Answered step by step

Verified Expert Solution

Question

1 Approved Answer

BUS132 Project 3-Cash Flow Statement Name____________ Budgeting & Planning The income statement and comparative balance sheets for O'Neill & Carter Company are as follows: O'Neill

| BUS132 | Project 3-Cash Flow Statement | Name____________ | ||||

| Budgeting & Planning | ||||||

| The income statement and comparative balance sheets for O'Neill & Carter Company are as follows: | ||||||

| O'Neill & Carter Co., Inc. | ||||||

| Income Statement | ||||||

| Year Ended Dec 31, 2021 | ||||||

| Sales | $602,000 | |||||

| Expenses: | ||||||

| Cost of Goods Sold | $322,000 | |||||

| Depreciation Exp. | 15,000 | |||||

| Amortization Exp. | 13,000 | |||||

| Salaries Expense | 78,400 | |||||

| Rent Expense | 21,000 | |||||

| Interest Expense | 5,200 | |||||

| Income Tax Expense | 56,000 | |||||

| Total Expenses | 510,600 | |||||

| Net Income | 91,400 | |||||

| O'Neill & Carter Co., Inc. | ||||||

| Balance Sheet | ||||||

| Dec 31, 2021 and Dec 31, 2020 | ||||||

| 2021 | 2020 | |||||

| Assets | ||||||

| Cash | $19,900 | $16,000 | ||||

| Accts Rec | 36,300 | 27,900 | ||||

| Inventory | 148,200 | 123,900 | ||||

| Prepaid Rent | 2,000 | 1,800 | ||||

| Land | 32,000 | 22,000 | ||||

| Other Fixed Assets | 130,000 | 118,000 | ||||

| Accum Depr | (46,000) | (39,000) | ||||

| Patent | 41,000 | 54,000 | ||||

| Total Assets | 363,400 | 324,600 | ||||

| Liabilities | ||||||

| Accounts Payable | 27,700 | 21,100 | ||||

| Salaries Payable | 6,200 | 5,700 | ||||

| Interest Payable | 1,600 | 400 | ||||

| Taxes Payable | 6,800 | 7,600 | ||||

| Bonds Payable | 46,000 | 36,000 | ||||

| Total Liabilities | 88,300 | 70,800 | ||||

| Stockholders Equity | ||||||

| Common Stock | 35,000 | 32,000 | ||||

| Paid-in-Capital in Excess of Par | 140,000 | 100,000 | ||||

| Retained Earnings | 100,100 | 121,800 | ||||

| Total Stockholders Equity | 275,100 | 253,800 | ||||

| Total Liabilities & Stockholders Equity | 363,400 | 324,600 | ||||

| No Land was sold in 2021Cash was received through an issuance of Bonds Payable, 10,000. | ||||||

| This cash was used later in 2021 to purchase Land. | ||||||

| A Fixed Asset was sold for $4,100. | ||||||

| Fixed Assets worth $12,200 were damaged in an accident in 2021. Insurance claims have been | ||||||

