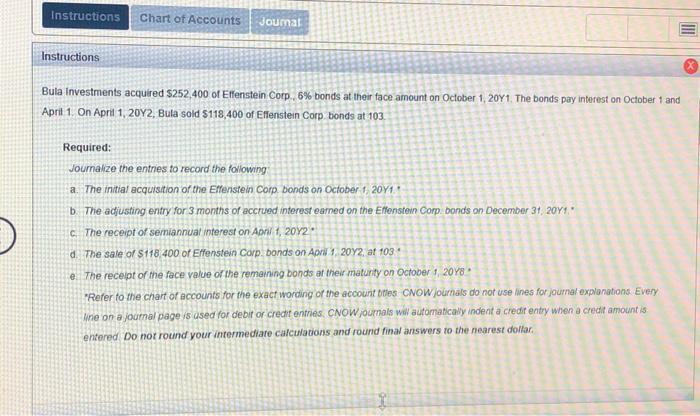

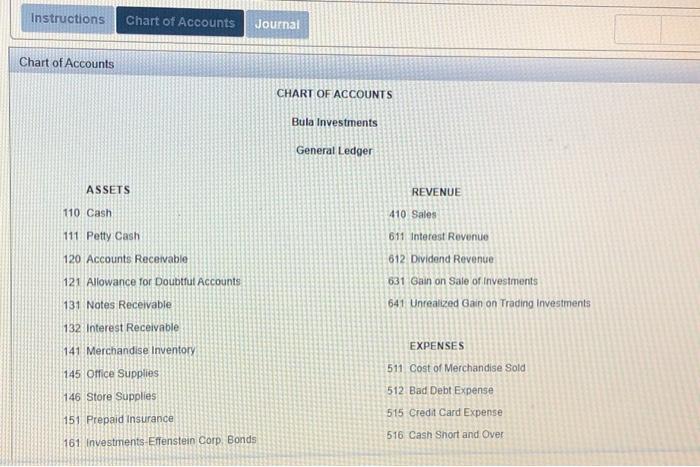

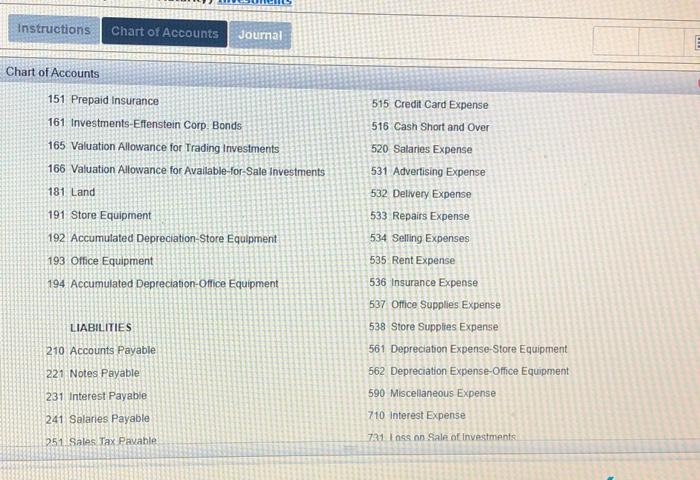

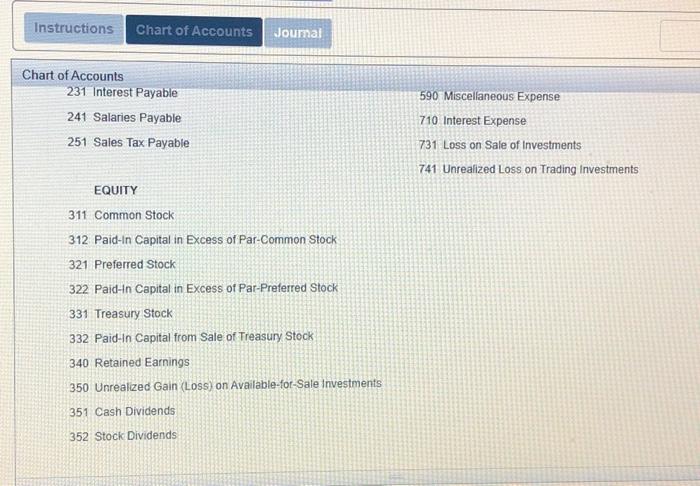

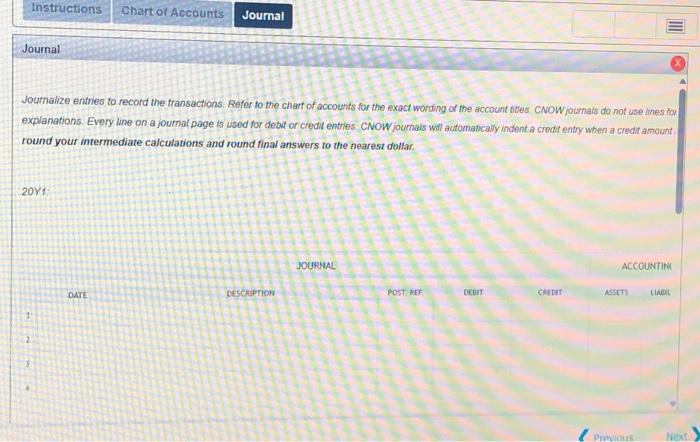

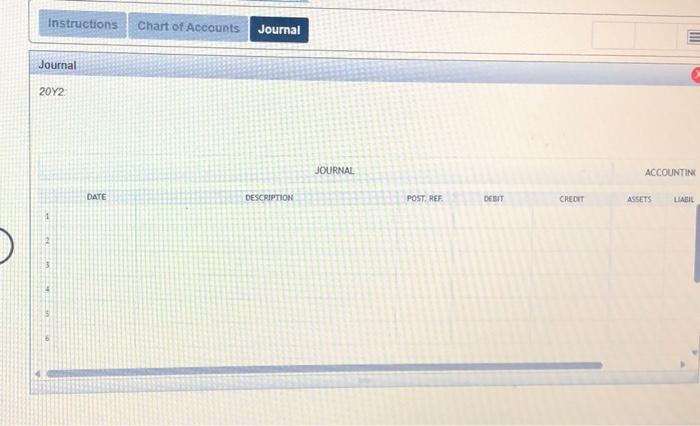

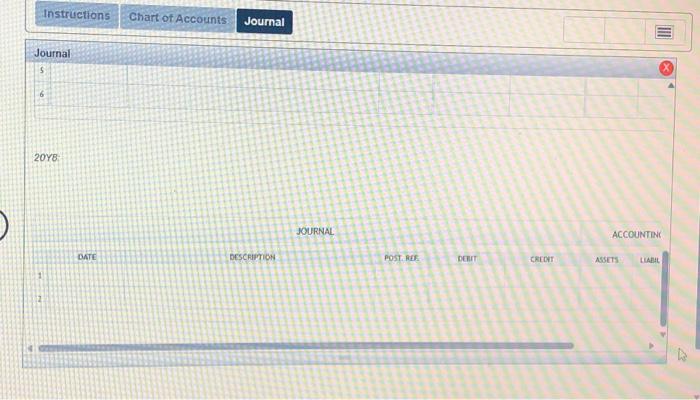

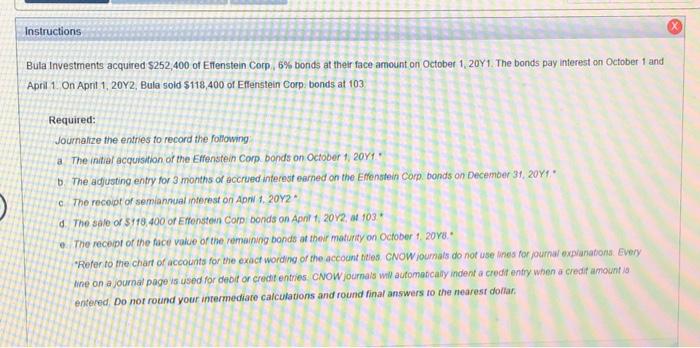

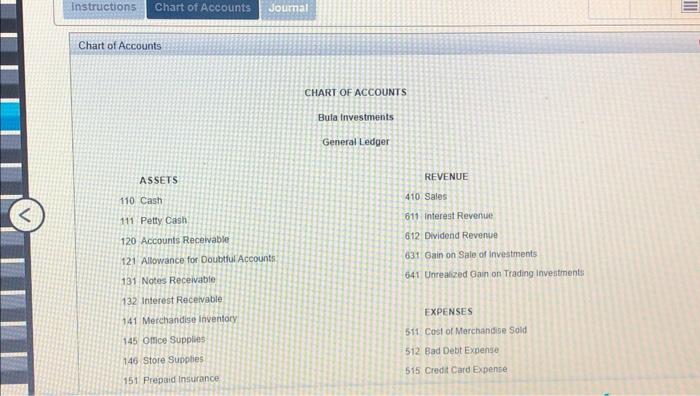

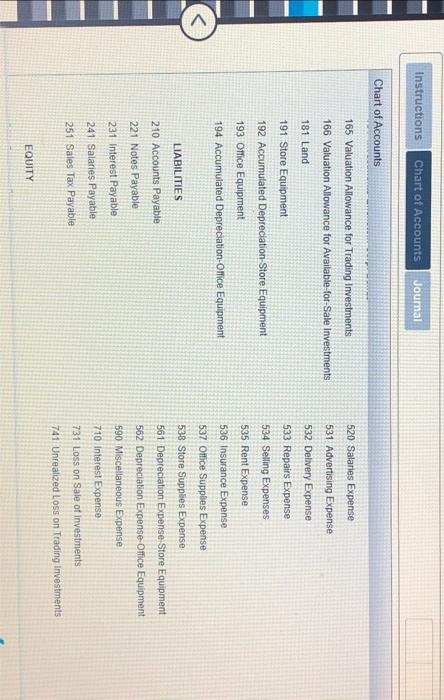

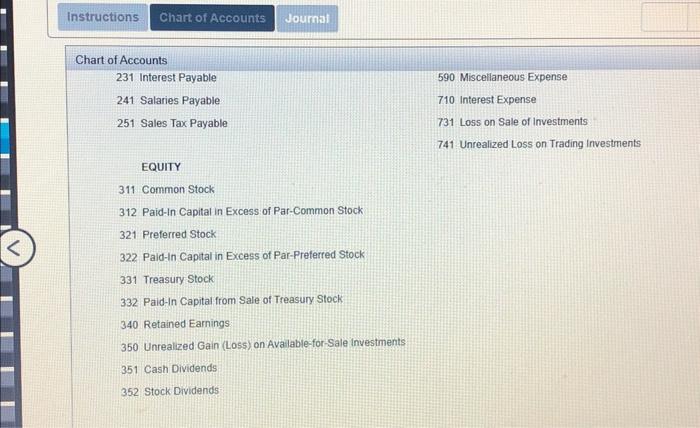

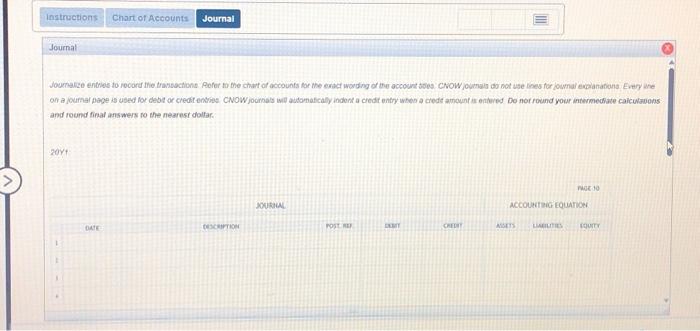

Bula investments acquired $252,400 of Effenstein Corp. 6% bonds at their face amount on October 1,20Y1. The bonds pay interest on October 1 and Aprit 1. On April 1, 20Y2, Bula sold $118,400 of Effenstein Corp. bonds at 103. Required: Journalize the entries to record the followng a. The initial acquistion of the Efrenstein Corp bonds on October 1, 20Y1. b. The adjusting entry for 3 months of accrued interest eamed on the Effenstein Corp bonds on December 31,20Y1. . c. The receipt of semiannuat interest on Aond 1,20V2. d. The sale of $118,400 or Effenstein Carp. bonds on Aoris 4, 20y2, at 103 e. The receipt of the face value or the remaining bonds ar their maturty on october 1,2048 . "Refer to the chart of accounts for the exact wording or the account bites CNOWjoumals do not use lines for joumal explanations Every Whe on a joutnal page is ased for debit or credit entries. CNOW Woumals wal automaticaly indent a credir entry when a credt amount is entered Do not round your intermediare calcwlations and round final answers to the nearest dollar. Instructions Ghart of Accounts Journal Chart of Accounts CHART OF ACCOUNTS Bula Investments General Ledger ASSETS 110 Cash 111 Petty Cash 120 Accounts Recevable 121 Alowance for Doubtrul Accounts 131 Notes Receivable 132 Interest Receivable 141 Merchandise Inventory 145 office Supplies 146 Store Supplies 151. Prepaid insurance 161 investments Effenstein Corp. Bonds REVENUE 410 Sales 611 Interest Rovenue 612 Dividend Revenue 631 Gain on Sale of investments 641 Untealized Gain on Trading investments EXPENSES 511 Cost of Merchandise Sold 512. Bad Debt Expense 515 Credi card Expense 516 Cash Shart and Over Instructions Chart of Accounts Jourma! Chart of Accounts 151 Prepaid insurance 161 Investments-Effenstein Corp. Bonds 165 Valuation Allowance for Trading investments 166 Valuation