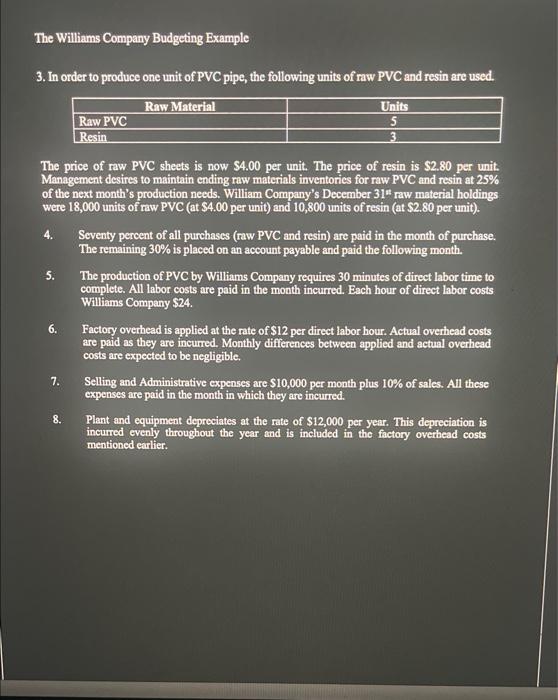

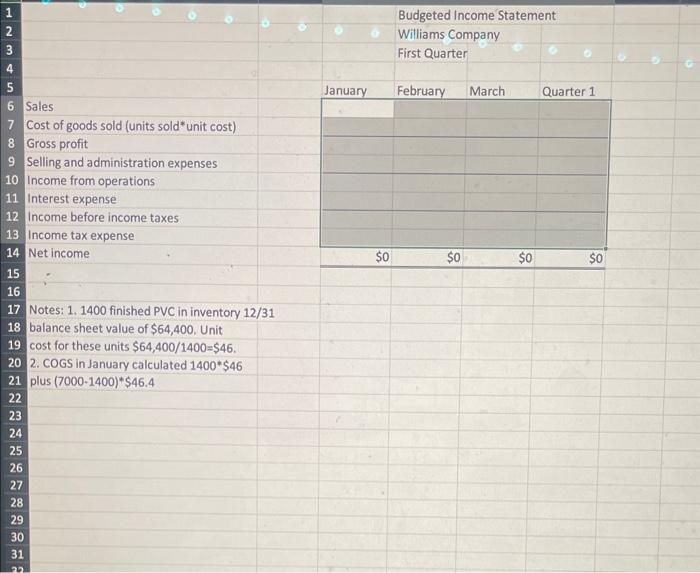

The Williams Company Budgeting Example The Williams Company manufactures PVC piping in long pipes which a finish manufecturer purchases and cuts to length for sale to retailers. Williams Company manufectures their piping using resin, sheets of raw PVC, and direct labor. The Williams Company has the following balance sheet as of December 31 e. Williams Company Balance Shet on December 31* The information shown below is extractod from the reconds of the Willians Company. 1. The Williams Company has projected its unit sales for the net five months to be: All sales are made on acecount. Each unit of PVC sells for S60. Forty percent of fall sales are collected in the month of the sale. The remaining 60% of the seles are collected in the following month 2. Williams Company has a management rule that at the end of each month the ending finished goods inventory of PVC mast bo 20% of the following moeth's forcecatod sales. Williams Compuny's finished goods inventory on December 31" consists of 1400 units of PVC piping The Williams Company Budgeting Example 3. In order to produce one unit of PVC pipe, the following units of raw PVC and resin are used. The price of raw PVC sheets is now $4.00 per unit. The price of resin is $2.80 per unit. Management desires to maintain ending raw materials inventories for raw PVC and resin at 25% of the next month's production needs. William Company's December 31" raw material holdings were 18,000 units of raw PVC (at $4.00 per unit) and 10,800 units of resin (at $2.80 per unit). 4. Seventy percent of all purchases (raw PVC and resin) are paid in the month of purchase. The remaining 30% is placed on an account payable and paid the following month. 5. The production of PVC by Williams Company requires 30 minutes of direct labor time to complete. All labor costs are paid in the month incurred. Each hour of direct labor costs Williams Company $24. 6. Factory overhead is applied at the rate of $12 per direct labor hour. Actual overhead costs are paid as they are incurred. Monthly differences between applied and actual overhead costs are expected to be negligible. 7. Selling and Administrative expenses are $10,000 per month plus 10% of sales. All these expenses are paid in the month in which they are incurred. 8. Plant and equipment depreciates at the rate of $12,000 per year. This depreciation is incurred evenly throughout the year and is included in the factory overhead costs mentioned earlier. Budgeted Income Statement Williams Company First Quarter January February March Quarter 1 Sales Cost of goods sold (units sold unit cost) Gross profit Selling and administration expenses Income from operations 1 Interest expense 12 Income before income taxes 13 Income tax expense 14 Net income 15 17 Notes: 1, 1400 finished PVC in inventory 12/31 18 balance sheet value of $64,400. Unit 19 cost for these units $64,400/1400=$46. 2. COGS in January calculated 1400$46 plus (70001400)$46.4 The Williams Company Budgeting Example The Williams Company manufactures PVC piping in long pipes which a finish manufecturer purchases and cuts to length for sale to retailers. Williams Company manufectures their piping using resin, sheets of raw PVC, and direct labor. The Williams Company has the following balance sheet as of December 31 e. Williams Company Balance Shet on December 31* The information shown below is extractod from the reconds of the Willians Company. 1. The Williams Company has projected its unit sales for the net five months to be: All sales are made on acecount. Each unit of PVC sells for S60. Forty percent of fall sales are collected in the month of the sale. The remaining 60% of the seles are collected in the following month 2. Williams Company has a management rule that at the end of each month the ending finished goods inventory of PVC mast bo 20% of the following moeth's forcecatod sales. Williams Compuny's finished goods inventory on December 31" consists of 1400 units of PVC piping The Williams Company Budgeting Example 3. In order to produce one unit of PVC pipe, the following units of raw PVC and resin are used. The price of raw PVC sheets is now $4.00 per unit. The price of resin is $2.80 per unit. Management desires to maintain ending raw materials inventories for raw PVC and resin at 25% of the next month's production needs. William Company's December 31" raw material holdings were 18,000 units of raw PVC (at $4.00 per unit) and 10,800 units of resin (at $2.80 per unit). 4. Seventy percent of all purchases (raw PVC and resin) are paid in the month of purchase. The remaining 30% is placed on an account payable and paid the following month. 5. The production of PVC by Williams Company requires 30 minutes of direct labor time to complete. All labor costs are paid in the month incurred. Each hour of direct labor costs Williams Company $24. 6. Factory overhead is applied at the rate of $12 per direct labor hour. Actual overhead costs are paid as they are incurred. Monthly differences between applied and actual overhead costs are expected to be negligible. 7. Selling and Administrative expenses are $10,000 per month plus 10% of sales. All these expenses are paid in the month in which they are incurred. 8. Plant and equipment depreciates at the rate of $12,000 per year. This depreciation is incurred evenly throughout the year and is included in the factory overhead costs mentioned earlier. Budgeted Income Statement Williams Company First Quarter January February March Quarter 1 Sales Cost of goods sold (units sold unit cost) Gross profit Selling and administration expenses Income from operations 1 Interest expense 12 Income before income taxes 13 Income tax expense 14 Net income 15 17 Notes: 1, 1400 finished PVC in inventory 12/31 18 balance sheet value of $64,400. Unit 19 cost for these units $64,400/1400=$46. 2. COGS in January calculated 1400$46 plus (70001400)$46.4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started