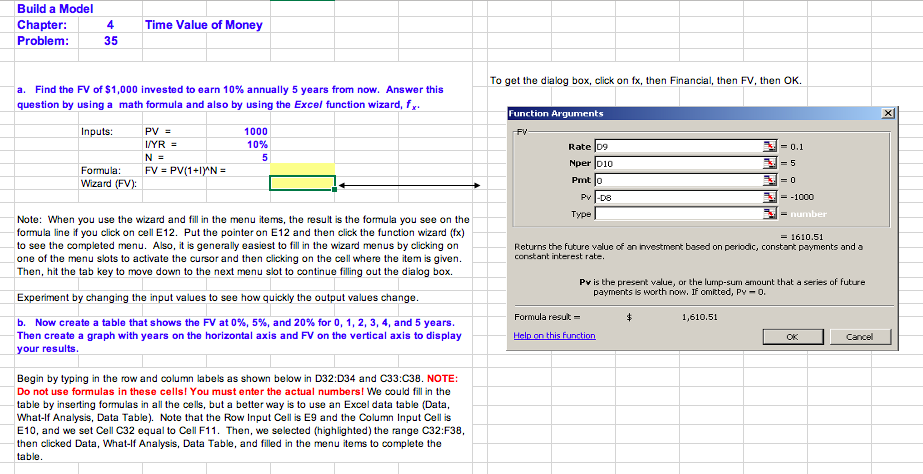

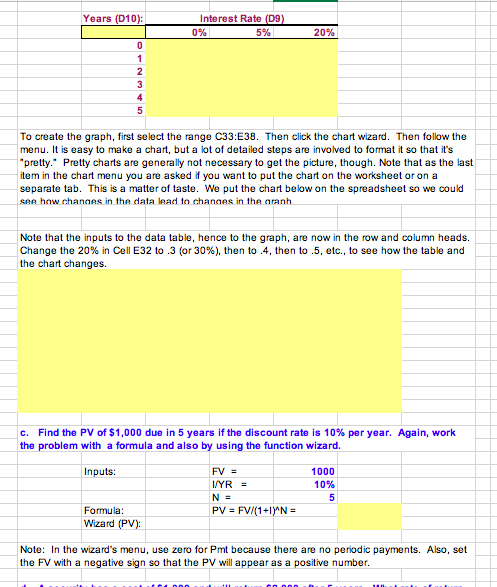

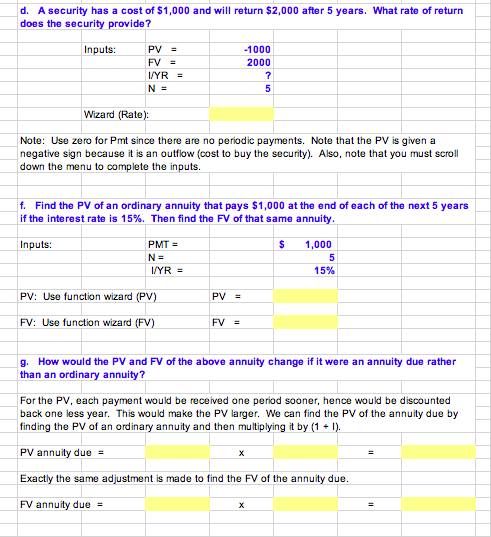

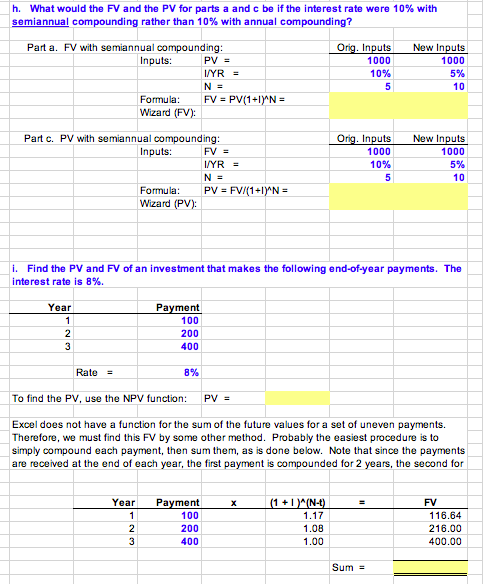

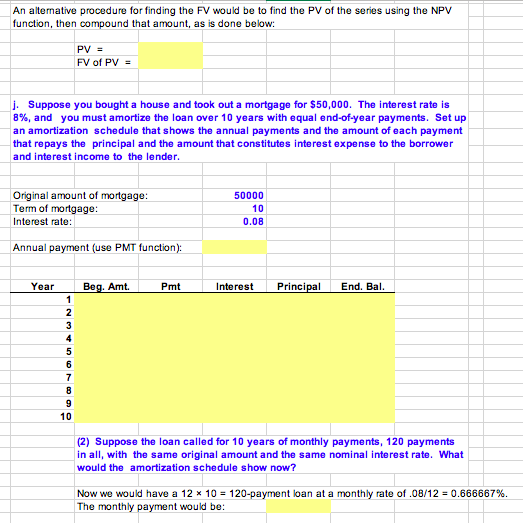

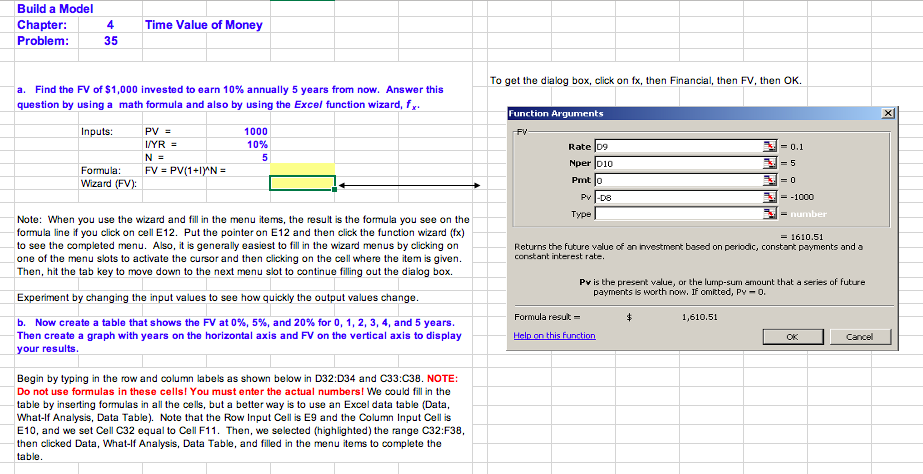

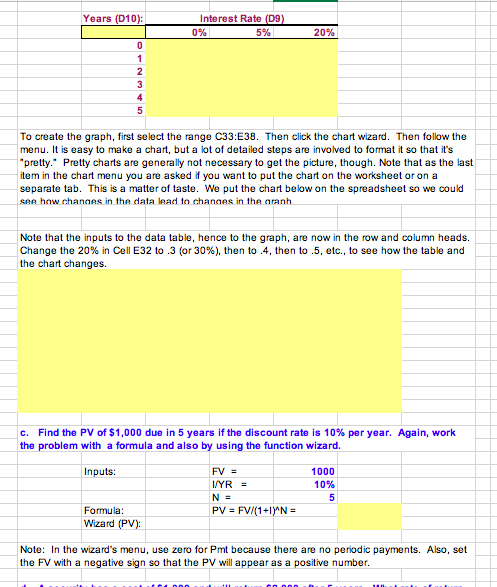

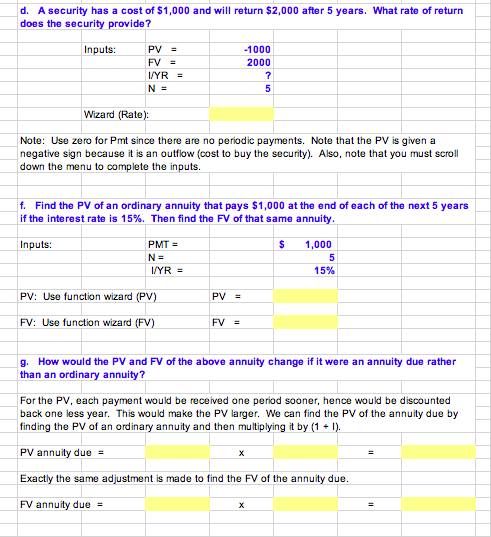

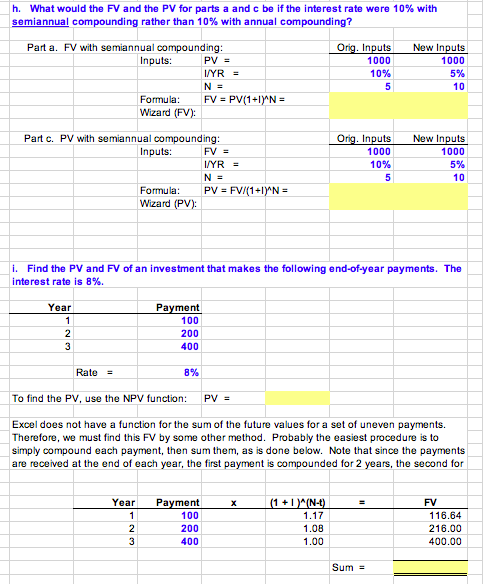

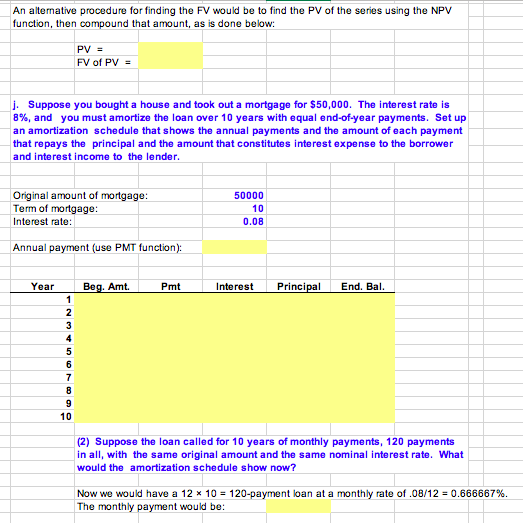

Build a Model 4 Time Value of Money Chapter: Problem: 35 To get the dialog box, click on fx, then Financial, then FV, then OK. a. Find the FV of $1,000 invested to earn 10% annually 5 years from now. Answer this question by using a math formula and also by using the Excel function wizard, fx Function Arguments x Inputs: 1000 FV 10% Rate 09 = 0.1 PV = I/YR = N = FV = PV(1+1) N = 5 = 5 Formula: Nper 010 Pmt lo = 0 Wizard (FV): PV-DB = -1000 Type = number Note: When you use the wizard and fill in the menu items, the result is the formula you see on the formula line if you click on cell E12. Put the pointer on E12 and then click the function wizard (fx) to see the completed menu. Also, it is generally easiest to fill in the wizard menus by clicking on one of the menu slots to activate the cursor and then clicking on the cell where the item is given. Then, hit the tab key to move down to the next menu slot to continue filling out the dialog box. = 1610.51 Returns the future value of an investment based on periodic, constant payments and a constant interest rate. Pv is the present velue, or the lump-sum amount that a series of future payments is worth now. If omitted, PY-0. Experiment by changing the input values to see how quickly the output values change. Formula result = $ 1,610.51 b. Now create a table that shows the