Answered step by step

Verified Expert Solution

Question

1 Approved Answer

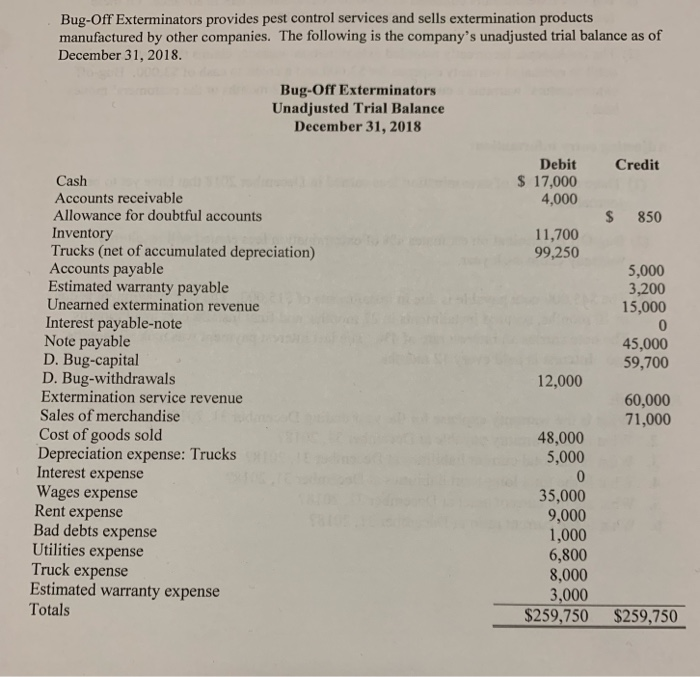

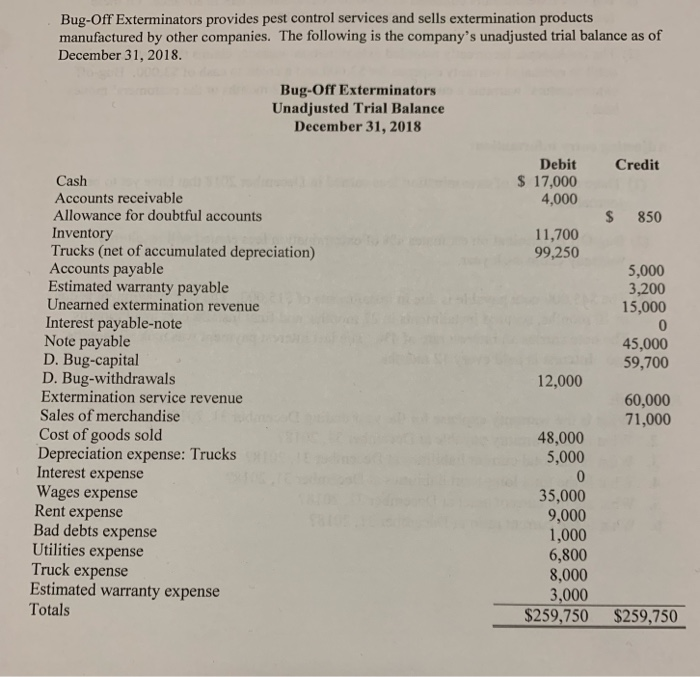

Bug-Off Exterminators provides pest control services and sells extermination products manufactured by other companies. Following is the company's unadjusted trial balance as of December 31,

Bug-Off Exterminators provides pest control services and sells extermination products manufactured by other companies. Following is the company's unadjusted trial balance as of December 31, 2013.

