Answered step by step

Verified Expert Solution

Question

1 Approved Answer

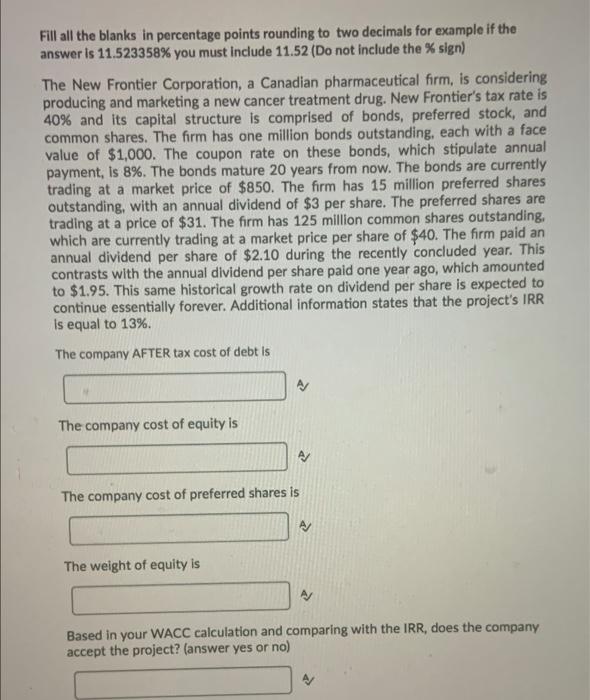

burry olz Fill all the blanks in percentage points rounding to two decimals for example if the answer is 11.523358% you must include 11.52 (Do

burry olz

Fill all the blanks in percentage points rounding to two decimals for example if the answer is 11.523358% you must include 11.52 (Do not include the % sign) The New Frontier Corporation, a Canadian pharmaceutical firm, is considering producing and marketing a new cancer treatment drug. New Frontier's tax rate is 40% and its capital structure is comprised of bonds, preferred stock, and common shares. The firm has one million bonds outstanding, each with a face value of $1,000. The coupon rate on these bonds, which stipulate annual payment, Is 8%. The bonds mature 20 years from now. The bonds are currently trading at a market price of $850. The firm has 15 million preferred shares outstanding, with an annual dividend of $3 per share. The preferred shares are trading at a price of $31. The firm has 125 million common shares outstanding, which are currently trading at a market price per share of $40. The firm paid an annual dividend per share of $2.10 during the recently concluded year. This contrasts with the annual dividend per share paid one year ago, which amounted to $1.95. This same historical growth rate on dividend per share is expected to continue essentially forever. Additional information states that the project's IRR Is equal to 13%. The company AFTER tax cost of debt is The company cost of equity is The company cost of preferred shares is A/ The weight of equity is Based in your WACC calculation and comparing with the IRR, does the company accept the project? (answer yes or no)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started