Allowance for Available-for-Sale investments 181 Land 191 Store Equipment 192 Accumulated Depreciation-Store Equipment 193 Orfice Equipment 194 Accumulated Depreciation-Ofice Equipment LIABILITIES 210 Accounts Payable 221 Notes Payable 231 Interest Payabie 241 Salaries Payable 251 Sales Tax Pavable 515 Credit Card Expense 516 Cash Short and Over 520 Salaries Expense 531 Advertising Expense 532 Delivery Expense 533 Repairs Expense 534 Selling Expenses 535 Rent Expense 536 Insurance Expense 537 Ofice Supplies Expense 538 Store Suppires Expense 561 Depreciation Expense-Store Equipment 562 Depreciation Expense-Office Equipment 590 Miscellaneous Expense 710 interest Expense 731 I nga nn. Sale of investments Instructions Chart of Accounts Joumal Chart of Accounts 231 Interest Payable 590 Miscellaneous Expense 241 Salaries Payable 710 Interest Expense 251 Sales Tax Payable 731 Loss on Sale of Investments 741 Unreafized Loss on Trading Investments EQUITY 311 Common Stock 312 Paid-In Capital in Excess of Par-Common Stock 321 Preferred Stock 322 Paid-in Capital in Excess of Par-Preferred Stock 331 Treasury Stock 332 Paid-in Capital from Sale of Treasury Stock 340 Retained Earnings 350 Unrealized Gain (Loss) on Available-for-Sale Investments 351 Cash Dividends 352 Stock Dividends Journalize entnes to record the transactions. Refer to the chart of accounts for the exact wording of the account tities CNOWjoumals do not ise lines for explanations. Every line on a joumal page is used for debit or credit entries. CNOW joumals will automatcaliy indent a credit entry when a credit amount round your intermediate ca/culations and round final answers to the nearest dollar. Instructions Chart of Accounts Journal Journal 20Y2 JOURNAL ACCOUNTIN DATE DESCRIPTIOP POST. REF. DEEIt CHECrT ASCETS LAEIS Instructions Chart of Accounts Journal Journal 5 6 20Y8 JOURNAL ACCOUNTRK onte orscaiption POST REE Dear ckrar Asers waAt ula Investments acquired $252,400 of Effenstein Corp, 6% bonds at their face amount on October 1,20Y1. The bonds pay interest on October 1 and pril 1. On Apnt 1, 20Y2, Bula soid $118,400 of Effenstein Corp. bonds at 103 : Required: Joumafize the entries to record the following a The initial acquisition of the Effenstein Corp bands on October 1, 20Y1. . b. The adjusting entry for 3 months of accrued inferest earned