Prepare journal entries to record each of the following sales transactions of a merchandising company. The company uses a perpetual inventory system and the

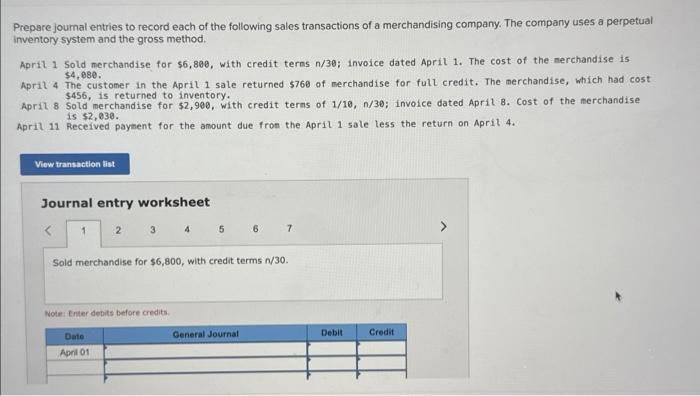

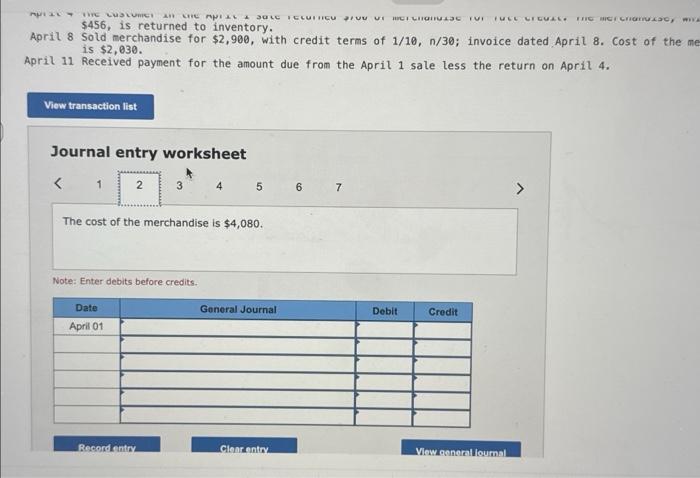

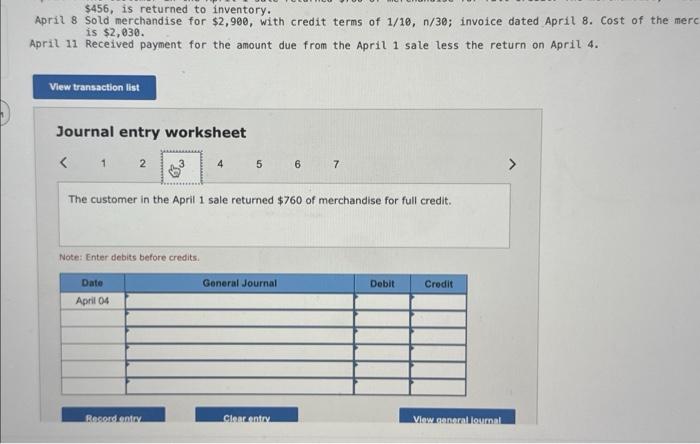

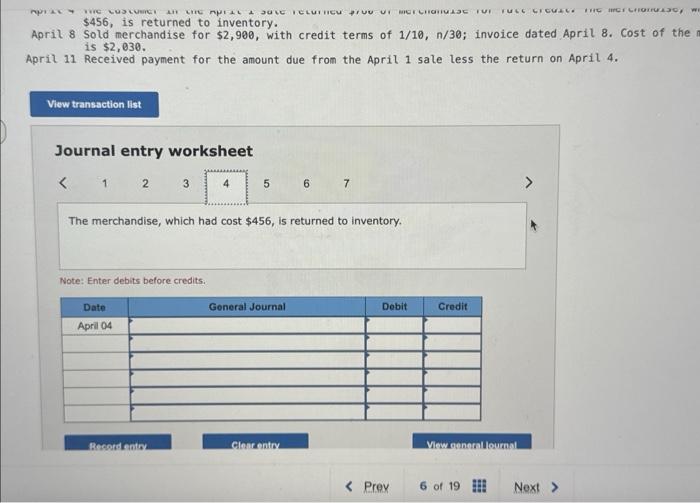

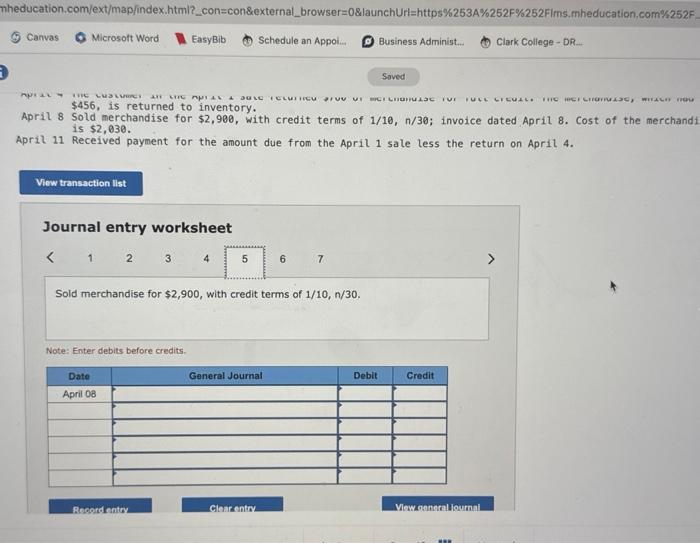

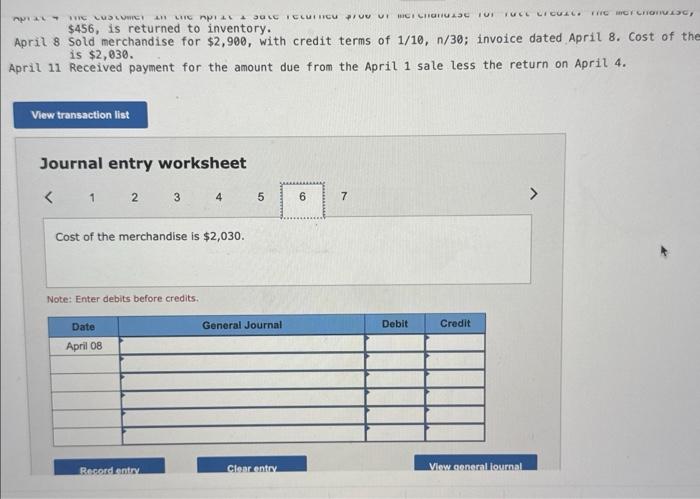

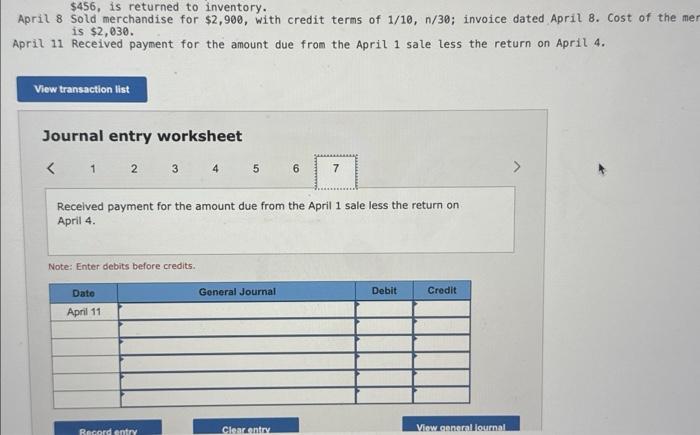

Prepare journal entries to record each of the following sales transactions of a merchandising company. The company uses a perpetual inventory system and the gross method. April 1 Sold merchandise for $6,800, with credit terms n/30; invoice dated April 1. The cost of the merchandise is $4,080. April 4 The customer in the April 1 sale returned $760 of merchandise for full credit. The merchandise, which had cost $456, is returned to inventory. April 8 Sold merchandise for $2,900, with credit terms of 1/10, n/30; invoice dated April 8. Cost of the merchandise is $2,030. April 11 Received payment for the amount due from the April 1 sale less the return on April 4.1 View transaction list Journal entry worksheet 1 2 3 4 5 6 7 Sold merchandise for $6,800, with credit terms n/30. Note: Enter debits before credits. Date April 01 General Journal Debit Credit $456, is returned to inventory. April 8 Sold merchandise for $2,900, with credit terms of 1/10, n/30; invoice dated April 8. Cost of the me is $2,030. April 11 Received payment for the amount due from the April 1 sale less the return on April 4. View