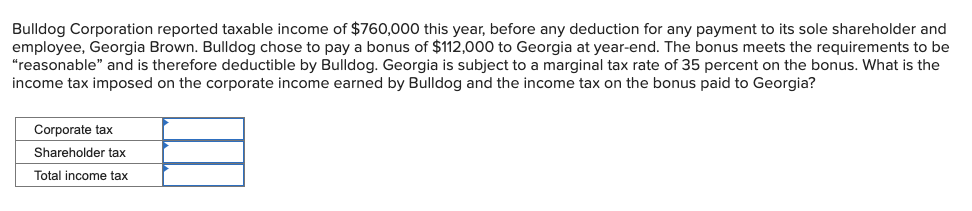

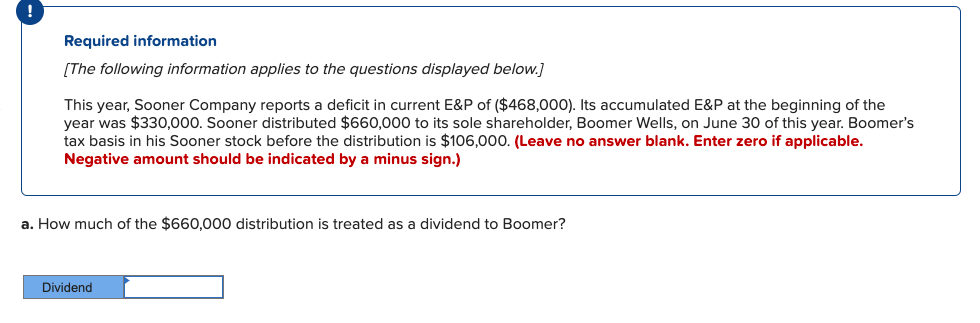

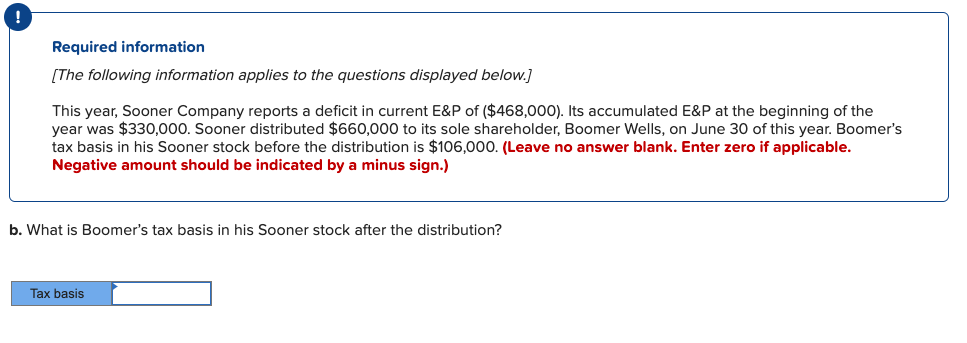

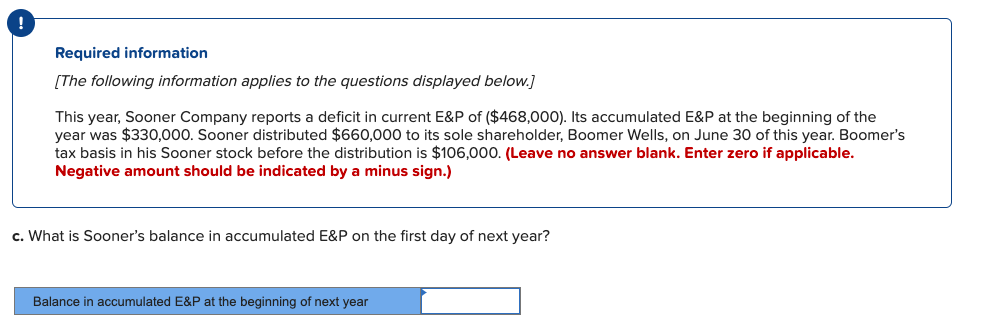

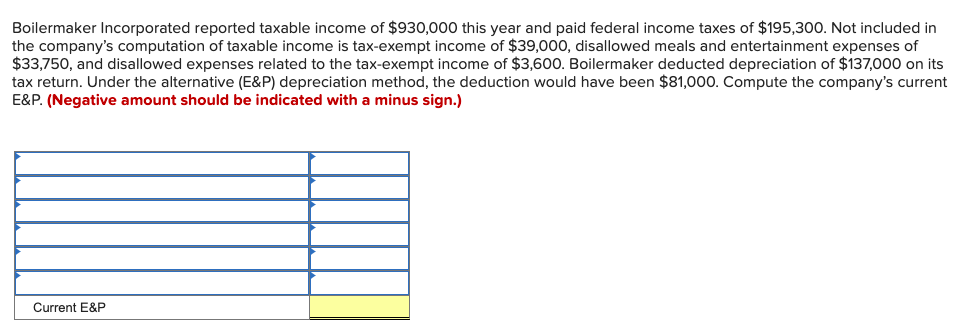

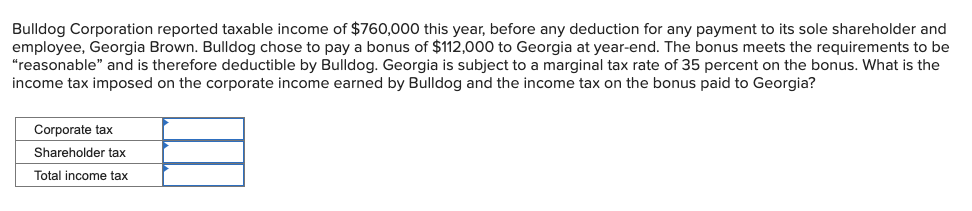

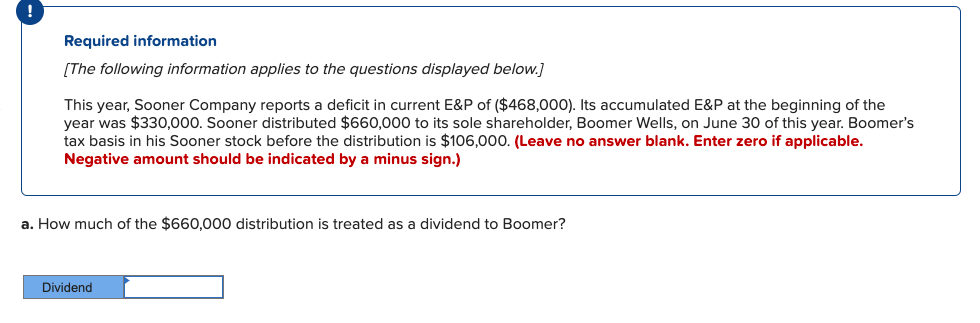

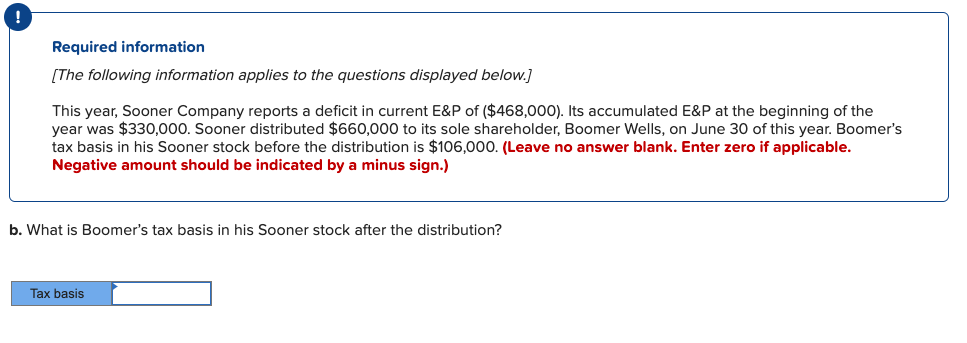

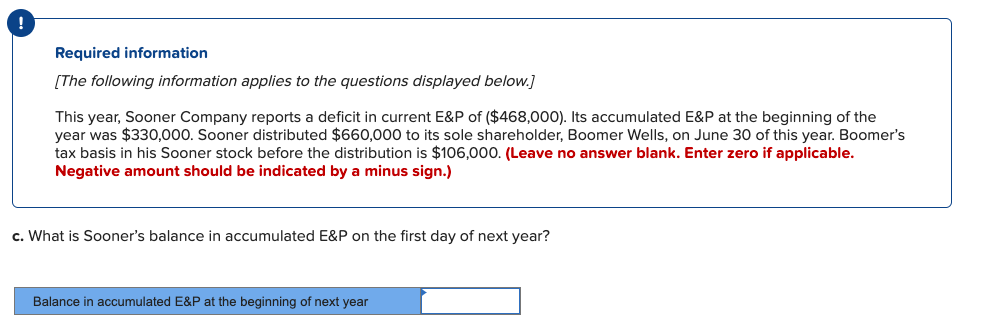

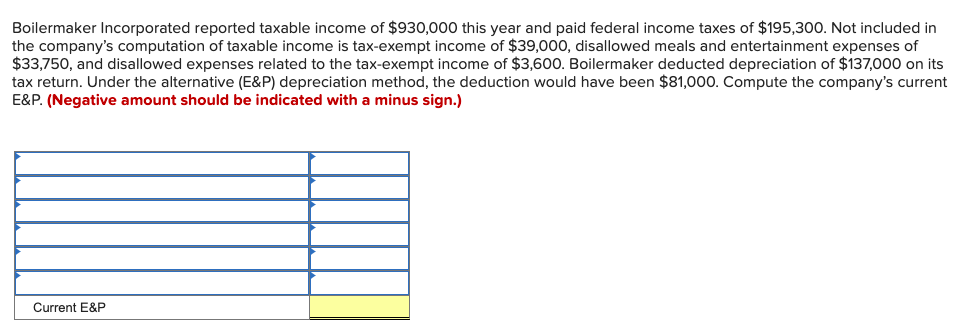

Bulldog Corporation reported taxable income of $760,000 this year, before any deduction for any payment to its sole shareholder and employee, Georgia Brown. Bulldog chose to pay a bonus of $112,000 to Georgia at year-end. The bonus meets the requirements to be "reasonable" and is therefore deductible by Bulldog. Georgia is subject to a marginal tax rate of 35 percent on the bonus. What is the income tax imposed on the corporate income earned by Bulldog and the income tax on the bonus paid to Georgia? Corporate tax Shareholder tax Total income tax Required information [The following information applies to the questions displayed below. This year, Sooner Company reports a deficit in current E&P