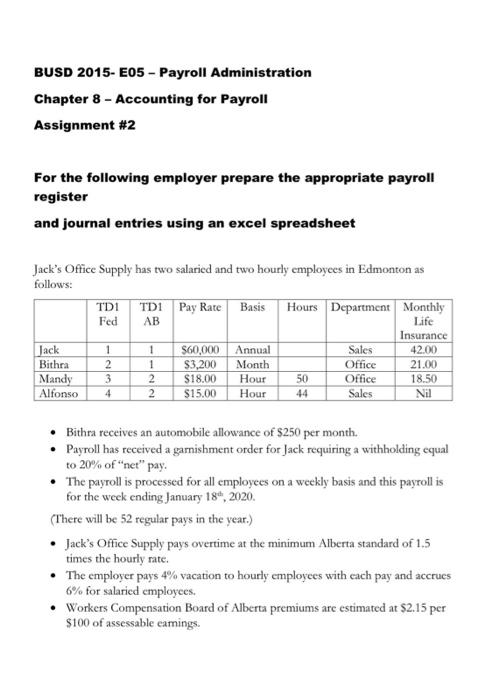

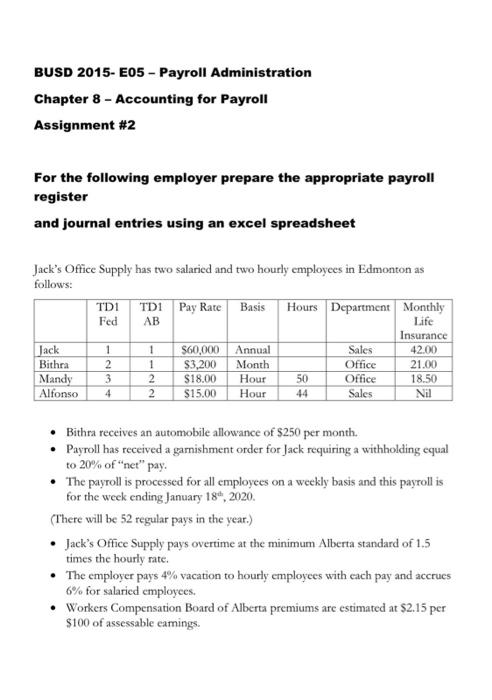

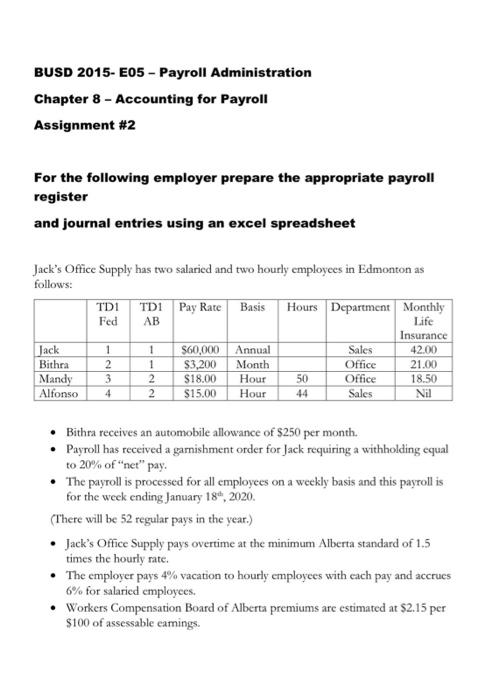

BUSD 2015-E05- Payroll Administration Chapter 8 - Accounting for Payroll Assignment #2 For the following employer prepare the appropriate payroll register and journal entries using an excel spreadsheet Jack's Office Supply has two salaried and two hourly employees in Edmonton as follows: TDI TDI Pay Rate Basis Hours Department Monthly Fed AB Life Insurance Jack 1 1 $60,000 Annual Sales 42.00 Bithra 2 $3,200 Month Office 21.00 Mandy 3 2 $18.00 Hour 50 Office 18.50 Alfonso 4 2 $15.00 Hour 44 1 Sales Nil Bithra receives an automobile allowance of $250 per month. Payroll has received a garnishment order for Jack requiring a withholding equal to 20% of "net" pay. The payroll is processed for all employees on a weekly basis and this payroll is for the week ending January 18, 2020. (There will be 52 regular pays in the year.) Jack's Office Supply pays overtime at the minimum Alberta standard of 1.5 times the hourly rate. The employer pays 4% vacation to hourly employees with each pay and accrues 6% for salaried employees. Workers Compensation Board of Alberta premiums are estimated at $2.15 per $100 of assessable eamings Hourly paid employees are members of a Union with dues per week of $10. All employees contribute $3.00 per pay to the Social Club through payroll deduction. All employees are between the ages of 20 and 60. The calculation of statutory deductions should be done by using the CRA online tables - Payroll Deduction Online Calculator. For the following employer, prepare an appropriate payroll register and journal entries using an excel spreadsheet BUSD 2015-E05- Payroll Administration Chapter 8 - Accounting for Payroll Assignment #2 For the following employer prepare the appropriate payroll register and journal entries using an excel spreadsheet Jack's Office Supply has two salaried and two hourly employees in Edmonton as follows: TDI TDI Pay Rate Basis Hours Department Monthly Fed AB Life Insurance Jack 1 1 $60,000 Annual Sales 42.00 Bithra 2 $3,200 Month Office 21.00 Mandy 3 2 $18.00 Hour 50 Office 18.50 Alfonso 4 2 $15.00 Hour 44 1 Sales Nil Bithra receives an automobile allowance of $250 per month. Payroll has received a garnishment order for Jack requiring a withholding equal to 20% of "net" pay. The payroll is processed for all employees on a weekly basis and this payroll is for the week ending January 18, 2020. (There will be 52 regular pays in the year.) Jack's Office Supply pays overtime at the minimum Alberta standard of 1.5 times the hourly rate. The employer pays 4% vacation to hourly employees with each pay and accrues 6% for salaried employees. Workers Compensation Board of Alberta premiums are estimated at $2.15 per $100 of assessable eamings Hourly paid employees are members of a Union with dues per week of $10. All employees contribute $3.00 per pay to the Social Club through payroll deduction. All employees are between the ages of 20 and 60. The calculation of statutory deductions should be done by using the CRA online