Budweiser's Competitive Advantage, Budweiser's Vision and Mission for the following case: -

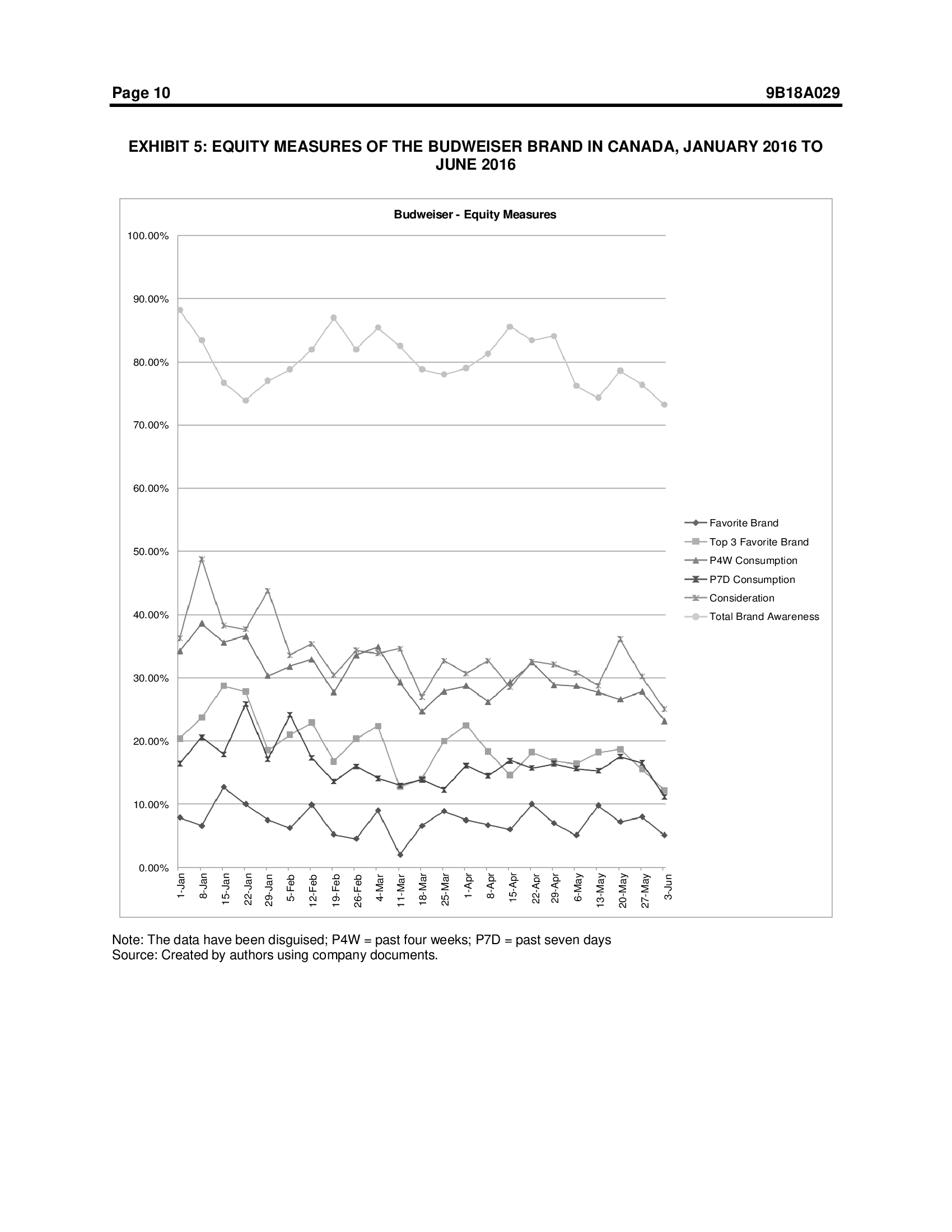

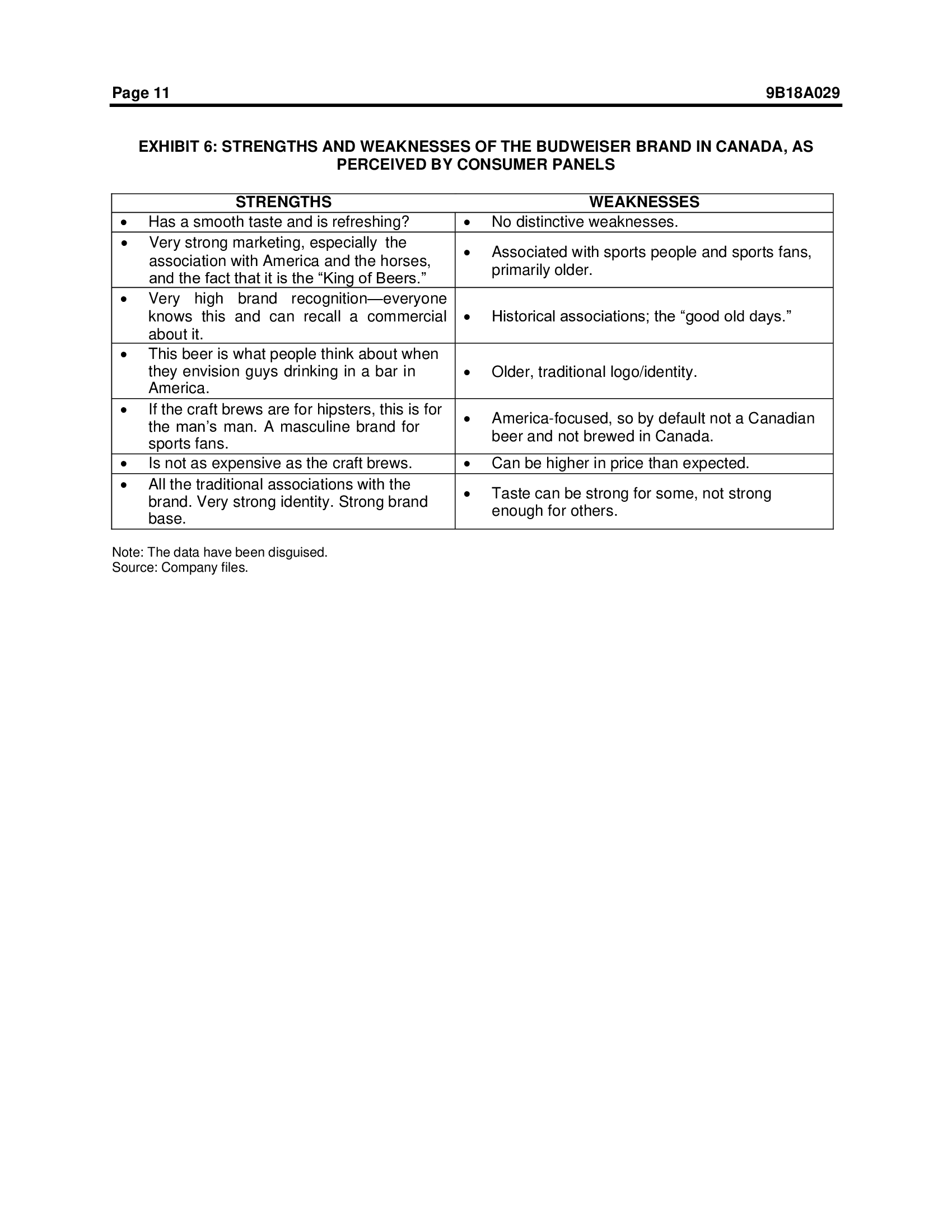

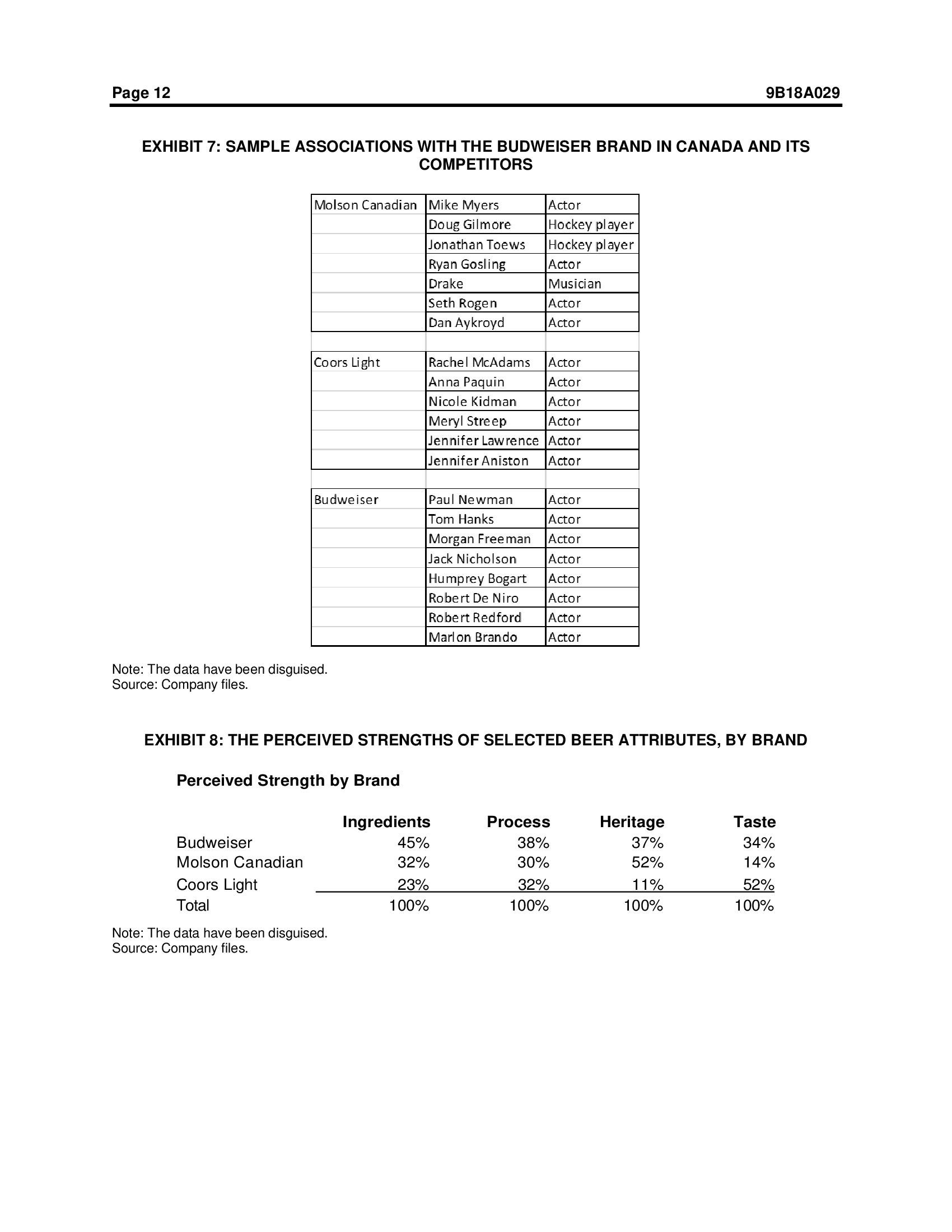

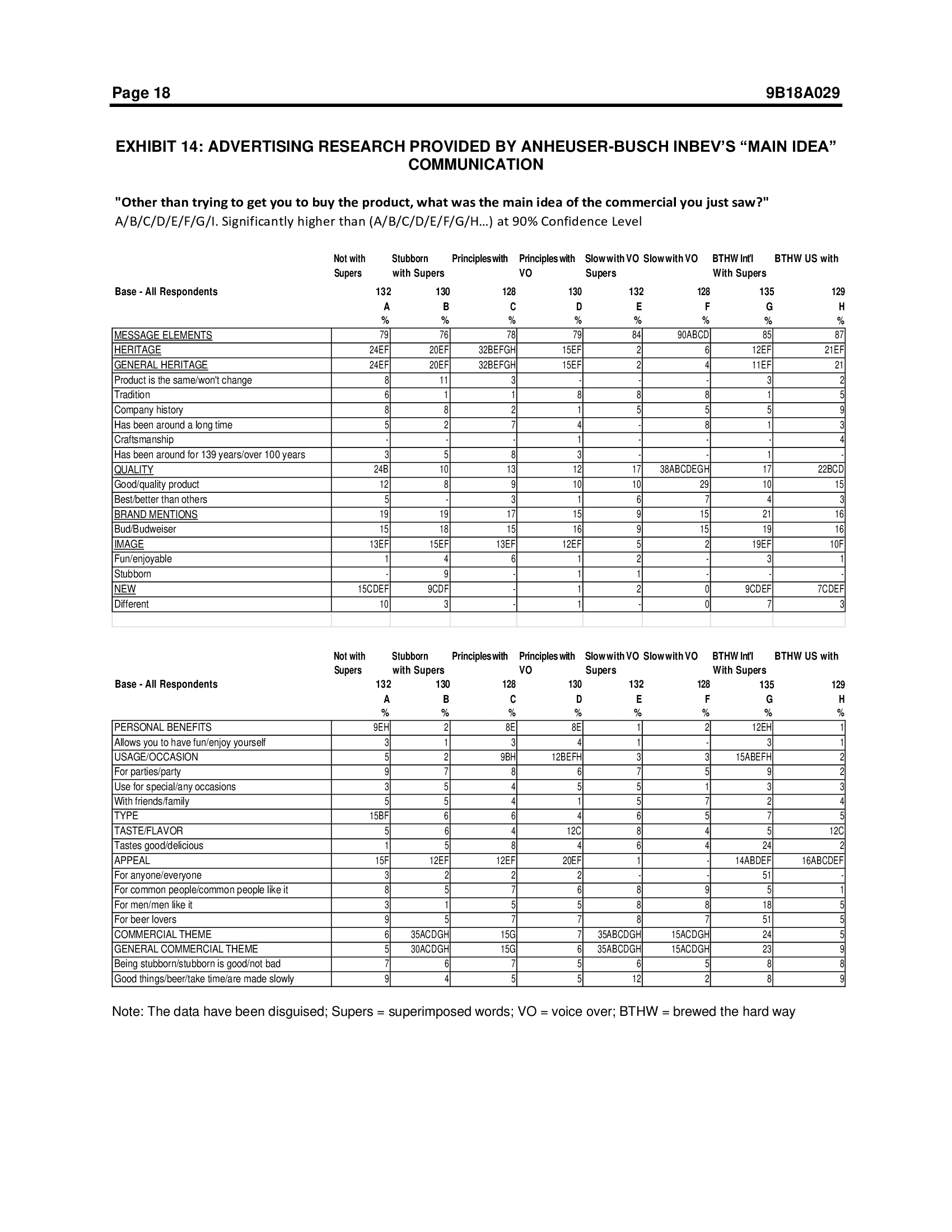

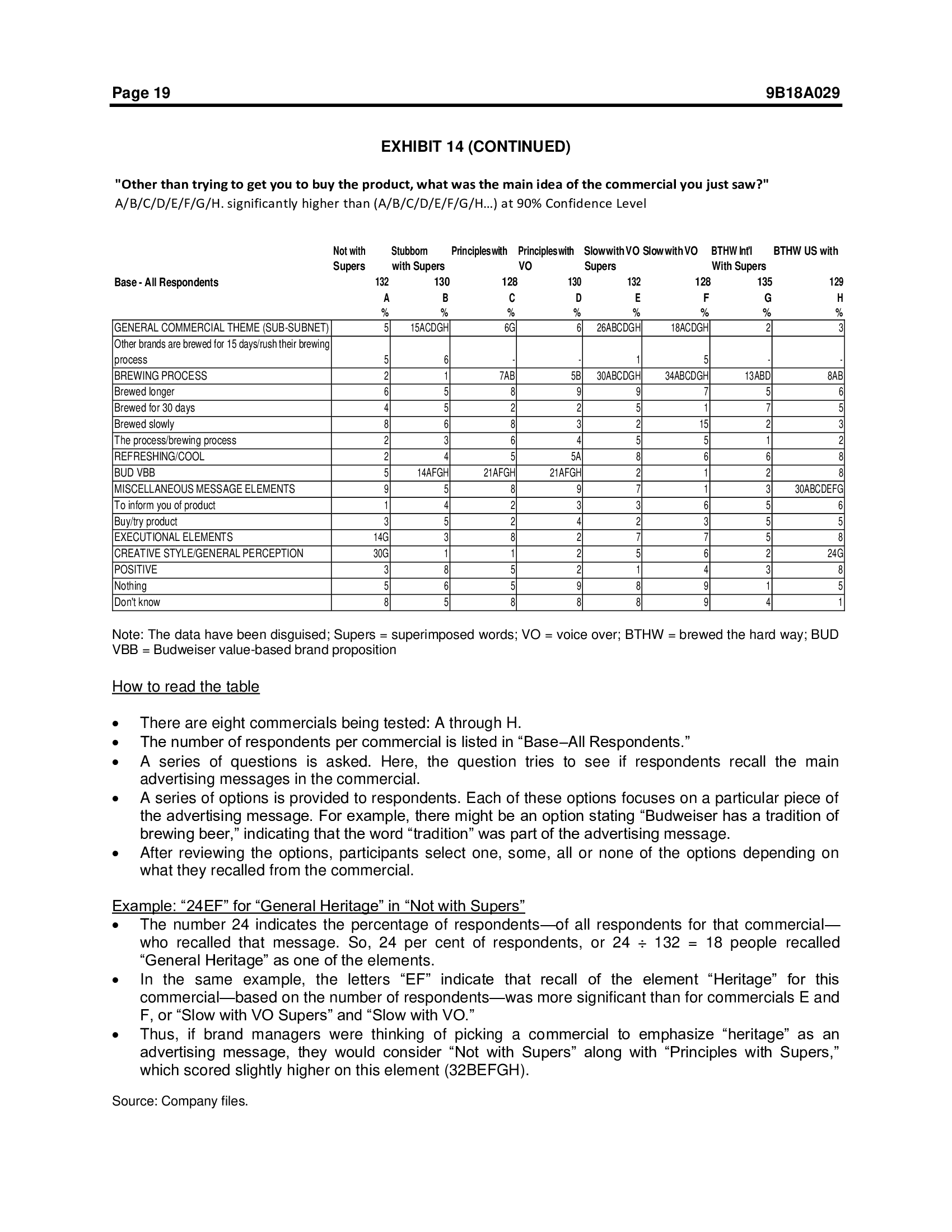

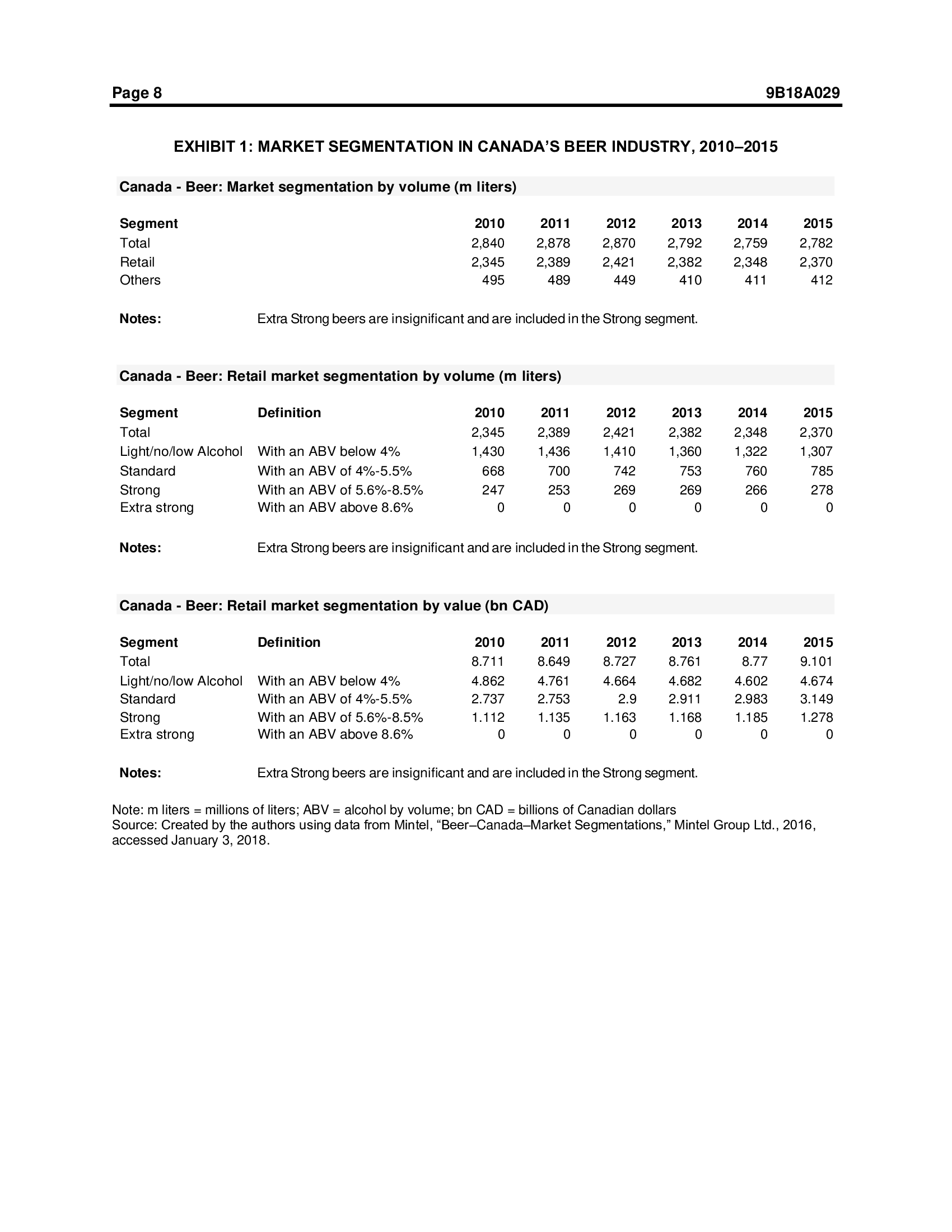

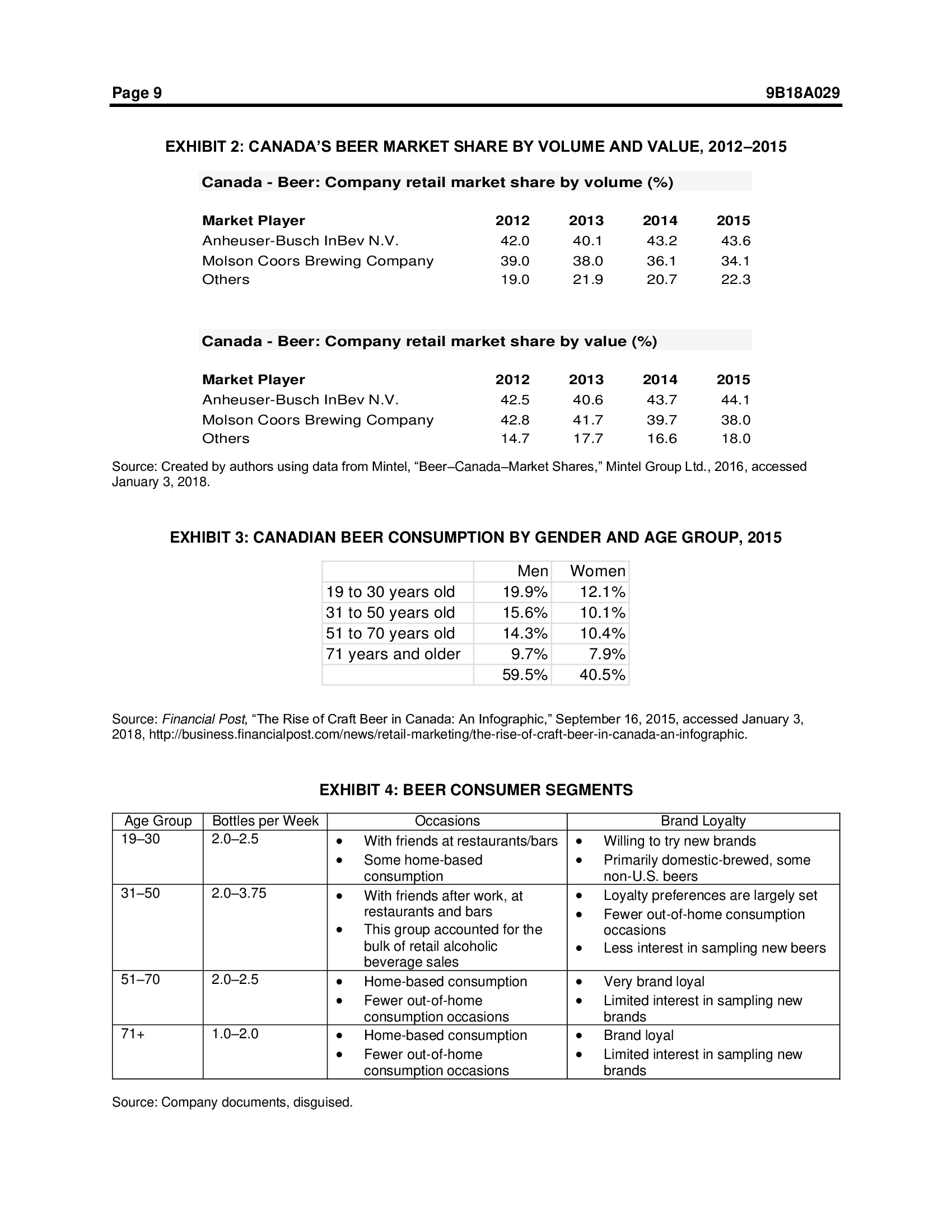

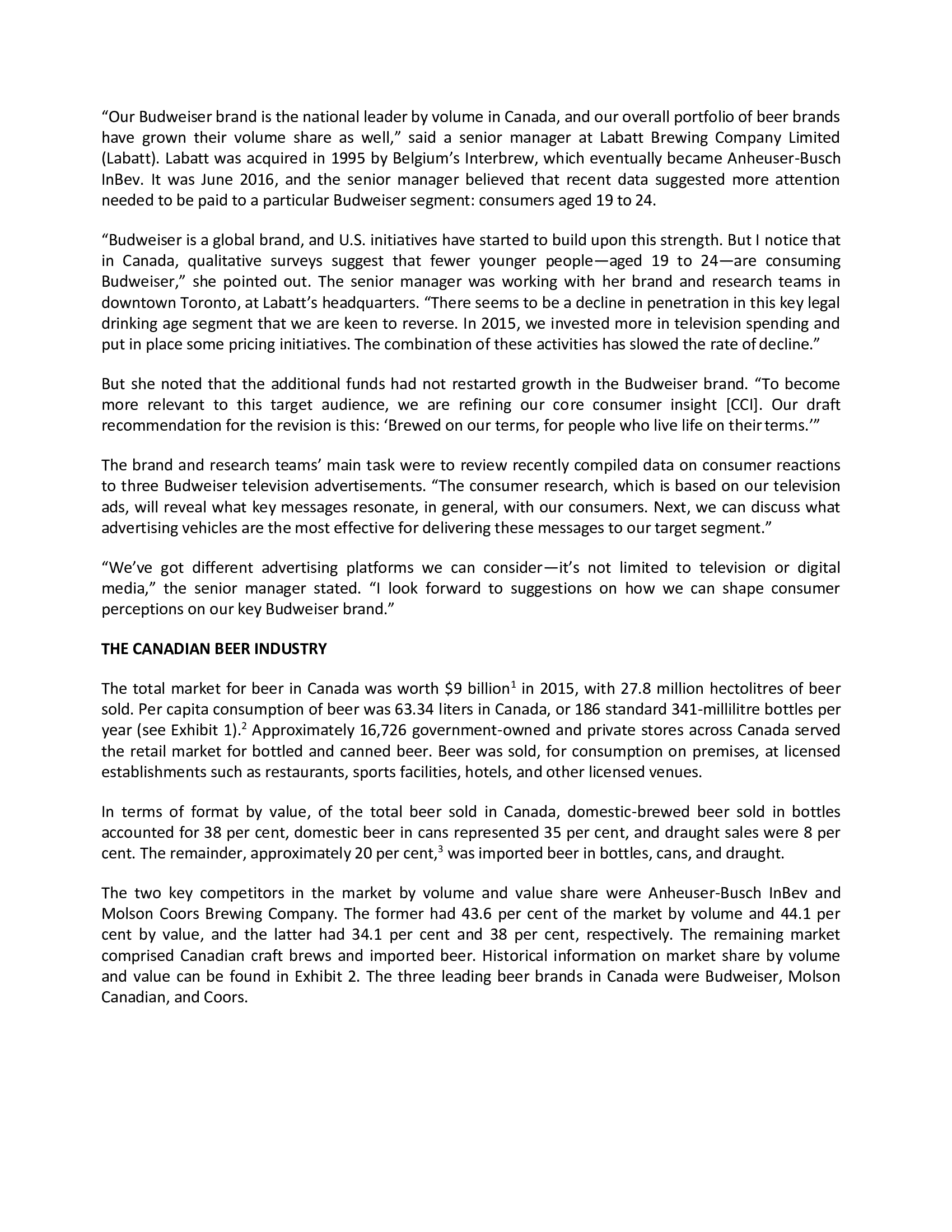

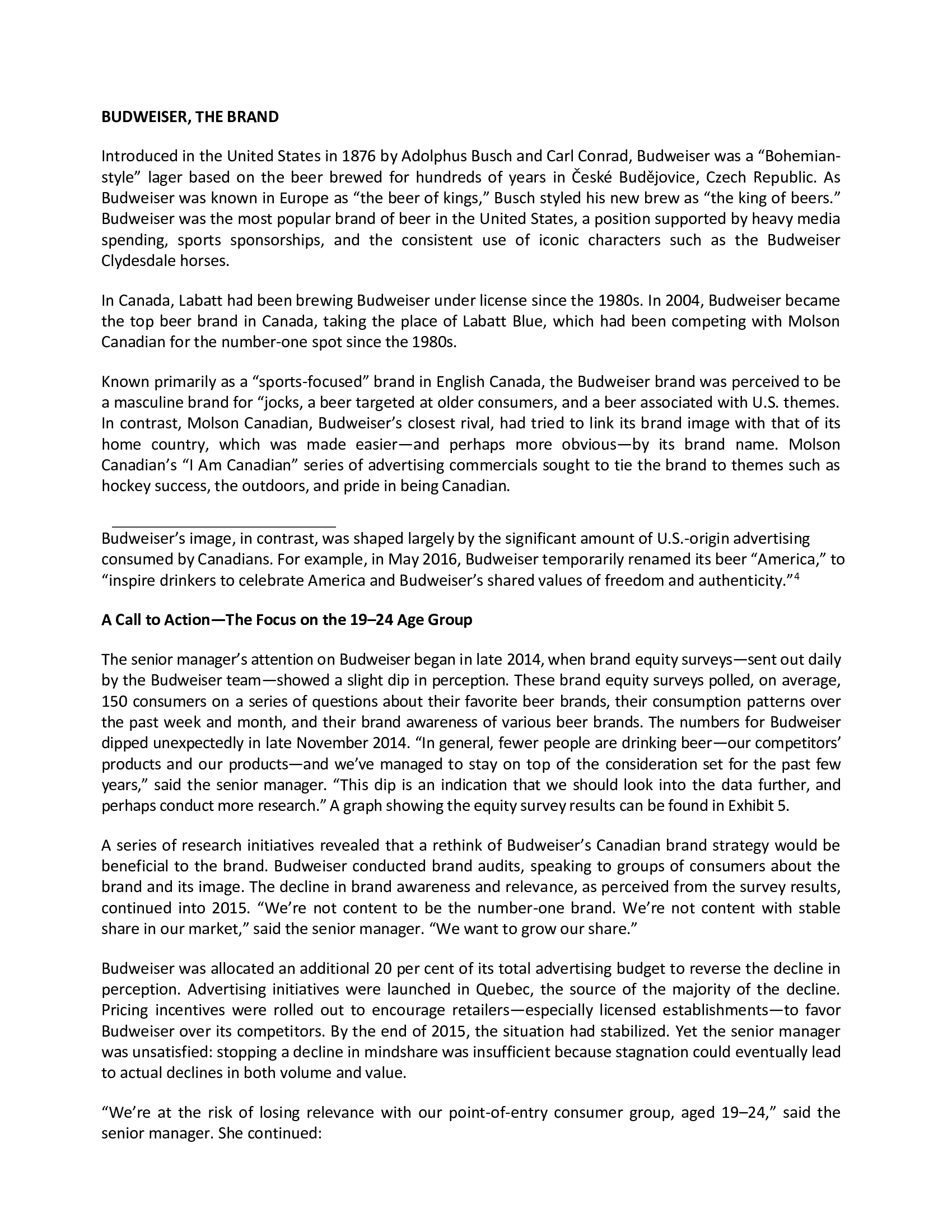

\fPage 11 9318A029 EXHIBIT 6: STRENGTHS AND WEAKNESSES OF THE BUDWEISER BRAND IN CANADA, AS PEBCEIVED BY CONSUMER PANELS STRENGTHS WEAKNESSES . Has a smooth taste and is refreshing? . No distinctive weaknesses. - Very strong marketing, especially the association with America and the horses Associated With sports people and sports fans, and the fact that it is the "Kin- of Beers.\" primarily older. . Very high brand recognitioneveryone knows this and can recall a commercial 0 Historical associations; the "good old days." about it. . This beer is what people think about when they envision guys drinking in a bar in . Older, traditional logo/identity. America. . If the craft brews are for hipsters, this is for the man's man. A masculine brand for sports fans. . Is not as expensive as the craft brews. . Can be higher in price than expected. 0 All the traditional associations with the . Americafocused, so by default not a Canadian beer and not brewed in Canada. 0 Taste can be strong for some, not strong enough for others. brand. Very strong identity. Strong brand base. Note: The data have been disguised. Source: Company files. \f\f\fCanada - Beer: Market segmentation by volume (m liters) Canada - Beer: Retail market segmentation by volume (m liters) Canada - Beer: Retail market segmentation by value (bn CAD)Canada - Beer: Company retail market share by volume (%) Canada - Beer: Company retail market share by value (%)"Our Budweiser brand is the national leader by volume in Canada, and our overall portfolio of beer brands have grown their volume share as well,\" said a senior manager at Labatt Brewing Company Limited (Labatt). Labatt was acquired in 1995 by Belgium's lnterbrew, which eventually became AnheuserBusch lnBev. It was June 2016, and the senior manager believed that recent data suggested more attention needed to be paid to a particular Budweiser segment: consumers aged 19 to 24. \"Budweiser is a global brand, and U.S. initiatives have started to build upon this strength. But I notice that in Canada, qualitative surveys suggest that fewer younger peopleaged 19 to 24are consuming Budweiser,\" she pointed out. The senior manager