Business Assignment 11 Derivatives (PepsiCo)

A small part of the Financial Instruments footnote for PepsiCo is attached. Answer the following questions.

1. We see in reference (f) from the Fair Value Measurement that the fair value of interest rate swaps are based on LIBOR forward rates. You will need to look this one up. (4 points)

A. What does LIBOR stand for?

B. What five currencies are included in the LIBOR?

2. see that one item is the location and net amount of gain or loss reported in earnings. That sounds funny until we read this footnote. Looking at the Losses and Gains section, where are the following located? (6 points)

Losses/Gains in the income statement:

A. Foreign exchange derivative losses/gains

B. Interest rate derivative losses/gains

C. Commodity derivative losses/gains

Losses/Gains reclassified from the Statement of Comprehensive income to income statement:

D. Foreign exchange derivative losses/gains

E. Interest rate derivative losses/gains

F. Commodity derivative losses/gains

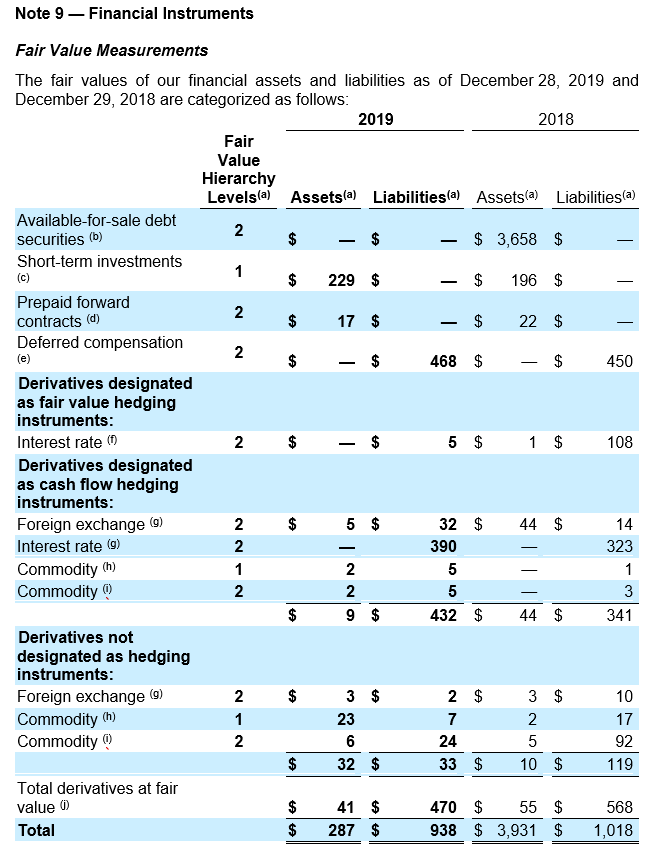

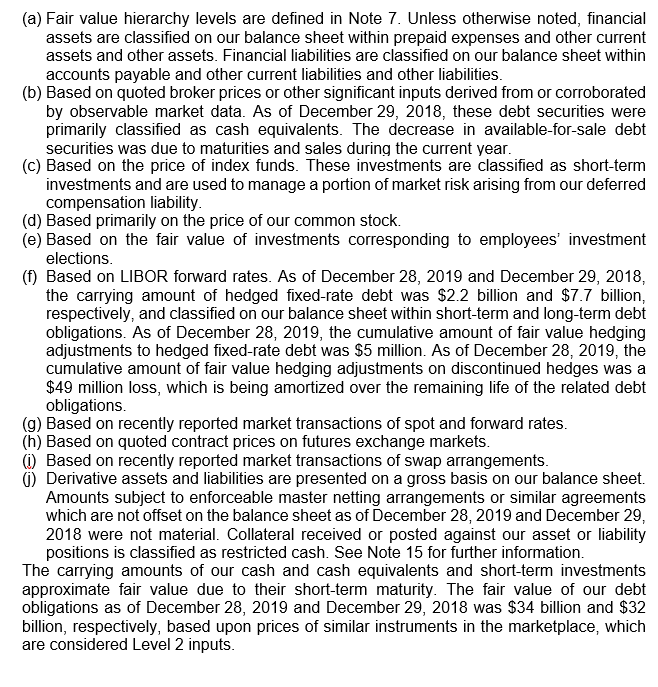

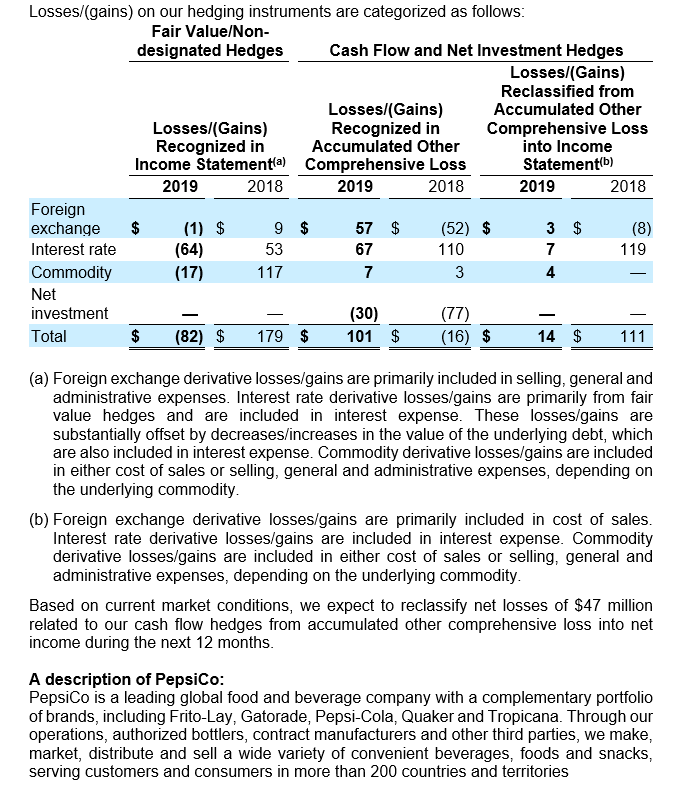

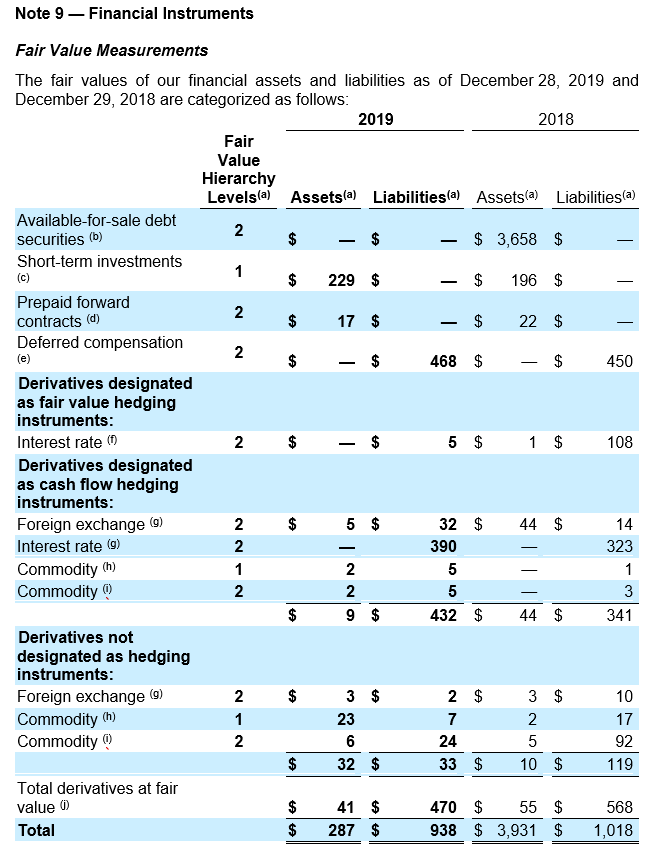

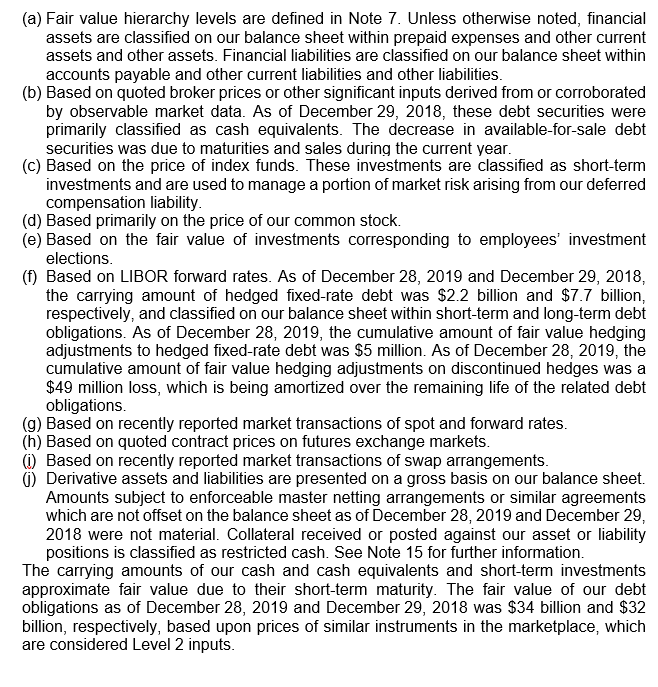

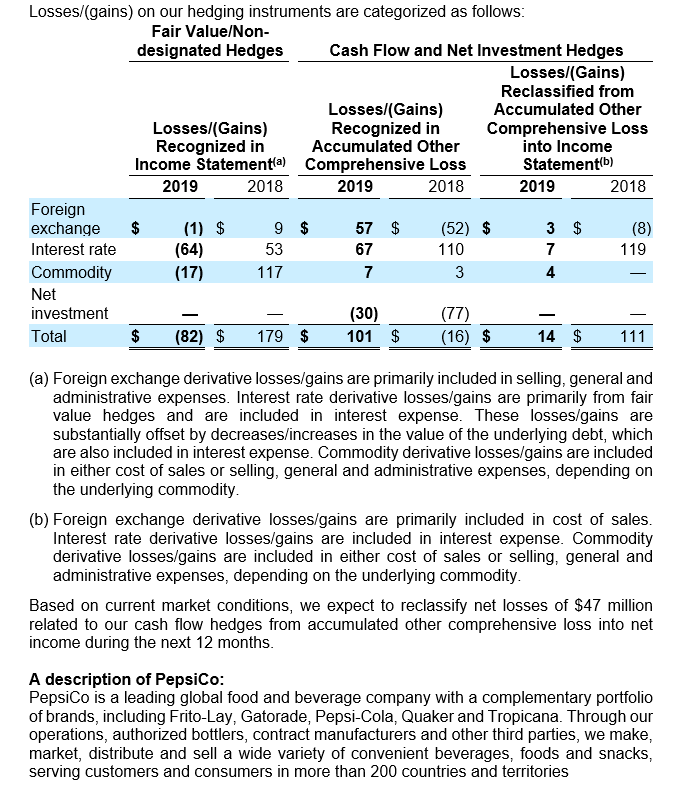

Note 9 - Financial Instruments $ $ - - $ | Fair Value Measurements The fair values of our financial assets and liabilities as of December 28, 2019 and December 29, 2018 are categorized as follows: 2019 2018 Fair Value Hierarchy Levels(a) Assets(a) Liabilities(a) Assets(a) Liabilities(a) Available-for-sale debt 2 securities (b) $ 3,658 $ Short-term investments (c) 1 229 $ $ 196 $ Prepaid forward 2 contracts (d) $ 17 $ $ 22 $ Deferred compensation 2 468 $ $ 450 Derivatives designated as fair value hedging instruments: Interest rate ( 2 5 $ 1 $ 108 Derivatives designated as cash flow hedging instruments: Foreign exchange (9) 2 $ 5$ 32 $ 44 $ 14 Interest rate (g) 390 323 Commodity (h) 2 5 1 Commodity 2 5 3 9 $ 432 $ 44 $ 341 Derivatives not designated as hedging instruments: Foreign exchange (9) 2 3 $ 2 $ 3 $ 10 Commodity (h) 1 23 7 2 17 Commodity 2 6 24 5 92 $ 32 $ 33 $ 10 $ 119 Total derivatives at fair $ 41 $ 470 $ 55 $ 568 Total $ 287 $ 938 $ 3,931 $ 1,018 - NNN ONN $ $ 6 $ value AA (a) Fair value hierarchy levels are defined in Note 7. Unless otherwise noted, financial assets are classified on our balance sheet within prepaid expenses and other current assets and other assets. Financial liabilities are classified on our