Answered step by step

Verified Expert Solution

Question

1 Approved Answer

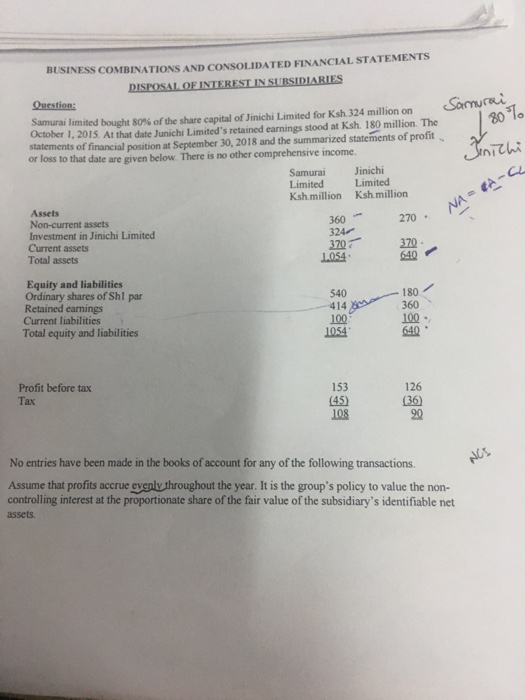

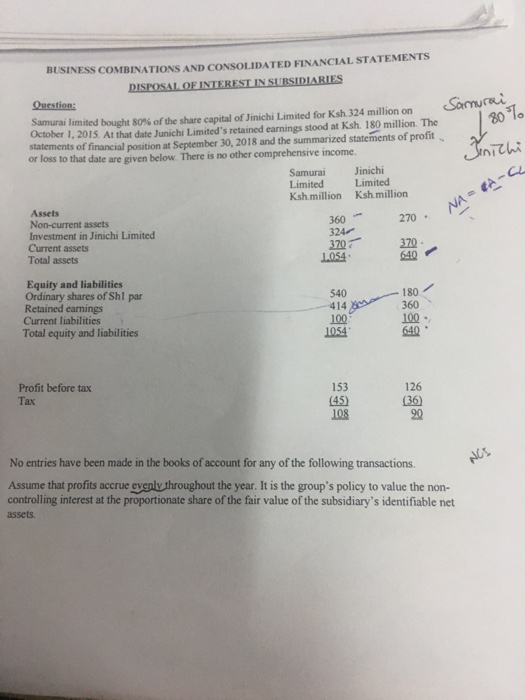

BUSINESS COMBINATIONS AND CONSOLIDATED FINANCIAL STATEMENTS DISPOSALOF INTEREST IN SURSIDIARIES am mi San ura limited bought 80% ofthe share capital ofJini hiLimited for Ksh 324