was working with her brand and research teams in downtown Toronto, at Labatt's headquarters. "There seems to be a decline in penetration in this key legal drinking age segment that we are keen to reverse. In 2015, we invested more in television spending and put in place some pricing initiatives. The combination of these activities has slowed the rate ofdecline." But she noted that the additional funds had not restarted growth in the Budweiser brand. \"To become more relevant to this target audience, we are refining our core consumer insight [CCI]. Our draft recommendation for the revision is this: 'Brewed on our terms, for people who live life on theirterms.'\" The brand and research teams' main task were to review recently compiled data on consumer reactions to three Budweiser television advertisements. "The consumer research, which is based on our television ads, will reveal what key messages resonate, in general, with our consumers. Next, we can discuss what advertising vehicles are the most effective for delivering these messages to our target segment.\" \"We've got different advertising platforms we can considerit's not limited to television or digital media,\" the senior manager stated. \"I look forward to suggestions on how we can shape consumer perceptions on our key Budweiser brand.\" THE CANADIAN BEER INDUSTRY The total market for beer in Canada was worth $9 billion1 in 2015, with 27.8 million hectolitres of beer sold. Per capita consumption of beer was 63.34 liters in Canada, or 186 standard 341millilitre bottles per year (see Exhibit 1).2 Approximately 16,726 government-owned and private stores across Canada served the retail market for bottled and canned beer. Beer was sold, for consumption on premises, at licensed establishments such as restaurants, sports facilities, hotels, and other licensed venues. In terms of format by value, of the total beer sold in Canada, domesticbrewed beer sold in bottles accounted for 38 per cent, domestic beer in cans represented 35 per cent, and draught sales were 8 per cent. The remainder, approximately 20 per cent,3 was imported beer in bottles, cans, and draught. The two key competitors in the market by volume and value share were AnheuserBusch lnBev and Molson Coors Brewing Company. The former had 43.6 per cent of the market by volume and 44.1 per cent by value, and the latter had 34.1 per cent and 38 per cent, respectively. The remaining market comprised Canadian craft brews and imported beer. Historical information on market share by volume and value can be found in Exhibit 2. The three leading beer brands in Canada were Budweiser, Molson