FV at 0%, 5%, and 20% for 0, 1, 2, 3, 4, and 5 years. Then create a graph with years on the horizontal axis and FV on the vertical axis to display your results. Heln on this function Cancel Begin by typing in the row and column labels as shown below in D32:034 and C33:C38. NOTE: Do not use formulas in these cells! You must enter the actual numbers! We could fill in the table by inserting formulas in all the cells, but a better way is to use an Excel data table (Data, What-If Analysis, Data Table). Note that the Row Input Cell is E9 and the Column Input Cell is E10, and we set Cell C32 equal to Cell F11. Then, we selected (highlighted) the range C32:F38. then clicked Data, What-If Analysis, Data Table, and filled in the menu items to complete the table. Years (D10): Interest Rate (D9) 0% 5% 20% 0 1 2 3 4 5 To create the graph, first select the range C33:E38. Then click the chart wizard. Then follow the menu. It is easy to make a chart, but a lot of detailed steps are involved to format it so that it's "pretty." Pretty charts are generally not necessary to get the picture, though. Note that as the last item in the chart menu you are asked if you want to put the chart on the worksheet or on a separate tab. This is a matter of taste. We put the chart below on the spreadsheet so we could see how changes in the data lead to changes in the aranh Note that the inputs to the data table, hence to the graph, are now in the row and column heads. Change the 20% in Cell E32 to 3 (or 30%), then to.4, then to .5, etc., to see how the table and the chart changes. c. Find the PV of $1,000 due in 5 years if the discount rate is 10% per year. Again, work the problem with a formula and also by using the function wizard. Inputs: FV = 1000 I/YR = 10% N = 5 Formula: PV = FV/(1+IYAN = Wizard (PV): Note: In the wizard's menu, use zero for Pmt because there are no periodic payments. Also, set the FV with a negative sign so that the PV will appear as a positive number. d. A security has a cost of $1,000 and will return $2,000 after 5 years. What rate of return does the security provide ? Inputs: PV = -1000 FV = 2000 I/YR = ? N = 5 Wizard (Rate): Note: Use zero for Pmt since there are no periodic payments. Note that the PV is given a negative sign because it is an outflow (cost to buy the security). Also, note that you must scroll down the menu to complete the inputs. f. Find the PV of an ordinary annuity that pays $1,000 at the end of each of the next 5 years if the interest rate is 15%. Then find the FV of that same annuity. Inputs: PMT = $ 1,000 N= 5 I/YR = 15% PV: Use function wizard (PV) PV = FV: Use function wizard (FV) FV = g. How would the PV and FV of the above annuity change if it were an annuity due rather than an ordinary annuity? For the PV, each payment would be received one period sooner, hence would be discounted back one less year. This would make the PV larger. We can find the PV of the annuity due by finding the PV of an ordinary annuity and then multiplying it by (1 + 1). PV annuity due = Exactly the same adjustment is made to find the FV of the annuity due. FV annuity due = h. What would the FV and the PV for parts a and be if the interest rate were 10% with semiannual compounding rather than 10% with annual compounding? Orig. Inputs Parta. FV with somiannual compounding: Inputs: PV = I/YR = 1000 New Inputs 1000 5% 10% N = 5 10 Formula: FV = PV(1+) N = Wizard (FV): Orig. Inputs Part c. PV with semiannual compounding: Inputs: FV = I/YR = 1000 New Inputs 1000 5% 