tables - Payroll Deduction Online Calculator. BUSD 2015-E05- Payroll Administration Chapter 8 - Accounting for Payroll Assignment #2 For the following employer prepare the appropriate payroll register and journal entries using an excel spreadsheet Jack's Office Supply has two salaried and two hourly employees in Edmonton as follows: TDI TDI Pay Rate Basis Hours Department Monthly Fed AB Life Insurance Jack 1 1 $60,000 Annual Sales 42.00 Bithra 2 $3,200 Month Office 21.00 Mandy 3 2 $18.00 Hour 50 Office 18.50 Alfonso 4 2 $15.00 Hour 44 1 Sales Nil Bithra receives an automobile allowance of $250 per month. Payroll has received a garnishment order for Jack requiring a withholding equal to 20% of "net" pay. The payroll is processed for all employees on a weekly basis and this payroll is for the week ending January 18, 2020. (There will be 52 regular pays in the year.) Jack's Office Supply pays overtime at the minimum Alberta standard of 1.5 times the hourly rate. The employer pays 4% vacation to hourly employees with each pay and accrues 6% for salaried employees. Workers Compensation Board of Alberta premiums are estimated at $2.15 per $100 of assessable eamings Hourly paid employees are members of a Union with dues per week of $10. All employees contribute $3.00 per pay to the Social Club through payroll deduction. All employees are between the ages of 20 and 60. The calculation of statutory deductions should be done by using the CRA online tables - Payroll Deduction Online Calculator. For the following employer, prepare an appropriate payroll register and journal entries using an excel spreadsheet BUSD 2015-E05- Payroll Administration Chapter 8 - Accounting for Payroll Assignment #2 For the following employer prepare the appropriate payroll register and journal entries using an excel spreadsheet Jack's Office Supply has two salaried and two hourly employees in Edmonton as follows: TDI TDI Pay Rate Basis Hours Department Monthly Fed AB Life Insurance Jack 1 1 $60,000 Annual Sales 42.00 Bithra 2 $3,200 Month Office 21.00 Mandy 3 2 $18.00 Hour 50 Office 18.50 Alfonso 4 2 $15.00 Hour 44 1 Sales Nil Bithra receives an automobile allowance of $250 per month. Payroll has received a garnishment order for Jack requiring a withholding equal to 20% of "net" pay. The payroll is processed for all employees on a weekly basis and this payroll is for the week ending January 18, 2020. (There will be 52 regular pays in the year.) Jack's Office Supply pays overtime at the minimum Alberta standard of 1.5 times the hourly rate. The employer pays 4% vacation to hourly employees with each pay and accrues 6% for salaried employees. Workers Compensation Board of Alberta premiums are estimated at $2.15 per $100 of assessable eamings Hourly paid employees are members of a Union with dues per week of $10. All employees contribute $3.00 per pay to the Social Club through payroll deduction. All employees are between the ages of 20 and 60. The calculation of statutory deductions should be done by using the CRA online tables - Payroll Deduction Online Calculator. For the following employer, prepare