Canadian, and Coors. BUDWEISER, THE BRAND Introduced in the United States in 1876 by Adolphus Busch and Carl Conrad, Budweiser was a "Bohemian- style" lager based on the beer brewed for hundreds of years in Cesk Budjovice, Czech Republic. As Budweiser was known in Europe as "the beer of kings,\" Busch styled his new brew as "the king of beers." Budweiser was the most popular brand of beer in the United States, a position supported by heavy media spending, sports sponsorships, and the consistent use of iconic characters such as the Budweiser Clydesdale horses. In Canada, Labatt had been brewing Budweiser under license since the 19805. In 2004, Budweiser became the top beer brand in Canada, taking the place of Labatt Blue, which had been competing with Molson Canadian for the numberone spot since the 19805. Known primarily as a \"sportsfocused" brand in English Canada, the Budweiser brand was perceived to be a masculine brand for \"jocks, a beer targeted at older consumers, and a beer associated with U.S. themes. In contrast, Molson Canadian, Budweiser's closest rival, had tried to link its brand image with that of its home country, which was made easierand perhaps more obviousby its brand name. Molson Canadian's \"I Am Canadian\" series of advertising commercials sought to tie the brand to themes such as hockey success, the outdoors, and pride in being Canadian. Budweiser's image, in contrast, was shaped largely by the significant amount of U.S.origin advertising consumed by Canadians. For example, in May 2016, Budweiser temporarily renamed its beer \"America,\" to "inspire drinkers to celebrate America and Budweiser's shared values of freedom and authenticity.\" A Call to ActionThe Focus on the 1924 Age Group The senior manager's attention on Budweiser began in late 2014, when brand equity surveyssent out daily by the Budweiser teamshowed a slight dip in perception. These brand equity surveys polled, on average, 150 consumers on a series of questions about their favorite beer brands, their consumption patterns over the past week and month, and their brand awareness of various beer brands. The numbers for Budweiser dipped unexpectedly in late November 2014. \"In general, fewer people are drinking beerour competitors' products and our productsand we've managed to stay on top of the consideration set for the past few years,\" said the senior manager. \"This clip is an indication that we should look into the data further, and perhaps conduct more research.