Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Burke's Corner currently sells blue jeans and T-shirts. Management is considering adding fleece tops to its inventory to provide a cooler weather option. The tops

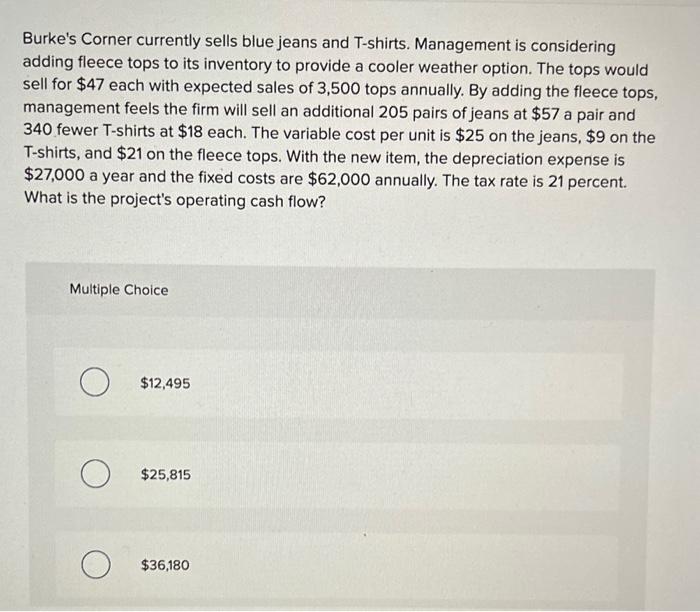

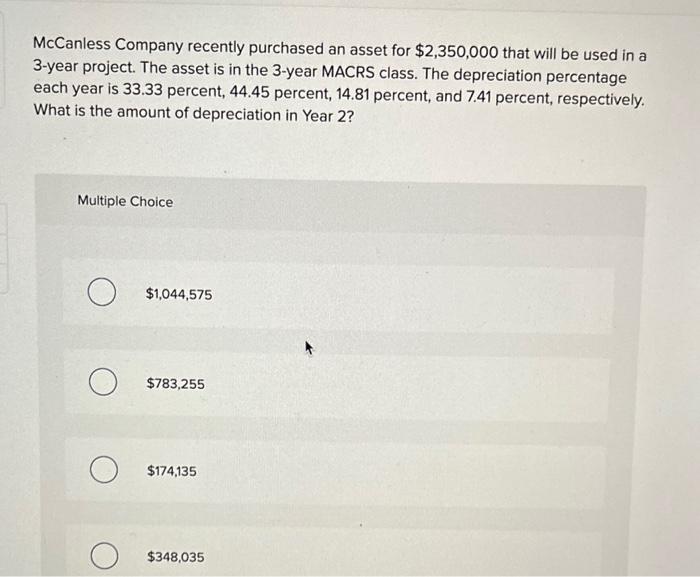

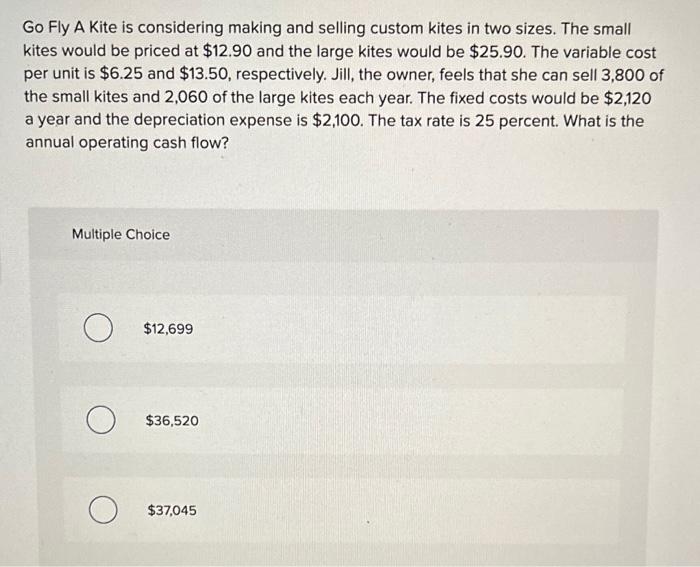

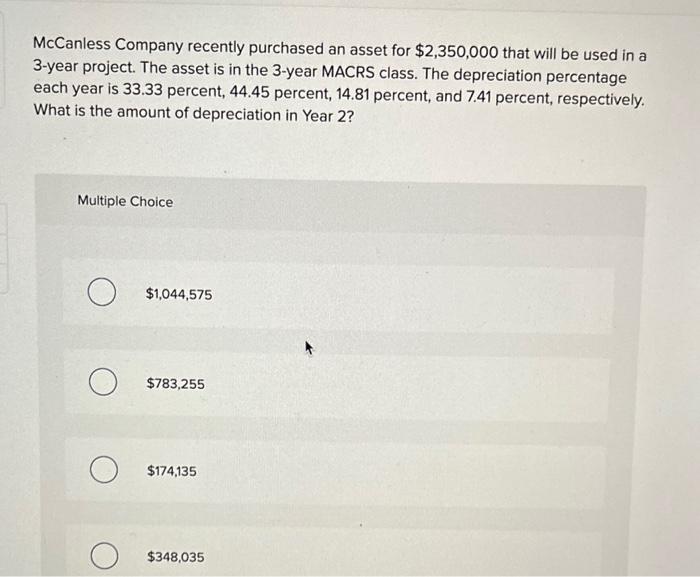

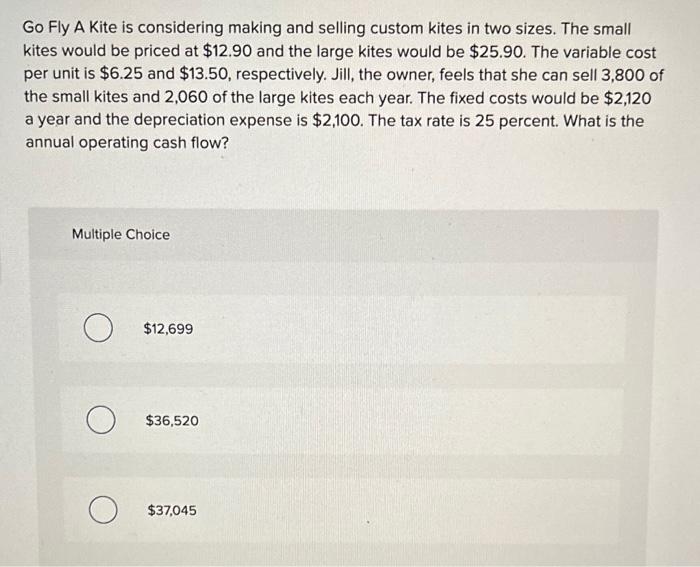

Burke's Corner currently sells blue jeans and T-shirts. Management is considering adding fleece tops to its inventory to provide a cooler weather option. The tops would sell for $47 each with expected sales of 3,500 tops annually. By adding the fleece tops, management feels the firm will sell an additional 205 pairs of jeans at $57 a pair and 340 fewer T-shirts at $18 each. The variable cost per unit is $25 on the jeans, $9 on the T-shirts, and $21 on the fleece tops. With the new item, the depreciation expense is $27,000 a year and the fixed costs are $62,000 annually. The tax rate is 21 percent. What is the project's operating cash flow? Multiple Choice $12,495 $25,815 $36,180 McCanless Company recently purchased an asset for $2,350,000 that will be used in a 3-year project. The asset is in the 3 -year MACRS class. The depreciation percentage each year is 33.33 percent, 44.45 percent, 14.81 percent, and 7.41 percent, respectively. What is the amount of depreciation in Year 2? Multiple Choice $1,044,575 $783,255 $174,135 $348,035 Go Fly A Kite is considering making and selling custom kites in two sizes. The small kites would be priced at $12.90 and the large kites would be $25.90. The variable cost per unit is $6.25 and $13.50, respectively. Jill, the owner, feels that she can sell 3,800 of the small kites and 2,060 of the large kites each year. The fixed costs would be $2,120 a year and the depreciation expense is $2,100. The tax rate is 25 percent. What is the annual operating cash flow? Multiple Choice $12,699 $36,520 $37,045