transaction list Journal entry worksheet < 1 2 3 4 5 6 7 The cost of the merchandise is $4,080. Note: Enter debits before credits. Date April 01 General Journal Debit Credit Record entry Clear entry View general journal $456, is returned to inventory. April 8 Sold merchandise for $2,900, with credit terms of 1/10, n/30; invoice dated April 8. Cost of the merc is $2,030. April 11 Received payment for the amount due from the April 1 sale less the return on April 4. View transaction list Journal entry worksheet < 1 2 4 5 6 7 The customer in the April 1 sale returned $760 of merchandise for full credit. Note: Enter debits before credits. Date April 04: General Journal Debit Credit Record entry Clear entry View general journal $456, is returned to inventory. April 8 Sold merchandise for $2,900, with credit terms of 1/10, n/30; invoice dated April 8. Cost of the m is $2,030. April 11 Received payment for the amount due from the April 1 sale less the return on April 4. View transaction list Journal entry worksheet < 1 2 3 4 5 6 7 The merchandise, which had cost $456, is returned to inventory. Note: Enter debits before credits. Date April 04 General Journal Debit Credit Record entry Clear entry View general Journal < Prev 6 of 19 Next > mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Flms.mheducation.com%252F. Canvas Microsoft Word EasyBib Schedule an Appol... Business Administ... Clark College-DR... Saved THE LULURGY A LING A C CLUTHICU $456, is returned to inventory. April 8 Sold merchandise for $2,900, with credit terms of 1/10, n/30; invoice