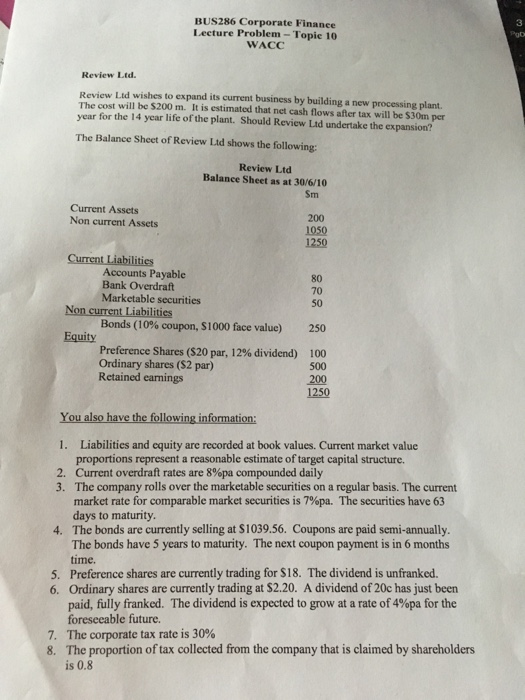

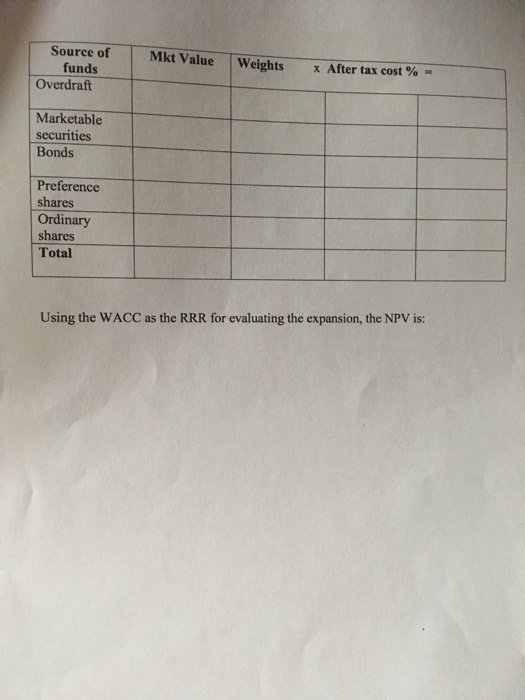

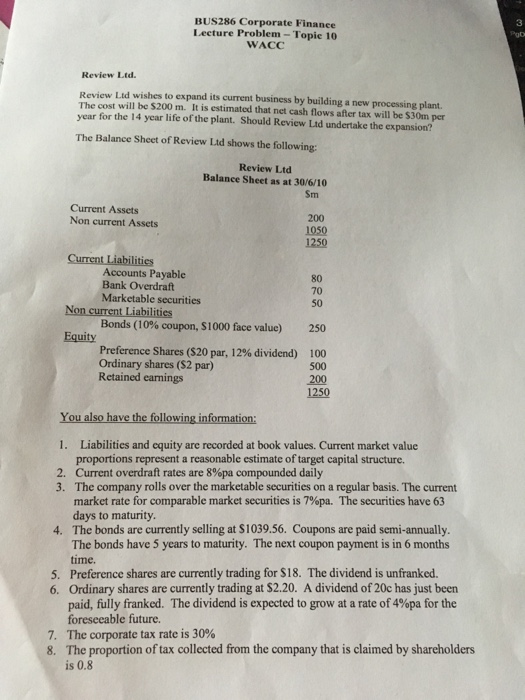

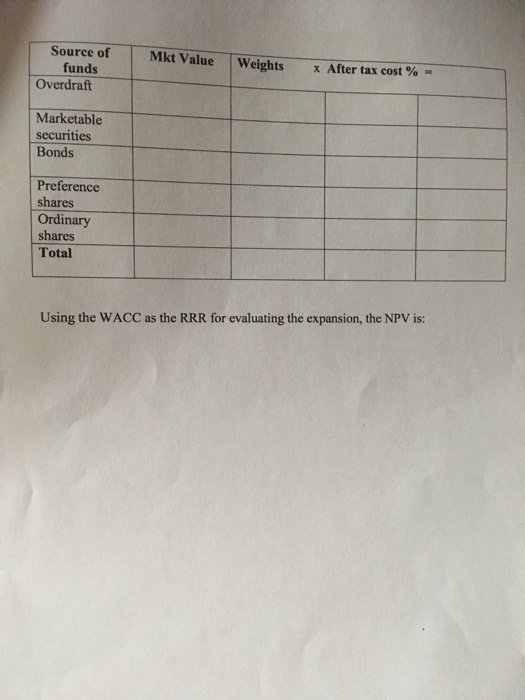

BUS286 Corporate Finance Lecture Problem- Topic 10 3 Pgb WACC Review Ltd. Review Ltd wishes to expand its current business by building a new processing plant. The cost will be $200 m. It is estimated that net cash flows after tax will be $30m per year for the 14 year life of the plant. Should Review Ltd undertake the expansion? The Balance Sheet of Review Ltd shows the following: Review Ltd Balance Sheet as at 30/6/10 Sm Current Assets Non current Assets 200 1050 1250 Current Liabilities Accounts Payable Bank Overdraft Marketable securities Non current Liabilities 80 70 50 Bonds (10% coupon, $1000 face value) 250 Equity Preference Shares ($20 par, 12 % dividend ) Ordinary shares ($2 par) Retained earnings 100 500 200 1250 You also have the following information: 1. Liabilities and equity proportions represent a reasonable estimate of target capital structure. 2. Current overdraft rates are 8 %pa compounded daily 3. The company rolls over the marketable securities on a regular basis. The current market rate for comparable market securities is 7% pa . The securities have 63 days to maturity. 4. The bonds are currently selling at S1039.56. Coupons are paid semi-annually. The bonds have 5 years to maturity. The next coupon payment is in 6 months time. 5. Preference shares are currently trading for $18. The dividend is unfranked. 6. Ordinary shares are currently trading at $2.20. A dividend of 20c has just been paid, fully franked. The dividend is expected to grow at a rate of 4%pa for the are recorded at book values. Current market value foreseeable future. 