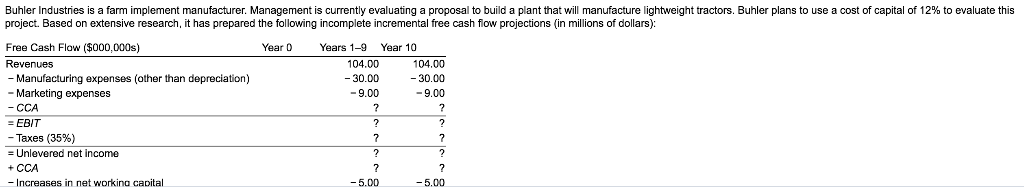

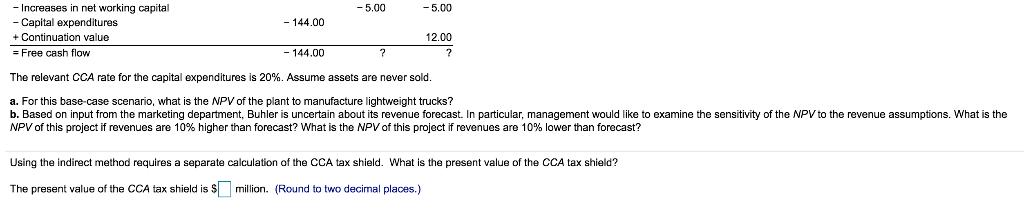

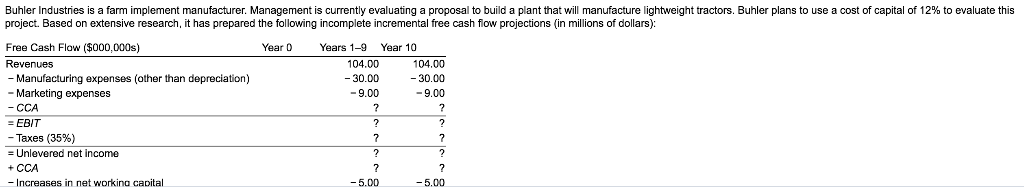

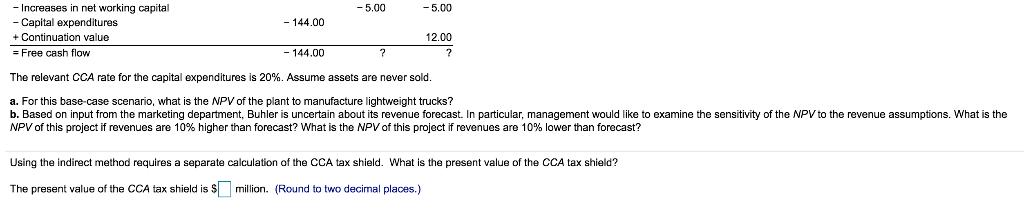

Buhler Industries is a farm implement manufacturer. Management is currently evaluating a proposal to build a plant that will manufacture lightweight tractors. Buhler plans to use a cost of capital of 12% to evaluate this project. Based on extensive research, it has prepared the following incomplete incremental free cash flow projections (in millions of dollars) Free Cash Flow ($000,000s) Revenues - Manufacturing expenses (other than depreciation) -Marketing expenses Year 0 Years 1-9 Year 10 104.00 -30.00 -9.00 104.00 - 30.00 -9.00 -EBIT -Taxes (35%) Unlevered net income +CCA - Increases in net workina capital - 5.00 -5.00 Increases in net working capital 5.005.00 144.00 Capital expenditures +Continuation value = Free cash flow 12.00 144.00 The relevant CCA rate for the capital expenditures is 20%. Assume assets are never sold a. For this base-case scenario, what is the NPV of the plant to manufacture lightweight trucks? b. Based on input rom the marketing department, Buhler is uncertain about its revenue recast. n particular, management would ke to examine the sens NPV of this project if revenues are 10% higher than forecast? What is the NPV of this project if revenues are 10% lower than forecast? ibof the NPVo e venue assumptions what she Using the indiract method requires a separate calculation of the CCA tax shield. What is the present value of the CCA tax shield? The present value of the CCA ta shield is S milion. (Round to two decimal places.) Buhler Industries is a farm implement manufacturer. Management is currently evaluating a proposal to build a plant that will manufacture lightweight tractors. Buhler plans to use a cost of capital of 12% to evaluate this project. Based on extensive research, it has prepared the following incomplete incremental free cash flow projections (in millions of dollars) Free Cash Flow ($000,000s) Revenues - Manufacturing expenses (other than depreciation) -Marketing expenses Year 0 Years 1-9 Year 10 104.00 -30.00 -9.00 104.00 - 30.00 -9.00 -EBIT -Taxes (35%) Unlevered net income +CCA - Increases in net workina capital - 5.00 -5.00 Increases in net working capital 5.005.00 144.00 Capital expenditures +Continuation value = Free cash flow 12.00 144.00 The relevant CCA rate for the capital expenditures is 20%. Assume assets are never sold a. For this base-case scenario, what is the NPV of the plant to manufacture lightweight trucks? b. Based on input rom the marketing department, Buhler is uncertain about its revenue recast. n particular, management would ke to examine the sens NPV of this project if revenues are 10% higher than forecast? What is the NPV of this project if revenues are 10% lower than forecast? ibof the NPVo e venue assumptions what she Using the indiract method requires a separate calculation of the CCA tax shield. What is the present value of the CCA tax shield? The present value of the CCA ta shield is S milion. (Round to two decimal places.)