10% N = 5 10 Formula: PV = FV/(1+1) N = Wizard (PV): i. Find the PV and FV of an investment that makes the following end-of-year payments. The interest rate is 8%. Year Payment 100 1 2 200 3 400 Rato = 8% To find the PV, use the NPV function: PV = Excel does not have a function for the sum of the future values for a set of uneven payments. Therefore, we must find this FV by some other method. Probably the easiest procedure is to simply compound each payment, then sum them, as is done below. Note that since the payments are received at the end of each year, the first payment is compounded for 2 years, the second for Year Payment 100 (1 + 1)(N-1) FV 1.17 116.64 WN - 200 1.08 216.00 400 1.00 400.00 Sum = An alternative procedure for finding the FV would be to find the PV of the series using the NPV function, then compound that amount, as is done below: PV = FV of PV = j. Suppose you bought a house and took out a mortgage for $50,000. The interest rate is 8%, and you must amortize the loan over 10 years with equal end-of-year payments. Set up an amortization schedule that shows the annual payments and the amount of each payment that repays the principal and the amount that constitutes interest expense to the borrower and interest income to the lender. 50000 Original amount of mortgage: Term of mortgage: Interest rate: 10 0.08 Annual payment (use PMT function): Year Bog. Amt. Pmt Interest Principal End. Bal. 1 2 4 5 6 7 8 9 10 (2) Suppose the loan called for 10 years of monthly payments, 120 payments in all, with the same original amount and the same nominal interest rate. What would the amortization schedule show now? Now we would have a 12 * 10 = 120-payment loan at a monthly rate of .08/12 = 0.666667%. The monthly payment would be