Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Build Ltd sold a property to Hotel Chain under a hire purchase agreement on 15 January 2006. Under the agreement, Hotel Chain was to pay

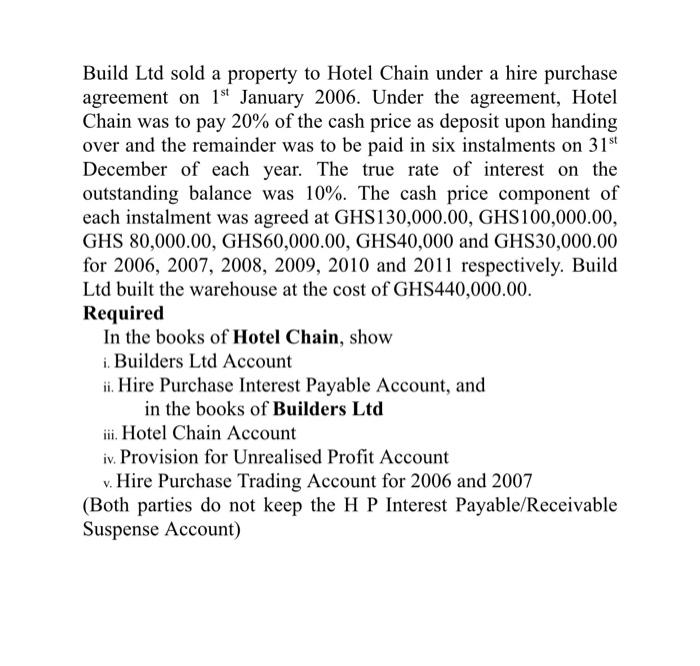

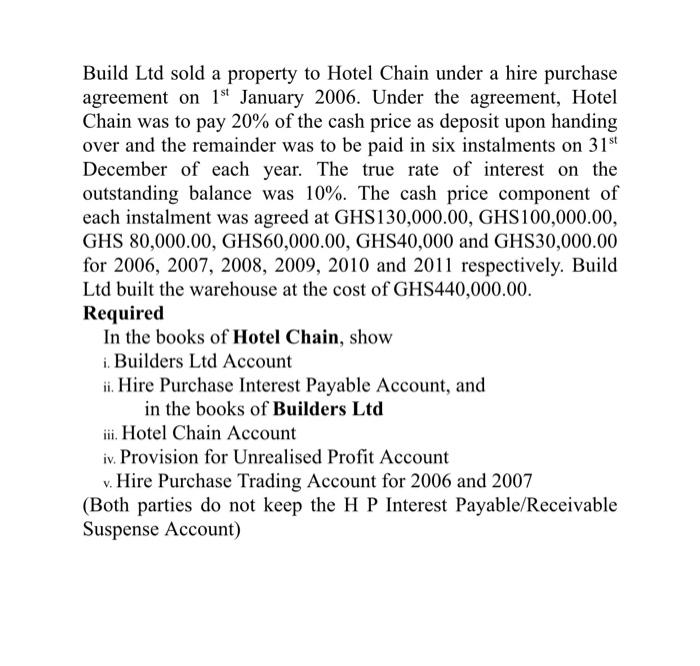

Build Ltd sold a property to Hotel Chain under a hire purchase agreement on 15 January 2006. Under the agreement, Hotel Chain was to pay 20% of the cash price as deposit upon handing over and the remainder was to be paid in six instalments on 31st December of each year. The true rate of interest on the outstanding balance was 10%. The cash price component of each instalment was agreed at GHS130,000.00, GHS100,000.00, GHS 80,000.00, GHS60,000.00, GHS40,000 and GHS30,000.00 for 2006, 2007, 2008, 2009, 2010 and 2011 respectively. Build Ltd built the warehouse at the cost of GHS440,000.00. Required In the books of Hotel Chain, show i. Builders Ltd Account ii. Hire Purchase Interest Payable Account, and in the books of Builders Ltd iii. Hotel Chain Account iv. Provision for Unrealised Profit Account v. Hire Purchase Trading Account for 2006 and 2007 (Both parties do not keep the H P Interest Payable/Receivable Suspense Account)

Build Ltd sold a property to Hotel Chain under a hire purchase agreement on 15 January 2006. Under the agreement, Hotel Chain was to pay 20% of the cash price as deposit upon handing over and the remainder was to be paid in six instalments on 31st December of each year. The true rate of interest on the outstanding balance was 10%. The cash price component of each instalment was agreed at GHS130,000.00, GHS100,000.00, GHS 80,000.00, GHS60,000.00, GHS40,000 and GHS30,000.00 for 2006, 2007, 2008, 2009, 2010 and 2011 respectively. Build Ltd built the warehouse at the cost of GHS440,000.00. Required In the books of Hotel Chain, show i. Builders Ltd Account ii. Hire Purchase Interest Payable Account, and in the books of Builders Ltd iii. Hotel Chain Account iv. Provision for Unrealised Profit Account v. Hire Purchase Trading Account for 2006 and 2007 (Both parties do not keep the H P Interest Payable/Receivable Suspense Account)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started