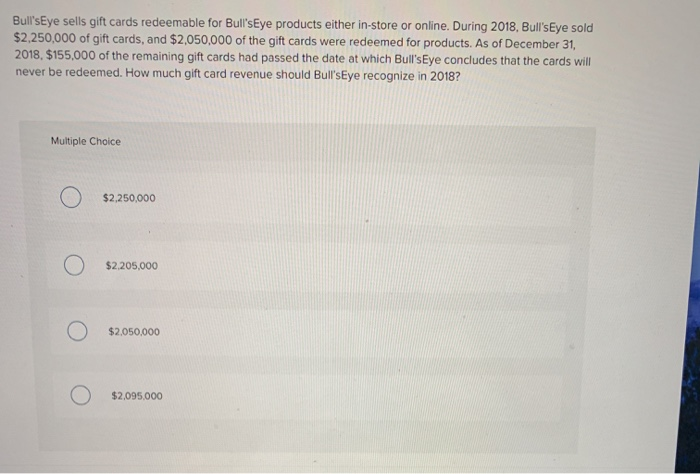

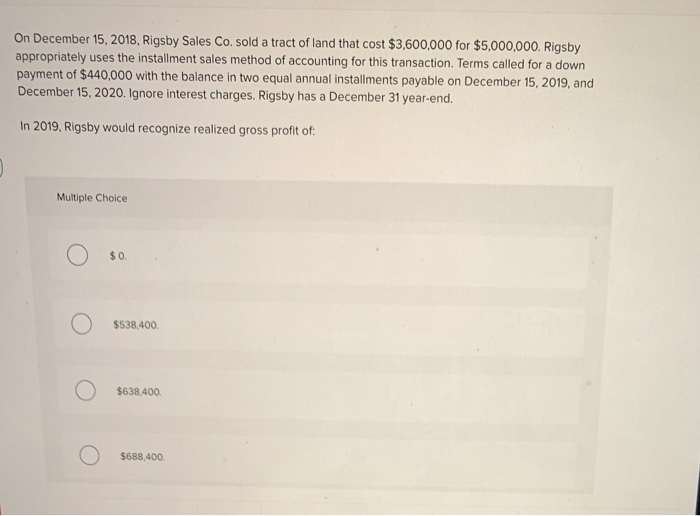

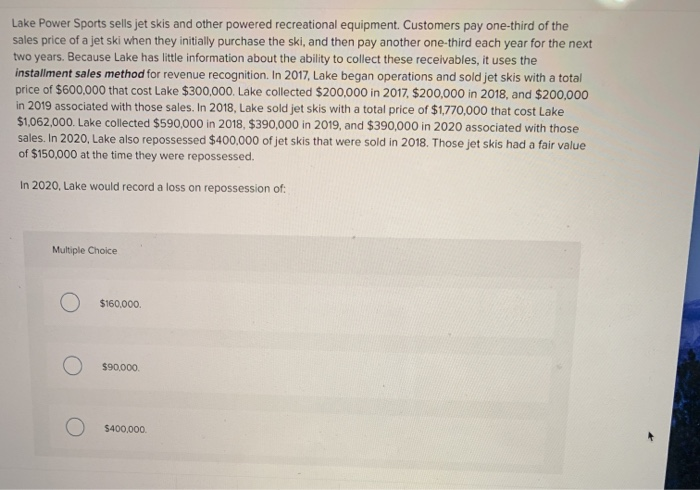

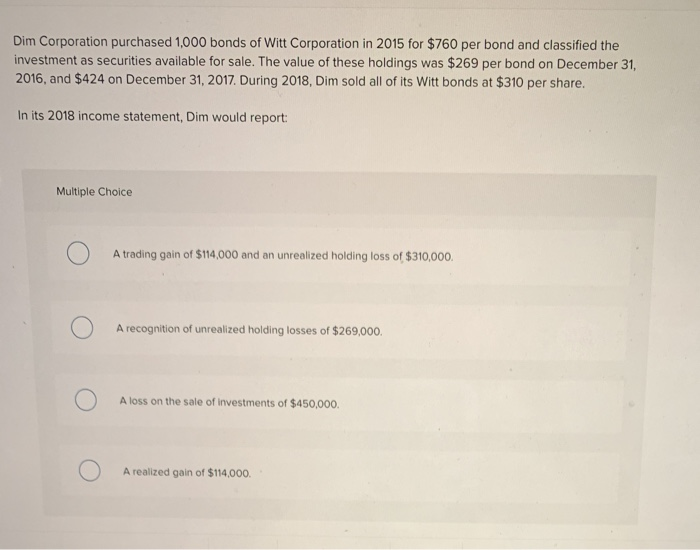

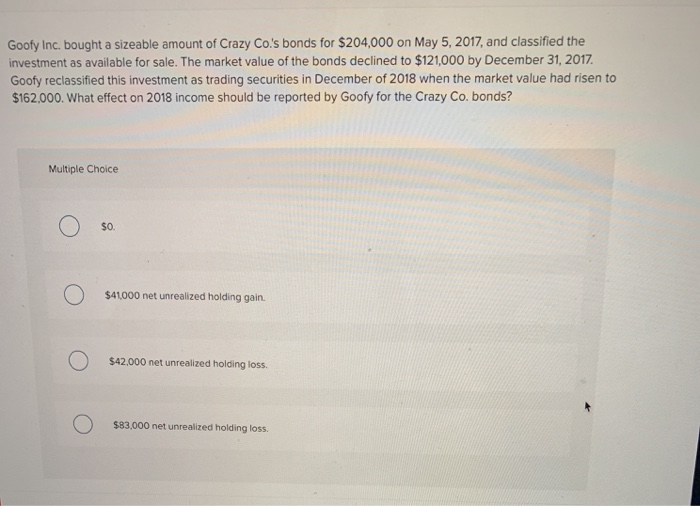

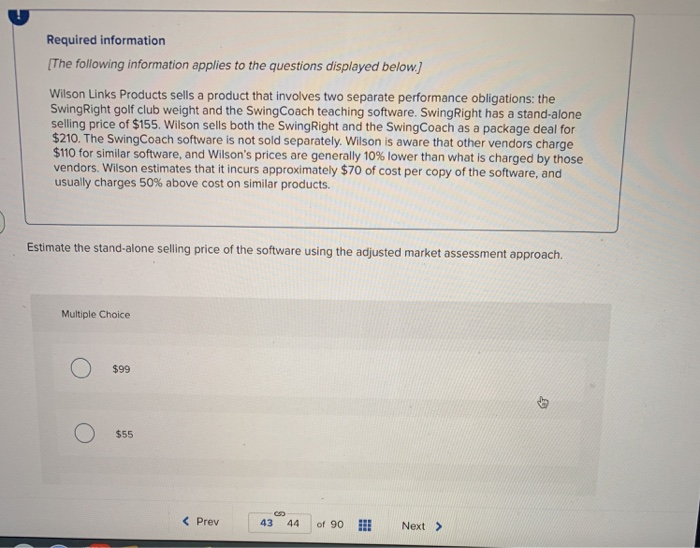

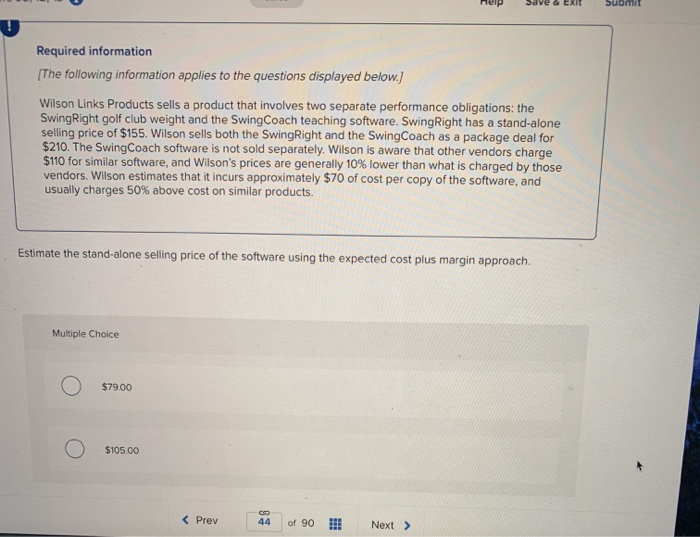

Bull'sEye sells gift cards redeemable for Bull'sEye products either in-store or online. During 2018, Bull'sEye sold $2,250,000 of gift cards, and $2,050,000 of the gift cards were redeemed for products. As of December 31, 2018, $155,000 of the remaining gift cards had passed the date at which Bull'sEye concludes that the cards will never be redeemed. How much gift card revenue should Bull'sEye recognize in 2018? Multiple Choice $2,250,000 $2,205,000 $2,050,000 $2,095,000 On December 15, 2018, Rigsby Sales Co. sold a tract of land that cost $3,600,000 for $5,000,000. Rigsby appropriately payment of $440,000 with the balance in two equal annual installments payable on December 15, 2019, and December 15, 2020. Ignore interest charges. Rigsby has a December 31 year-end. uses the installment sales method of accounting for this transaction. Terms called for a down In 2019, Rigsby would recognize realized gross profit of Multiple Choice $0. $538,400 $638.400 $688,400. Lake Power Sports sells jet skis and other powered recreational equipment. Customers pay one-third of the sales price of a jet ski when they initially purchase the ski, and then pay another one-third each year for the next two years. Because Lake has little information about the ability to collect these receivables, it uses the installment sales method for revenue recognition. In 2017, Lake began operations and sold jet skis with a total price