of ($468,000). Its accumulated E&P at the beginning of the year was $330,000. Sooner distributed $660,000 to its sole shareholder, Boomer Wells, on June 30 of this year. Boomer's tax basis in his Sooner stock before the distribution is $106,000. (Leave no answer blank. Enter zero if applicable. Negative amount should be indicated by a minus sign.) a. How much of the $660,000 distribution is treated as a dividend to Boomer? Dividend Required information [The following information applies to the questions displayed below. This year, Sooner Company reports a deficit in current E&P of ($468,000). Its accumulated E&P at the beginning of the year was $330,000. Sooner distributed $660,000 to its sole shareholder, Boomer Wells, on June 30 of this year. Boomer's tax basis in his Sooner stock before the distribution is $106,000. (Leave no answer blank. Enter zero if applicable. Negative amount should be indicated by a minus sign.) b. What is Boomer's tax basis in his Sooner stock after the distribution? Tax basis ! Required information [The following information applies to the questions displayed below.) This year, Sooner Company reports a deficit in current E&P of ($468,000). Its accumulated E&P at the beginning of the year was $330,000. Sooner distributed $660,000 to its sole shareholder, Boomer Wells, on June 30 of this year. Boomer's tax basis in his Sooner stock before the distribution is $106,000. (Leave no answer blank. Enter zero if applicable. Negative amount should be indicated by a minus sign.) c. What is Sooner's balance in accumulated E&P on the first day of next year? Balance in accumulated E&P at the beginning of next year Boilermaker Incorporated reported taxable income of $930,000 this year and paid federal income taxes of $195,300. Not included in the company's computation of taxable income is tax-exempt income of $39,000, disallowed meals and entertainment expenses of $33,750, and disallowed expenses related to the tax-exempt income of $3,600. Boilermaker deducted depreciation of $137,000 on its tax return. Under the alternative (E&P) depreciation method, the deduction would have been $81,000. Compute the company's current E&P. (Negative amount should be indicated with a minus sign.) Current E&P