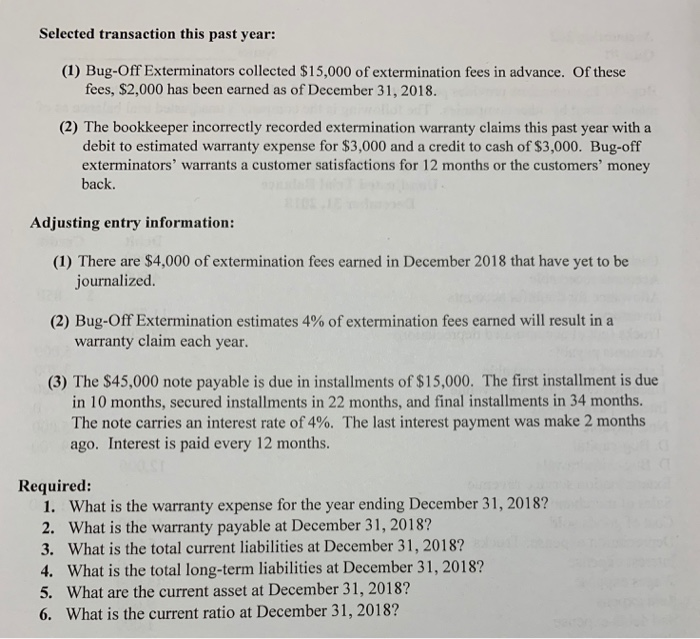

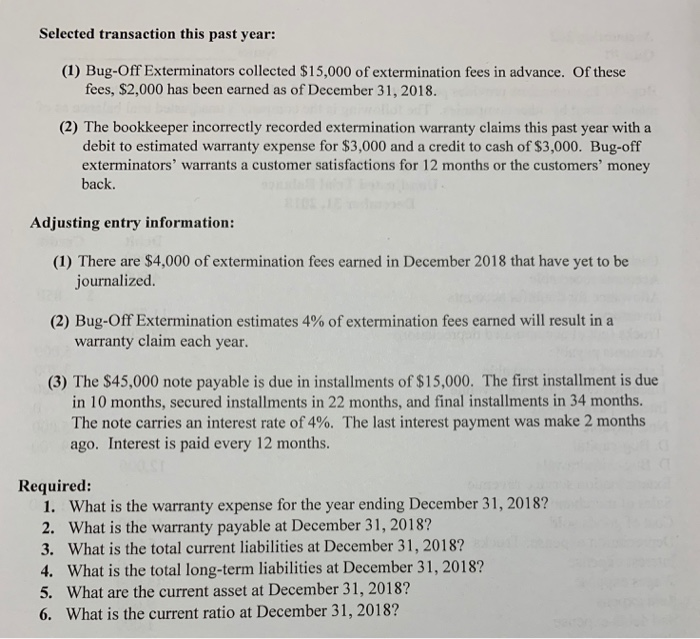

Bug-Off Exterminators provides pest control services and sells extermination products manufactured by other companies. The following is the company's unadjusted trial balance as of December 31, 2018 Bug-Off Exterminators Unadjusted Trial Balance December 31, 2018 Debit S 17,000 4,000 Credit Cash Accounts receivable Allowance for doubtful accounts S 850 Inventory 11,700 99,250 Trucks (net of accumulated depreciation) 5,000 3,200 15,000 0 45,000 59,700 Accounts payable Estimated warranty payable Unearned extermination revenue Interest payable-note Note payable D. Bug-capital D. Bug-withdrawals Extermination service revenue Sales of merchandise Cost of goods sold Depreciation expense: Trucks Interest expense Wages expense Rent expense Bad debts expense Utilities expense 12,000 60,000 71,000 48,000 5,000 35,000 9,000 1,000 6,800 8,000 3,000 Truck expense Estimated warranty expense Totals $259,750 $259,750 Selected transaction this past year: (1) Bug-Off Exterminators collected $15,000 of extermination fees in advance. Of these fees, $2,000 has been earned as of December 31, 2018 (2) The bookkeeper incorrectly recorded extermination warranty claims this past year with a debit to estimated warranty expense for $3,000 and a credit to cash of $3,000. Bug-off exterminators' warrants a customer satisfactions for 12 months or the customers' money back Adjusting entry information: (1) There are $4,000 of extermination fees earned in December 2018 that have yet to be journalized. (2) Bug-Off Extermination estimates 4% of extermination fees earned will result in a warranty claim each year. (3) The $45,000 note payable is due in installments of $15,000. The first installment is due in 10 months, secured installments in 22 months, and final installments in 34 months. The note carries an interest rate of 4%. The last interest payment was make 2 months ago. Interest is paid every 12 months. Required: 1. What is the warranty expense for the year ending December 31, 2018? 2. What is the warranty payable at December 31, 2018? 3. What is the total current liabilities at December 31, 2018? 4. What is the total long-term liabilities at December 31, 2018? 5. What are the current asset at December 31, 2018? 6. What is the current ratio at December 31, 2018

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started