Answered step by step

Verified Expert Solution

Question

1 Approved Answer

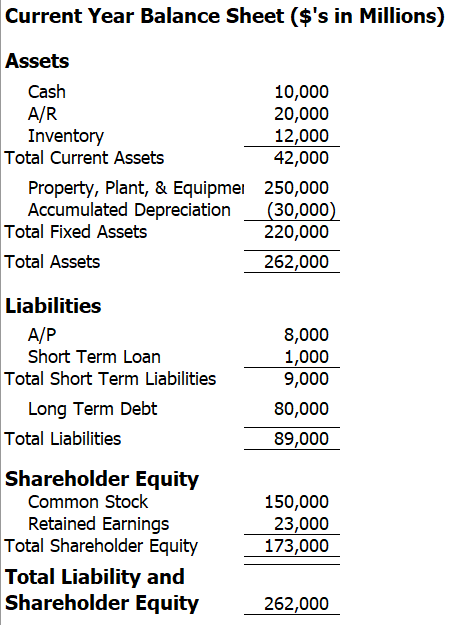

Business Case Analysis #2: Reinventing the Business New Product Development Q1. Using the balance sheet and assuming that Photonics cost of raising debt is 6%

Business Case Analysis #2: Reinventing the Business New Product Development

Q1. Using the balance sheet and assuming that Photonics cost of raising debt is 6% and its cost of raising equity is 23% what is the companys weighted average cost of capital? Explain and provide a separate excel file with the supporting quantitative analysis

Current Year Balance Sheet ($'s in Millions) Assets Cash 10,000 A/R 20,000 Inventory 12,000 Total Current Assets 42,000 Property, Plant, & Equipmei 250,000 Accumulated Depreciation (30,000 Total Fixed Assets 220,000 Total Assets 262,000 Liabilities A/P Short Term Loan Total Short Term Liabilities Long Term Debt Total Liabilities 8,000 1,000 9,000 80,000 89,000 Shareholder Equity Common Stock Retained Earnings Total Shareholder Equity Total Liability and Shareholder Equity 150,000 23,000 173,000 262,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started