an appropriate payroll register and journal entries using an excel spreadsheet BUSD 2015-E05- Payroll Administration Chapter 8 - Accounting for Payroll Assignment #2 For the following employer prepare the appropriate payroll register and journal entries using an excel spreadsheet Jack's Office Supply has two salaried and two hourly employees in Edmonton as follows: TDI TDI Pay Rate Basis Hours Department Monthly Fed AB Life Insurance Jack 1 1 $60,000 Annual Sales 42.00 Bithra 2 $3,200 Month Office 21.00 Mandy 3 2 $18.00 Hour 50 Office 18.50 Alfonso 4 2 $15.00 Hour 44 1 Sales Nil Bithra receives an automobile allowance of $250 per month. Payroll has received a garnishment order for Jack requiring a withholding equal to 20% of "net" pay. The payroll is processed for all employees on a weekly basis and this payroll is for the week ending January 18, 2020. (There will be 52 regular pays in the year.) Jack's Office Supply pays overtime at the minimum Alberta standard of 1.5 times the hourly rate. The employer pays 4% vacation to hourly employees with each pay and accrues 6% for salaried employees. Workers Compensation Board of Alberta premiums are estimated at $2.15 per $100 of assessable eamings Hourly paid employees are members of a Union with dues per week of $10. All employees contribute $3.00 per pay to the Social Club through payroll deduction. All employees are between the ages of 20 and 60. The calculation of statutory deductions should be done by using the CRA online tables - Payroll Deduction Online Calculator. BUSD 2015-E05- Payroll Administration Chapter 8 - Accounting for Payroll Assignment #2 For the following employer prepare the appropriate payroll register and journal entries using an excel spreadsheet Jack's Office Supply has two salaried and two hourly employees in Edmonton as follows: TDI TDI Pay Rate Basis Hours Department Monthly Fed AB Life Insurance Jack 1 1 $60,000 Annual Sales 42.00 Bithra 2 $3,200 Month Office 21.00 Mandy 3 2 $18.00 Hour 50 Office 18.50 Alfonso 4 2 $15.00 Hour 44 1 Sales Nil Bithra receives an automobile allowance of $250 per month. Payroll has received a garnishment order for Jack requiring a withholding equal to 20% of "net" pay. The payroll is processed for all employees on a weekly basis and this payroll is for the week ending January 18, 2020. (There will be 52 regular pays in the year.) Jack's Office Supply pays overtime at the minimum Alberta standard of 1.5 times the hourly rate. The employer pays 4% vacation to hourly employees with each pay and accrues 6% for salaried employees. Workers Compensation Board of Alberta premiums are estimated at $2.15 per $100 of assessable eamings Hourly paid employees are members of a Union with dues per week of $10. All employees contribute $3.00 per pay to the Social Club through payroll deduction. All employees are between the ages of 20 and 60. The calculation of statutory deductions should be done by using the CRA online tables - Payroll Deduction Online Calculator. For the following employer, prepare an appropriate payroll register and journal entries using an excel spreadsheet