on the Effenstein Corp. bonds on December 31,20Y1. . c. The recopt of semiannual inerest on ApN 1,20Y2* d. The sale of $118,400 or Eftonsten Corp Donds an Aphi 1, 20 Y2, at 103 * e. The recopt of the face vaiue of the remainigg bonds at their maturity on October 1.20Y8. "Reter to the chart of accounts for the exact wording of the accocant tites. CNOWioumals do not use ines for journal expianations. Every Whe on a journal page is used for debit or credit entries. CNOW joumals wil automoncaidy indent a credir entry when a credit amount is entered Do not round your imermediate calculations and round final answers to the nearest dollar. Chart of Accounts CHART OF ACCOUNTS Bula Investments General Ledger ASSETS 110 Cash 111 Petty Cash 120 Accounts Recewable 121 Allowance for Doubtful Accounts 131 Notes Receivable 132 Interest Recevable 141 Merchandise Inventory 145 ortice Supples 146 store Supplies 151 Prepaid insurance REVENUE 410 Sales 611 interest Revenue 612 Dividend Revenue 631 Gain on Sale of investments 641 Unreaczed Gain on Trading investments EXPENSES 511 Cost of Merchandise Sold 512 Bad Debt Expenge 515 credt Card Expense Instructions Chart of Accounts Joumal Chart of Accounts 165 Valuation Allowance for Trading Investments 166 Valuation Allowance for Available-for-Sale investrnents 181 Land 191 Store Equipment 192 Accumulated Depreciation-Store Equipment 193 Orfice Equipment. 194 Accumulated Depreciation-Olfice Equipment LIABILITIES 210 Accounts. Payable 221 Notes Payable 231 Interest Payable 241 Salaries Payable 251 Sales Tax Payable 520 Salaries Expense 531. Advertising Expense 532 Delivery Expense 533 Repairs Expense 534 Selling Expenses 535 Rent Expense 536 insurance Expense 537 Ottice Supples Expense 538 Store Supples Expense 561 Depreciation ExpenseStore Equipment 562 Depreciation Expense-Ofice Equipment 590 Misceltaneous Experse 710 Interest Expense 731 Loss on Sale of investments 741 Unrealized Loss on Trading investments EQUITY Instructions Chart of Accounts Joumat Chart of Accounts 231 Interest Payable 241 Salaries Payable 251 Sales Tax Payable EQUITY 311 Common Stock 312 Paid-In Capital in Excess of Par-Common Stock 321 Preferred Stock 322. Paid-in Capital in Excess of Par-Preferred Stock 331 Treasury Stock 332 Paid-In Capital from Sale of Treasury Stock 340 Retained Earnings 350 Unrealized