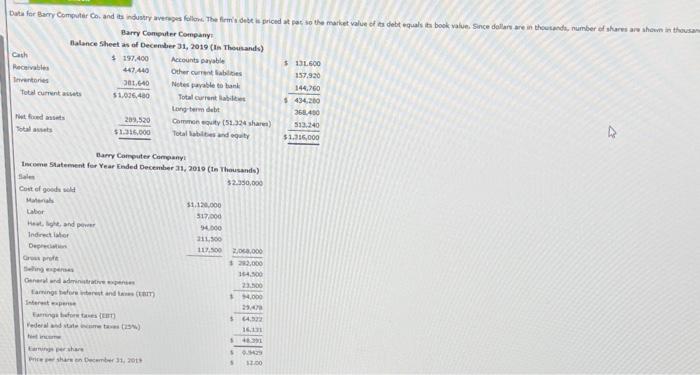

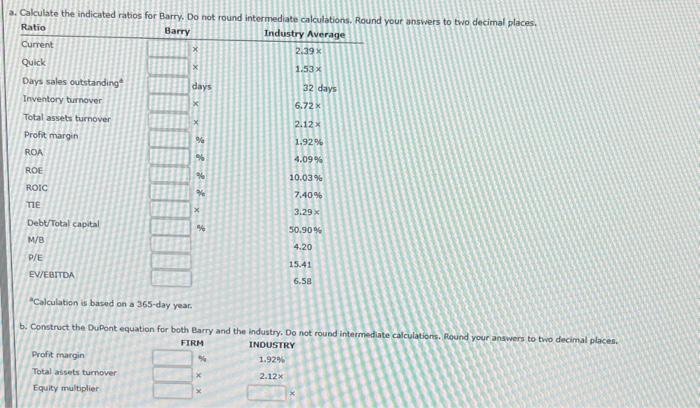

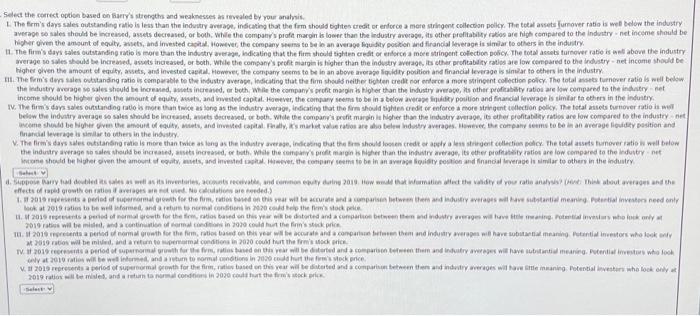

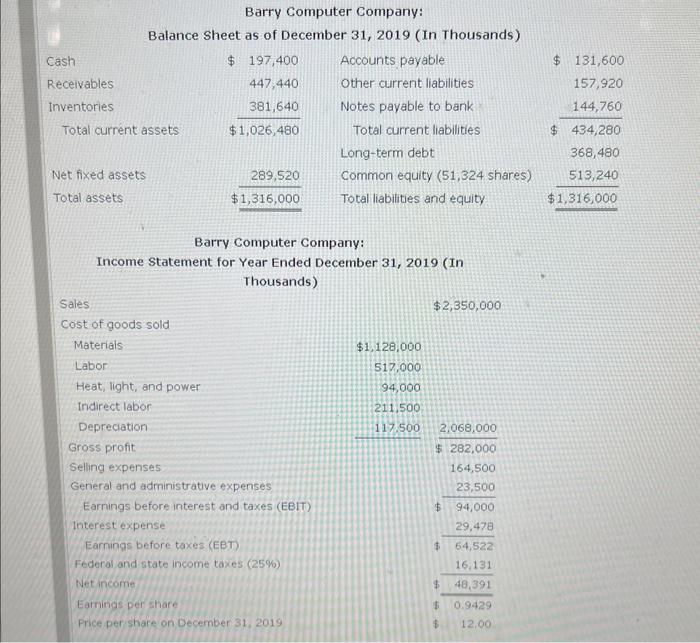

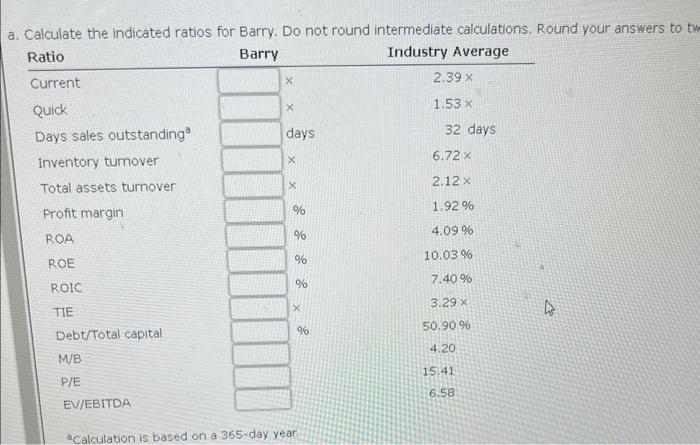

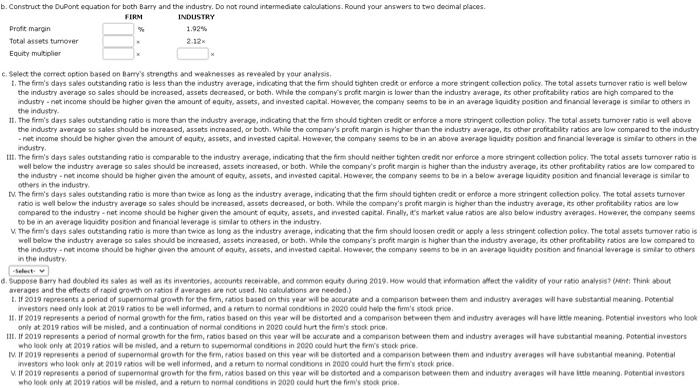

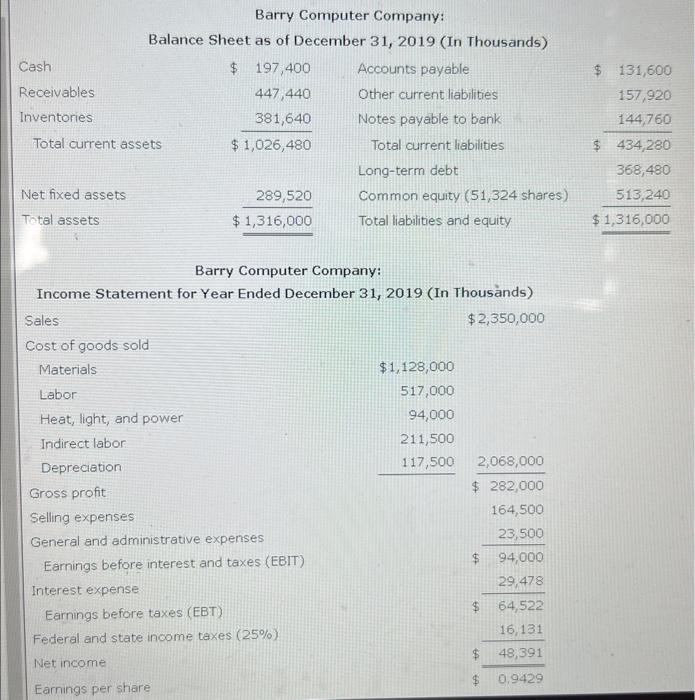

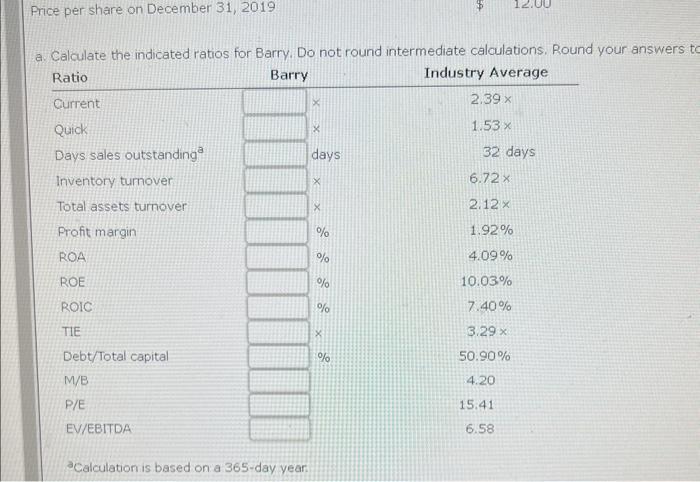

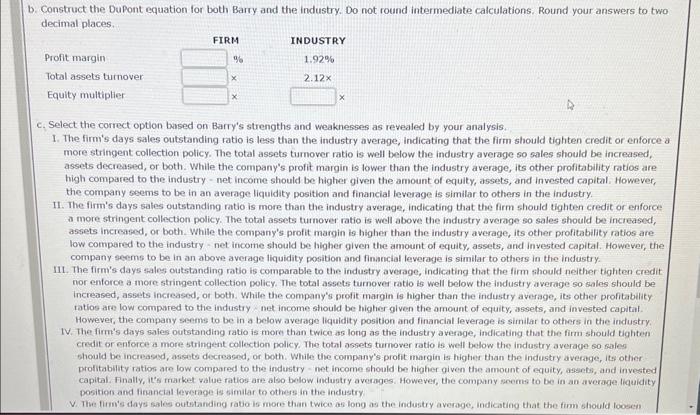

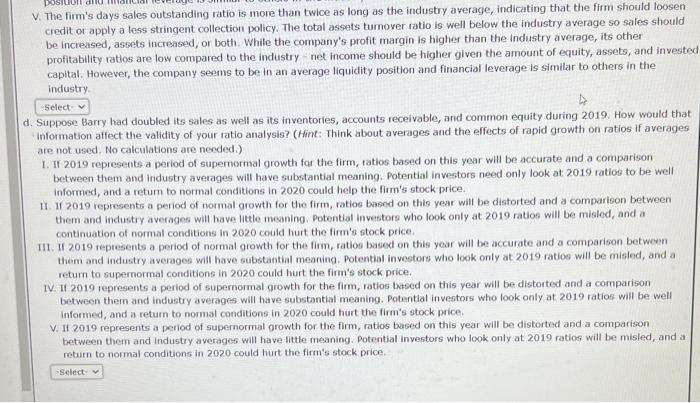

Buery Canputer Company 1ecome 5latement for Year Ended December 31, 2010 (tn Thausands) Salen a Calculation is based on a 365 -day year. b. Construct the Dupont equation for both Barry and the industry. Do not round intermediate calculations. Pqund your answers to two decimal places. 5elect the correct option based on farrys tromoths and weaknesses as revealed Ey rour anahni. finarial leverage is simalar to othen in the inbiatiy. Barry Computer Company: Balance Sheet as of December 31, 2019 (In Thousands) Barry Computer Company: Income Statement for Year Ended December 31, 2019 (In Thousands) Calculate the indicated ratios for Barry. Do not round intermediate calculations. Round your answers to t a Calculation is based on a 365-day year Barry Computer Company: Income Statement for Year Ended December 31, 2019 (In Thousnds) Price per share on December 31,2019 2 Calculation is based on a 365-day year b. Construct the Dupont equation for both Barry and the industry. Do not round intermediate calculations. Round your answers to two decimal places. c. Select the correct option bised on Barry's strengths and weaknesses as revealed by your analysis. 