Question

Built-Right Appliances, Inc. produces washing machines, dryers, and dishwashers. Because of increasing competition, Built-Right is considering investing in an automated manufacturing system. Competition is most

Built-Right Appliances, Inc. produces washing machines, dryers, and dishwashers. Because of increasing competition, Built-Right is considering investing in an automated manufacturing system. Competition is most keen for dishwashers, so this production process for this line has been selected for initial evaluation.

Built-Right Appliances, Inc. produces washing machines, dryers, and dishwashers. Because of increasing competition, Built-Right is considering investing in an automated manufacturing system. Competition is most keen for dishwashers, so this production process for this line has been selected for initial evaluation.

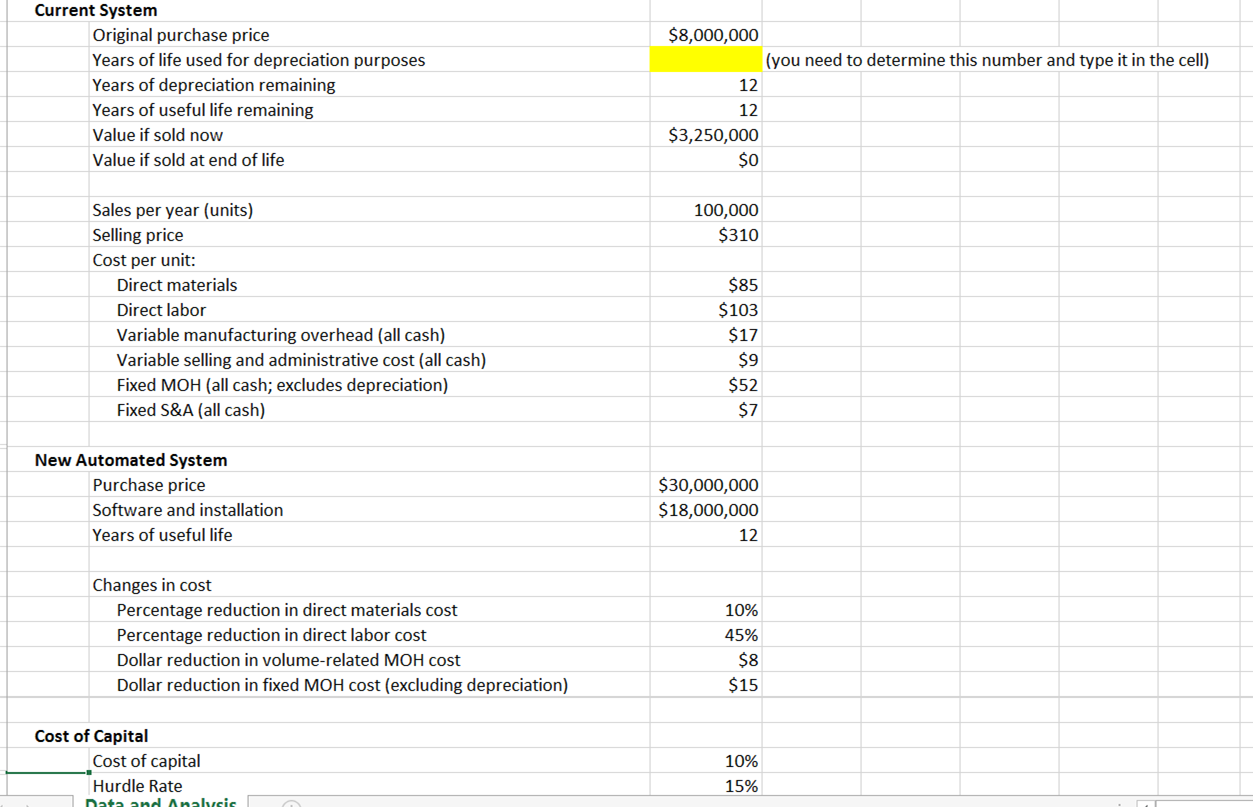

The Current System

The existing system was purchased one year ago for $8 million. Although it will be fully depreciated in 10 more years, management believes it will last for 12 more years (a total of 13 years from its purchase date).

The existing system is capable of producing 100,000 dishwashers per year. Sales and production data using the existing system are provided by the Accounting Department:

Sales per year (units) 100,000

Selling price $310

Prime cost per unit:

Direct materials $85

Direct labor $103

Volume-related manufacturing overhead* $17

Volume-related selling and administration* $9

Fixed MOH (excluding depreciation)* $52

Fixed selling and administration* $7

*All cash expenses

The New Automated System

The new automated system for the dishwasher line would replace an existing system. The new system is expected to last for 12 years. It would cost $30 million to purchase, plus an estimated $18 in software and installation. If the automated system is purchased, the existing system will be sold for $3.25 million.

The automated system requires fewer parts for production and has less waste in the production process. Because of this, the direct material cost per unit will be reduced by 10%. Automation replaces direct labor, so direct labor cost will be reduced by 45%. Automation will also require fewer support activities. As a consequence, volume-related overhead will be reduced by $8 per unit and the fixed overhead (excluding depreciation) will be reduced by $15 per unit.

The firm will use straight-line depreciation with zero salvage value to depreciate the automated system. This is the same method it uses for all assets.

Because sales volume is not changing, the firms selling and administrative costs will not change.

Cost of Capital

The firms cost of capital is 10%.

Questions?

1. Suppose the firm takes on only projects with an internal rate of return greater than 15%. Should the firm replace the existing equipment? Estimate the internal rate of return of the project. State your answer as the nearest percent (for example, 9%).

2. Assume that the automated equipment would have a salvage value of $4.5 million at the end of 12 years. How would this affect the net present value of the project?

Current System Original purchase price Years of life used for depreciation purposes Years of depreciation remaining Years of useful life remaining Value if sold noww Value if sold at end of life $8,000,000 (you need to determine this number and type it in the cell) 12 12 $3,250,000 Sales per year (units) Selling price Cost per unit: 100,000 $310 Direct materials Direct labor Variable manufacturing overhead (all cash) Variable selling and administrative cost (all cash) Fixed MOH (all cash; excludes depreciation) Fixed S&A (all cash) $85 $103 $17 $9 $52 $7 New Automated System Purchase price Software and installation Years of useful life $30,000,000 $18,000,000 12 Changes in cost Percentage reduction in direct materials cost Percentage reduction in direct labor cost Dollar reduction in volume-related MOH cost Dollar reduction in fixed MOH cost (excluding depreciation) 10% 45% $8 $15 Cost of Capital Cost of capital Hurdle Rate 10% 15%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started