Answered step by step

Verified Expert Solution

Question

1 Approved Answer

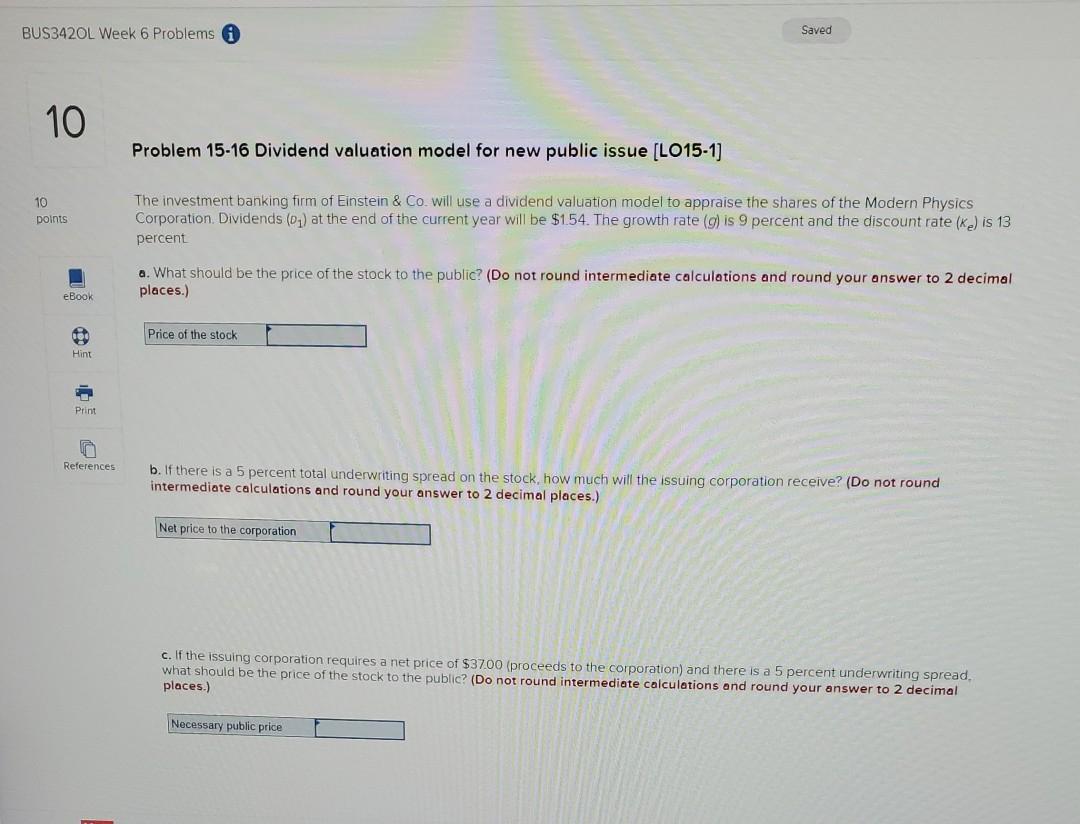

BUS342OL Week 6 Problems i Saved 10 Problem 15-16 Dividend valuation model for new public issue [LO15-1] 10 Doints The investment banking firm of Einstein

BUS342OL Week 6 Problems i Saved 10 Problem 15-16 Dividend valuation model for new public issue [LO15-1] 10 Doints The investment banking firm of Einstein & Co will use a dividend valuation model to appraise the shares of the Modern Physics Corporation Dividends (01) at the end of the current year will be $1.54. The growth rate (g) is 9 percent and the discount rate (K) is 13 percent a. What should be the price of the stock to the public? (Do not round intermediate calculations and round your answer to 2 decimal places.) eBook Price of the stock Hint Print References b. If there is a 5 percent total underwriting spread on the stock, how much will the issuing corporation receive? (Do not round intermediate calculations and round your answer to 2 decimal places.) Net price to the corporation c. If the issuing corporation requires a net price of $37.00 (proceeds to the corporation) and there is a 5 percent underwriting spread. what should be the price of the stock to the public? (Do not round intermediate calculations and round your answer to 2 decimal places.) Necessary public price

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started