Answered step by step

Verified Expert Solution

Question

1 Approved Answer

BUS 132QU MT2 W2022 - V1 10 Marks each, 120 marks total 1) Priest and Sons, a local manufacturer of a product that sells

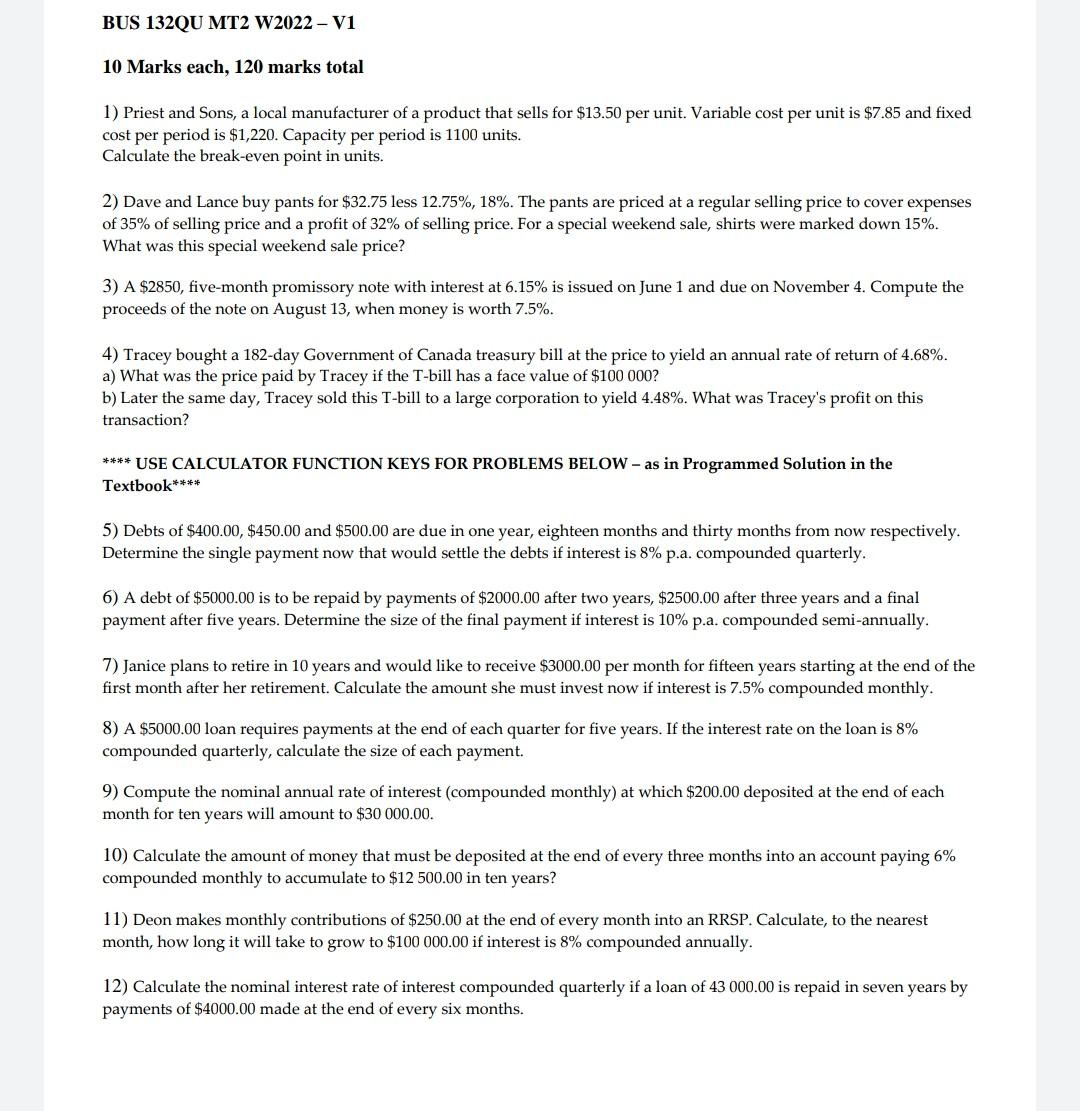

BUS 132QU MT2 W2022 - V1 10 Marks each, 120 marks total 1) Priest and Sons, a local manufacturer of a product that sells for $13.50 per unit. Variable cost per unit is $7.85 and fixed cost per period is $1,220. Capacity per period is 1100 units. Calculate the break-even point in units. 2) Dave and Lance buy pants for $32.75 less 12.75%, 18%. The pants are priced at a regular selling price to cover expenses of 35% of selling price and a profit of 32% of selling price. For a special weekend sale, shirts were marked down 15%. What was this special weekend sale price? 3) A $2850, five-month promissory note with interest at 6.15% is issued on June 1 and due on November 4. Compute the proceeds of the note on August 13, when money is worth 7.5%. 4) Tracey bought a 182-day Government of Canada treasury bill at the price to yield an annual rate of return of 4.68%. a) What was the price paid by Tracey if the T-bill has a face value of $100 000? b) Later the same day, Tracey sold this T-bill to a large corporation to yield 4.48%. What was Tracey's profit on this transaction? **** USE CALCULATOR FUNCTION KEYS FOR PROBLEMS BELOW - as in Programmed Solution in the Textbook**** 5) Debts of $400.00, $450.00 and $500.00 are due in one year, eighteen months and thirty months from now respectively. Determine the single payment now that would settle the debts if interest is 8% p.a. compounded quarterly. 6) A debt of $5000.00 is to be repaid by payments of $2000.00 after two years, $2500.00 after three years and a final payment after five years. Determine the size of the final payment if interest is 10% p.a. compounded semi-annually. 7) Janice plans to retire in 10 years and would like to receive $3000.00 per month for fifteen years starting at the end of the first month after her retirement. Calculate the amount she must invest now if interest is 7.5% compounded monthly. 8) A $5000.00 loan requires payments at the end of each quarter for five years. If the interest rate on the loan is 8% compounded quarterly, calculate the size of each payment. 9) Compute the nominal annual rate of interest (compounded monthly) at which $200.00 deposited at the end of each month for ten years will amount to $30 000.00. 10) Calculate the amount of money that must be deposited at the end of every three months into an account paying 6% compounded monthly to accumulate to $12 500.00 in ten years? 11) Deon makes monthly contributions of $250.00 at the end of every month into an RRSP. Calculate, to the nearest month, how long it will take to grow to $100 000.00 if interest is 8% compounded annually. 12) Calculate the nominal interest rate of interest compounded quarterly if a loan of 43 000.00 is repaid in seven years by payments of $4000.00 made at the end of every six months.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started