Question

Bulldog Appliances uses the periodic inventory system. Details regarding the inventory of appliances at August 1, 2009, purchases invoices during the year, and the inventory

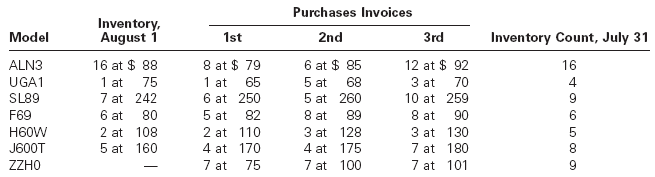

Bulldog Appliances uses the periodic inventory system. Details regarding the inventory of appliances at August 1, 2009, purchases invoices during the year, and the inventory count at July 31, 2010, are summarized as follows:

1. Determine the cost of the inventory on July 31, 2010, by the first-in, first-out method.

If the inventory of a particular model comprises one entire purchase plus a portion of another purchase acquired at a different unit cost, use a separate line for each purchase.

2. Determine the cost of the inventory on July 31, 2010, by the last-in, first-out method. If the inventory of a particular model comprises one entire purchase plus a portion of another purchase acquired at a different unit cost, use a separate line for each purchase.

3. Determine the cost of the inventory on July 31, 2010, by the average cost method. If the inventory of a particular model comprises one entire purchase plus a portion of another purchase acquired at a different unit cost, use a separate line for each purchase.

4. Discuss which method (FIFO or LIFO) would be preferred for income tax purposes in periods of (a) rising prices and (b) declining prices. The input in the box below will not be graded, but may be reviewed and considered by your instructor. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started