balance sheet within accounts payable and other current liabilities and other liabilities. (b) Based on quoted broker prices or other significant inputs derived from or corroborated by observable market data. As of December 29, 2018, these debt securities were primarily classified as cash equivalents. The decrease in available-for-sale debt securities was due to maturities and sales during the current year. (c) Based on the price of index funds. These investments are classified as short-term investments and are used to manage a portion of market risk arising from our deferred compensation liability. (d) Based primarily on the price of our common stock. (e) Based on the fair value of investments corresponding to employees' investment elections. (f) Based on LIBOR forward rates. As of December 28, 2019 and December 29, 2018, the carrying amount of hedged fixed-rate debt was $2.2 billion and $7.7 billion, respectively, and classified on our balance sheet within short-term and long-term debt obligations. As of December 28, 2019, the cumulative amount of fair value hedging adjustments to hedged fixed-rate debt was $5 million. As of December 28, 2019, the cumulative amount of fair value hedging adjustments on discontinued hedges was a $49 million loss, which is being amortized over the remaining life of the related debt obligations. (9) Based on recently reported market transactions of spot and forward rates. (h) Based on quoted contract prices on futures exchange markets. 0) Based on recently reported market transactions of swap arrangements. 0) Derivative assets and liabilities are presented on a gross basis on our balance sheet. Amounts subject to enforceable master netting arrangements or similar agreements which are not offset on the balance sheet as of December 28, 2019 and December 29, 2018 were not material. Collateral received or posted against our asset or liability positions is classified as restricted cash. See Note 15 for further information. The carrying amounts of our cash and cash equivalents and short-term investments approximate fair value due to their short-term maturity. The fair value of our debt obligations as of December 28, 2019 and December 29, 2018 was $34 billion and $32 billion, respectively, based upon prices of similar instruments in the marketplace, which are considered Level 2 inputs. Losses/(gains) on our hedging instruments are categorized as follows: Fair Value/Non- designated Hedges Cash Flow and Net Investment Hedges Losses/(Gains) Reclassified