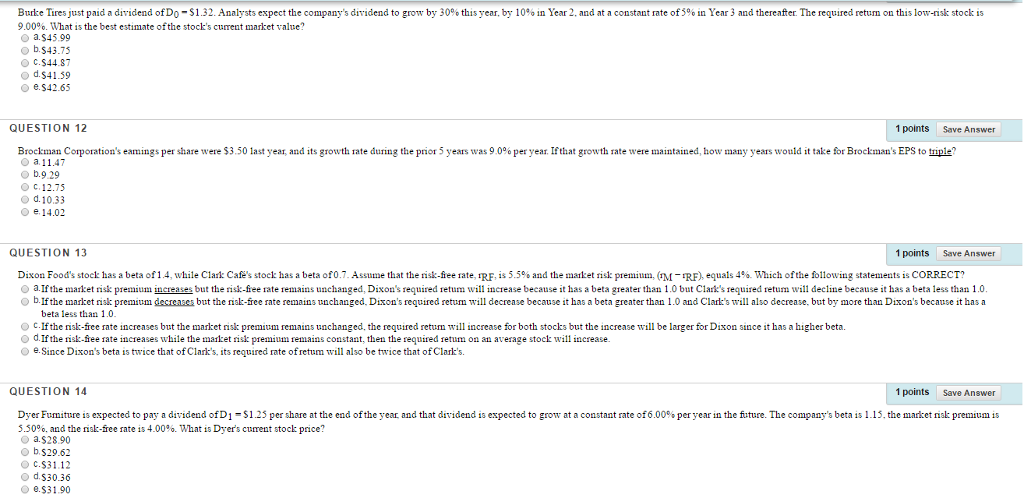

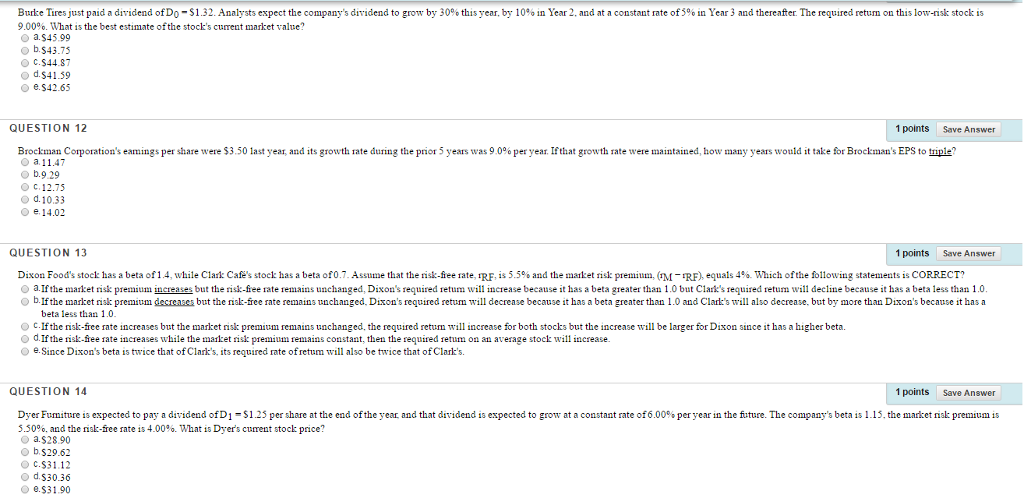

Burke Tires just paid a dividend of D_0 = $1.32. Analysts expect the company's dividend to grow by 30% this year, by 10% in Year 2, and at a constant rate of 5% Year 3 and thereafter. The required return on this low-risk stock is 9.00%. What is the best estimate of the stock's current market value? a.$45.99 b. $43.75 C. $44.87 d. $41.59 C. $42.65 Brockman Corporation's earnings per share were $3.50 last year, and its growth late during the prior 5 year was 9.0% per year. If that growth rate were maintained, how many years would it take for Brock man's EPS to triple? a. 11.47 b.9.29 c. 12.75 d. 10.33 e. 14.02 Dixon Food's stock has a beta of 1.4, while Clark Cafe's stock has a beta of 0.7. Assume that the risk-free rate, r_RF is 5.5% and the market risk premium, (r_M - r_RF), equals 4%. Which of the following statements is CORRECT? a. If the market risk premium increases, but the risk-free rate remains unchanged. Dixon's required return will increase because it has a beta greater than 1.0 but Clark's required return will decline because it has a beta less than 1.0. b. If the market risk premium decreases but the risk-free rate remains unchanged. Dixon's required return will decrease because it has a beta greater than 1.0 and Clark's will also decrease, but by more than Dixon's because it has a beta less than 1.0 c. If the risk-free rate increases but the market risk premium remains unchanged, the required return will increase for both stocks but the increase will be larger for Dixon since it has a higher beta. d. If the risk-free rate increases while the market risk premium remains constant, then the required return on an average stock will increase e. Since Dixon's beta is twice that of Clark's, its required rate of return will also be twice that of Clark's. Dyer Furniture is expected to pay a dividend of D_1 = $1.25 per share at the end of the year and that dividend is expected to grow at a constant rate of 6.00% per year in the future. The company's beta is 1.15. the market risk premium is 5.50%, and the risk-free rate is 4.00% What is Dyer's current stock price? a.$28.90 b. $29.62 C. $31.12 d. $30.36 e. $31.90