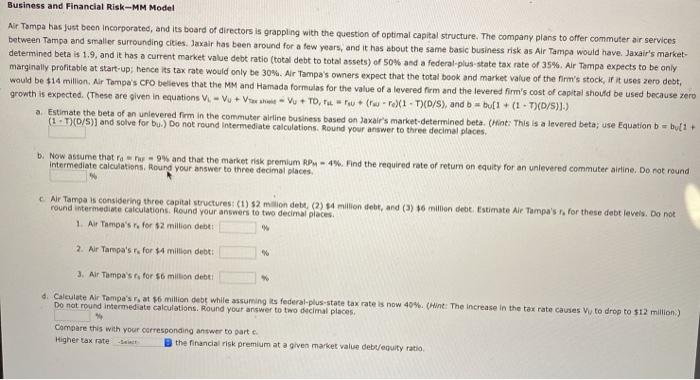

Business and Financial Risk-MM Model Air Tampa has just been incorporated, and its board of directors is grappling with the question of optimal capital structure. The company plans to offer commuter air services between Tampa and smaller surrounding cities. Jaxair has been around for a few years, and it has about the same basic business risk as Alr Tampa would have. Jaxair's market determined beta is 1.9. and it has a current market value debt ratio (total debt to total assets) of 50% and a federal-plus-state tax rate of 35%. Air Tampa expects to be only marginally profitable at start-up; hence its tax rate would only be 30%. Air Tampa's owners expect that the total book and market value of the firm's stock, in it uses zero debt, would be $14 million. Air Tampa's CFO believes that the MM and Hamada formulas for the value of a lovered firm and the levered firm's cost of capital should be used because zero growth is expected. These are given in equations VVV-Vu + TO, nuw(1 T)(D/S), and be bu[1 + (1 - 1)(D/S).) a. Estimate the beta of an unlevered firm in the commuter alrtine business based on Jaxalr's market-determined beta. (Hint: This is a levered beta; use Equation b = but1 . (1 T)D/S)) and solve for bu.) Do not round Intermediate calculations. Round your answer to three decimal places b. Now assume that rau 9% and that the market risk premium RPW - 4%. Find the required rate of retum on equity for an unlevered commuter airline. Do not round Intermediate calculations. Round your answer to three decimal places c Air Tampa is considering three capital structures (1) $2 millon debt (2) million debt, and (9) $6 million dett. Estimate Air Tompa's is for these debt levels. Do not round Intermediate calculations. Round your answers to two decimal places 1. Air Tamoa's for $2 million deb 2. Air Tampa's r. for $4 million debt: 3. Air Tampa's, for $6 million debt d. Calculate Air Tampa's, at $6 million debt while assuming its federal-plus-state tax rate is now 40%. (Hint: The increase in the tax rate causes Vy to drop to $12 million) Do not round intermediate calculations. Round your answer to two decimal places. 9 Compare this with your corresponding answer to part c. Higher tax rate the financial risk premium at a given market value debt/equity ratio