1. The firm's days sales outstanding ratio is less than the industry average, indicating that the firm should tighten credit or enforce a more stringent collection policy. The total assets turnover ratio is well below the industry average so sales should be increased, assets decreased, or both. While the company's profit margin is lower than the industry average, its other profitability ratios are high compared to the industry - net income should be higher given the amount of equity, assets, and invested capital. However, the company seems to be in an average liquidity position and financial leverage is similar to others in the industry. 11. The firm's days sales outstanding ratio is more than the industry average, indicating that the firm should tighten credit or enforce a more stringent collection policy. The total assets turnover ratio is well above the industry average so sales should be increased, assets increased, or both. While the company's profit margin is higher than the industry average, its other profitability ratios are low compared to the industry - net income should be higher given the amount of equity, assets, and invested capital. However, the company seems to be in an above average liquidity position and financial leverage is similar to others in the industry. III. The firm's days sales outstanding ratio is comparable to the industry average, indicating that the firm should neither tighten credit nor enforce a more stringent collection policy. The total assets turnover ratio is well below the industry average so sales should be increased, assets increased, or both. While the company's profit margin is higher than the industry average, its other profitability ratios are low compared to the industry net income stiould be higher given the amount of equity, assets, and invested capital. However, the company seems to be in a below average liquidity position and financial leverage is similar to others in