\" A graph showing the equity survey results can be found in Exhibit 5. A series of research initiatives revealed that a rethink of Budweiser's Canadian brand strategy would be beneficial to the brand. Budweiser conducted brand audits, speaking to groups of consumers about the brand and its image. The decline in brand awareness and relevance, as perceived from the survey results, continued into 2015. \"We're not content to be the number-one brand. We're not content with stable share in our market,\" said the senior manager. "We want to grow our share.\" Budweiser was allocated an additional 20 per cent of its total advertising budget to reverse the decline in perception. Advertising initiatives were launched in Quebec, the source of the majority of the decline. Pricing incentives were rolled out to encourage retailersespecially licensed establishmentsto favor Budweiser over its competitors. By the end of 2015, the situation had stabilized. Yet the senior manager was unsatisfied: stopping a decline in mindshare was insufficient because stagnation could eventually lead to actual declines in both volume and value. \"We're at the risk of losing relevance with our pointofentry consumer group, aged 1924,\" said the senior manager. She continued: This group sees brands such as Apple or Google as influencers, and even Adidas has revived itself to become a popular brand. How do we know they're popular? Because they're being followed on lnstagram and on other social media sites. Fewer people in our target group are following Budweiser. We've lost our \"cool\" factor with this group. Our challenge is to use our global marketing tools in relevant ways for our Canadian target groups. Keep in mind that our brand mandate comes from our U.S. team and we have to be very cognizant of how we develop Canadian brand strategy. The 1924 age group comprised six distinctive subsegments: dynamos, connoisseurs, ecosocials, adventurers, impromptus, and practicals.5 Dynamos Dynamos comprised 17 per cent of the market, and were 90 per cent female and 10 per cent male. This segment was focused on a highachieving career. They were bold, sought adventures, and were willing to take a little risk. They would try new brands, new restaurants, and new products, but did not tend to blindly follow trends. Their lives were semistructuredthey set aside time for work and play, and knew how to set boundaries between the two. They were not prone to "taking it easy" or to underperforming at work or at play. They were likely to be university educated, and many were considering postgraduate degrees. Their friends might have considered them very motivated and, at times, a little too competitive. They would define themselves as worldly, environmentally conscious, trendaware, and