Gain (Loss) on Avalable-for-Sale investments 351 Cash Dividends 352 Stock Dividends 590 Miscellaneous Expense 710 interest Expense 731 Loss on Sale of investments 741 Unrealized Loss on Trading investments and round finat answers to the nearest dollar: Bula investments acquired $252,400 of Effenstein Corp. 6% bonds at their face amount on October 1,20Y1. The bonds pay interest on October 1 and Aprit 1. On April 1, 20Y2, Bula sold $118,400 of Effenstein Corp. bonds at 103. Required: Journalize the entries to record the followng a. The initial acquistion of the Efrenstein Corp bonds on October 1, 20Y1. b. The adjusting entry for 3 months of accrued interest eamed on the Effenstein Corp bonds on December 31,20Y1. . c. The receipt of semiannuat interest on Aond 1,20V2. d. The sale of $118,400 or Effenstein Carp. bonds on Aoris 4, 20y2, at 103 e. The receipt of the face value or the remaining bonds ar their maturty on october 1,2048 . "Refer to the chart of accounts for the exact wording or the account bites CNOWjoumals do not use lines for joumal explanations Every Whe on a joutnal page is ased for debit or credit entries. CNOW Woumals wal automaticaly indent a credir entry when a credt amount is entered Do not round your intermediare calcwlations and round final answers to the nearest dollar. Instructions Ghart of Accounts Journal Chart of Accounts CHART OF ACCOUNTS Bula Investments General Ledger ASSETS 110 Cash 111 Petty Cash 120 Accounts Recevable 121 Alowance for Doubtrul Accounts 131 Notes Receivable 132 Interest Receivable 141 Merchandise Inventory 145 office Supplies 146 Store Supplies 151. Prepaid insurance 161 investments Effenstein Corp. Bonds REVENUE 410 Sales 611 Interest Rovenue 612 Dividend Revenue 631 Gain on Sale of investments 641 Untealized Gain on Trading investments EXPENSES 511 Cost of Merchandise Sold 512. Bad Debt Expense 515 Credi card Expense 516 Cash Shart and Over Instructions Chart of Accounts Jourma! Chart of Accounts 151 Prepaid insurance 161 Investments-Effenstein Corp. Bonds 165 Valuation Allowance for Trading investments 166 Valuation Allowance for Available-for-Sale investments 181 Land 191 Store Equipment 192 Accumulated Depreciation-Store Equipment 193 Orfice Equipment 194 Accumulated Depreciation-Ofice Equipment LIABILITIES 210 Accounts Payable 221 Notes Payable 231 Interest