Question

Build Corporation wants to purchase a new machine for $298,000. Management predicts that the machine can produce sales of $205,000 each year for the next

Build Corporation wants to purchase a new machine for $298,000. Management predicts that the machine can produce sales of $205,000 each year for the next 5 years. Expenses are expected to include direct materials, direct labor, and factory overhead (excluding depreciation) totaling $68,000 per year. The firm uses straight-line depreciation with no residual value for all depreciable assets. Build's combined income tax rate is 40%. Management requires a minimum after-tax rate of return of 10% on all investments.

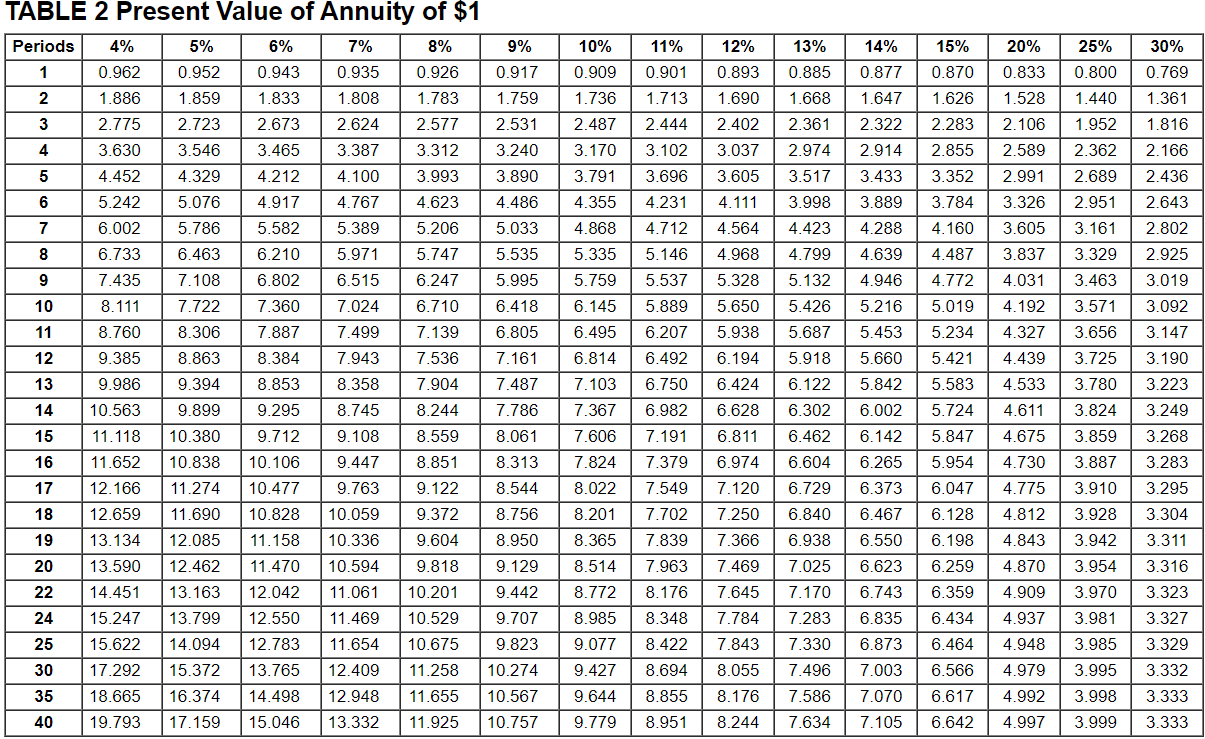

What is the approximate internal rate of return (IRR) of the investment? Assume that annual after-tax cash flows occur at year-end.