the industry. IV. The firm's days sales outstanding ratio is more than twice as lonig as the industry average, indicating that the firm should tighten credit or enforce a more stringent collection policy. The total assets tumover ratio is well below the industry averave so sales should be increased, ansets decreased, or both. While the company's profit margin is higher than the industry average, its other prolitability ration are low compared to the industry - net income should be higher given the amount of equity, assents, and invested capital. Finally, its market value ratios are abo below induitry averages. Howeves, the company sceme to be in an average liquidity position and firancial leverage is simitar to othess in the industry v. The firm's doys sales outstanding ratio is more than twice as long as the industry average, indicating that the fimm should loosen v. The firm's days sales outstanding ratio is more than twice as long as the industry average, indicating that the firm should loosen credit or apply a less stringent collection policy. The total assets tumover ratio is well below the industry average so sales should be increased, assets increased, or both. While the company's profit margin is higher than the industry average, its other profitability ratios are low compared to the industry - net income should be higher given the amount of equity, assets, and investe capital. However, the company seems to be in an average liquidity position and financial leverage is similar to others in the industry. d. Suppose Barry had doubled its sales as well as its inventories, accounts receivable, and common equity during 2019 . How would that information affect the validity of your ratio analysis? (Hint: Think about averages and the effects of rapid growth on ratios if averages are not used. No calculations are needed.) 