from Losses/(Gains) Accumulated Other Losses/(Gains) Recognized in Comprehensive Loss Recognized in Accumulated Other into Income Income Statement(a) Comprehensive Loss Statement(b) 2019 2018 2019 2018 2019 2018 Foreign exchange $ (1) $ 9 $ 57 $ (52) $ 3 $ Interest rate (64) 53 67 110 7 119 Commodity (17) 117 7 3 4 Net investment (30) (77) Total $ (82) $ 179 $ 101 $ (16) $ 14 $ 111 (8) (a) Foreign exchange derivative losses/gains are primarily included in selling, general and administrative expenses. Interest rate derivative losses/gains are primarily from fair value hedges and are included in interest expense. These losses/gains are substantially offset by decreases/increases in the value of the underlying debt, which are also included in interest expense. Commodity derivative losses/gains are included in either cost of sales or selling, general and administrative expenses, depending on the underlying commodity. (b) Foreign exchange derivative losses/gains are primarily included in cost of sales. Interest rate derivative losses/gains are included in interest expense. Commodity derivative losses/gains are included in either cost of sales or selling, general and administrative expenses, depending on the underlying commodity. Based on current market conditions, we expect to reclassify net losses of $47 million related to our cash flow hedges from accumulated other comprehensive loss into net income during the next 12 months. A description of Pepsico: PepsiCo is a leading global food and beverage company with a complementary portfolio of brands, including Frito-Lay, Gatorade, Pepsi-Cola, Quaker and Tropicana. Through our operations, authorized bottlers, contract manufacturers and other third parties, we make, market, distribute and sell a wide variety of convenient beverages, foods and snacks, serving customers and consumers in more than 200 countries and territories Note 9 - Financial Instruments $ $ - - $ | Fair Value Measurements The fair values of our financial assets and liabilities as of December 28, 2019 and December 29, 2018 are categorized as follows: 2019 2018 Fair Value Hierarchy Levels(a) Assets(a) Liabilities(a) Assets(a) Liabilities(a) Available-for-sale debt 2 securities (b) $ 3,658 $ Short-term investments (c) 1 229 $ $ 196 $ Prepaid forward 2 contracts (d) $ 17 $ $ 22 $ Deferred compensation 2 468 $ $ 450 Derivatives designated as fair value hedging instruments: Interest rate ( 2 5 $ 1 $ 108 Derivatives designated as cash flow hedging instruments: Foreign