Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Burnley, Understanding Financial Accounting Help 1 Contact Us 1 Log t ACCOUNTING PRINCIPLES (ACCT 100 / PMBAS04/ ACCT101) Gradebook ORION Downloadable eTextboolk ent SCREEN PRINTER

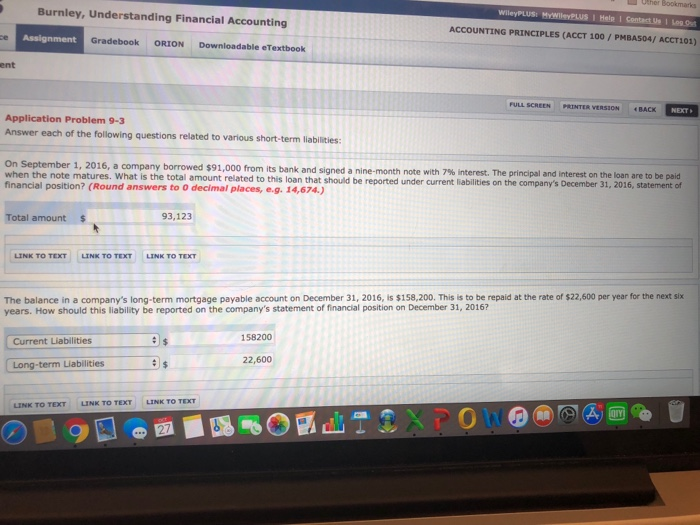

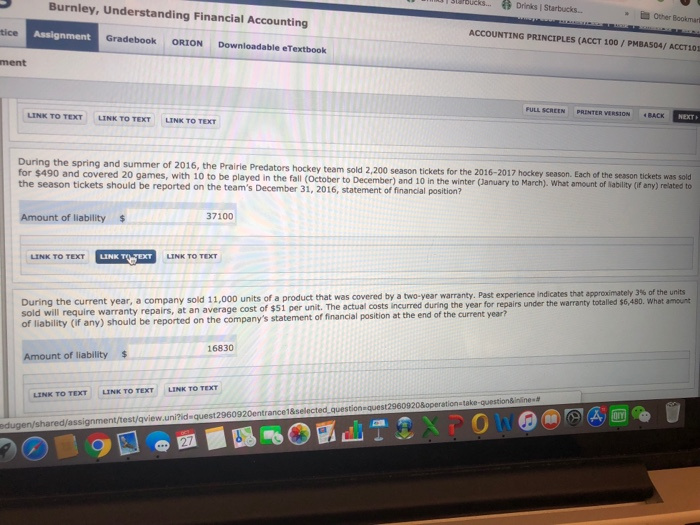

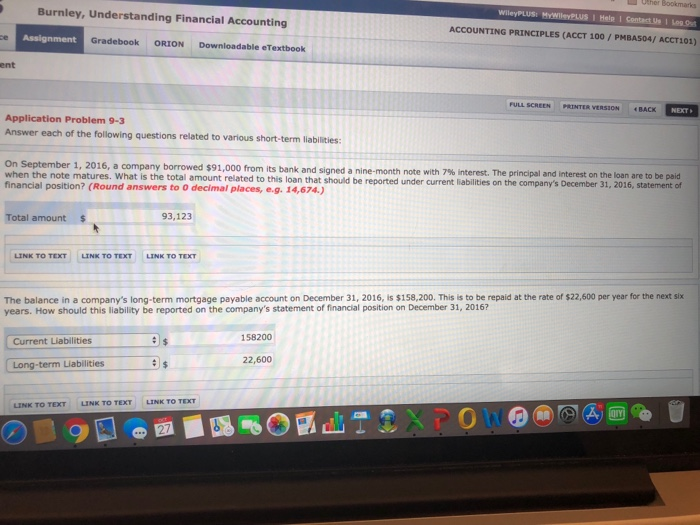

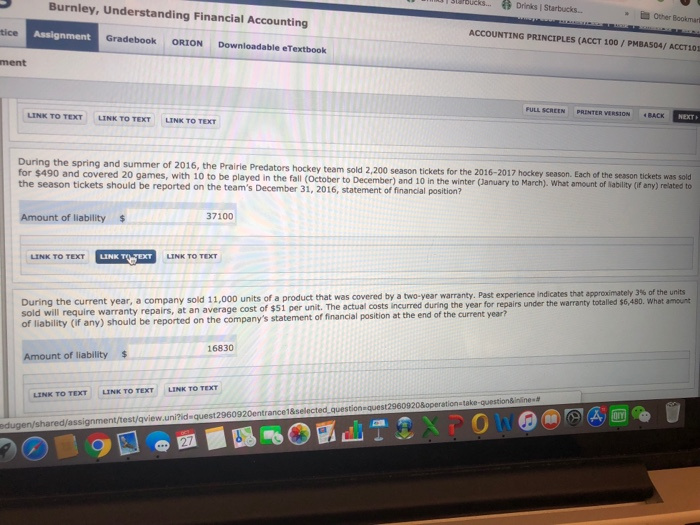

Burnley, Understanding Financial Accounting Help 1 Contact Us 1 Log t ACCOUNTING PRINCIPLES (ACCT 100 / PMBAS04/ ACCT101) Gradebook ORION Downloadable eTextboolk ent SCREEN PRINTER VERSIONBACK Application Problem 9-3 Answer each of the following questions related to various short-term liabilities: On September 1, 2016 a company borrowed $91,000 from its bank and signed a nine-month note with 7% interest. The when the note matures. What is the total amount related to this loan that should be reported under current liabilities on the company's December 31, 2016, statement of financial position? (Round answers to 0 decimal places, e.g. 14,674.) and interest on the loan are to be paid Total amount 93,123 LINK TO TEXT LINK TO TEXT LINK TO TEXT The balance in a company's long-term mortgage payable account on December 31, 2016, is $158,200. This is to be repaid at the rate of $22,600 per year for the next six years. How should this liability be reported on the company's statement of financial position on December 31, 2016? Current Liabilities 158200 22,600 Long-term Labilities LINK TO TEXT LINK TO TEXT LINK TO TOT

Burnley, Understanding Financial Accounting Help 1 Contact Us 1 Log t ACCOUNTING PRINCIPLES (ACCT 100 / PMBAS04/ ACCT101) Gradebook ORION Downloadable eTextboolk ent SCREEN PRINTER VERSIONBACK Application Problem 9-3 Answer each of the following questions related to various short-term liabilities: On September 1, 2016 a company borrowed $91,000 from its bank and signed a nine-month note with 7% interest. The when the note matures. What is the total amount related to this loan that should be reported under current liabilities on the company's December 31, 2016, statement of financial position? (Round answers to 0 decimal places, e.g. 14,674.) and interest on the loan are to be paid Total amount 93,123 LINK TO TEXT LINK TO TEXT LINK TO TEXT The balance in a company's long-term mortgage payable account on December 31, 2016, is $158,200. This is to be repaid at the rate of $22,600 per year for the next six years. How should this liability be reported on the company's statement of financial position on December 31, 2016? Current Liabilities 158200 22,600 Long-term Labilities LINK TO TEXT LINK TO TEXT LINK TO TOT

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started