of $600,000 that cost Lake $300,000. Lake collected $200,000 in 2017, $200,000 in 2018, and $200,000 in 2019 associated with those sales. In 2018, Lake sold jet skis with a total price of $1,770,000 that cost Lake $1,062,000. Lake collected $590,000 in 2018, $390,000 in 2019, and $390,000 in 2020 associated with those sales. In 2020, Lake also repossessed $400,000 of jet skis that were sold in 2018. Those jet skis had a fair value of $150,000 at the time they were repossessed. In 2020, Lake would record a loss repossession of: on Multiple Choice $160,000. $90,000 $400,000. Dim Corporation purchased 1,000 bonds of Witt Corporation in 2015 for $760 per bond and classified the investment as securities available for sale. The value of these holdings was $269 per bond on December 31, 2016, and $424 on December 31, 2017. During 2018, Dim sold all of its Witt bonds at $310 per share. In its 2018 income statement, Dim would report Multiple Choice A trading gain of $114,000 and an unrealized holding loss of $310,000. A recognition of unrealized holding losses of $269,000. A loss on the sale of in vestments of $450,000. A realized gain of $114,000. Goofy Inc. bought a sizeable amount of Crazy Co.'s bonds for $204,000 on May 5, 2017, and classified the investment as available for sale. The market value of the bonds declined to $121,000 by December 31, 2017 Goofy reclassified this investment as trading securities in December of 2018 when the market value had risen to $162.000. What effect on 2018 income should be reported by Goofy for the Crazy Co. bonds? Multiple Choice $0. $41000 net unrealized holding gain. $42,000 net unrealized holding loss. $83,000 net unrealized holding loss. Required