Answered step by step

Verified Expert Solution

Question

1 Approved Answer

BUS115S-20220516SC8A Test: Week 6 Assignment This test: 50 Question 6 of 15 > point(s) possible This Resume late question: 3 point(s) possible Submit test

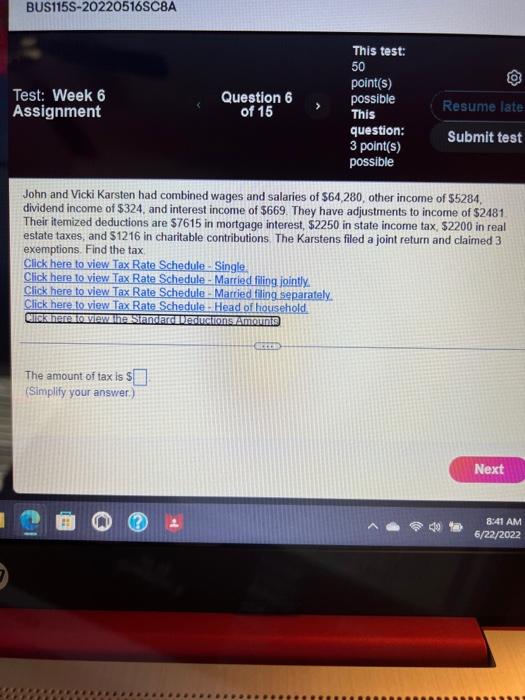

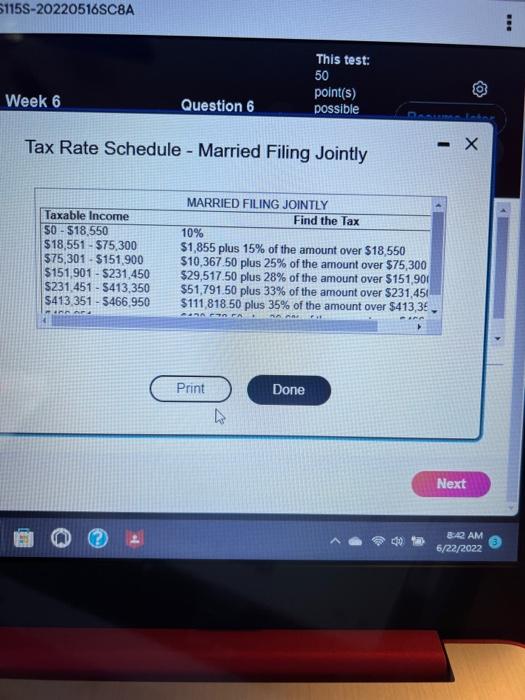

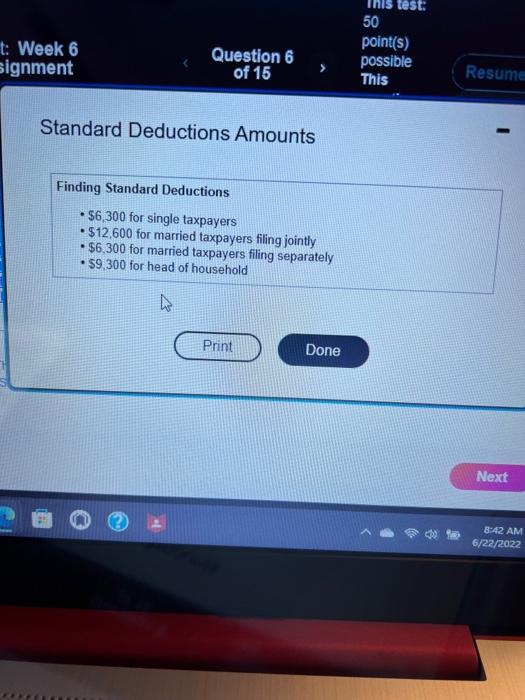

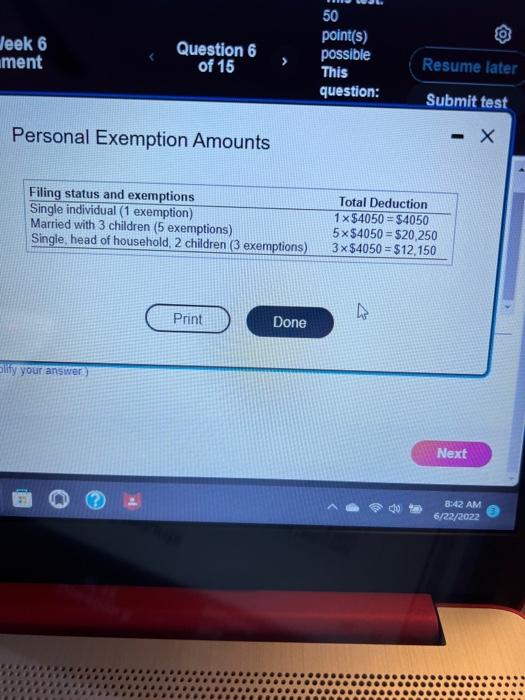

BUS115S-20220516SC8A Test: Week 6 Assignment This test: 50 Question 6 of 15 > point(s) possible This Resume late question: 3 point(s) possible Submit test John and Vicki Karsten had combined wages and salaries of $64,280, other income of $5284, dividend income of $324, and interest income of $669. They have adjustments to income of $2481 Their itemized deductions are $7615 in mortgage interest, $2250 in state income tax, $2200 in real estate taxes, and $1216 in charitable contributions. The Karstens filed a joint return and claimed 3 exemptions. Find the tax. Click here to view Tax Rate Schedule-Single Click here to view Tax Rate Schedule - Married filing jointly. Click here to view Tax Rate Schedule - Married filing separately. Click here to view Tax Rate Schedule- Head of household. Click here to view the Standard Deductions Amounts The amount of tax is $ (Simplify your answer.) Next 8:41 AM 6/22/2022

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started