TABLE 2 Present Value of Annuity of $1 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 25% Periods 1 0.962 1.886 || 0.877 0.917 1.759 0.901 1.713 15% 0.870 1.626 0.885 1.668 2.361 2 30% 0.769 1.361 1.816 1.647 0.800 1.440 1.952 3 0.952 1.859 2.723 3.546 4.329 5.076 20% 0.833 1.528 2.106 2.589 2.991 3.326 4 2.974 2.283 2.855 3.352 3.784 2.531 3.240 3.890 4.486 5.033 5 2.362 2.689 2.951 2.775 3.630 4.452 5.242 6.002 6.733 7.435 8.111 6 7 4.160 3.605 2.444 3.102 3.696 4.231 4.712 5.146 5.537 5.889 6.207 8 5.535 3.161 3.329 0.909 1.736 2.487 3.170 3.791 4.355 4.868 5.335 5.759 6.145 6.495 6.814 7.103 7.367 7.606 0.926 1.783 2.577 3.312 3.993 4.623 5.206 5.747 6.247 6.710 7.139 7.536 7.904 8.244 8.559 8.851 3.517 3.998 4.423 4.799 5.132 5.426 5.687 4.487 9 4.772 5.995 6.418 6.805 10 5.019 2.322 2.914 3.433 3.889 4.288 4.639 4.946 5.216 5.453 5.660 5.842 6.002 6.142 6.26 11 8.760 5.234 12 6.492 3.837 4.031 4.192 4.327 4.439 4.533 4.611 5.918 0.943 1.833 2.673 3.465 4.212 4.917 5.582 6.210 6.802 7.360 7.887 8.384 8.853 9.295 9.712 10.106 10.477 10.828 11.158 11.470 12.042 12.550 12.783 13.765 14.498 15.046 5.421 0.935 1.808 2.624 3.387 4.100 4.767 5.389 5.971 6.515 7.024 7.499 7.943 8.358 8.745 9.108 447 9.763 10.059 10.336 10.594 11.061 11.469 11.654 12.409 12.948 13.332 13 7.161 7.487 7.786 6.750 6.982 7.191 14 0.893 1.690 2.402 3.037 3.605 4.111 4.564 4.968 5.328 5.650 5.938 6.194 6.424 6.628 6.811 6.974 7.120 7.250 7.366 7.469 7.645 7.784 7.843 8.055 8.176 8.244 5.583 5.724 5.847 15 8.061 5.786 6.463 7.108 7.722 8.306 8.863 9.394 9.899 10.380 10.838 11.274 11.690 12.085 12.462 13.163 13.799 14.094 15.372 16.374 17.159 3.463 3.571 3.656 3.725 3.780 3.824 3.859 3.887 3.910 3.928 3.942 3.954 4.675 4.730 16 5.954 2.166 2.436 2.643 2.802 2.925 3.019 3.092 3.147 3.190 3.223 3.249 3.268 3.283 3.295 3.304 3.311 3.316 3.323 3.327 3.329 3.332 3.333 3.333 17 8.544 9.385 9.986 10.563 11.118 1.652 12.166 12.659 13.134 13.590 14.451 15.247 15.622 17.292 18.665 19.793 8.022 6.122 6.302 6.462 6.604 6.729 6.840 6.938 7.025 7.170 7.549 6.047 18 8.201 19 8.756 8.950 9.129 9.442 8.365 8.514 7.702 7.839 7.963 6.128 6.198 6.259 4.775 4.812 4.843 4.870 4.909 20 22 6.359 9.122 9.372 9.604 9.818 10.201 10.529 10.675 11.258 11.655 11.925 8.176 8.348 6.373 6.467 6.550 6.623 6.743 6.835 6.873 7.003 7.070 7.105 24 9.707 7.283 6.434 4.937 25 6.464 8.772 8.985 9.077 9.427 9.644 9.779 8.422 8.694 9.823 10.274 10.567 10.757 TH 30 7.330 7.496 7.586 7.634 F 3.970 3.981 3.985 3.995 3.998 3.999 4.948 4.979 4.992 4.997 T 35 6.566 6.617 6.642 8.855 8.951 40 |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started