information The following information applies to the questions displayed below Wilson Links Products sells a product that involves two separate performance obligations: the SwingRight golf club weight and the SwingCoach teaching software. SwingRight has a stand-alone selling price of $155. Wilson sells both the SwingRight and the SwingCoach as a package deal for $210. The SwingCoach software is not sold separately. Wilson is aware that other vendors charge $110 for similar software, and Wilson's prices are generally 10 % lower than what is charged by those vendors. Wilson estimates that it incurs approximately $70 of cost per copy of the software, and usually charges 50% above cost on similar products. Estimate the stand-alone selling price of the software using the adjusted market assessment approach. Multiple Choice $99 $55

Save & Required information The following information applies to the questions displayed below. Wilson Links Products sells a product that involves two separate performance obligations: the SwingRight golf club weight and the SwingCoach teaching software. SwingRight has a stand-alone selling price of $155. Wilson sells both the SwingRight and the SwingCoach as a package deal for $210. The SwingCoach software is not sold separately. Wilson is aware that other vendors charge $110 for similar software, and Wilson's prices are generally 10% lower than what is charged by those vendors. Wilson estimates that it incurs approximately $70 of cost per copy of the software, and usually charges 50% above cost on similar products. Estimate the stand-alone selling price of the software using the expected cost plus margin approach. Multiple Choice $79.00 $105.00 Prev of 90 44 Next >