Budgeting

Using your actual inflows & outflows from Assignment 2, create a budget for (1)

one week and (2) one month in either Excel or Word. In Word, write a one to two-paragraph

analysis of what you will need to change to meet the budget, how you will make those changes,

and what might hinder you from making those changes.

the information from Assignment 2 : you have to Using your actual inflows & outflows from (Assignment 2), create a budget :

1

2

3

example for this homehwork

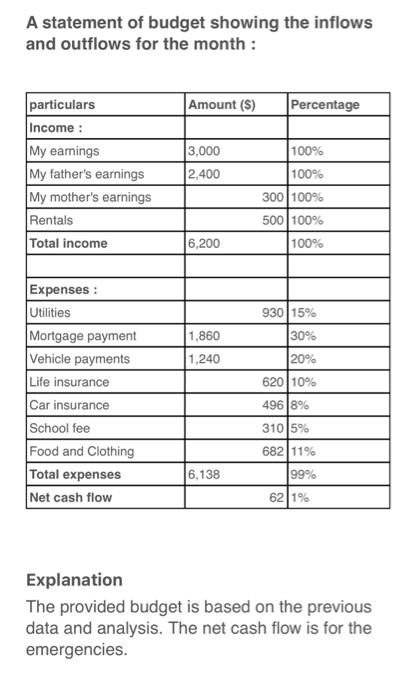

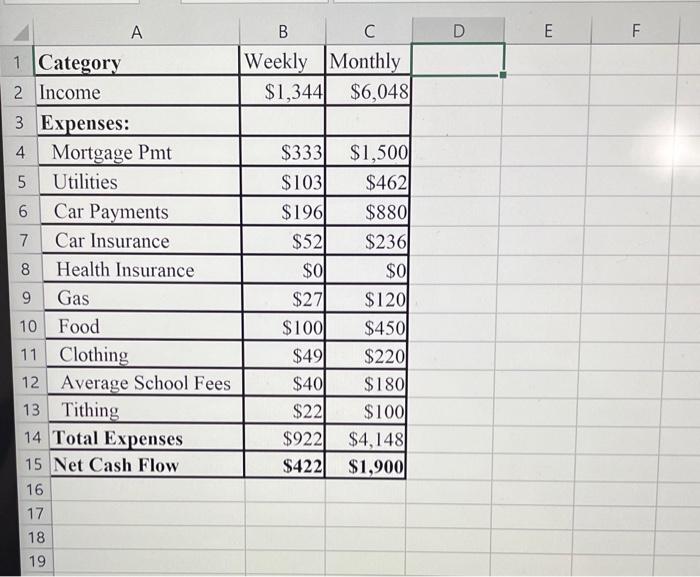

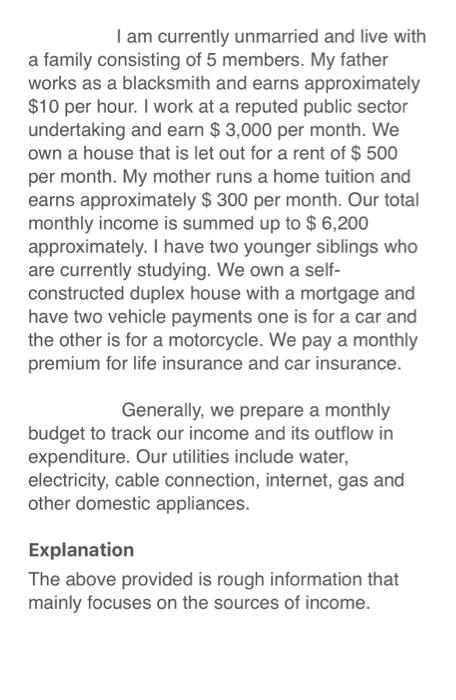

I am currently unmarried and live with a family consisting of 5 members. My father works as a blacksmith and earns approximately $10 per hour. I work at a reputed public sector undertaking and earn $3,000 per month. We own a house that is let out for a rent of $500 per month. My mother runs a home tuition and earns approximately $300 per month. Our total monthly income is summed up to $6,200 approximately. I have two younger siblings who are currently studying. We own a selfconstructed duplex house with a mortgage and have two vehicle payments one is for a car and the other is for a motorcycle. We pay a monthly premium for life insurance and car insurance. Generally, we prepare a monthly budget to track our income and its outflow in expenditure. Our utilities include water, electricity, cable connection, internet, gas and other domestic appliances. Explanation The above provided is rough information that mainly focuses on the sources of income. A statement of budget showing the inflows and outflows for the month : Explanation The provided budget is based on the previous data and analysis. The net cash flow is for the emergencies. I would like our income to be increased by atleast 15% of current income. It could be possible by investing in return yielding bonds and other securities. Since we only have 1% of total income for emergencies, it may not be sufficient enough to meet all the emergency needs. Coming to expenditure, it has been made cautiously and without any extravagancy. We do not see any need to change the distribution of expenses but to change our sources of income by including more. \begin{tabular}{|l|l|r|r|r|} \hline \multicolumn{1}{|c|}{ A } & \multicolumn{1}{c|}{ B } & \multicolumn{1}{c|}{C} & \multicolumn{1}{c|}{D} \\ \hline 1 & Category & Weekly & Monthly & \\ \hline 2 & Income & $1,344 & $6,048 & \\ \hline 3 & Expenses: & & & \\ \hline 4 & Mortgage Pmt & $333 & $1,500 & \\ \hline 5 & Utilities & $103 & $462 & \\ \hline 6 & Car Payments & $196 & $880 & \\ \hline 7 & Car Insurance & $52 & $236 & \\ \hline 8 & Health Insurance & $0 & $0 & \\ \hline 9 & Gas & $27 & $120 & \\ \hline 10 & Food & $100 & $450 \\ \hline 11 & Clothing & $49 & $220 \\ \hline 12 & Average School Fees & $40 & $180 \\ \hline 13 & Tithing & $22 & $100 & \\ \hline 14 & Total Expenses & $922 & $4,148 \\ \hline 15 & Net Cash Flow & $422 & $1,900 & \\ \hline \end{tabular} I am currently unmarried and live with a family consisting of 5 members. My father works as a blacksmith and earns approximately $10 per hour. I work at a reputed public sector undertaking and earn $3,000 per month. We own a house that is let out for a rent of $500 per month. My mother runs a home tuition and earns approximately $300 per month. Our total monthly income is summed up to $6,200 approximately. I have two younger siblings who are currently studying. We own a selfconstructed duplex house with a mortgage and have two vehicle payments one is for a car and the other is for a motorcycle. We pay a monthly premium for life insurance and car insurance. Generally, we prepare a monthly budget to track our income and its outflow in expenditure. Our utilities include water, electricity, cable connection, internet, gas and other domestic appliances. Explanation The above provided is rough information that mainly focuses on the sources of income. A statement of budget showing the inflows and outflows for the month : Explanation The provided budget is based on the previous data and analysis. The net cash flow is for the emergencies. I would like our income to be increased by atleast 15% of current income. It could be possible by investing in return yielding bonds and other securities. Since we only have 1% of total income for emergencies, it may not be sufficient enough to meet all the emergency needs. Coming to expenditure, it has been made cautiously and without any extravagancy. We do not see any need to change the distribution of expenses but to change our sources of income by including more. \begin{tabular}{|l|l|r|r|r|} \hline \multicolumn{1}{|c|}{ A } & \multicolumn{1}{c|}{ B } & \multicolumn{1}{c|}{C} & \multicolumn{1}{c|}{D} \\ \hline 1 & Category & Weekly & Monthly & \\ \hline 2 & Income & $1,344 & $6,048 & \\ \hline 3 & Expenses: & & & \\ \hline 4 & Mortgage Pmt & $333 & $1,500 & \\ \hline 5 & Utilities & $103 & $462 & \\ \hline 6 & Car Payments & $196 & $880 & \\ \hline 7 & Car Insurance & $52 & $236 & \\ \hline 8 & Health Insurance & $0 & $0 & \\ \hline 9 & Gas & $27 & $120 & \\ \hline 10 & Food & $100 & $450 \\ \hline 11 & Clothing & $49 & $220 \\ \hline 12 & Average School Fees & $40 & $180 \\ \hline 13 & Tithing & $22 & $100 & \\ \hline 14 & Total Expenses & $922 & $4,148 \\ \hline 15 & Net Cash Flow & $422 & $1,900 & \\ \hline \end{tabular}