exchange (9) 2 $ 5$ 32 $ 44 $ 14 Interest rate (g) 390 323 Commodity (h) 2 5 1 Commodity 2 5 3 9 $ 432 $ 44 $ 341 Derivatives not designated as hedging instruments: Foreign exchange (9) 2 3 $ 2 $ 3 $ 10 Commodity (h) 1 23 7 2 17 Commodity 2 6 24 5 92 $ 32 $ 33 $ 10 $ 119 Total derivatives at fair $ 41 $ 470 $ 55 $ 568 Total $ 287 $ 938 $ 3,931 $ 1,018 - NNN ONN $ $ 6 $ value AA (a) Fair value hierarchy levels are defined in Note 7. Unless otherwise noted, financial assets are classified on our balance sheet within prepaid expenses and other current assets and other assets. Financial liabilities are classified on our balance sheet within accounts payable and other current liabilities and other liabilities. (b) Based on quoted broker prices or other significant inputs derived from or corroborated by observable market data. As of December 29, 2018, these debt securities were primarily classified as cash equivalents. The decrease in available-for-sale debt securities was due to maturities and sales during the current year. (c) Based on the price of index funds. These investments are classified as short-term investments and are used to manage a portion of market risk arising from our deferred compensation liability. (d) Based primarily on the price of our common stock. (e) Based on the fair value of investments corresponding to employees' investment elections. (f) Based on LIBOR forward rates. As of December 28, 2019 and December 29, 2018, the carrying amount of hedged fixed-rate debt was $2.2 billion and $7.7 billion, respectively, and classified on our balance sheet within short-term and long-term debt obligations. As of December 28, 2019, the cumulative amount of fair value hedging adjustments to hedged fixed-rate debt was $5 million. As of December 28, 2019, the cumulative amount of fair value hedging adjustments on discontinued hedges was a $49 million loss, which is being amortized over the remaining life of the related debt obligations. (9) Based on recently reported market transactions of spot and forward rates. (h) Based on quoted contract prices on futures exchange markets. 0) Based on recently reported market transactions of swap arrangements. 