Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Budgeting Cash Flow The following various elements relate to Murphy, Inc.'s cash budget for October of the current year. For each item, determine the amount

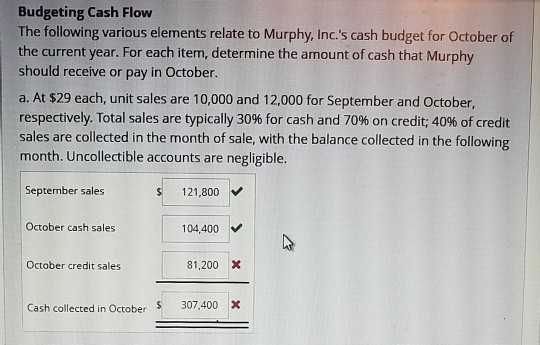

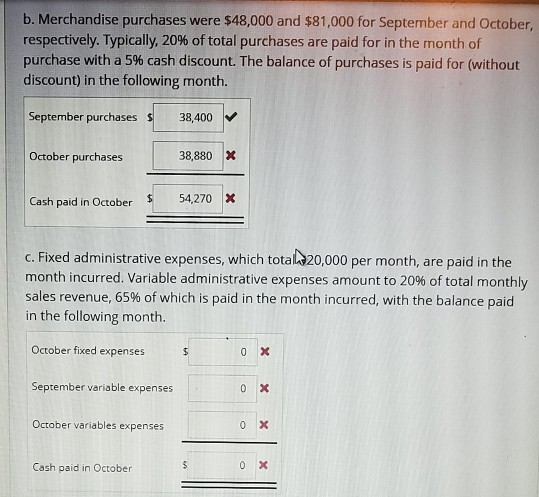

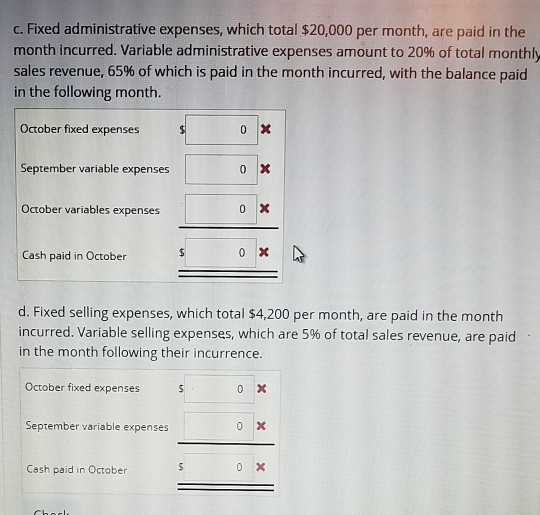

Budgeting Cash Flow The following various elements relate to Murphy, Inc.'s cash budget for October of the current year. For each item, determine the amount of cash that Murphy should receive or pay in October. a. At $29 each, unit sales are 10,000 and 12,000 for September and October, respectively. Total sales are typically 30% for cash and 70% on credit; 40% of credit sales are collected in the month of sale, with the balance collected in the following month. Uncollectible accounts are negligible. September sales 121,800 October cash sales 104,400 October credit sales 81,200 x Cash collected in October 307,400 x b. Merchandise purchases were $48,000 and $81,000 for September and October, respectively. Typically, 20% of total purchases are paid for in the month of purchase with a 5% cash discount. The balance of purchases is paid for (without discount) in the following month. September purchases 38,400 October purchases 38,880 X Cash paid in October $ 54,270 x c. Fixed administrative expenses, which total 20,000 per month, are paid in the month incurred. Variable administrative expenses amount to 20% of total monthly sales revenue, 65% of which is paid in the month incurred, with the balance paid in the following month October fixed expenses September variable expenses 0 x October variables expenses 0 X Cash paid in October c. Fixed administrative expenses, which total $20,000 per month, are paid in the month incurred. Variable administrative expenses amount to 20% of total monthly sales revenue, 65% of which is paid in the month incurred, with the balance paid in the following month. October fixed expenses September variable expenses October variables expenses 0 X Cash paid in October incurred. Variable selling expenses, which are 5% of total sales revenue, are paid in the month following their incurrence. October fixed expenses 0 X September variable expenses Cash paid in October

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started