Payabie 241 Salaries Payable 251 Sales Tax Pavable 515 Credit Card Expense 516 Cash Short and Over 520 Salaries Expense 531 Advertising Expense 532 Delivery Expense 533 Repairs Expense 534 Selling Expenses 535 Rent Expense 536 Insurance Expense 537 Ofice Supplies Expense 538 Store Suppires Expense 561 Depreciation Expense-Store Equipment 562 Depreciation Expense-Office Equipment 590 Miscellaneous Expense 710 interest Expense 731 I nga nn. Sale of investments Instructions Chart of Accounts Joumal Chart of Accounts 231 Interest Payable 590 Miscellaneous Expense 241 Salaries Payable 710 Interest Expense 251 Sales Tax Payable 731 Loss on Sale of Investments 741 Unreafized Loss on Trading Investments EQUITY 311 Common Stock 312 Paid-In Capital in Excess of Par-Common Stock 321 Preferred Stock 322 Paid-in Capital in Excess of Par-Preferred Stock 331 Treasury Stock 332 Paid-in Capital from Sale of Treasury Stock 340 Retained Earnings 350 Unrealized Gain (Loss) on Available-for-Sale Investments 351 Cash Dividends 352 Stock Dividends Journalize entnes to record the transactions. Refer to the chart of accounts for the exact wording of the account tities CNOWjoumals do not ise lines for explanations. Every line on a joumal page is used for debit or credit entries. CNOW joumals will automatcaliy indent a credit entry when a credit amount round your intermediate ca/culations and round final answers to the nearest dollar. Instructions Chart of Accounts Journal Journal 20Y2 JOURNAL ACCOUNTIN DATE DESCRIPTIOP POST. REF. DEEIt CHECrT ASCETS LAEIS Instructions Chart of Accounts Journal Journal 5 6 20Y8 JOURNAL ACCOUNTRK onte orscaiption POST REE Dear ckrar Asers waAt ula Investments acquired $252,400 of Effenstein Corp, 6% bonds at their face amount on October 1,20Y1. The bonds pay interest on October 1 and pril 1. On Apnt 1, 20Y2, Bula soid $118,400 of Effenstein Corp. bonds at 103 : Required: Joumafize the entries to record the following a The initial acquisition of the Effenstein Corp bands on October 1, 20Y1. . b. The adjusting entry for 3 months of accrued inferest earned on the Effenstein Corp. bonds on December 31,20Y1. . c. The recopt of semiannual inerest on ApN 1,20Y2* d. The sale of $118,400 or Eftonsten Corp Donds an Aphi 1, 20 Y2, at 103 * e. The recopt of the face vaiue of the remainigg bonds at their maturity