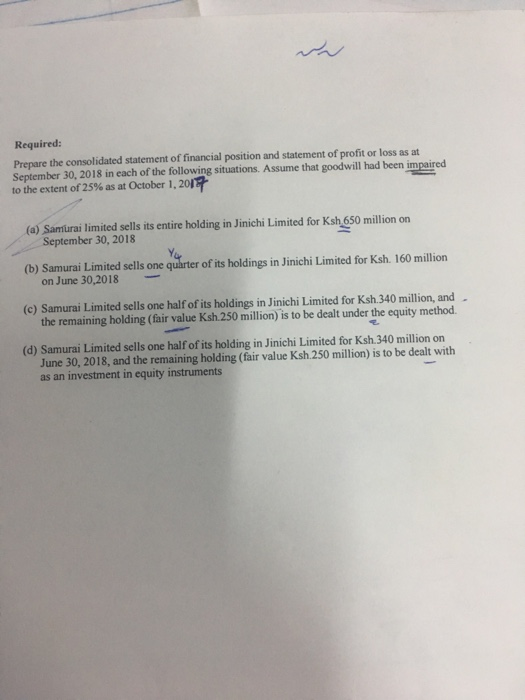

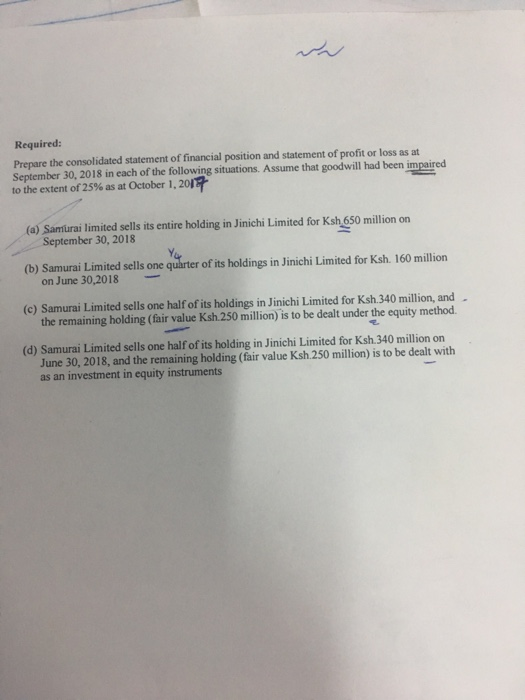

BUSINESS COMBINATIONS AND CONSOLIDATED FINANCIAL STATEMENTS DISPOSALOF INTEREST IN SURSIDIARIES am mi San ura limited bought 80% ofthe share capital ofJini hiLimited for Ksh 324 million on October 1, 2015. At that date Junichi Limited's retained earnings stood at Ksh. 180 million. The statements of financial position at September 30, 2018 and the summarized statements of profit or loss to that date are given below. There is no other comprehensive income iChi Samurai Jinichi LimitedLimited Ksh million Ksh million Assets Non-current assets Investment in Jinichi Limited Current assets Total assets 360 324 320370 270 Equity and liabilities Ordinary shares of Shl par Retained earnings 540 414 100 1054 180 360 100 640 Current liabilities Total equity and liabilities Profit before tax Tax 153 (45) 108 126 (36) 90 No entries have been made in the books of account for any of the following transactions. Assume that profits accrue eyeply throughout the year. It is the group's policy to value the non- controlling interest at the proportionate share of the fair value of the subsidiary's identifiable net assets. Required: Prepare the consolidated statement of financial position and statement of profit or loss as at September 30, 2018 in each of the following situations. Assume that goodwill had been impaired to the extent of 25% as at October 1, 20 17 (a) Samurai limited sells its entire holding in Jinichi Limited for Ksh 650 million on (0) Samurai Limite sells one quarter of its holdings in Jinichi Limited for Ksh. 160 million (c) Samurai Limited sells one half of its holdings in Jinichi Limited for Ksh 340 million, and (d) Samurai Limited sells one half of its holding in Jinichi Limited for Ksh.340 million on September 30, 2018 on June 30,2018 the remaining holding (fair value Ksh.250 million) is to be dealt under the equity method June 30, 2018, and the remaining holding (fair value Ksh.250 million) is to be dealt with as an investment in equity instruments BUSINESS COMBINATIONS AND CONSOLIDATED FINANCIAL STATEMENTS DISPOSALOF INTEREST IN SURSIDIARIES am mi San ura limited bought 80% ofthe share capital ofJini hiLimited for Ksh 324 million on October 1, 2015. At that date Junichi Limited's retained earnings stood at Ksh. 180 million. The statements of financial position at September 30, 2018 and the summarized statements of profit or loss to that date are given below. There is no other comprehensive income iChi Samurai Jinichi LimitedLimited Ksh million Ksh million Assets Non-current assets Investment in Jinichi Limited Current assets Total assets 360 324 320370 270 Equity and liabilities Ordinary shares of Shl par Retained earnings 540 414 100 1054 180 360 100 640 Current liabilities Total equity and liabilities Profit before tax Tax 153 (45) 108 126 (36) 90 No entries have been made in the books of account for any of the following transactions. Assume that profits accrue eyeply throughout the year. It is the group's policy to value the non- controlling interest at the proportionate share of the fair value of the subsidiary's identifiable net assets. Required: Prepare the consolidated statement of financial position and statement of profit or loss as at September 30, 2018 in each of the following situations. Assume that goodwill had been impaired to the extent of 25% as at October 1, 20 17 (a) Samurai limited sells its entire holding in Jinichi Limited for Ksh 650 million on (0) Samurai Limite sells one quarter of its holdings in Jinichi Limited for Ksh. 160 million (c) Samurai Limited sells one half of its holdings in Jinichi Limited for Ksh 340 million, and (d) Samurai Limited sells one half of its holding in Jinichi Limited for Ksh.340 million on September 30, 2018 on June 30,2018 the remaining holding (fair value Ksh.250 million) is to be dealt under the equity method June 30, 2018, and the remaining holding (fair value Ksh.250 million) is to be dealt with as an investment in equity instruments

