Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Budgeting statements. I can't seem to figure out how they got these numbers. The only fields I need help with are the ones that aren't

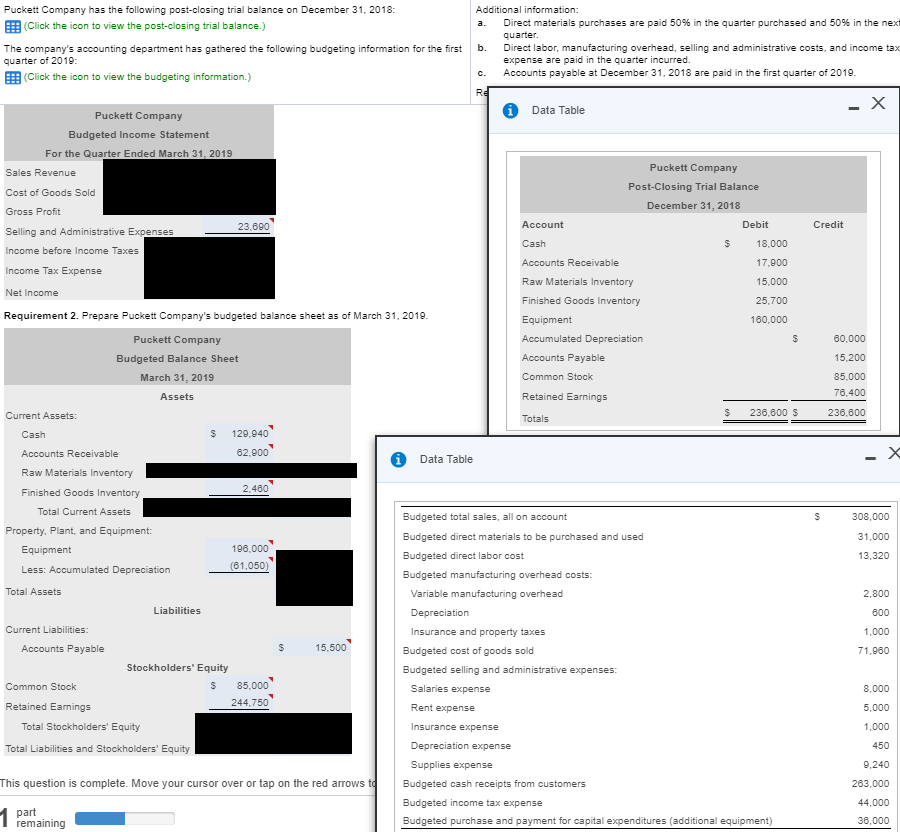

Budgeting statements. I can't seem to figure out how they got these numbers. The only fields I need help with are the ones that aren't blacked out.

Puckett Company has the following post-closing trial balance on December 31, 2018 Additional information (Click the icon to view the post-closing trial balance.) a. Direct materials purchases are paid 50% in the quarter purchased and 50% in the next quarter. The company's accounting department has gathered the following budgeting information for the first b Direct labor, manufacturing overhead, selling and administrative costs, and income tax quarter of 2019 expense are paid in the quarter incurred. Ell (Click the icon to view the budgeting information.) Accounts payable at December 31, 2018 are paid in the first quarter of 2019 Data Table Puckett Company Budgeted Income Statement For the Quarter Ended March 31, 2019 Puckett Company Post-Closing Trial Balance December 31, 2018 Sales Revenue Cost of Goods Sold Gross Profit Selling and Administrative Expense Income before Income Taxes Income Tax Expense Net Income Account Cash Accounts Receivable Raw Materials Inventory Finished Goods Inventory Equipment Accumulated Depreciation Accounts Payable Common Stock Retained Earnings Totals 23,690 Debit Credit S 18,000 17.900 15,000 25,700 160,000 Requirement 2. Prepare Puckett Company's budgeted balance sheet as of March 31, 2019 Puckett Company Budgeted Balance Sheet March 31, 2019 Assets 76,400 Current Assets S 236,600 S 236,600 S 129.940 82.900 Accounts Receivable Raw Materials Inventory Finished Goods Inventory Data Table 2.460 Total Current Assets Budgeted total sales, all on account Budgeted direct materials to be purchased and used Budgeted direct labor cost Budgeted manufacturing overhead costs: 308,000 Property, Plant, and Equipment: 31,000 Equipment 196,000 61,050 Less: Accumulated Depreciation Total Assets Variable manufacturing overhead Liabilities 600 1,000 71,960 Current Liabilities: Insurance and property taxes Budgeted cost of goods sold Budgeted selling and administrative expenses Accounts Payable Stockholders' Equity Common Stock S 85,000 244,750 Retained Earnings Rent expense Total Stockholders' Equity Insurance expense 1,000 450 9,240 263,000 44,000 36,000 Total Liabilities and Stockholders' Equity Supplies expense Budgeted cash receipts from customers Budgeted income tax expense Budgeted purchase and payment for capital expenditures (additional equipment) his question is complete. Move your cursor over or tap on the red arrowst part remainingStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started