Burke's Corner currently sells blue jeans and T-shirts. Management is considering adding fleece tops to its inventory to provide a cooler weather option. The tops would sell for $47 each with expected sales of 3,500 tops annually. By adding the fleece tops, management feels the firm will sell an additional 205 pairs of jeans at $57 a pair and 340 fewer T-shirts at $18 each. The variable cost per unit is $25 on the jeans, $9 on the T-shirts, and $21 on the fleece tops. With the new item, the depreciation expense is $27,000 a year and the fixed costs are $62,000 annually. The tax rate is 21 percent. What is the project's operating cash flow? Multiple Choice $12,495 $25,815 $36,180 McCanless Company recently purchased an asset for $2,350,000 that will be used in a 3-year project. The asset is in the 3 -year MACRS class. The depreciation percentage each year is 33.33 percent, 44.45 percent, 14.81 percent, and 7.41 percent, respectively. What is the amount of depreciation in Year 2? Multiple Choice $1,044,575 $783,255 $174,135 $348,035 Go Fly A Kite is considering making and selling custom kites in two sizes. The small kites would be priced at $12.90 and the large kites would be $25.90. The variable cost per unit is $6.25 and $13.50, respectively. Jill, the owner, feels that she can sell 3,800 of the small kites and 2,060 of the large kites each year. The fixed costs would be $2,120 a year and the depreciation expense is $2,100. The tax rate is 25 percent. What is the annual operating cash flow? Multiple Choice $12,699 $36,520 $37,045

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started