1. If 2019 represents a period of supernormal growth for the firm, ratios based on this year will be accurate and a comparison between them and industry averages will have subotantial meaning. Potential investors need only look at 2019 ratios to be well informed, and a retum to normal conditions in 2020 could help the firm's stock price. 11. If 2019 represents a period of normal growth for the firm, ratios based on this year will be distorted and a comparison between them and industry averages will have little meaning. Potential investors who look only at 2019 ratios will be misled, and a continuation of normal conditions in 2020 could hurt the firm's stock price. 111. II 2019 represents a period of normal growth for the firm, ratios based on this year will be accurate and a comparison between them and industry averages will have substantial meaning. Potential investors who look only at 2019 ratios will be misled, and a return to supernormal conditions in 2020 could hurt the firm's stock price. IV. If 2019 represents a period of supernormal growth for the firm, ratios betsed on this year will be distorted and a comparison between them and industry averages will have substantial meaning. Potential investors who look only at 2019 ratios will be well informed, and a retum to normal conditions in 2020 could hurt the firm's stock price. V. If 2019 represents a period of supernormal growth for the firm, ratios based on this year will be distorted and a comparison between them and industry averages will have little meaning. Potential investors who look only at 2019 ratios will be misled, and a return to normal conditions in 2020 could hurt the firm's stock price