on October 1.20Y8. "Reter to the chart of accounts for the exact wording of the accocant tites. CNOWioumals do not use ines for journal expianations. Every Whe on a journal page is used for debit or credit entries. CNOW joumals wil automoncaidy indent a credir entry when a credit amount is entered Do not round your imermediate calculations and round final answers to the nearest dollar. Chart of Accounts CHART OF ACCOUNTS Bula Investments General Ledger ASSETS 110 Cash 111 Petty Cash 120 Accounts Recewable 121 Allowance for Doubtful Accounts 131 Notes Receivable 132 Interest Recevable 141 Merchandise Inventory 145 ortice Supples 146 store Supplies 151 Prepaid insurance REVENUE 410 Sales 611 interest Revenue 612 Dividend Revenue 631 Gain on Sale of investments 641 Unreaczed Gain on Trading investments EXPENSES 511 Cost of Merchandise Sold 512 Bad Debt Expenge 515 credt Card Expense Instructions Chart of Accounts Joumal Chart of Accounts 165 Valuation Allowance for Trading Investments 166 Valuation Allowance for Available-for-Sale investrnents 181 Land 191 Store Equipment 192 Accumulated Depreciation-Store Equipment 193 Orfice Equipment. 194 Accumulated Depreciation-Olfice Equipment LIABILITIES 210 Accounts. Payable 221 Notes Payable 231 Interest Payable 241 Salaries Payable 251 Sales Tax Payable 520 Salaries Expense 531. Advertising Expense 532 Delivery Expense 533 Repairs Expense 534 Selling Expenses 535 Rent Expense 536 insurance Expense 537 Ottice Supples Expense 538 Store Supples Expense 561 Depreciation ExpenseStore Equipment 562 Depreciation Expense-Ofice Equipment 590 Misceltaneous Experse 710 Interest Expense 731 Loss on Sale of investments 741 Unrealized Loss on Trading investments EQUITY Instructions Chart of Accounts Joumat Chart of Accounts 231 Interest Payable 241 Salaries Payable 251 Sales Tax Payable EQUITY 311 Common Stock 312 Paid-In Capital in Excess of Par-Common Stock 321 Preferred Stock 322. Paid-in Capital in Excess of Par-Preferred Stock 331 Treasury Stock 332 Paid-In Capital from Sale of Treasury Stock 340 Retained Earnings 350 Unrealized Gain (Loss) on Avalable-for-Sale investments 351 Cash Dividends 352 Stock Dividends 590 Miscellaneous Expense 710 interest Expense 731 Loss on Sale of investments 741 Unrealized Loss on Trading investments and round finat answers to the nearest dollar