cultured. They were likely to seek out local, organic foods or to join a running group or a climbing gym. They tended to consume a range of media, including newspapers, some television, and online media. Connoisseurs Connoisseurs represented 16 per cent of the market, and were 75 per cent male and 25 per cent female. This segment liked to be aware of the latest fads, and their friends looked to them as being trendsetters. They focused on unearthing new ideas, brands, and styles, and sought to put their own spin on them. They were technology-focused, preferring to write a pithy blog about their latest finds. They were known as being quiet, even shy, and socialized with those who were like them. They tended to prefer sedentary pursuits and were often found participating in online discussion groups and playing video games. EcoSocials Ecosocials were 17 per cent of the market, and were 75 per cent female and 25 per cent male. This segment lived, studied, and worked in the core of the city, where everything was close by. They valued freedom and time with friends, and avoided the limelight and loud social events. They were socially and environmentally conscious, and sought to give back to the community by volunteering and making \"green" choices. Work and career success were not priorities, and they were likely to be in solid but low stress careers. m Adventurers made up 14 per cent of the market, and were 90 per cent male and 10 per cent female. This segment comprised athletic individuals who loved sports and parties. They had extroverted personalities and were trendconscious. They were most likely seen at concerts, bars, and sports events. They participated in highenergy activities, including traditional sports and weekend warriortype events such as adventure races. They were careerfocused, yet were unfazed (typically) by continuing to live with their parents. They were technologysavvy and tended to rely on technology to communicate with their friends. Impromptus Those categorized as impromptus comprised 18 per cent of the market, and were 50 per cent female and 50 per cent male. This segment lived life in the momentthey were likely to switch plans at the last instant and tended not to have set routines. They participated in lowcompetition athletic pursuits such as yoga and hiking, and were focused on living their lives, conscious of the fact that they \"only live once.