dated April 8. Cost of the merchandi is $2,030. April 11 Received payment for the amount due from the April 1 sale less the return on April 4. View transaction list Journal entry worksheet < 1 2 3 4 5 6 7 Sold merchandise for $2,900, with credit terms of 1/10, n/30. Note: Enter debits before credits. Date April 08 General Journal Debit Credit Record entry Clear entry View general journal FINE MOTCHING $456, is returned to inventory. April 8 Sold merchandise for $2,900, with credit terms of 1/10, n/30; invoice dated April 8. Cost of the is $2,030. April 11 Received payment for the amount due from the April 1 sale less the return on April 4. View transaction list Journal entry worksheet < 1 2 3 4 5 Cost of the merchandise is $2,030. Note: Enter debits before credits. Date April 08 9 7 General Journal Debit Credit Record entry Clear entry View general journal $456, is returned to inventory. April 8 Sold merchandise for $2,900, with credit terms of 1/10, n/30; invoice dated April 8. Cost of the mer is $2,030. April 11 Received payment for the amount due from the April 1 sale less the return on April 4. View transaction list Journal entry worksheet < 1 2 3 4 5 6 7 Received payment for the amount due from the April 1 sale less the return on April 4. Note: Enter debits before credits.. Date April 11 General Journal Debit Credit Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer April 1 Sold merchandise for 6800 with credit terms n30 The cost of the merchandise is 4880 D... View full answer

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards