Question

Build an EXCEL spreadsheet to show all work and answer the questions. Place the title of your spreadsheet in cell A1 with FIN 326 Chapter

Build an EXCEL spreadsheet to show all work and answer the questions.

Place the title of your spreadsheet in cell A1 with FIN 326 Chapter 9 Mini Case Fall 2022 first name and last name. Use this title to name your file.

Label all column and row headings.

Design your spreadsheet with an inputs or assumptions area, your calculations using formulas and cell references in another portion of your spreadsheet, and a results section for distinguishing components of your answers.

Modeling using spreadsheets is typical in financial analysis and business.

Do not just add values to cells; use the spreadsheet as a table to display your design and information.

Write a memo stating your recommendation and reasoning. Summary the results that you calculated in EXCEL in your memo. Write your memo in MS Word.

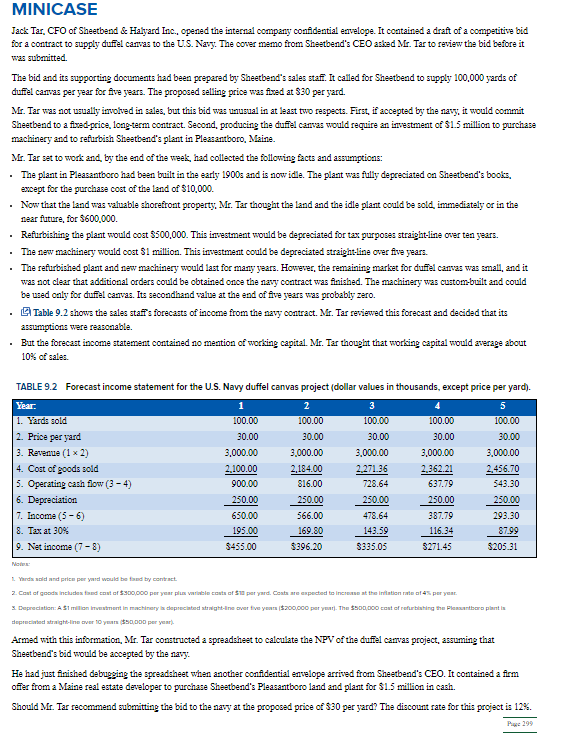

Jack Tar, CFO of Sheetbend \&: Halyard Inc., opened the internal company confidential envelope. It contained a draft of a competitive bid for a contract to supply duffel canvas to the U.S. Navy. The corer memo from Sheatbend's CEO asked Mr. Tar to review the bid before it was submitted. The bid and its supporting documents had been prepared by Sheetbend's sales staff. It called for Sheetbend to supply 100,000 yards of duffel canvas per year for flve years. The proposed selling price was flved at 830 per yard. Mr. Tar was not usually involved in sales, but this bid was unusual in at least two respects. First, if accepted by the navy, it would commit Sheetbend to a fused-price, long-term contract. Second, producing the duffel camvas would require an investment of $1.5 million to purchasa machinery and to refurbish Sheetbend's plant in Pleasantboro, Maine. Mr. Tar set to work and, by the end of the week, had collected the folloning facts and assumptions: - The plant in Pleasantboro had been built in the early 1900 s and is now idle. The plant was fully depreciated on Sheatbend's books, except for the purchase cost of the land of $10,000. - Now that the land was valuable shorefront property, Mr. Tar thought the land and the idle plant could be sold, immediately or in the near future, for $600,000. - Refurbishing the plant would cost 5500,000 . This irvestment would be depreciated for tax purposes straight-line orer ten years. - The new machinery would cost $1 million. This investment could be depreciated straight line orer five years. - The refurbished plant and new machinery would last for many years. However, the remaining market for duffel camvas was small, and it was not clear that additional orders could be obtained once the navy contract was finished. The machinery was custombuilt and could be used only for duffel canvas. Its secondhand value at the end of flve years was probably zero. - Gable 9.2 shows the sales staff's forecasts of income from the navy contract. Mr. Tar reviewed this forecast and decided that its assumptions were reasonable. - But the forecast income statement contained no mention of working capital. Mr. Tar thought that working capital would average about 10% of sales. TABLE 9.2 Forecast income statement for the U.S. Navy duffel canvas project (dollar values in thousands, except price per yard). Metwe: 1. Yurdx adid and price per yaud would be fand by contract. depreciuted atraight-line aver to ywarn \$\$52,000 per year;. Armed with this information, Mr. Tar constructed a spreadshest to calculate the NPV of the duffel carrvas project, assuming that Sheetbend's bid would be accepted by the navy. He had just finished debugging the spreadsheet when another confidential envelope arrived from Sheetbend's CEO. It contained a frm offer from a Maine real estate developer to purchase Sheetbend's Pleasantboro land and plant for $1.5 million in cash. Should Mr. Tar recommend submitting the bid to the navy at the proposed price of $30 per yard? The discount rate for this project is 12%. Jack Tar, CFO of Sheetbend \&: Halyard Inc., opened the internal company confidential envelope. It contained a draft of a competitive bid for a contract to supply duffel canvas to the U.S. Navy. The corer memo from Sheatbend's CEO asked Mr. Tar to review the bid before it was submitted. The bid and its supporting documents had been prepared by Sheetbend's sales staff. It called for Sheetbend to supply 100,000 yards of duffel canvas per year for flve years. The proposed selling price was flved at 830 per yard. Mr. Tar was not usually involved in sales, but this bid was unusual in at least two respects. First, if accepted by the navy, it would commit Sheetbend to a fused-price, long-term contract. Second, producing the duffel camvas would require an investment of $1.5 million to purchasa machinery and to refurbish Sheetbend's plant in Pleasantboro, Maine. Mr. Tar set to work and, by the end of the week, had collected the folloning facts and assumptions: - The plant in Pleasantboro had been built in the early 1900 s and is now idle. The plant was fully depreciated on Sheatbend's books, except for the purchase cost of the land of $10,000. - Now that the land was valuable shorefront property, Mr. Tar thought the land and the idle plant could be sold, immediately or in the near future, for $600,000. - Refurbishing the plant would cost 5500,000 . This irvestment would be depreciated for tax purposes straight-line orer ten years. - The new machinery would cost $1 million. This investment could be depreciated straight line orer five years. - The refurbished plant and new machinery would last for many years. However, the remaining market for duffel camvas was small, and it was not clear that additional orders could be obtained once the navy contract was finished. The machinery was custombuilt and could be used only for duffel canvas. Its secondhand value at the end of flve years was probably zero. - Gable 9.2 shows the sales staff's forecasts of income from the navy contract. Mr. Tar reviewed this forecast and decided that its assumptions were reasonable. - But the forecast income statement contained no mention of working capital. Mr. Tar thought that working capital would average about 10% of sales. TABLE 9.2 Forecast income statement for the U.S. Navy duffel canvas project (dollar values in thousands, except price per yard). Metwe: 1. Yurdx adid and price per yaud would be fand by contract. depreciuted atraight-line aver to ywarn \$\$52,000 per year;. Armed with this information, Mr. Tar constructed a spreadshest to calculate the NPV of the duffel carrvas project, assuming that Sheetbend's bid would be accepted by the navy. He had just finished debugging the spreadsheet when another confidential envelope arrived from Sheetbend's CEO. It contained a frm offer from a Maine real estate developer to purchase Sheetbend's Pleasantboro land and plant for $1.5 million in cash. Should Mr. Tar recommend submitting the bid to the navy at the proposed price of $30 per yard? The discount rate for this project is 12%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started