Answered step by step

Verified Expert Solution

Question

1 Approved Answer

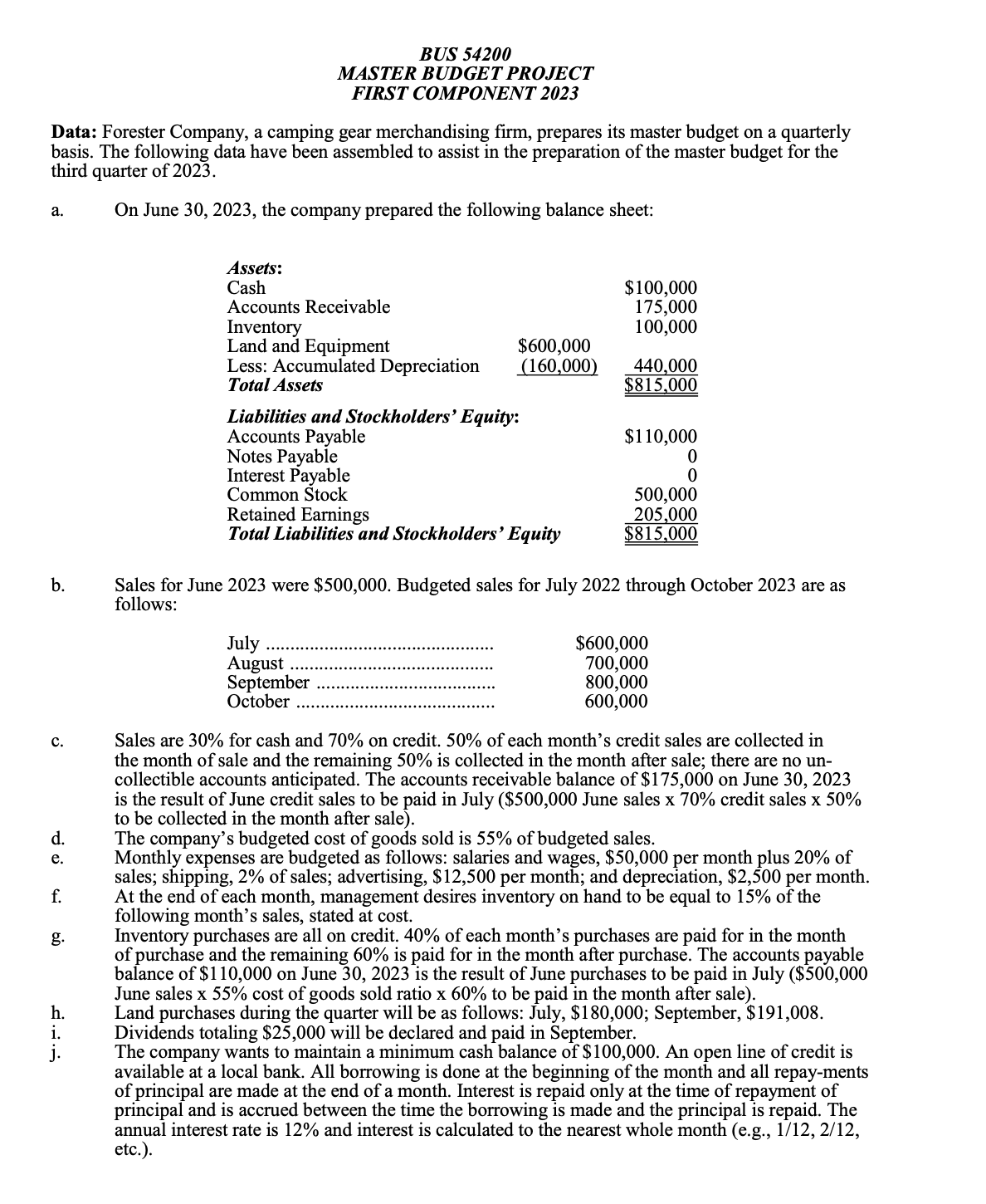

BUS 5 4 2 0 0 MASTER BUDGET PROJECT FIRST COMPONENT 2 0 2 3 Data: Forester Company, a camping gear merchandising firm, prepares its

BUS

MASTER BUDGET PROJECT

FIRST COMPONENT

Data: Forester Company, a camping gear merchandising firm, prepares its master budget on a quarterly

basis. The following data have been assembled to assist in the preparation of the master budget for the

third quarter of

a On June the company prepared the following balance sheet:

b Sales for June were $ Budgeted sales for July through October are as

follows:

July $

August

September

October

July

$

August

September

October

c Sales are for cash and on credit. of each month's credit sales are collected in

the month of sale and the remaining is collected in the month after sale; there are no un

collectible accounts anticipated. The accounts receivable balance of $ on June

is the result of June credit sales to be paid in July $ June sales x credit sales x

to be collected in the month after sale

d The company's budgeted cost of goods sold is of budgeted sales.

e Monthly expenses are budgeted as follows: salaries and wages, $ per month plus of

sales; shipping, of sales; advertising, $ per month; and depreciation, $ per month.

f At the end of each month, management desires inventory on hand to be equal to of the

following month's sales, stated at cost

g Inventory purchases are all on credit. of each month's purchases are paid for in the month

of purchase and the remaining is paid for in the month after purchase. The accounts payable

balance of $ on June is the result of June purchases to be paid in July $

June sales x cost of goods sold ratio to be paid in the month after sale

h Land purchases during the quarter will be as follows: July, $; September, $

i Dividends totaling $ will be declared and paid in September.

j The company wants to maintain a minimum cash balance of $ An open line of credit is

available at a local bank. All borrowing is done at the beginning of the month and all repayments

of principal are made at the end of a month. Interest is repaid only at the time of repayment of

principal and is accrued between the time the borrowing is made and the principal is repaid. The

annual interest rate is and interest is calculated to the nearest whole month eg

etc.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started