\" They had good careers but were not particularly interested in working harder to advance themselves. Practical's The practical's segment represented 18 per cent of the market, and were 50 per cent female and 50 per cent male. These individuals were not risk takers, preferring security and practicality above all. They were not entrepreneurs, and looked to be contributors by working in a team at large organization. They did not follow trends; they were aware of them but selected sensible choices in every aspect of their lives. They liked to follow a simple life plan that included school, employment in a stable job, buying a home, and starting a familyin that order. They were not particularly interested in thrillseeking activities, and could be found enjoying a coffee at a local shop, meeting friends in their apartment for simple meals, and going to the mall. Budweiser's Red-Light Campaign In the company's efforts to target the 1924 age group, one key initiative that had yielded success for Budweiser since 2013 was its "Budweiser Red Light" campaign. The Budweiser Red Light, a WiFi enabled, replica hockey goal light, selling for $149 through Budweiser, was activated whenever the purchaser's hockey team scored. \"We're not in this to make money off Red Lights,\" noted Kyle Norrington, marketing director for Budweiser. \"We're in the game of elevating the experience for hockeyloving fans across the country/'6 Supporting the launch of the red lights was a television spot during the Super Bowl. Called \"Perfect Timing,\" it featured a group of fans watching a hockey game, and Budweiser employees delivering the Budweiser Red Light to their house. The next iteration of the campaign saw a 20-foot (6- metre) tall version of the hockey red light, and its journey to the North Pole where it was installed in time for the World Cup of Hockey.7 \"Our RedLight campaign continued to keep our Budweiser brand number one in the country,\" said the senior manager. \"But our data shows our relevance is slipping with the 1924 age group. This group feels that we have not evolved with the times and we do not speak to them\" (see Exhibit 6). An interesting attempt to depict the brand character of each of the top three brands, by grouping actors and sports stars, can be found in Exhibit 7. Revisiting Budweiser' 5 Core Consumer Insight The senior manager and her team revisited the positioning for Budweiser Canada. "Molson Canadian focuses on the patriotic link. Coors focuses on being the 'cold' beer." Budweiser's focus, since 2013, had been on hockey and Canada, a direct challenge to Molson Canadian's brand positioning. In the United States, Budweiser's brand positioning focused on the fact that it used great ingredients, did not compromise on its brewing process, possessed a rich heritage, and was "great tasting." These attributes could be narrowed down to \"ingredients," \"process,\" \"heritage,\" and \"taste." Research was conducted on how well these words resonated with consumers. The results, by brand, can be found in Exhibit 8. The senior manager looked at the efforts of her team in 2015, to develop advertising creative motivated by a more relevant core consumer insight (CCI). The focus, in 2015, was on "taste\" and "quality\" as key differentiators. Five television creative executions were adapted from global advertising copy and tested, leading to the following five executions: "Not\": focusing on all the things that Budweiser was notsee Exhibit 9 \"Stubborn": Budweiser as a brand determined to do things its own waysee Exhibit 10 \"Principles\": Brewing beer the way it had always been done by Budweisersee Exhibit 11 "Slow": Budweiser took 30 days to brew, twice as long as other beerssee Exhibit 12 \"Brewed the Hard Way\": Unpretentious beer brewed for a crisp, smooth finishsee Exhibit 13 However, the consumer research was inconclusive in terms of how well the main idea of each commercial had been conveyed (see Exhibit 14). According to the senior manager: Initial Global Quality spots under the new CCI failed in breaking through and positively impacting the brand due to lack of comprehension of the creative driven by the executional treatment of the spots. After further research on the new Global CCI in Canada, a couple of key optimizations were identified: 1) CCI needs to evolve to include "making choices" as a relevant way to speak to living life on your own terms in a confident versus arrogant tone. 2) Quality is defined as taste by consumers. Additional research was done, and a new direction was chosen for Budweiser. "We started by mapping out our brand, its personality traits, and functional benefits,\" said the senior manager. She explained: A new core creative idea was defined. Our research, on the global level, of what our core values are led to the idea of \"freedom," living life to the fullest, being your own person, choosing to do it your own way. Our target 1924 age group are Millennials. While many thinks that Millennials are irresponsible, our research uncovered that younger Millennials are very strong, responsible and smart. They're just trying to find their own way of going through the system. They're trying to find ways without breaking the rules, to do it on their own terms, and not to compromise their values. Our brand stands for "freedomliving life on your own terms." Budweiser exists to live life on your own terms. That's our philosophywe brew on our own terms. We've got the most expensive brew to brew because we won't compromise our own standards. "Our new CCI builds upon our recent research and previous insights," said the senior manager. The proposed CCI ladder would like this: \"The TASTE of Budweiser is defined by its perceived QUALITY.\" "QUALITY is defined by the ability to take CONTROL." \"CONTROL requires making CHOICES that you believe in." "It is the CHOICES we make that define who we truly are.\" \"Which allows us to 'Live Life on Our Own Terms'.\" The following was a sample statement that incorporated the proposed CCI: Over 30 years ago, we chose to start brewing Budweiser right here in Canada. And we continue to choose only the finest ingredients. And we rely on our exclusive beechwood aging process. We could have compromised and made a lot of other choices over the years, but ultimately, we know people choose Budweiser because it has an unmistakable smoothness and drinkability found in no other beer. Budweiser. Brewed on our own terms, for those that live life on their own terms. Creating Marketing Plans To target the 1924 age group, the team discovered that this group had three "passion points\": music, food, and travel. \"We have to home in on those passion points, to be able to relate to this group. Millennials are focused on experiences,\" the senior manager noted. Here were some of the advertising options available to the marketing and research team: Partnering with or advertising at music festivals Working with food or news bloggers focused on a Millennial audience Relying on other social media or digital advertising Using traditional television, radio, and print advertising \"Each option is enticing, and we need to keep an eye on our return on investment. Some of the ideas may be more exciting than others, but we need to sift through the options because we do not have an unlimited budget,\" noted the senior manager. \"What should the right ROI [return on investment] metric look like? Should it be 'likes? 'Retweets'? 'Reposting's'? The number of views? Should we expect this to be a longerterm play and, if so, how can we know if we're successful?\" \"Keep in mind that, at the end of the day, we have to continue to protect our core consumerthe group aged 2535. As we reach for this 1924 target group, we cannot alienate the group that delivers the bulk of our volume," she noted. She turned to her research and marketing team. \"Given what we've faced and what we've learned, what is your recommendation for short-term and longterm marketing plans for this 1924 target group? And, importantly, on what data points are you basing your recommendations?\