0) Derivative assets and liabilities are presented on a gross basis on our balance sheet. Amounts subject to enforceable master netting arrangements or similar agreements which are not offset on the balance sheet as of December 28, 2019 and December 29, 2018 were not material. Collateral received or posted against our asset or liability positions is classified as restricted cash. See Note 15 for further information. The carrying amounts of our cash and cash equivalents and short-term investments approximate fair value due to their short-term maturity. The fair value of our debt obligations as of December 28, 2019 and December 29, 2018 was $34 billion and $32 billion, respectively, based upon prices of similar instruments in the marketplace, which are considered Level 2 inputs. Losses/(gains) on our hedging instruments are categorized as follows: Fair Value/Non- designated Hedges Cash Flow and Net Investment Hedges Losses/(Gains) Reclassified from Losses/(Gains) Accumulated Other Losses/(Gains) Recognized in Comprehensive Loss Recognized in Accumulated Other into Income Income Statement(a) Comprehensive Loss Statement(b) 2019 2018 2019 2018 2019 2018 Foreign exchange $ (1) $ 9 $ 57 $ (52) $ 3 $ Interest rate (64) 53 67 110 7 119 Commodity (17) 117 7 3 4 Net investment (30) (77) Total $ (82) $ 179 $ 101 $ (16) $ 14 $ 111 (8) (a) Foreign exchange derivative losses/gains are primarily included in selling, general and administrative expenses. Interest rate derivative losses/gains are primarily from fair value hedges and are included in interest expense. These losses/gains are substantially offset by decreases/increases in the value of the underlying debt, which are also included in interest expense. Commodity derivative losses/gains are included in either cost of sales or selling, general and administrative expenses, depending on the underlying commodity. (b) Foreign exchange derivative losses/gains are primarily included in cost of sales. Interest rate derivative losses/gains are included in interest expense. Commodity derivative losses/gains are included in either cost of sales or selling, general and administrative expenses, depending on the underlying commodity. Based on current market conditions, we expect to reclassify net losses of $47 million related to our cash flow hedges from accumulated other comprehensive loss into net income during the next 12 months. A description of Pepsico: PepsiCo is a leading global food and beverage company with a complementary portfolio of brands, including Frito-Lay, Gatorade, Pepsi-Cola, Quaker and Tropicana. Through our operations, authorized bottlers, contract manufacturers and other third parties, we make, market, distribute and sell a wide variety of convenient beverages, foods and snacks, serving customers and consumers in more than 200 countries and territories