Answered step by step

Verified Expert Solution

Question

1 Approved Answer

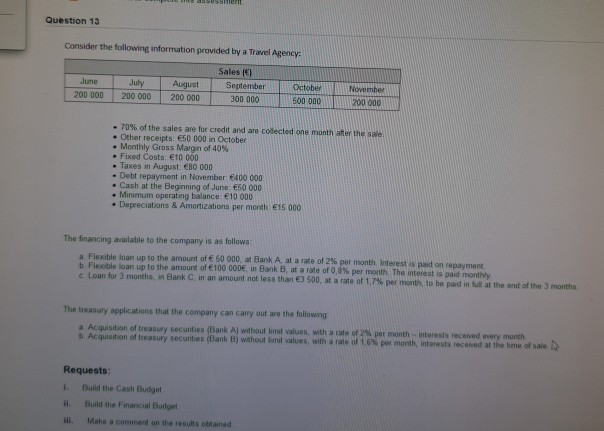

build cash budget and financial budget Question 13 Consider the following information provided by a Travel Agency June 200 000 July 200 000 August 200

build cash budget and financial budget

Question 13 Consider the following information provided by a Travel Agency June 200 000 July 200 000 August 200 000 Sales (0) September 300 000 October 500 000 November 200 000 -70% of the sales are for credit and are collected one month after the sale Other receipts: 50 000 in October . Monthly Gross Margin of 40% . Fixed Costs 10 000 Taxes in August 80 000 - Debt repayment in November 400 000 Cash at the Beginning of June 50 000 Minimum operating balance: 10 000 Depreciations & Amortizations per month 15 000 The financing available to the company is as follows a Flexible loan up to the amount of 50 000 at Bank A at a rate of 2% per month Interest paid on repayment b. Flexible loan up to the amount of 100 00DE in Bank B, at a rate of 0,6% per month The interest is paid monthly c. Loan for 3 months in Bank C, in an amount not less than 3 500 at a rate of 1.7% per month, to be paid in ill at the end of the 3 months The treasury applications that the company can carry out are the following - Acquisition of treasury secunties (Bank Al without limit values, with a rate of 2 per month - interests received every month Acquisition of treasury securities (Bank without limit values, with a rate 16% per month interests recenved at the time of sale Requests: Build the Cash Budget Build the Financial Budget Make a comment on the results obtained Question 13 Consider the following information provided by a Travel Agency June 200 000 July 200 000 August 200 000 Sales (0) September 300 000 October 500 000 November 200 000 -70% of the sales are for credit and are collected one month after the sale Other receipts: 50 000 in October . Monthly Gross Margin of 40% . Fixed Costs 10 000 Taxes in August 80 000 - Debt repayment in November 400 000 Cash at the Beginning of June 50 000 Minimum operating balance: 10 000 Depreciations & Amortizations per month 15 000 The financing available to the company is as follows a Flexible loan up to the amount of 50 000 at Bank A at a rate of 2% per month Interest paid on repayment b. Flexible loan up to the amount of 100 00DE in Bank B, at a rate of 0,6% per month The interest is paid monthly c. Loan for 3 months in Bank C, in an amount not less than 3 500 at a rate of 1.7% per month, to be paid in ill at the end of the 3 months The treasury applications that the company can carry out are the following - Acquisition of treasury secunties (Bank Al without limit values, with a rate of 2 per month - interests received every month Acquisition of treasury securities (Bank without limit values, with a rate 16% per month interests recenved at the time of sale Requests: Build the Cash Budget Build the Financial Budget Make a comment on the results obtainedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started