| filed , but not paid as of 12/31/21 | ||||||

| Total Cash Purchases of Fixed Assets $28,300 | ||||||

| Cash Dividends Paid were $108,900 in 2021 | ||||||

| Required: | ||||||

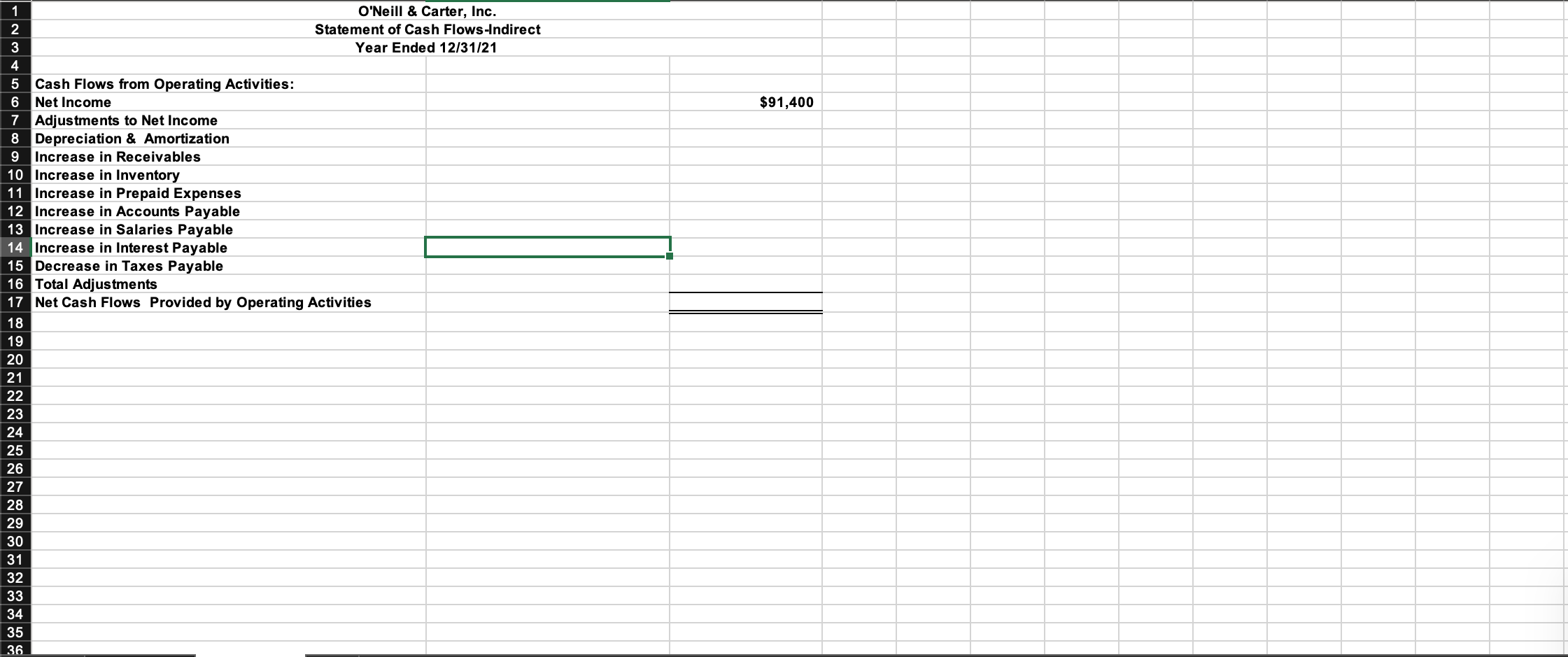

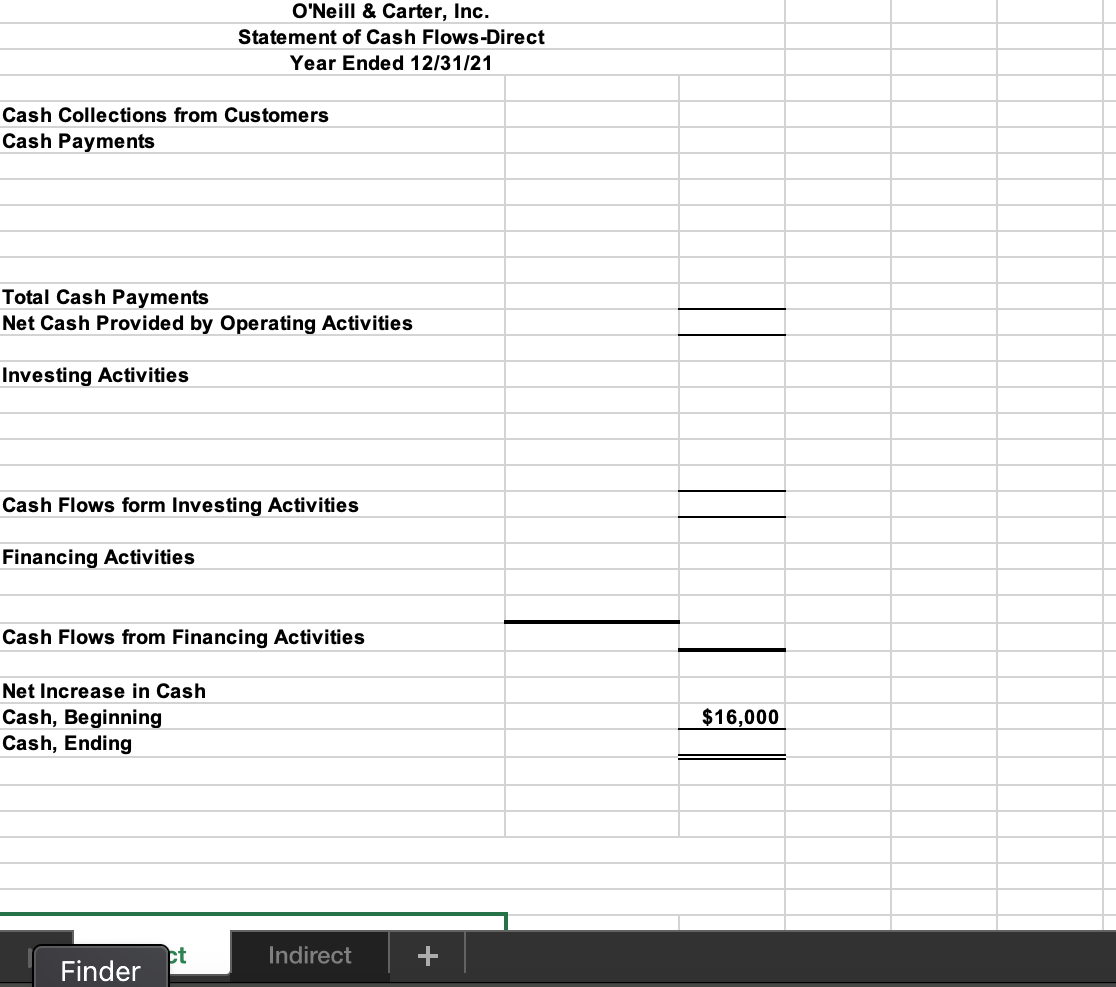

| Prepare a Statement of Cash Flows for December 31, 2021 using the Direct Method and Indirect Method |   | |||||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started