7. The corporate tax rate is 30% 8. The proportion of tax collected from the company that is claimed by shareholders is 0.8 Source of funds Mkt Value Weights x After tax cost % Overdraft Marketable securities Bonds Preference shares Ordinary shares Total Using the WACC as the RRR for evaluating the expansion, the NPV is: BUS286 Corporate Finance Lecture Problem- Topic 10 3 Pgb WACC Review Ltd. Review Ltd wishes to expand its current business by building a new processing plant. The cost will be $200 m. It is estimated that net cash flows after tax will be $30m per year for the 14 year life of the plant. Should Review Ltd undertake the expansion? The Balance Sheet of Review Ltd shows the following: Review Ltd Balance Sheet as at 30/6/10 Sm Current Assets Non current Assets 200 1050 1250 Current Liabilities Accounts Payable Bank Overdraft Marketable securities Non current Liabilities 80 70 50 Bonds (10% coupon, $1000 face value) 250 Equity Preference Shares ($20 par, 12 % dividend ) Ordinary shares ($2 par) Retained earnings 100 500 200 1250 You also have the following information: 1. Liabilities and equity proportions represent a reasonable estimate of target capital structure. 2. Current overdraft rates are 8 %pa compounded daily 3. The company rolls over the marketable securities on a regular basis. The current market rate for comparable market securities is 7% pa . The securities have 63 days to maturity. 4. The bonds are currently selling at S1039.56. Coupons are paid semi-annually. The bonds have 5 years to maturity. The next coupon payment is in 6 months time. 5. Preference shares are currently trading for $18. The dividend is unfranked. 6. Ordinary shares are currently trading at $2.20. A dividend of 20c has just been paid, fully franked. The dividend is expected to grow at a rate of 4%pa for the are recorded at book values. Current market value foreseeable future. 7. The corporate tax rate is 30% 8. The proportion of tax collected from the company that is claimed by shareholders is 0.8 Source of funds Mkt Value Weights x After tax cost % Overdraft Marketable securities Bonds Preference shares Ordinary shares Total Using the WACC as the RRR for evaluating the expansion, the NPV is