BUSINESS COMBINATIONS AND CONSOLIDATED FINANCIAL STATEMENTS DISPOSALOF INTEREST IN SURSIDIARIES am mi San ura limited bought 80% ofthe share capital ofJini hiLimited for Ksh 324 million on October 1, 2015. At that date Junichi Limited's retained earnings stood at Ksh. 180 million. The statements of financial position at September 30, 2018 and the summarized statements of profit or loss to that date are given below. There is no other comprehensive income iChi Samurai Jinichi LimitedLimited Ksh million Ksh million Assets Non-current assets Investment in Jinichi Limited Current assets Total assets 360 324 320370 270 Equity and liabilities Ordinary shares of Shl par Retained earnings 540 414 100 1054 180 360 100 640 Current liabilities Total equity and liabilities Profit before tax Tax 153 (45) 108 126 (36) 90 No entries have been made in the books of account for any of the following transactions. Assume that profits accrue eyeply throughout the year. It is the group's policy to value the non- controlling interest at the proportionate share of the fair value of the subsidiary's identifiable net assets. Required: Prepare the consolidated statement of financial position and statement of profit or loss as at September 30, 2018 in each of the following situations. Assume that goodwill had been impaired to the extent of 25% as at October 1, 20 17 (a) Samurai limited sells its entire holding in Jinichi Limited for Ksh 650 million on (0) Samurai Limite sells one quarter of its holdings in Jinichi Limited for Ksh. 160 million (c) Samurai Limited sells one half of its holdings in Jinichi Limited for Ksh 340 million, and (d) Samurai Limited sells one half of its holding in Jinichi Limited for Ksh.340 million on September 30, 2018 on June 30,2018 the remaining holding (fair value Ksh.250 million) is to be dealt under the equity method June 30, 2018, and the remaining holding (fair value Ksh.250 million) is to be dealt with as an investment in equity instruments BUSINESS COMBINATIONS AND CONSOLIDATED FINANCIAL STATEMENTS DISPOSALOF INTEREST IN SURSIDIARIES am mi San ura limited bought 80% ofthe share capital ofJini hiLimited for Ksh 324 million on October 1, 2015. At that date Junichi Limited's retained earnings stood at Ksh. 180 million. The statements of financial position at September 30, 2018 and the summarized statements of profit or loss to that date are given below. There is no other comprehensive income iChi Samurai Jinichi LimitedLimited Ksh million Ksh million Assets Non-current assets Investment in Jinichi Limited Current assets Total assets 360 324 320370 270 Equity and liabilities Ordinary shares of Shl par Retained earnings 540 414 100 1054 180 360 100 640 Current liabilities Total equity and liabilities Profit before tax Tax 153 (45) 108 126 (36) 90 No entries have been made in the books of account for any of the following transactions. Assume that profits accrue eyeply throughout the year. It is the group's policy to value the non- controlling interest at the proportionate share of the fair value of the subsidiary's identifiable net assets. Required: Prepare the consolidated statement of financial position and statement of profit or loss as at September 30, 2018 in each of the following situations. Assume that goodwill had been impaired to the extent of 25% as at October 1, 20 17 (a) Samurai limited sells its entire holding in Jinichi Limited for Ksh 650 million on (0) Samurai Limite sells one quarter of its holdings in Jinichi Limited for Ksh. 160 million (c) Samurai Limited sells one half of its holdings in Jinichi Limited for Ksh 340 million, and (d) Samurai Limited sells one half of its holding in Jinichi Limited for Ksh.340 million on September 30, 2018 on June 30,2018 the remaining holding (fair value Ksh.250 million) is to be dealt under the equity method June 30, 2018, and the remaining holding (fair value Ksh.250 million) is to be dealt with as an investment in equity instruments

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started